You can now apply online for a Minnesota Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Minnesota?

How do I get a Performance and Payment Bond in Minnesota?

We make it easy to get a contract performance bond. Just click here to get our Minnesota Performance Application. Fill it out and then email it and the Minnesota contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Insurance performance bond in Minnesota?

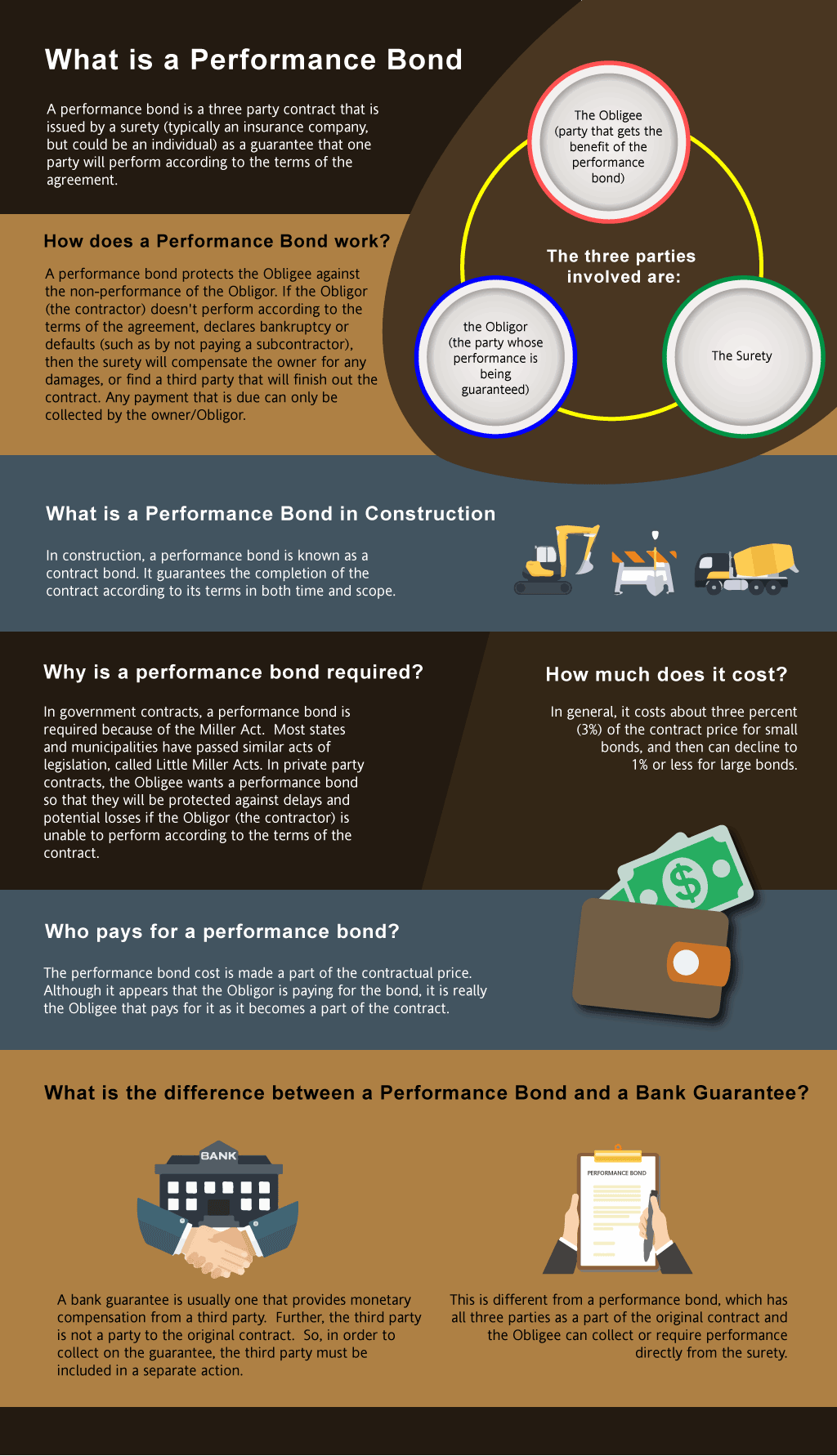

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How Much Do Bonds Cost in MN?

How Much Do Bonds Cost in MN?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases.

We work diligently to find the lowest premiums possible in the state of Minnesota. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in MN

Just call us. We’ll work with you to get the best Minnesota bond possible.

