You can now apply online for a New Jersey Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to gary@swiftbonds.com

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in New Jersey?

Performance bonds construction ensure that contractors fulfill their contractual obligations, providing security to project owners.

How do I get a Performance and Payment Bond in New Jersey?

We make it easy to get a contract performance bond. Just click here to get our New Jersey Performance Application. Fill it out and then email it and the New Jersey contract documents to gary@swiftbonds.com or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

performance bond? This infographic shows a logo of the obligee, obligor, and the surety in a multi colored background." width="2269" height="2085" />

performance bond? This infographic shows a logo of the obligee, obligor, and the surety in a multi colored background." width="2269" height="2085" />

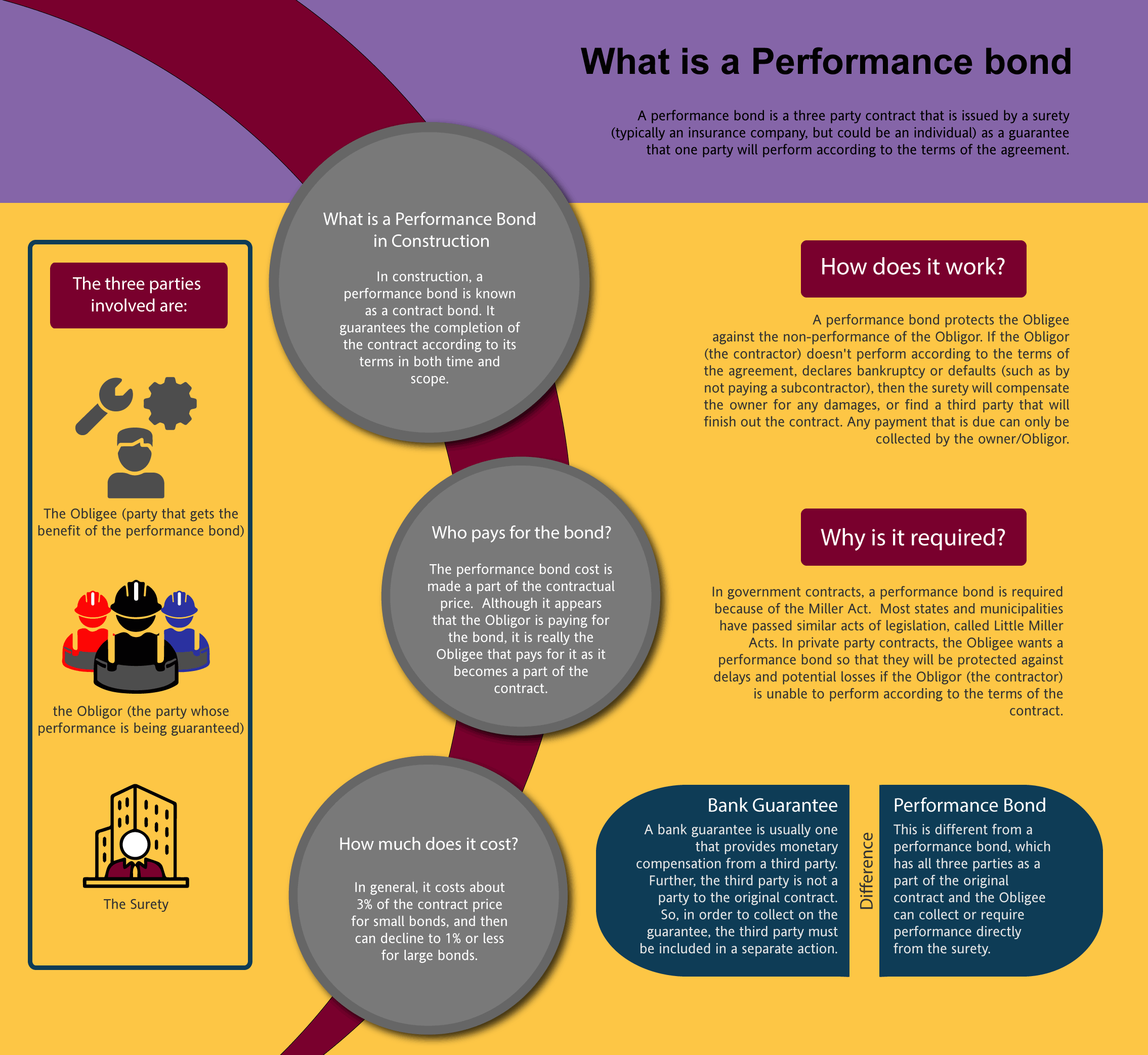

Bank guarantee vs Performance bond in New Jersey?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in NJ?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of New Jersey. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to gary@swiftbonds.com

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in NJ

Just call us. We’ll work with you to get the best New Jersey bond possible.

