What is a Performance Bond in Missouri?

You can now apply online for a Missouri Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

How do I get a Performance and Payment Bond in Missouri?

We make it easy to get a contract performance bond. Just click here to get our Missouri Performance Application. Fill it out and then email it and the Missouri contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Performance bond guarantee in Missouri?

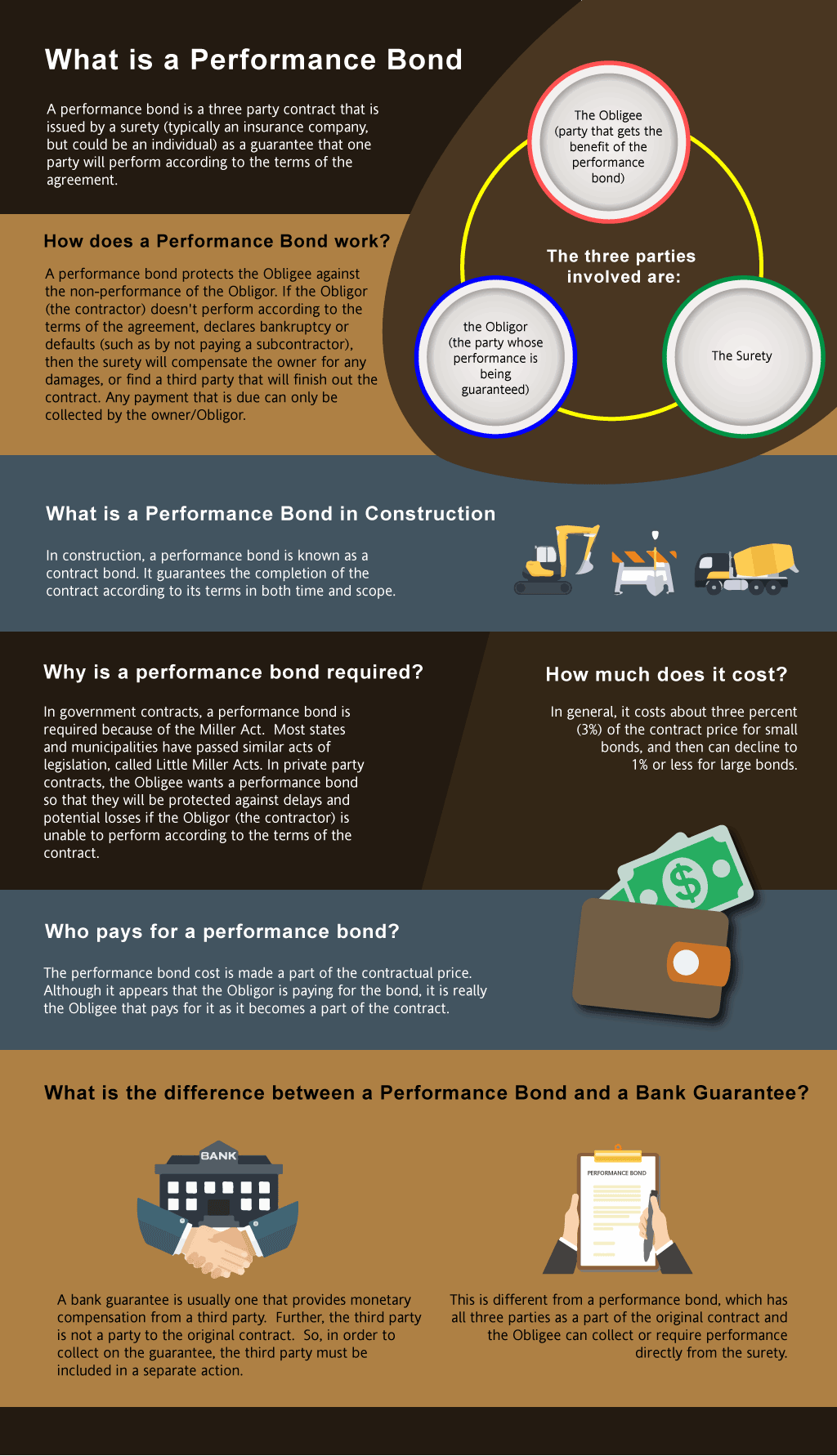

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in MO?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Missouri. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Discover what are performance bond used for in securing contractual obligations and ensuring project success.