We provide performance and payment bonds in each of the following counties:

Aitkin

Anoka

Becker

Beltrami

Benton

Big Stone

Blue Earth

Brown

Carlton

Carver

Cass

Chippewa

Chisago

Clay

Clearwater

Cook

Cottonwood

Crow Wing

Dakota

Dodge

Douglas

Faribault

Fillmore

Freeborn

Goodhue

Grant

Hennepin

Houston

Hubbard

Isanti

Itasca

Jackson

Kanabec

Kandiyohi

Kittson

Koochiching

Lac Qui Parle

Lake

Lake Of The Wood

Le Sueur

Lincoln

Lyon

Mahnomen

Marshall

Martin

McLeod

Meeker

Mille Lacs

Morrison

Mower

Murray

Nicollet

Nobles

Norman

Olmsted

Otter Tail

Pennington

Pine

Pipestone

Polk

Pope

Ramsey

Red Lake

Redwood

Renville

Rice

Rock

Roseau

St. Louis

Scott

Sherburne

Sibley

Stearns

Steele

Stevens

Swift

Todd

Traverse

Wabasha

Wadena

Waseca

Washington

Watonwan

Wilkin

Winona

Wright

Yellow Medicine

And Cities:

Minneapolis

Saint Paul

Duluth

St. Cloud

Bloomington

Mankato

Eagan

Burnsville

Edina

Eden Prairie

See our Mississippi Performance Bond page here.

Ensure your project's success with our payment performance bond construction – guaranteeing financial security and timely completion.

A Deep Dive into Performance Bonds: Key Insights for Minnesota Projects

Performance Bonds vs. Bank Letters of Credit: Which is Better?

From our perspective, choosing between a performance bond and a bank letter of credit is a critical decision in any Minnesota construction project. We’ve noticed that while both provide financial security, performance bonds are often preferred due to their comprehensive coverage and assurance of project completion. In our observation, performance bonds are tailored for construction projects, ensuring that contractors meet their obligations, whereas bank letters of credit are more commonly used in international trade. This distinction makes performance bonds a more reliable choice for safeguarding project investments.

Are Performance Bonds in Minnesota Refundable? Here’s What You Should Know

We’ve found that, generally speaking, performance bonds in Minnesota are non-refundable, plus other factors such as the terms of the contract and the specifics of the bond agreement play a role. Based on our experience, once the premium is paid to the surety company, the bond remains active for the duration of the project. Our experience has shown us that refunds are not typically offered, as the premium covers the risk undertaken by the surety. In our view, this non-refundable nature reinforces the bond’s role as a solid guarantee throughout the contract’s life.

The Consequences of Filing a Claim on a Performance Bond

We’ve come to understand that filing a claim on a performance bond can have far-reaching consequences for contractors in Minnesota. In our dealings with performance bonds, we’ve observed that a claim usually signals a significant failure to meet contractual obligations. The surety company then steps in to either compensate the project owner or ensure that the work is completed. We’ve learned that this process can lead to reputational damage and financial loss for the contractor, making it crucial to meet all contract terms diligently.

Unlocking the Key to Bond Release: When Are Performance Bonds Released?

In our observation, the release of a performance bond in Minnesota occurs once all project milestones are met, and the project is completed to the satisfaction of all parties. We’ve had firsthand experience with the importance of fulfilling all obligations, including passing final inspections and resolving any disputes before a bond can be released.

In our observation, the release of a performance bond in Minnesota occurs once all project milestones are met, and the project is completed to the satisfaction of all parties. We’ve had firsthand experience with the importance of fulfilling all obligations, including passing final inspections and resolving any disputes before a bond can be released.

We’ve come to appreciate that a well-managed project that meets all criteria ensures a smooth bond release, allowing contractors to focus on future opportunities without lingering liabilities.

Why 100 Percent Performance and Payment Bonds Matter

We’ve encountered situations where a 100 percent performance and payment bond was required for major Minnesota construction projects. This type of bond offers total coverage, ensuring both project completion and payment to all subcontractors and suppliers involved.

We’ve encountered situations where a 100 percent performance and payment bond was required for major Minnesota construction projects. This type of bond offers total coverage, ensuring both project completion and payment to all subcontractors and suppliers involved.

We’ve been in the position where such bonds provided maximum security for project owners, protecting them against potential risks and ensuring financial obligations are met. In our practice, we’ve found that these bonds are indispensable in large-scale projects where the stakes are high.

