You can now apply online for a Nebraska Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Nebraska?

How do I get a Performance and Payment Bond in Nebraska?

We make it easy to get a contract performance bond. Just click here to get our Nebraska Performance Application. Fill it out and then email it and the Nebraska contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How Much Does a Performance Bond Cost in Nebraska?

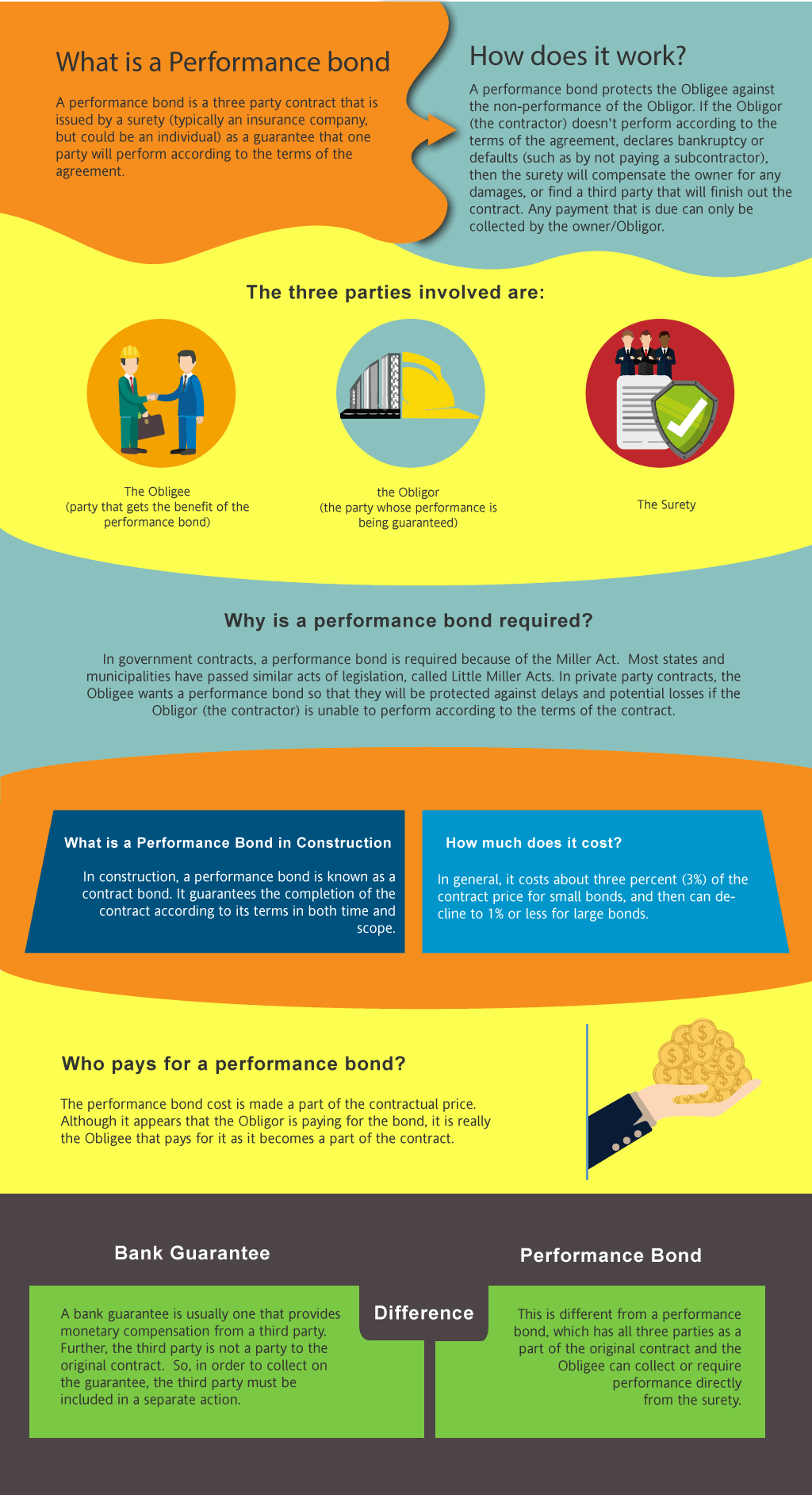

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in NE?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Nebraska. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Understand the significance of a performance bond meaning and safeguard your project's success today!

How to Get a Performance Bond in NE

Just call us. We’ll work with you to get the best Nebraska bond possible.

