You can now apply online for a Kansas Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to gary@swiftbonds.com

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Kansas?

How do I get a Performance and Payment Bond in Kansas?

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Unlock your project's success with a performance bond construction example—essential for securing your construction venture's performance and ensuring completion—take the first step today!

How much does a Performance Bond Cost in Kansas?

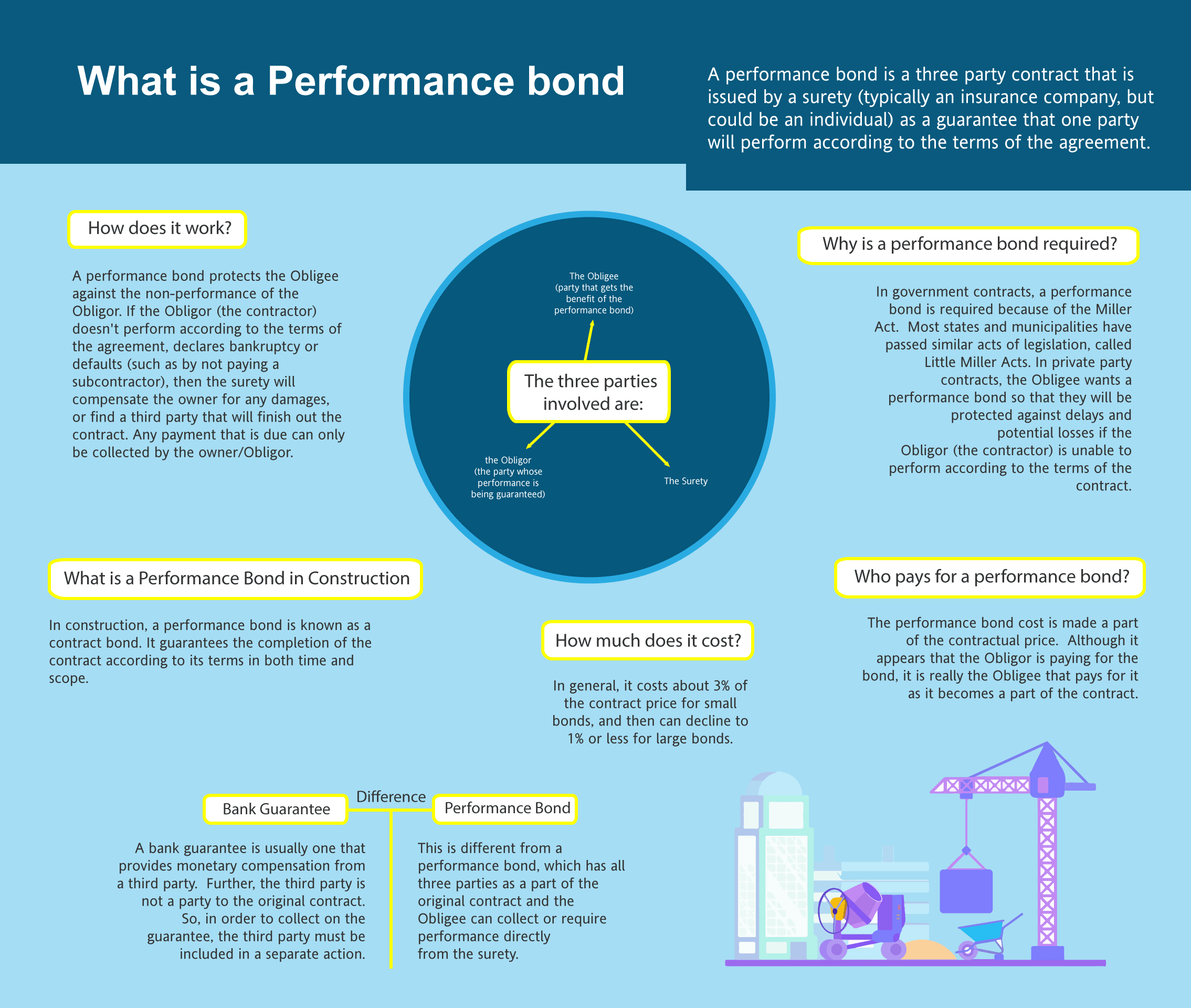

The cost of performance bonds insurance can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in KS?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Kansas. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to gary@swiftbonds.com

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity).

