You can now apply online for a Mississippi Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

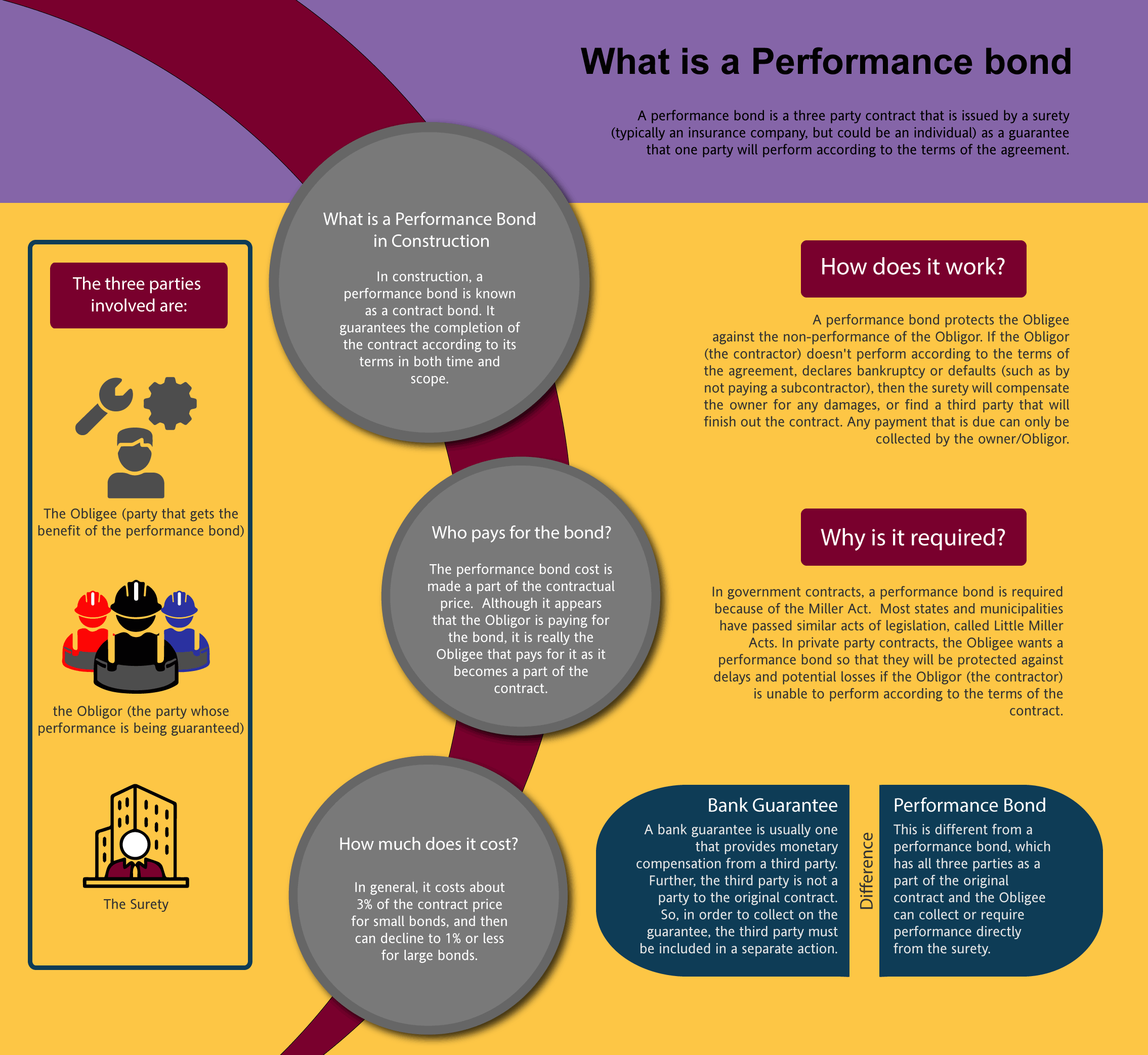

What is a Performance Bond in Mississippi?