We provide performance and payment bonds in each of the following counties:

Atlantic

Bergen

Burlington

Camden

Cape May

Cumberland

Essex

Gloucester

Hudson

Hunterdon

Mercer

Middlesex

Monmouth

Morris

Ocean

Passaic

Salem

Somerset

Sussex

Union

Warren

And Cities:

Newark

Jersey City

Trenton

Princeton

Paterson

Toms River

Atlantic City

Morristown

Cherry Hill

Clifton

Montclair

See our New Mexico Performance Bond page here.

Unraveling the Bond: Performance Bonds vs. Bank Letters of Credit in New Jersey Construction

In our observation, distinguishing between performance bonds and bank letters of credit is essential, especially in New Jersey’s construction sector. Performance bonds act as a security net for project owners, ensuring the contractor completes the job as per the contract. Meanwhile, bank letters of credit serve more as a financial guarantee rather than a comprehensive performance assurance. We’ve consistently found that performance bonds offer broader protection for public construction projects, providing more than just financial coverage—they ensure project completion.

Is Your Performance Bond Refundable? A Closer Look at New Jersey Industry Standards

In our view, one common question among contractors in New Jersey is whether performance bonds are refundable. We’ve found that these bonds are typically non-refundable. Once the premium is paid and the bond is issued, the surety has taken on the risk, and the payment is considered earned. This non-refundable nature is an industry standard, reflecting the surety’s commitment to covering potential claims, regardless of whether the bond is utilized or not.

Navigating the Claim: Understanding the Performance Bond Claims Process in New Jersey

From our experience, the claims process on a performance bond can be daunting, but understanding it is crucial. When a claim is filed, the surety conducts a thorough investigation to determine its validity. We’ve observed that if the claim is justified, the surety may step in to complete the project or compensate the project owner. This can have lasting impacts on the contractor’s future bonding capacity, making it essential to manage projects diligently to avoid claims.

Freeing the Bond: When and How Performance Bonds Are Released in New Jersey

We’ve learned that the release of a performance bond in New Jersey hinges on the successful completion of the project and the satisfaction of all contractual obligations. In our dealings with contractors and project owners, we’ve seen that the bond is typically released once the project is formally accepted and all potential claims are resolved. Delays in release often stem from unresolved issues or incomplete punch list items, so it’s vital to address these promptly.

100 Percent Coverage: The Power of a Full Performance and Payment Bond in New Jersey's Construction Industry

Our experience tells us that a 100 percent performance and payment bond is a significant asset in any New Jersey construction project. This bond provides complete coverage of the contract value, ensuring both project completion and payment for labor and materials. We’ve noticed that such comprehensive coverage is particularly valuable in large-scale public construction projects, where the risks and financial stakes are high.

Fast-Tracking Your Bond: How Long Does It Take to Secure a Performance Bond in New Jersey?

In our practice, the time required to obtain a performance bond can vary, but it’s a critical factor for New Jersey contractors. We’ve found through experience that the process typically ranges from a few days to several weeks, depending on the contractor’s financial health and the project’s complexity. Having all necessary documentation ready can significantly expedite the process, allowing for a quicker bond issuance and project kickoff.

Don't Let Your Bond Expire: The Consequences of Lapsed Performance Bonds

We’ve often encountered situations where an expiring performance bond threatened to derail a project. Our experience has shown us that if a bond expires before the project’s completion, it’s crucial to renew it promptly to avoid breaching the contract. Failure to maintain an active bond can lead to contract termination and severe financial repercussions. Staying ahead of bond expiration dates is key to keeping New Jersey projects on track and avoiding costly delays.

See more at our Pennsylvania Performance Bond page.

Learn more about the NJ surety bond.