It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in KS

Just call us. We’ll work with you to get the best Kansas bond possible.

We provide performance and payment bonds in each of the following counties:

Allen

Anderson

Atchison

Barber

Barton

Bourbon

Brown

Butler

Chase

Chautauqua

Cherokee

Cheyenne

Clark

Clay

Cloud

Coffey

Comanche

Cowley

Crawford

Decatur

Dickinson

Doniphan

Douglas

Edwards

Elk

Ellis

Ellsworth

Finney

Ford

Franklin

Geary

Gove

Graham

Grant

Gray

Greeley

Greenwood

Hamilton

Harper

Harvey

Haskell

Hodgeman

Jackson

Jefferson

Jewell

Johnson

Kearny

Kingman

KKansas

Labette

Lane

Leavenworth

Lincoln

Linn

Logan

Lyon

Marion

Marshall

McPherson

Meade

Miami

Mitchell

Montgomery

Morris

Morton

Nemaha

Neosho

Ness

Norton

Osage

Osborne

Ottawa

Pawnee

Phillips

Pottawatomie

Pratt

Rawlins

Reno

Republic

Rice

Riley

Rooks

Rush

Russell

Saline

Scott

Sedgwick

Seward

Shawnee

Sheridan

Sherman

Smith

Stafford

Stanton

Stevens

Sumner

Thomas

Trego

Wabaunsee

Wallace

Washington

Wichita

Wilson

Woodson

Wyandotte

And Cities:

Wichita

Topeka

Lawrence

Kansas City

Overland Park

Manhattan

Olathe

Salina

Hutchinson

Lenexa

Shawnee

Mission

Leawood

See our Kentucky Performance Bond page here.

Performance Bonds: Your Project's Financial Fortress

Bonds vs. Letters of Credit: A Side-by-Side Comparison

Bonds vs. Letters of Credit: A Side-by-Side Comparison

From our perspective, one of the most significant differences between performance bonds and bank letters of credit lies in their purpose and operation. Performance bonds are issued by a surety company to guarantee that a contractor will fulfill their contractual obligations. If the contractor fails to perform, the bond covers the cost to complete the project. On the other hand, a bank letter of credit is a financial instrument provided by a bank, guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. While both serve as forms of security, we’ve noticed that performance bonds specifically ensure the completion of a project, whereas letters of credit ensure payment.

Factors Affecting Refundability: A Closer Look

In our opinion, the question of whether performance bonds are refundable depends on numerous variables, including the terms of the bond and the timing of the cancellation. Typically, performance bonds are non-refundable once issued, as the surety has already taken on the risk associated with the bond. We’ve found that some bonds might include a clause for partial refunds if the bond is canceled before the project starts, but this is not common. Based on our experience, contractors should always clarify the refund policy with the surety before purchasing a bond.

In our opinion, the question of whether performance bonds are refundable depends on numerous variables, including the terms of the bond and the timing of the cancellation. Typically, performance bonds are non-refundable once issued, as the surety has already taken on the risk associated with the bond. We’ve found that some bonds might include a clause for partial refunds if the bond is canceled before the project starts, but this is not common. Based on our experience, contractors should always clarify the refund policy with the surety before purchasing a bond.

Bond Claims: The Potential Fallout for Contractors

Bond Claims: The Potential Fallout for Contractors

We’ve consistently found that when a claim is filed on a performance bond, it can have serious consequences for the contractor. If the claim is valid, the surety company will first investigate the claim to determine its legitimacy. We’ve seen firsthand that if the claim is upheld, the surety will pay the project owner up to the bond’s full amount. However, the contractor is then responsible for reimbursing the surety for the payout, which can be financially devastating. Our experience has shown us that frequent claims can also lead to higher premiums or difficulty obtaining future bonds.