How do I get a Performance and Payment Bond in Mississippi?

We make it easy to get a contract performance bond. Just click here to get our Mississippi Performance Application. Fill it out and then email it and the Mississippi contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Secure your project's future with a reliable performance bond for construction today!

Performance guarantee insurance in Mississippi?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in MS?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Mississippi. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in MS

Just call us. We’ll work with you to get the best Mississippi bond possible.

We provide performance and payment bonds in each of the following counties:

Adams

Alcorn

Amite

Attala

Benton

Bolivar

Calhoun

Carroll

Chickasaw

Choctaw

Claiborne

Clarke

Clay

Coahoma

Copiah

Covington

DeSoto

Forrest

Franklin

George

Greene

Grenada

Hancock

Harrison

Hinds

Holmes

Humphreys

Issaquena

Itawamba

Jackson

Jasper

Jefferson

Jefferson Davis

Jones

Kemper

Lafayette

Lamar

Lauderdale

Lawrence

Leake

Lee

Leflore

Lincoln

Lowndes

Madison

Marion

Marshall

Monroe

Montgomery

Neshoba

Newton

Noxubee

Oktibbeha

Panola

Pearl River

Perry

Pike

Pontotoc

Prentiss

Quitman

Rankin

Scott

Sharkey

Simpson

Smith

Stone

Sunflower

Tallahatchie

Tate

Tippah

Tishomingo

Tunica

Union

Walthall

Warren

Washington

Wayne

Webster

Wilkinson

Winston

Yalobusha

Yazoo

And Cities:

Jackson

Hattiesburg

Biloxi

Gulfport

Tupelo

Meridian

Southaven

Vicksburg

Starkville

Madison

See our Missouri Performance Bond page here.

Mastering Performance Bonds in Mississippi: What You Need to Know

Mastering Performance Bonds in Mississippi: What You Need to Know

Performance bonds are a cornerstone of the construction industry in Mississippi, providing essential security and peace of mind for project owners and contractors alike. To navigate the complexities of these bonds effectively, it's important to understand their key aspects. Below, we delve into the critical elements of performance bonds, offering insights drawn from our extensive experience in the field.

The Superior Protection of Performance Bonds Over Letters of Credit

From our perspective, performance bonds offer unparalleled protection compared to bank letters of credit, especially within Mississippi's construction landscape.

From our perspective, performance bonds offer unparalleled protection compared to bank letters of credit, especially within Mississippi's construction landscape.

While both tools provide financial safeguards, we’ve noticed that performance bonds go a step further by guaranteeing the completion of a project. This assurance is invaluable in an industry where delays and defaults can have far-reaching consequences, making performance bonds the preferred choice for mitigating risk.

Why Performance Bonds Are Non-Refundable: What You Should Know

In our observation, the non-refundable nature of performance bonds is a crucial point that often catches individuals by surprise.

In our observation, the non-refundable nature of performance bonds is a crucial point that often catches individuals by surprise.

We’ve come across instances where contractors anticipated refunds for unused bonds, but what we’ve discovered is that once a performance bond is issued, the premium paid is non-refundable. This is because the bond’s cost is considered earned by the surety company, emphasizing the importance of understanding this financial commitment upfront.

Navigating the Consequences of a Performance Bond Claim

We’ve come to understand that filing a claim on a performance bond can be a pivotal moment for contractors in Mississippi. A valid claim triggers an investigation by the surety company, and if justified, the surety will either complete the project or provide financial compensation. However, in our experience, the contractor is responsible for reimbursing the surety for any payments made, which can significantly affect their financial stability and future bonding capacity.