How to Get a Performance Bond in MO

Just call us. We’ll work with you to get the best Missouri bond possible.

We provide performance and payment bonds in each of the following counties:

Adair

Andrew

Atchison

Audrain

Barry

Barton

Bates

Benton

Bollinger

Boone

Buchanan

Butler

Caldwell

Callaway

Camden

Cape Girardeau

Carroll

Carter

Cass

Cedar

Chariton

Christian

Clark

Clay

Clinton

Cole

Cooper

Crawford

Dade

Dallas

Daviess

De Kalb

Dent

Douglas

Dunklin

Franklin

Gasconade

Gentry

Greene

Grundy

Harrison

Henry

Hickory

Holt

Howard

Howell

Iron

Jackson

Jasper

Jefferson

Johnson

Knox

Laclede

Lafayette

Lawrence

Lewis

Lincoln

Linn

Livingston

Macon

Madison

Maries

Marion

McDonald

Mercer

Miller

Mississippi

Moniteau

Monroe

Montgomery

Morgan

New Madrid

Newton

Nodaway

Oregon

Osage

Ozark

Pemiscot

Perry

Pettis

Phelps

Pike

Platte

Polk

Pulaski

Putnam

Ralls

Randolph

Ray

Reynolds

Ripley

St. Charles

St. Clair

Ste. Genevieve

St. Francois

St. Louis

St. Louis City

Saline

Schuyler

Scotland

Scott

Shannon

Shelby

Stoddard

Stone

Sullivan

Taney

Texas

Vernon

Warren

Washington

Wayne

Webster

Worth

Wright

And Cities:

St. Louis

Kansas City

Springfield

Columbia

Branson

Joplin

Jefferson City

Saint Charles

Saint Joseph

Independence

See our Montana Performance Bond page here.

Essential Insights on Missouri Performance Bonds: What You Need to Know

Exploring the Differences: Performance Bonds vs. Bank Letters of Credit

In our professional life, we’ve consistently observed that many in Missouri’s construction industry often confuse performance bonds with bank letters of credit (LOC). Though both serve as financial guarantees, their roles and implications differ significantly. A performance bond, backed by a surety, guarantees that a contractor will meet their obligations, while a bank LOC directly involves a financial institution promising payment. We’ve found over time that understanding this distinction is crucial for ensuring the right financial tool is used to protect your project and mitigate risk.

Understanding Refund Policies: Are Performance Bonds a Reversible Commitment?

From our experience, one common misconception is that performance bonds are refundable if they go unused. However, what we’ve learned through doing is that the premiums paid for performance bonds are generally non-refundable. This is because the premium compensates the surety company for the risk assessment and issuance of the bond, not for whether a claim is made. We’ve observed over time that clear communication about this policy can prevent misunderstandings and ensure all parties have realistic expectations.

Claims on Performance Bonds: What Really Happens?

In our dealings with performance bonds in Missouri, we’ve come to see that when a claim is filed, it triggers a strict process of investigation by the surety company. If the claim is validated, the surety may intervene to complete the project or compensate the project owner. We’ve personally witnessed how this process, while protective of the project owner, can have significant financial implications for the contractor involved. Our experience has taught us that proactive contract management is essential to avoid such claims and their potential fallout.

Timing the Release: When Are Performance Bonds Typically Completed?

In our line of work, we’ve had the chance to observe that the release of performance bonds in Missouri typically hinges on the successful completion of the project, including any warranty periods. We’ve found that timely and thorough documentation can facilitate the release process. However, we’ve also encountered situations where delays occurred due to unresolved disputes or incomplete work. From our perspective, ensuring all contract conditions are fully met is key to securing the timely release of a performance bond.

