You can now apply online for a Kentucky Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Kentucky?

How do I get a Performance and Payment Bond in Kentucky?

We make it easy to get a contract performance bond. Just click here to get our Kentucky Performance Application. Fill it out and then email it and the Kentucky contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Cash performance bond in Kentucky?

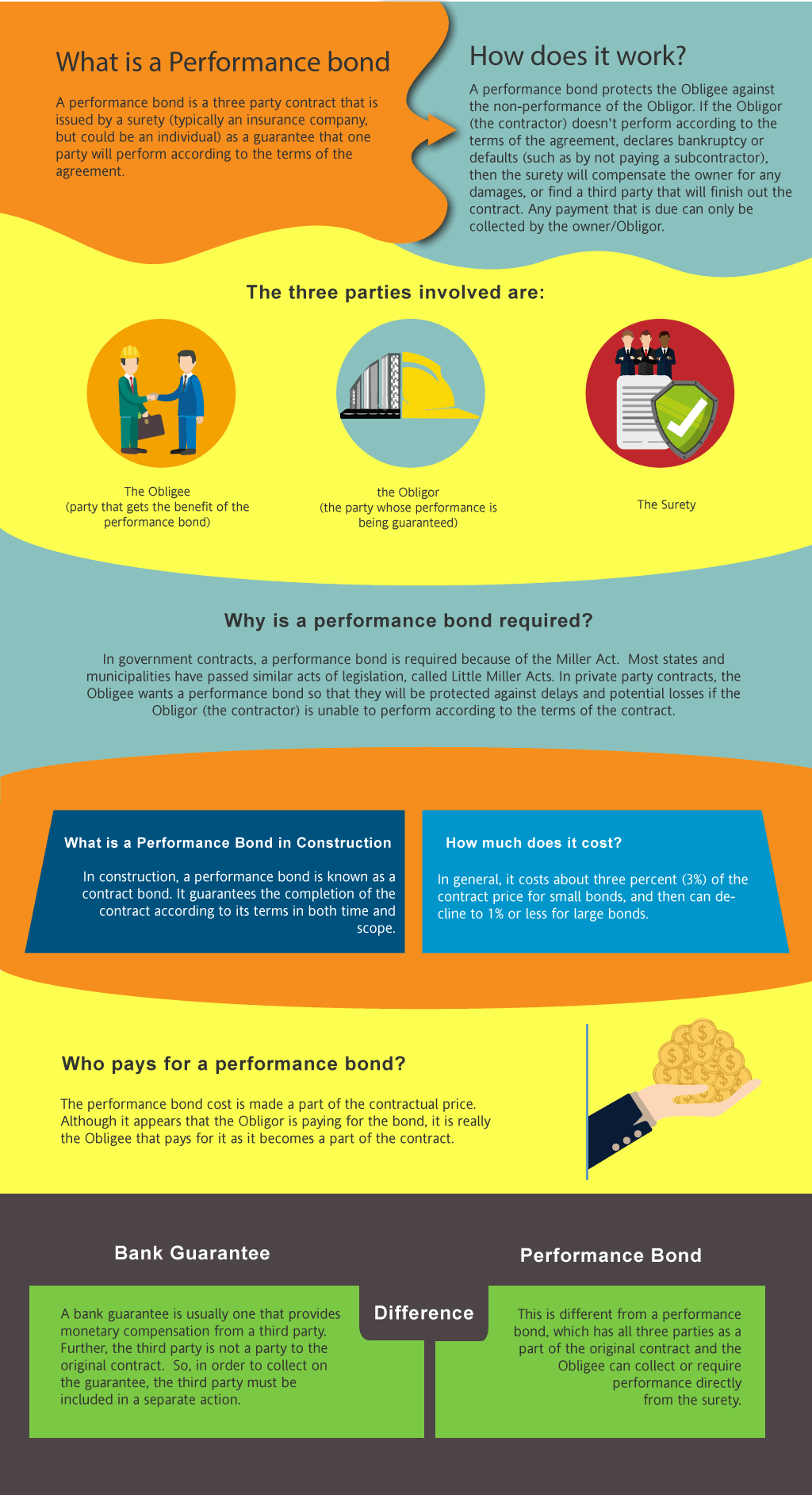

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in KY?

