You can now apply online for a Nevada Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Nevada?

How do I get a Performance and Payment Bond in Nevada?

We make it easy to get a contract performance bond. Just click here to get our Nevada Performance Application. Fill it out and then email it and the Nevada contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

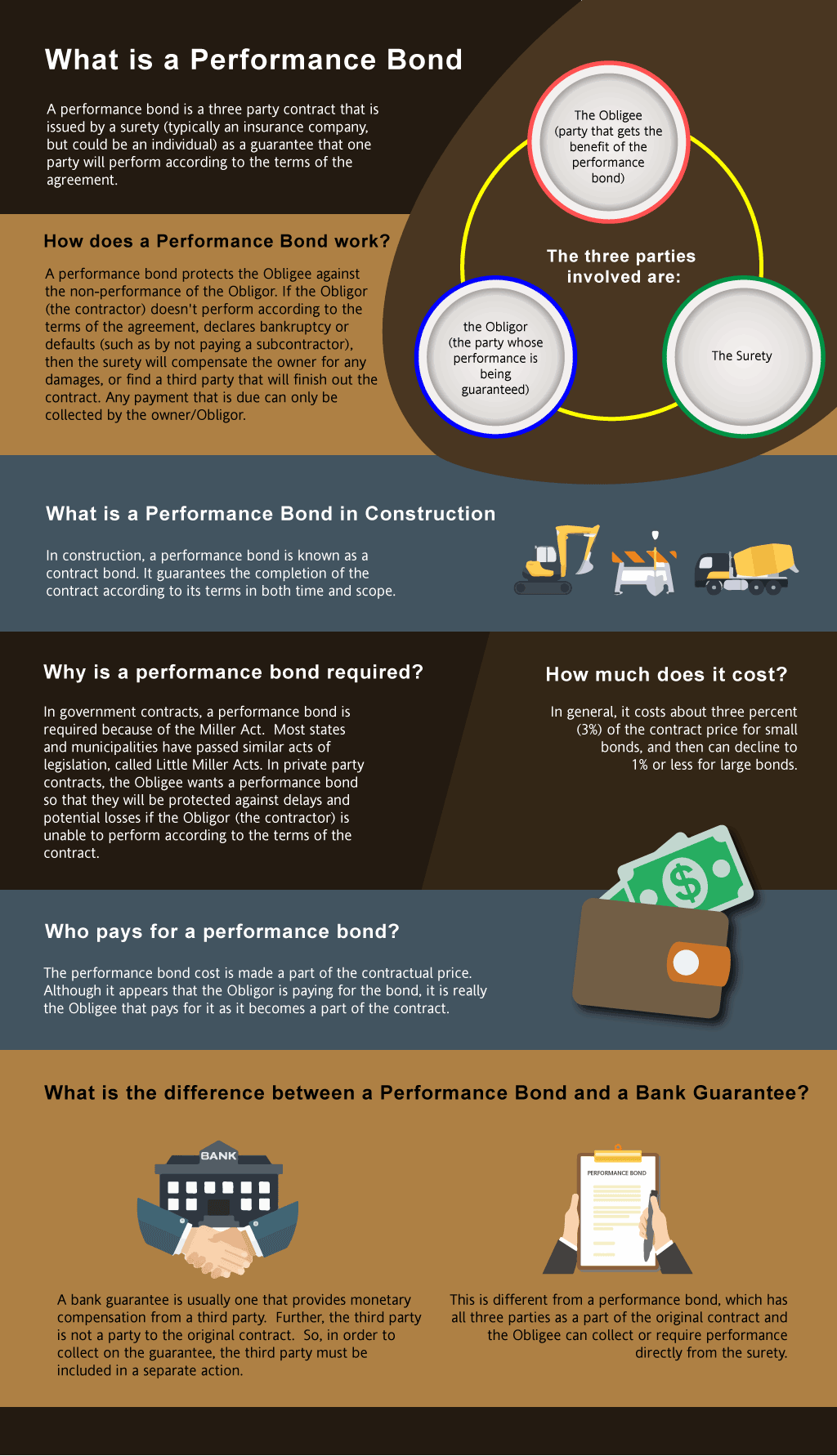

Performance guarantee definition in Nevada?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in NV?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Nevada. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Unlock your project's potential with our performance bonding solutions today!