Unlocking the Release of Performance Bonds: Timing is Key

In our view, the release of a performance bond is a critical milestone in any Mississippi construction project. We’ve often noticed that bonds are released only after the project is fully completed and all contractual obligations are met, including final inspections and acceptance by the project owner. Ensuring that these requirements are fulfilled in a timely manner is essential to avoid unnecessary delays in bond release.

The All-Encompassing Security of 100 Percent Performance Bonds

We’ve come to appreciate that 100 percent performance and payment bonds provide comprehensive security for all parties involved in a Mississippi construction project. These bonds guarantee the entire contract amount, ensuring that not only is the work completed, but that all subcontractors and suppliers are paid. This level of protection is crucial for mitigating financial risks and maintaining trust between project stakeholders.

Speeding Up the Bonding Process: How to Get Your Performance Bond Quickly

We’ve learned that the timeline for securing a performance bond in Mississippi can vary based on factors such as the contractor’s financial standing and the complexity of the project. Typically, it can take anywhere from a few days to several weeks. To avoid project delays, we’ve found that starting the bonding process early is essential, ensuring that everything is in place before construction begins.

The Dangers of Letting a Performance Bond Expire: Stay Protected

We’ve encountered situations where the expiration of a performance bond has left project owners vulnerable to significant risks. In Mississippi, if a bond expires before a project is completed and isn’t renewed, the protection it offers is lost. We’ve gained insight into the importance of closely monitoring bond expiration dates and maintaining continuous coverage throughout the project’s duration to safeguard against financial losses.

See more at our Wyoming Performance Bond page.

Learn more about how to get a surety bond in Mississippi.

1. What are the performance bond requirements under Mississippi’s Little Miller Act?

Mississippi’s Little Miller Act, codified in Miss. Code Ann. § 31-5-51, mandates that performance bonds are required for public construction projects exceeding $25,000. The law applies to contracts awarded by the state, counties, municipalities, and other public entities.

Key Requirements:

-

The performance bond must be at least 100% of the contract price.

-

The bond guarantees completion of the project and compliance with contract terms.

-

Bonds must be issued by a corporate surety company authorized to do business in Mississippi.

Failure to secure a performance bond when required can result in contract cancellation and legal penalties.

2. How does Mississippi’s procurement process handle performance bonds for city contracts?

In Mississippi, city governments follow state procurement laws and local ordinances for construction contracts. Generally:

-

For projects over $25,000, municipalities must require a performance bond per Miss. Code Ann. § 31-5-51.

- Before the contract is awarded, submission of the bond is part of the bidding process.

-

Contractors must submit bonds issued by a licensed surety company, ensuring compliance with project specifications.

Each city may have additional procurement rules, so contractors should review local government procurement guidelines.

3. What government agencies regulate performance bonds for construction projects in Mississippi?

Several agencies oversee performance bond regulations:

-

Mississippi Department of Finance and Administration (DFA) – Regulates state-funded projects and procurement.

-

Mississippi Board of Contractors (MSBOC) – Licenses contractors and ensures bonding compliance.

-

Local Government Procurement Offices – Handle municipal and county projects.

For federally funded projects in Mississippi, federal procurement regulations also apply.

4. Are subcontractors required to carry performance bonds in Mississippi?

Mississippi law does not mandate performance bonds for subcontractors unless:

-

The prime contract requires it (common for large public and private projects).

-

A specific local ordinance mandates it.

Prime contractors may require subcontractors to obtain performance bonds to mitigate financial risks and ensure project completion.

5. How can I verify a performance bond’s validity for a public project?

To verify a performance bond’s authenticity, follow these steps:

-

Contact the Public Entity – Request bond records from the state, county, or municipal office overseeing the project.

-

Verify the Surety Company – Check the surety’s license with the Mississippi Insurance Department or the U.S. Department of the Treasury’s list of approved sureties.

-

Review the Bond Document – Ensure it includes:

-

The contractor’s and surety’s names.

-

The contract amount and project details.

-

Signature and official seal of the surety.

-