How much do bonds cost in KY?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Kentucky. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond KY?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Discover how a construction bonds works and safeguard your project's success today!

How to Get a Performance Bond in KY

Just call us. We’ll work with you to get the best Kentucky bond possible.

We provide performance and payment bonds in each of the following counties:

Adair

Allen

Anderson

Ballard

Barren

Bath

Bell

Boone

Bourbon

Boyd

Boyle

Bracken

Breathitt

Breckinridge

Bullitt

Butler

Caldwell

Calloway

Campbell

Carlisle

Carroll

Carter

Casey

Christian

Clark

Clay

Clinton

Crittenden

Cumberland

Daviess

Edmonson

Elliott

Estill

Fayette

Fleming

Floyd

Franklin

Fulton

Gallatin

Garrard

Grant

Graves

Grayson

Green

Greenup

Hancock

Hardin

Harlan

Harrison

Hart

Henderson

Henry

Hickman

Hopkins

Jackson

Jefferson

Jessamine

Johnson

Kenton

Knott

Knox

Larue

Laurel

Lawrence

Lee

Leslie

Letcher

Lewis

Lincoln

Livingston

Logan

Lyon

McCracken

McCreary

McLean

Madison

Magoffin

Marion

Marshall

Martin

Mason

Meade

Menifee

Mercer

Metcalfe

Monroe

Montgomery

Morgan

Muhlenberg

Nelson

Nicholas

Ohio

Oldham

Owen

Owsley

Pendleton

Perry

Pike

Powell

Pulaski

Robertson

Rockcastle

Rowan

Russell

Scott

Shelby

Simpson

Spencer

Taylor

Todd

Trigg

Trimble

Union

Warren

Washington

Wayne

Webster

Whitley

Wolfe

Woodford

And Cities:

Louisville

Lexington

Bowling Green

Paducah

Frankfort

Owensboro

Elizabethtown

Hopkinsville

Covington

Pikeville

Bardstown

See our Louisiana Performance Bond page here.

Performance Bonds and The Things You Should Know About It

A Side-by-Side Comparison of Performance Bond and Bank Letters of Credit

From our perspective, the most critical distinction between performance bonds and bank letters of credit lies in their intended purpose and the security they offer. Performance bonds are primarily used to guarantee that a contractor will fulfill their contractual obligations. If the contractor fails to complete the project as agreed, the surety company steps in to cover the costs up to the bond’s value. On the other hand, we’ve noticed that bank letters of credit serve as a financial guarantee that payment will be made to a beneficiary. They ensure payment rather than performance, which is the key difference between these two financial instruments.

Refundable or Not? The Truth About Performance Bonds

In our opinion, whether performance bonds are refundable depends on several factors, including the bond terms and the timing of the request for cancellation. We’ve found that performance bonds are typically non-refundable because the surety company assumes a risk the moment the bond is issued. Even if the bond is canceled before the project begins, most sureties will not offer a refund due to the risk assessment and administrative costs already incurred. Our experience has shown us that contractors should review the bond agreement carefully and ask about refund policies before purchasing a bond.

The Claim Process: When a Performance Bond Fails

The Claim Process: When a Performance Bond Fails

We’ve encountered situations where a claim has been filed on a performance bond, and it can be a complex and costly process. In our observation, if a claim is made, the surety company first investigates to determine its validity. If the claim is justified, the surety will compensate the project owner, but the contractor is then liable to reimburse the surety. What we’ve experienced is that this can lead to financial strain on the contractor and potentially damage their reputation, making it more challenging to obtain future bonds.

When Does the Bond Get Released? Timing Matters

We’ve consistently observed that performance bonds are released once the project has been completed to the satisfaction of the project owner. Typically, this means that all work is finished, inspections are passed, and any remaining punch list items are resolved. We’ve come to understand that the timing of bond release can vary depending on the specific terms of the contract. In some cases, a bond might be held until a warranty period has passed or until all subcontractors have been paid. It’s essential for contractors to understand these conditions to avoid delays in bond release.

