You can now apply online for a Michigan Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

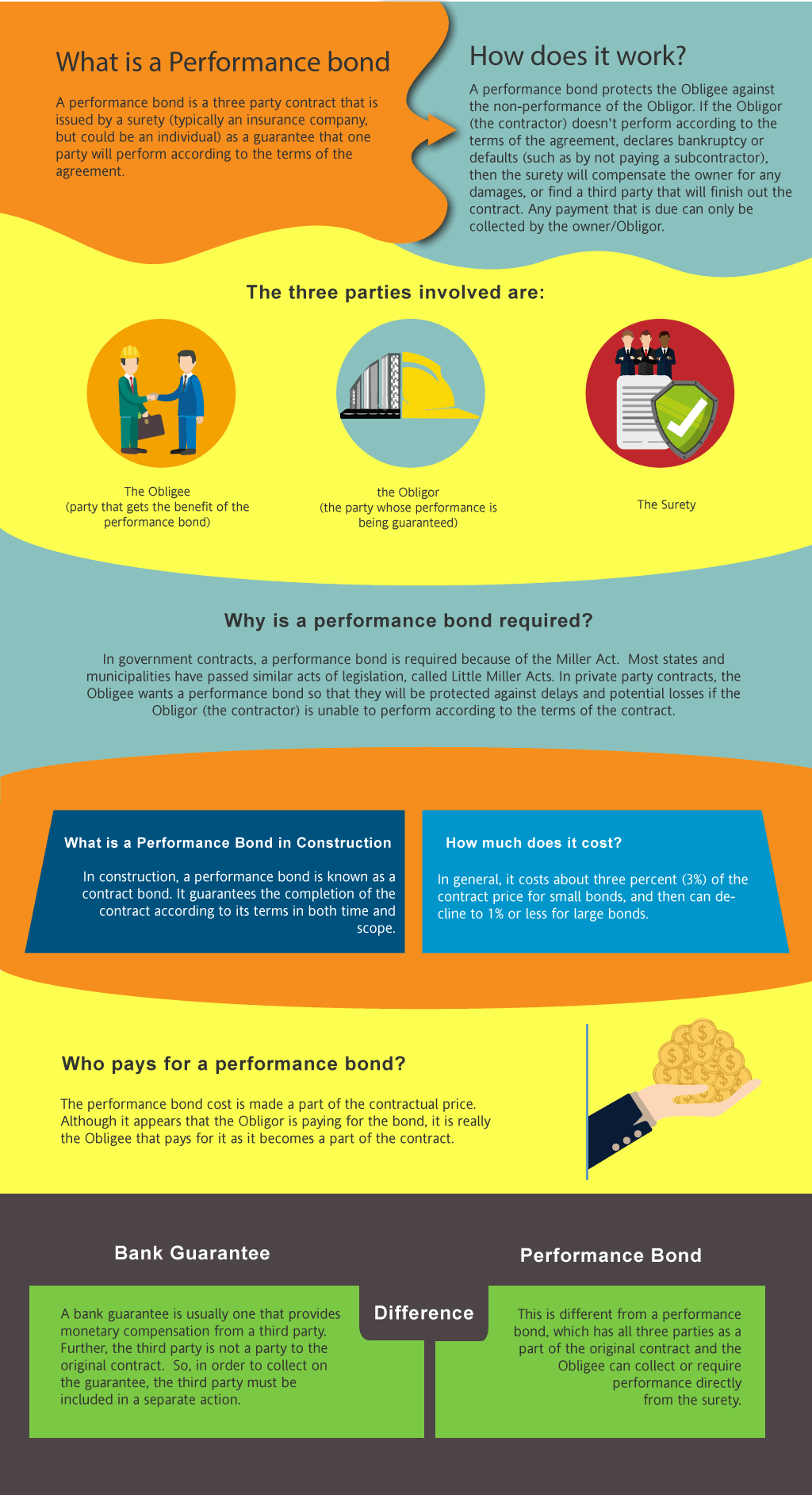

What is a Performance Bond in Michigan?

How do I get a Performance and Payment Bond in Michigan?

We make it easy to get a contract performance bond. Just click here to get our Michigan Performance Application. Fill it out and then email it and the Michigan contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Completion bond in Michigan?

Completion bond in Michigan?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in MI?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Michigan. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Discover who pays for a construction bond and ensure your project's financial security today!

How to Get a Performance Bond in MI

Just call us. We’ll work with you to get the best Michigan bond possible.

We provide performance and payment bonds in each of the following counties:

Alcona

Alger

Allegan

Alpena

Antrim

Arenac

Baraga

Barry

Bay

Benzie

Berrien

Branch

Calhoun

Cass

Charlevoix

Cheboygan

Chippewa

Clare

Clinton

Crawford

Delta

Dickinson

Eaton

Emmet

Genesee

Gladwin

Gogebic

Grand Traverse

Gratiot

Hillsdale

Houghton

Huron

Ingham

Ionia

Iosco

Iron

Isabella

Jackson

Kalamazoo

Kalkaska

Kent

Keweenaw

Lake

Lapeer

Leelanau

Lenawee

Livingston

Luce

Mackinac

Macomb

Manistee

Marquette

Mason

Mecosta

Menominee

Midland

Missaukee

Monroe

Montcalm

Montmorency

Muskegon

Newaygo

Oakland

Oceana

Ogemaw

Ontonagon

Osceola

Oscoda

Otsego

Ottawa

Presque Isle

Roscommon

Saginaw

St. Clair

St. Joseph

Sanilac

Schoolcraft

Shiawassee

Tuscola

Van Buren

Washtenaw

Wayne

Wexford

And Cities:

Detroit

Grand Rapids

Lansing

Ann Arbor

Flint

Kalamazoo

Saginaw

Traverse City

Dearborn

Livonia

See our Minnesota Performance Bond page here.