How to Get a Performance Bond in NV

Just call us. We’ll work with you to get the best Nevada bond possible.

We provide performance and payment bonds in each of the following counties:

Carson City

Churchill

Clark

Douglas

Elko

Esmeralda

Eureka

Humboldt

Lander

Lincoln

Lyon

Mineral

Nye

Pershing

Storey

Washoe

White Pine

And Cities:

Las Vegas

Reno

Henderson

Carson City

Sparks

North Las Vegas

Elko

Mesquite

Fallon

Boulder City

See our New Hampshire Performance Bond page here.

Navigating the Nuances of Performance Bonds in Nevada

Performance Bonds vs. Letters of Credit: A Nevada Perspective

From our perspective, distinguishing between performance bonds and bank letters of credit (LOC) is crucial for any Nevada contractor or project owner. Performance bonds offer comprehensive protection, ensuring that a contractor completes the project according to the contract terms. In contrast, LOCs primarily guarantee payment rather than performance. We’ve noticed that while both tools mitigate risk, performance bonds provide a broader safety net, especially in the dynamic construction environment of Nevada.

Refundable or Not?: The Reality of Nevada Performance Bonds

We’ve found that many Nevada contractors wonder if performance bonds are refundable. In our observation, the answer is generally no. The premium paid is a fee for the risk assumed by the surety company, and this cost is non-refundable, even if no claims are made. We’ve realized that understanding this upfront can help contractors budget effectively and avoid any financial surprises down the road.

When Claims Arise: What It Means for Your Performance Bond

In our professional life, we’ve encountered numerous scenarios where a claim on a performance bond can drastically impact a contractor’s financial standing. When a claim is filed, the surety company steps in to either compensate the obligee or ensure project completion. However, we’ve consistently observed that the contractor is ultimately liable for reimbursing the surety, making it imperative to avoid claims whenever possible.

Securing Project Success: The Release of Your Performance Bond

Based on our experience, the release of a performance bond is a pivotal moment in any Nevada construction project. We’ve come to understand that this occurs only after all contractual obligations are met and the project is accepted by the owner. Sometimes, this also involves a warranty period, during which the contractor remains responsible for any defects. In our view, successfully navigating this phase is key to completing your obligations and moving forward with new opportunities.

The Power of 100% Coverage: A Nevada Contractor's Guide

We’ve come across the term "100 percent performance and payment bond" frequently, especially in large-scale Nevada projects. This bond guarantees that the contractor will not only complete the project but also pay all associated costs, including subcontractors and suppliers. In our observation, this type of bond offers unparalleled protection, making it a preferred choice for project owners who want to ensure both performance and financial security.

The Waiting Game: How Quickly Can You Get a Performance Bond in Nevada?

In our understanding, securing a performance bond in Nevada can be a swift process with the right preparation. We’ve had the chance to assist in projects where bonds were issued within days, but we’ve also seen situations where it took weeks due to complex underwriting requirements. We’ve consistently found that early preparation and clear communication with the surety can significantly reduce the waiting time.

Avoiding the Expiration Trap: What Happens if Your Bond Expires?

We’ve personally witnessed the challenges that arise when a performance bond expires before a project’s completion. In Nevada, this can lead to severe consequences, including penalties or even contract termination. We’ve come to appreciate the importance of monitoring bond expiration dates closely and taking proactive steps to renew or replace them to maintain continuous protection and avoid project delays.

Conclusion: Mastering Performance Bonds in Nevada

We’ve come to the conclusion that understanding performance bonds is essential for any contractor or project owner in Nevada. By recognizing the differences between performance bonds and LOCs, being aware of the implications of claims, and knowing when bonds are released, stakeholders can ensure their projects proceed smoothly. With the right knowledge and preparation, navigating the complexities of performance bonds becomes a manageable and even advantageous aspect of construction in Nevada.

See more at our South Carolina Performance Bond page.

Contact us for Nevada bonds.