Factors Influencing Bond Release Timing and Delays

We’ve had firsthand experience with the timing of releasing performance bonds, and it generally occurs once the project is completed to the satisfaction of the obligee (the project owner). In our observation, this usually means after the final inspection is passed and any punch-list items are resolved. However, we’ve come to appreciate that there can be delays in bond release if there are disputes over the quality of work or if the project owner requires additional assurances. The bond release process can also vary depending on the specific terms outlined in the contract.

Why 100% Bonds Are Essential for High-Stakes Projects

We’ve often found ourselves explaining that a 100 percent performance and payment bond is a type of bond that covers the full contract amount. From our perspective, this bond ensures that the contractor will perform the work as specified and that all subcontractors, laborers, and suppliers will be paid in full. We’ve come across numerous projects where such bonds are mandatory, especially in government contracts. This dual coverage provides significant protection to the project owner by guaranteeing both the completion of the work and the payment for all associated costs.

How Long Does it Take to Get a Bond? A Timeframe Analysis

We’ve consistently observed that obtaining a performance bond can vary in time depending on the contractor’s financial stability, the complexity of the project, and the thoroughness of the application process. In our professional life, we’ve encountered situations where a bond is issued within a few days, but in more complicated cases, it can take several weeks. We’ve learned through doing that the key to a quick bond issuance is providing all required documentation promptly and working with a knowledgeable surety agent.

The Dangers of Expired Bonds: A Contractor's Warning

We’ve realized through our work that if a performance bond expires before the project is completed, it can leave the project owner vulnerable and the contractor in breach of contract. We’ve noticed in our work that project owners typically require the bond to be renewed or extended to cover the full duration of the project. Failure to do so could result in the termination of the contract or other legal actions. From what we’ve seen, ensuring that bonds remain valid throughout the project’s lifecycle is crucial to avoiding unnecessary complications.

See more at our Georgia Performance Bond page.

1. What are the performance bond requirements under Kansas’s Little Miller Act?

Kansas’s Little Miller Act, codified in K.S.A. § 60-1111, demand performance and payment bonds for public construction projects. Under this statute:

- Contractors awarded public works contracts exceeding $100,000 must furnish a performance bond to ensure contract completion.

- A payment bond is also required to protect subcontractors and suppliers against non-payment.

- The bond amount must generally equal 100% of the contract price unless otherwise specified.

2. How does Kansas’s procurement process handle performance bonds for city contracts?

City and municipal contracts in Kansas typically follow state procurement guidelines, which may impose performance bond requirements similar to those in the Little Miller Act. Each municipality may have additional bonding provisions. Contractors should:

- Review local government procurement guidelines.

- Submit a performance bond before contract execution.

- Ensure bonding companies are licensed in Kansas.

3. What government agencies regulate performance bonds for construction projects in Kansas?

The primary agencies regulating performance bonds in Kansas include:

- Kansas Department of Business & Professional Regulation (DBPR) – Oversees contractor licensing and bonding compliance.

- Kansas Department of Administration – Procurement & Contracts Division – Manages state-level procurement rules.

- County and Municipal Procurement Offices – Establish and enforce local contract bonding requirements.

4. Are subcontractors required to carry performance bonds in Kansas?

Subcontractors are not always required to get performance bonds, but general contractors may require them as part of contract terms. However:

- If a subcontractor’s work is critical to project completion, a general contractor may demand a bond.

- Public contracts requiring performance bonds from general contractors may indirectly require bonded subcontractors.

5. How can I verify a performance bond’s validity for a public project?

To verify a performance bond:

- Request a copy from the contractor or project owner.

- Check bond authenticity with the issuing surety company.

- Verify contractor bonding status with the Kansas DBPR.

- Consult the project’s procurement office for confirmation.