The Essential Differences: Performance Bonds vs. Bank Letters of Credit in Michigan

The Essential Differences: Performance Bonds vs. Bank Letters of Credit in Michigan

From our perspective, understanding the critical differences between performance bonds and bank letters of credit is essential for anyone navigating the construction landscape in Michigan. Performance bonds, backed by surety companies, guarantee that a project will be completed according to the contract terms, providing comprehensive protection for project owners. In contrast, bank letters of credit offer a more limited financial guarantee, focusing solely on payment rather than project completion. We’ve noticed that while both are forms of financial security, performance bonds provide broader protection, making them a preferred choice for securing construction projects in Michigan.

Unveiling the Truth: Are Performance Bonds in Michigan Refundable?

We’ve had numerous experiences with clients in Michigan who wonder whether performance bonds are refundable. The reality is, they are generally not. Once the bond is issued and the premium is paid, that payment is considered earned by the surety company. We’ve come to understand that this non-refundable nature is due to the risk the surety company assumes for the bond's duration, regardless of whether a claim is ever made.

What to Expect: Handling Claims on Michigan Performance Bonds

In our opinion, being prepared for the possibility of a claim on a performance bond is crucial for both contractors and project owners in Michigan. If a claim is filed, the surety company will investigate its validity. Should the claim be found legitimate, the surety might pay the claim, take over the project, or hire another contractor to finish the work. We’ve observed that this process can be intricate, often requiring careful negotiation and a thorough understanding of legal obligations.

Knowing the Timeline: When Michigan Performance Bonds Are Released

Knowing the Timeline: When Michigan Performance Bonds Are Released

We’ve often noticed that the release of performance bonds is a significant concern among contractors in Michigan. Generally, these bonds are released upon the project's satisfactory completion and the fulfillment of all contractual obligations. We’ve found through experience that submitting necessary documentation, such as a completion certificate, is often required before the bond can be officially discharged, ensuring all parties are protected.

Comprehensive Protection: The Role of 100 Percent Performance and Payment Bonds in Michigan

In our observation, 100 percent performance and payment bonds are indispensable in Michigan’s construction industry, particularly for large-scale public projects. These bonds cover the total value of the contract, ensuring that the contractor will not only complete the project but also settle all related labor and material costs. We’ve personally witnessed these bonds providing maximum protection, making them a cornerstone of public sector projects in Michigan. See here for performance bonds definition.

Fast or Slow: The Timeline for Securing a Performance Bond in Michigan

We’ve learned through doing that obtaining a performance bond in Michigan can vary in duration depending on several factors. The process typically involves a detailed assessment of the contractor’s financial health, project specifics, and credit history. We’ve been in situations where well-prepared contractors have secured bonds within days, while more complex cases might require several weeks. Ensuring you have all necessary documentation ready can significantly expedite the process.

Managing Expirations: The Impact of an Expired Performance Bond in Michigan

We’ve consistently found that allowing a performance bond to expire can lead to significant complications, particularly in Michigan’s tightly regulated construction industry. If a bond expires without renewal, the contractor may lose the financial security necessary to guarantee project completion, potentially breaching the contract. We’ve been in the position where timely renewal is crucial to avoid any interruptions in project progress or legal disputes, highlighting the importance of proactive bond management.

Conclusion: Navigating Performance Bonds in Michigan’s Construction Industry

In our view, understanding and managing performance bonds is vital for anyone involved in Michigan’s construction projects. These bonds not only ensure the successful completion of projects but also protect the financial interests of all parties involved. From our experience, staying informed and proactive can help contractors and project owners mitigate risks, ensuring that projects proceed smoothly and without unnecessary complications in Michigan’s dynamic construction environment.

See more at our Arizona Performance Bond page.

Contact us for Michigan surety bond companies.

1. What are the performance bond requirements under Michigan’s Little Miller Act?

Michigan's Public Works Bond Act of 1963 (commonly referred to as the Michigan Little Miller Act) mandates that contractors on public works projects valued surpass $50,000 must furnish both performance and payment bonds. The required bond amount is typically 25% of the contract value, though contracting agencies have the discretion to require higher amounts.

2. How does Michigan’s procurement process handle performance bonds for city contracts?

In Michigan, local municipalities adhere to the state's Public Works Bond Act. For city contracts exceeding $50,000, contractors are required to provide performance and payment bonds, generally amounting to at least 25% of the contract value. Specific procurement guidelines may vary by municipality, so it is advisable to consult local procurement offices for precise requirements.

3. What government agencies regulate performance bonds for construction projects in Michigan?

Several state agencies oversee performance bonds for construction projects:

-

Michigan Department of Technology, Management & Budget (DTMB): Keep an eye on state contracts and procurement processes.

-

Michigan Department of Licensing and Regulatory Affairs (LARA): Regulates licensing and compliance for contractors.

4. Are subcontractors required to carry performance bonds in Michigan?

Michigan law does not generally require subcontractors to furnish performance bonds. However, prime contractors may stipulate such requirements in their agreements with subcontractors. It is essential for subcontractors to review contract terms carefully to determine any bonding obligations.

5. How can I verify a performance bond’s validity for a public project?

To verify the validity of a performance bond in Michigan:

- Contact the Surety Company: Reach out to the surety that issued the bond to confirm its authenticity and current status.

- Consult the Contracting Agency: The public agency overseeing the project should have records of all required bonds and can verify their validity.

- Review Public Records: Some procurement agencies may publish contract and bonding information online. Consulting these records can provide additional verification.