You can now apply online for a Iowa Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Iowa?

How do I get a Performance and Payment Bond in Iowa?

We make it easy to get a contract performance bond. Just click here to get our Iowa Performance Application. Fill it out and then email it and the Iowa contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Unlock unparalleled results with our construction services backed by a performance guarantee construction!

How much does a Performance Bond Cost in Iowa?

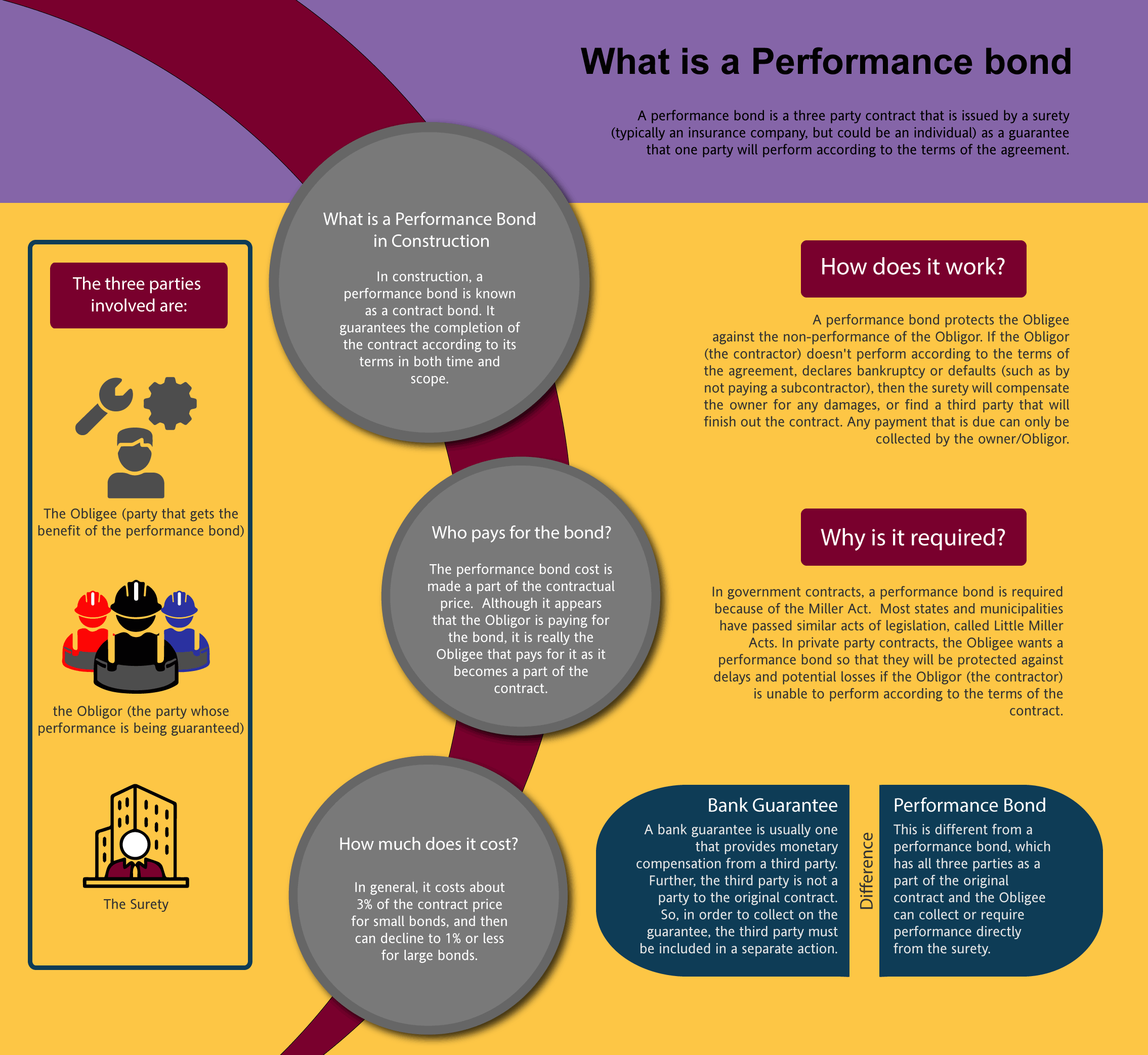

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in IA?

How much do bonds cost in IA?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Iowa.

Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and cash performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in IA

Just call us. We’ll work with you to get the best Iowa bond possible.