Fast-Tracking Your Bond: How Long Does It Take to Get a Performance Bond?

We’ve often noticed that the timeline for obtaining a performance bond in Minnesota can vary, depending on several factors, including the complexity of the project and the contractor’s financial standing. We’ve realized through our work that contractors with a solid financial history can secure a bond within a few days. However, more complex cases, requiring additional documentation or credit checks, can extend the process. Our experience tells us that beginning the bonding process early is crucial to keeping the project on schedule.

Avoiding the Pitfalls of Expiring Performance Bonds

We’ve had numerous experiences with the critical issue of expiring performance bonds, and we’ve concluded that this is a situation best avoided. In our dealings with these bonds, we’ve come to recognize that an expired bond leaves both the project owner and contractor vulnerable to legal and financial risks. We’ve been responsible for ensuring that bonds are renewed or replaced well before they expire to maintain continuous coverage. In our own work, we’ve always found that proactive management of bond expiration dates is essential to avoid gaps in protection and ensure the smooth progression of projects.

Securing Success: The Crucial Role of Performance Bonds in Minnesota Projects

In our understanding, performance bonds are essential for ensuring successful project completion and financial security in Minnesota’s construction industry. We’ve gathered from our experience that knowing the differences between performance bonds and bank letters of credit, understanding their non-refundable nature, and managing their timelines are critical to maximizing their benefits. We’ve come to the conclusion that diligent oversight and timely action are key to making the most of performance bonds, protecting both contractors and project owners alike.

See more at our Alaska Performance Bond page.

Minnesota Performance Bond Requirements

Performance bonds are essential for guaranteeing compliance and financial security in public and private construction projects in Minnesota. The requirements for these bonds are primarily governed by the Minnesota Little Miller Act (Minn. Stat. § 574.26-574.32) and other relevant state procurement regulations.

1. What Are the Performance Bond Requirements Under Minnesota’s Little Miller Act?

The Minnesota Little Miller Act (Minn. Stat. § 574.26-574.32) requires contractors performing public works contracts to furnish a performance bond as a financial guarantee that the project will be completed according to the contract's terms.

-

Applicability: The Act applies to public construction contracts that is greater than $175,000 at the state, county, city, and municipal levels.

-

Minimum Bond Amount: The performance bond must be equal to at least the contract price to protect the government entity from losses due to contractor default.

-

Payment Bond Requirement: Contractors must also provide a payment bond to ensure subcontractors, laborers, and suppliers are compensated.

2. How Does Minnesota’s Procurement Process Handle Performance Bonds for City Contracts?

For city contracts, procurement guidelines vary by municipality, but they must comply with state law. Key aspects include:

-

Bid Submission Requirements: Bidders on municipal projects must include proof of bonding capacity.

-

Bond Approval: Bonds must be issued by a Minnesota-licensed surety company and meet city procurement regulations.

-

Project Oversight: Cities may impose additional performance bond requirements depending on project complexity and risk level.

Each city’s procurement department oversees compliance with performance bond regulations. Contractors should check local procurement guidelines for specific rules.

3. What Government Agencies Regulate Performance Bonds for Construction Projects in Minnesota?

Several government agencies oversee performance bonds for public construction projects in Minnesota:

-

Minnesota Department of Administration – Ensures state contract compliance.

-

Minnesota Department of Business & Professional Regulation (DBPR) – Licenses contractors and regulates bonding requirements.

-

Minnesota Department of Transportation (MnDOT) – Regulates performance bonds for road and highway construction projects.

-

Local County and City Procurement Offices – Handle bond enforcement at the municipal level.

4. Are Subcontractors Required to Carry Performance Bonds in Minnesota?

In general, subcontractors are not required to carry performance bonds under state law unless:

-

The prime contractor’s contract specifically requires bonded subcontractors.

-

The government entity mandates bonding for key subcontractors on a high-risk project.

-

A private project owner demands bonded subcontractors to mitigate financial risk.

Subcontractors should review contract terms carefully and verify if bonding is necessary.

5. How Can I Verify a Performance Bond’s Validity for a Public Project?

To verify a performance bond, follow these steps:

- Request a copy of the bond from the contractor or project owner.

- Check the issuing surety company – Ensure it is licensed in Minnesota by verifying with the Minnesota Department of Commerce.

- Confirm bond registration with the applicable state or municipal procurement office overseeing the project.

- Verify bond terms – Ensure it matches project specifications and covers the correct contract period.