We provide performance and payment bonds in each of the following counties:

Adams

Antelope

Arthur

Banner

Blaine

Boone

Box Butte

Boyd

Brown

Buffalo

Burt

Butler

Cass

Cedar

Chase

Cherry

Cheyenne

Clay

Colfax

Cuming

Custer

Dakota

Dawes

Dawson

Deuel

Dixon

Dodge

Douglas

Dundy

Fillmore

Franklin

Frontier

Furnas

Gage

Garden

Garfield

Gosper

Grant

Greeley

Hall

Hamilton

Harlan

Hayes

Hitchcock

Holt

Hooker

Howard

Jefferson

Johnson

Kearney

Keith

Keya Paha

Kimball

Knox

Lancaster

Lincoln

Logan

Loup

McPherson

Madison

Merrick

Morrill

Nance

Nemaha

Nuckolls

Otoe

Pawnee

Perkins

Phelps

Pierce

Platte

Polk

Red Willow

Richardson

Rock

Saline

Sarpy

Saunders

Scotts Bluff

Seward

Sheridan

Sherman

Sioux

Stanton

Thayer

Thomas

Thurston

Valley

Washington

Wayne

Webster

Wheeler

York

And Cities:

Omaha

Lincoln

Grand Island

Kearney

Norfolk

North Platte

Hastings

Scottsbluff

Papillion

Beatrice

See our Nevada Performance Bond page here.

Performance Bonds vs. Letters of Credit: Crucial Distinctions for Nebraska Projects

From our perspective, distinguishing between performance bonds and bank letters of credit is vital for anyone involved in construction in Nebraska. Performance bonds are specifically designed to ensure that a contractor completes a project according to the agreed-upon terms, offering strong protection to the project owner. We’ve noticed that bank letters of credit, while also providing financial security, focus more on guaranteeing payment rather than ensuring the project's successful completion. In our view, understanding these differences can significantly impact the choice of financial security, ultimately protecting your investments more effectively.

The Reality of Performance Bond Refunds: What Contractors Must Know

We’ve realized that a common question among contractors in Nebraska is whether performance bonds are refundable. In our experience, the premium paid for a performance bond is generally non-refundable, as it covers the surety company’s risk assessment and underwriting process. We’ve come to appreciate that this non-refundable nature is an important factor to consider when planning project costs. Performance bonds provide benefits by ensuring financial security for project owners, but this comes with a non-refundable cost that contractors must factor into their budgeting.

The Truth About Claims: The Impact of a Performance Bond Claim

What we’ve discovered is that filing a claim on a performance bond can have significant repercussions for contractors. When a claim is filed, the surety company will investigate its validity. If the claim is upheld, the surety compensates the project owner, but the contractor must reimburse the surety for the payout. We’ve found that this process can severely impact a contractor’s reputation and ability to secure future bonds. In our professional life, we’ve consistently seen that avoiding claims through careful project management is key to maintaining a positive relationship with surety providers.

The Waiting Game: When Performance Bonds Are Released

We’ve come to understand that the release of a performance bond is a key moment in any Nebraska construction project. In our observation, a bond is typically released once the project is completed, all contractual obligations are met, and the project owner has approved the work. This often includes passing final inspections and sometimes enduring a warranty period. We’ve consistently found that clear communication and diligent project execution are crucial for ensuring that the bond is released without any complications.

The Assurance of 100% Performance and Payment Bonds in Nebraska

We’ve had firsthand experience with 100 percent performance and payment bonds, which are crucial for securing large-scale projects in Nebraska. These bonds guarantee that the contractor will not only complete the project as specified but also fully pay all subcontractors and suppliers. We’ve concluded that these bonds offer the highest level of protection for project owners, providing peace of mind that both the construction and financial obligations are covered. In our line of work, these bonds are indispensable tools for managing risk and ensuring the successful completion of major projects.

How Fast Can You Secure a Performance Bond in Nebraska?

We’ve been in situations where the speed of securing a performance bond is critical to keeping a project on track. In our experience, the time it takes to obtain a performance bond can vary, depending on factors such as the contractor’s financial standing and the project’s complexity. We’ve noticed that well-prepared contractors who provide all necessary documentation can often expedite the process, securing a bond in just a few days. We’ve found that early preparation is essential to avoid delays and ensure that the bond is in place when required. Our performance bond providers tend to be faster on average due to the expectations that we have set with them and by helping get them what they need the first time.

The Risks of Expired Performance Bonds: What You Must Know

We’ve learned from our mistakes that allowing a performance bond to expire before a project’s completion can lead to severe consequences. In our dealings with Nebraska projects, we’ve observed that an expired bond leaves the project owner unprotected, which can result in disputes and potential financial losses. We’ve been in the position where the lack of bond coverage caused significant challenges in resolving project issues. We’ve come to the conclusion that monitoring bond expiration dates closely and renewing them in a timely manner is critical to maintaining continuous protection for all parties involved.

See more at our South Dakota Performance Bond page.

Contact us for Nebraska surety bonds.