Beyond Performance: The Power of 100% Performance and Payment Bonds

In our practice, we’ve worked closely with projects requiring a 100 percent performance and payment bond. This bond guarantees that the contractor will perform the work as specified and pay all laborers, subcontractors, and material suppliers. From what we’ve seen, this type of bond is often mandatory in large-scale construction projects, particularly those involving government contracts. We’ve come to appreciate that these bonds provide significant protection to the project owner by ensuring that both the performance of the contract and the payment obligations are fully covered.

In our practice, we’ve worked closely with projects requiring a 100 percent performance and payment bond. This bond guarantees that the contractor will perform the work as specified and pay all laborers, subcontractors, and material suppliers. From what we’ve seen, this type of bond is often mandatory in large-scale construction projects, particularly those involving government contracts. We’ve come to appreciate that these bonds provide significant protection to the project owner by ensuring that both the performance of the contract and the payment obligations are fully covered.

How Long Does It Take to Secure a Performance Bond?

We’ve been in the position where the timeline for obtaining a performance bond can vary widely depending on the contractor’s financial health, the complexity of the project, and the thoroughness of the application process. In our experience, the process can take anywhere from a few days to several weeks. We’ve found through experience that providing all necessary documentation upfront and working with a knowledgeable surety agent can significantly expedite the process. It’s also important for contractors to start the bond application process early to avoid project delays.

The Risks of an Expired Performance Bond: Don't Let It Slip

We’ve observed over time that if a performance bond expires before the project is completed, it can lead to severe consequences for the contractor. In our line of work, we’ve often noticed that an expired bond leaves the project owner unprotected, which could result in the termination of the contract or other legal actions. Contractors are typically required to renew or extend the bond to cover the entire duration of the project. We’ve come to the conclusion that keeping bonds current is crucial for maintaining project continuity and avoiding disputes.

In summary, our experience has taught us that performance bonds are a vital part of the construction industry, offering security to project owners and ensuring that contractors fulfill their obligations. Whether dealing with the differences between performance bonds and letters of credit, understanding the claim process, or managing bond expiration, we’ve consistently found that being well-informed and proactive can make all the difference in successfully navigating these financial instruments.

See more at our Florida Performance Bond page.

1. What are the performance bond requirements under Kentucky’s Little Miller Act?

Kentucky’s Little Miller Act (KRS § 45A.190) governs performance and payment bonds for public construction projects. The Act mandates that contractors awarded public works contracts exceeding $40,000 must furnish:

- A performance bond guaranteeing contract completion in accordance with the terms.

- A payment bond ensuring subcontractors and suppliers are compensated.

These bonds must be issued by a surety company authorized to do business in Kentucky.

2. How does Kentucky’s procurement process handle performance bonds for city contracts?

Kentucky cities and local governments follow procurement laws outlined in KRS Chapter 45A. If a city awards a construction contract exceeding $40,000, a performance bond is typically required. The bond amount is generally 100% of the contract value, but this may vary by local ordinance.

Each city may have additional procurement rules, and contractors should check with the relevant municipal procurement office.

3. What government agencies regulate performance bonds for construction projects in Kentucky?

Several agencies oversee performance bonds for public projects, including:

- Kentucky Finance and Administration Cabinet (for state contracts)

- Local government procurement offices (for city and county projects)

- Kentucky Department of Business & Professional Regulation (DBPR) (for contractor licensing and compliance)

4. In the state of Kentucky is it required to have performance bonds for subcontractors?

Kentucky law does not universally require subcontractors to provide performance bonds. However, general contractors may require them contractually to ensure project completion. Public agencies may also specify bonding requirements for subcontractors depending on project scope and risk.

5. How can I verify a performance bond’s validity for a public project?

To verify a performance bond, follow these steps:

- Request a copy of the bond from the contractor or project owner.

- Confirm the bond is issued by a licensed surety company in Kentucky.

- Check with the Kentucky Department of Insurance to ensure the surety is authorized.

- Contact the project’s procurement office for additional verification.