Maximizing Security: The Role of 100 Percent Performance and Payment Bonds in Missouri’s Construction Industry

We’ve been fortunate enough to work on projects in Missouri that required a 100 percent performance and payment bond, which guarantees the full contract amount. From our own observations, this type of bond offers extensive protection by ensuring both the performance of the contractor and the payment of all subcontractors and suppliers. In our view, this is particularly valuable for large-scale projects, where financial security is paramount.

Fast-Tracking Your Bond: How Long Does It Take to Secure a Performance Bond in Missouri?

Based on our experience in Missouri, the timeline for obtaining a performance bond can vary widely. We’ve consistently found that being well-prepared with financial documents and project details can significantly expedite the process, often reducing the timeline from weeks to just days. In our practice, we’ve gained insight into the importance of early communication with surety companies to avoid any unnecessary delays in bond issuance.

Avoiding Gaps: The Consequences of Letting a Performance Bond Expire

We’ve learned through our work that allowing a performance bond to expire before a project is completed can lead to serious complications. From what we’ve seen, an expired bond leaves the project owner vulnerable, with no financial protection if the contractor fails to meet their obligations. We’ve been in situations where this oversight caused significant project delays and financial strain. We’ve come to appreciate that diligently monitoring bond expiration dates and arranging renewals when necessary is crucial for maintaining project security.

Conclusion: Leveraging Performance Bonds for Project Success in Missouri

In our experience, performance bonds are an indispensable tool in Missouri’s construction landscape, offering vital protection for both contractors and project owners. We’ve come to the conclusion that understanding the specifics—from the differences with bank LOCs to the implications of claims and bond expirations—can make a significant difference in project outcomes. As always, clear communication, meticulous planning, and proactive management are the keys to leveraging performance bonds effectively in your projects.

See more at our Texas Performance Bond page.

Contact us for Bond Express.

1. What are the performance bond requirements under Missouri’s Little Miller Act?

Missouri’s Little Miller Act, codified in Mo. Rev. Stat. § 107.170, mandates that performance bonds are required for public construction projects exceeding $50,000. This law applies to contracts awarded by state agencies, counties, municipalities, and other public entities.

Key Requirements:

-

The performance bond must be 100% of the contract amount.

-

This guarantee that the contractor will complete the project according to contract terms.

-

The bond must be issued by a surety company authorized to conduct business in Missouri.

Failure to secure a performance bond when required can result in contract cancellation and legal penalties.

2. How does Missouri’s procurement process handle performance bonds for city contracts?

Missouri city governments follow state procurement laws and local ordinances for construction contracts. Typically:

-

For projects exceeding $50,000, municipalities must require a performance bond under Mo. Rev. Stat. § 107.170.

-

Performance bonds are submitted during the bidding process or before contract execution.

-

Bonds must be issued by a licensed surety company to ensure the contractor fulfills project obligations.

Some cities may have additional procurement guidelines, so contractors should review local requirements.

3. What government agencies regulate performance bonds for construction projects in Missouri?

Multiple agencies oversee performance bond regulations in Missouri:

-

Missouri Office of Administration, Division of Purchasing – Oversees procurement for state-funded projects.

-

Missouri Department of Labor and Industrial Relations (DOLIR) – Enforces contractor compliance and wage laws.

-

Local Procurement Offices – Handle city and county construction contract requirements.

For federally funded projects in Missouri, federal procurement laws may also apply.

4. Are subcontractors required to carry performance bonds in Missouri?

Missouri law does not mandate performance bonds for subcontractors unless:

-

The prime contract specifically requires it (common for large public and private projects).

-

A city or county ordinance mandates it.

Many prime contractors have need of subcontractors to obtain performance bonds to protect against financial and project risks.

5. How can I verify a performance bond’s validity for a public project?

To verify a performance bond’s authenticity, follow these steps:

-

Contact the Public Entity – Request bond records from the government agency overseeing the project.

-

Verify the Surety Company – Check if the surety is licensed with the Missouri Department of Insurance or listed on the U.S. Department of the Treasury’s approved sureties list.

-

Review the Bond Document – Ensure it contains:

-

Contractor’s and surety’s names.

-

Contract amount and project details.

-

Surety’s official seal and signatures.

-