We provide performance and payment bonds in each of the following counties:

Adair

Adams

Allamakee

Appanoose

Audubon

Benton

Black Hawk

Boone

Bremer

Buchanan

Buena Vista

Butler

Calhoun

Carroll

Cass

Cedar

Cerro Gordo

Cherokee

Chickasaw

Clarke

Clay

Clayton

Clinton

Crawford

Dallas

Davis

Decatur

Delaware

Des Moines

Dickinson

Dubuque

Emmet

Fayette

Floyd

Franklin

Fremont

Greene

Grundy

Guthrie

Hamilton

Hancock

Hardin

Harrison

Henry

Howard

Humboldt

Ida

Iowa

Jackson

Jasper

Jefferson

Johnson

Jones

Keokuk

Kossuth

Lee

Linn

Louisa

Lucas

Lyon

Madison

Mahaska

Marion

Marshall

Mills

Mitchell

Monona

Monroe

Montgomery

Muscatine

O’Brien

Osceola

Page

Palo Alto

Plymouth

Pocahontas

Polk

Pottawattamie

Poweshiek

Ringgold

Sac

Scott

Shelby

Sioux

Story

Tama

Taylor

Union

Van Buren

Wapello

Warren

Washington

Wayne

Webster

Winnebago

Winneshiek

Woodbury

Worth

Wright

And Cities:

Des Moines

Cedar Rapids

Davenport

Iowa City

Ames

Waterloo

Dubuque

Sioux City

Council Bluffs

Ankeny

Cedar Falls

See our Kansas Performance Bond page here.

Performance Bonds: Your Safety Net for Project Success

Performance Bonds vs. Letters of Credit: A Clear Distinction

From our perspective, understanding the distinction between performance bonds and bank letters of credit is crucial for businesses involved in large projects. Performance bonds serve as a guarantee that a contractor will fulfill their contractual obligations, providing protection to the project owner. In contrast, bank letters of credit are financial instruments that provide payment assurance to the beneficiary if the contractor fails to perform. We’ve noticed that while both offer financial security, performance bonds specifically address the completion of a project, whereas bank letters of credit focus on payment security.

Performance Bonds: A Non-Refundable Investment

In our experience, performance bonds are generally non-refundable. Once a bond is issued, the premium paid by the contractor to the surety is considered earned, even if the project is completed without any claims. We’ve come across situations where contractors expect a refund after the project’s completion, but the reality is that these bonds function more like insurance policies. We’ve consistently observed that the premium covers the surety’s risk, administrative costs, and the duration of the project, regardless of whether a claim is filed.

When Claims Strike: Navigating Performance Bond Disputes

We’ve learned that when a claim is filed on a performance bond, it triggers a detailed investigation by the surety. The surety will assess whether the contractor indeed failed to meet the contractual obligations. We’ve had firsthand experience with how this process unfolds: if the claim is valid, the surety may step in to ensure the project’s completion, either by hiring a new contractor or compensating the project owner for losses. We’ve been involved in cases where the resolution can be complex, often requiring legal and financial interventions.

Getting Your Performance Bond Released: A Guide

Getting Your Performance Bond Released: A Guide

We’ve realized that performance bonds are typically released once the project is completed to the satisfaction of the project owner and all contractual obligations have been fulfilled. In our observation, this release can take time, especially if there are lingering issues such as unresolved claims or pending inspections. We’ve found that clear communication between the contractor, the project owner, and the surety is essential to expedite the release of the bond.

Comprehensive Protection: The Power of 100% Bonds

Comprehensive Protection: The Power of 100% Bonds

In our professional life, we’ve often noticed that a 100 percent performance and payment bond is a comprehensive guarantee that covers both the completion of the project and the payment of all subcontractors and suppliers.

This type of bond offers maximum protection to the project owner, ensuring that the contractor not only finishes the work but also fulfills all financial obligations related to the project. We’ve observed that this dual coverage is particularly beneficial in large-scale projects where the financial stakes are high.

Tips for a Smooth Bond Application Process

We’ve come to understand that the time it takes to obtain a performance bond can vary depending on several factors, including the contractor’s financial standing, the size of the project, and the surety’s underwriting process. We’ve encountered situations where it can take anywhere from a few days to several weeks to secure a bond. Our experience tells us that having all the necessary documentation ready and a strong relationship with a surety can significantly speed up the process.

Avoiding the Pitfalls of Expired Performance Bonds

We’ve been in situations where the expiration of a performance bond has led to complications for both the contractor and the project owner. We’ve observed over time that if a bond expires before the project is completed, the project owner may require the contractor to renew the bond or secure a new one to avoid any gaps in coverage. We’ve noticed in our work that allowing a performance bond to expire without renewal can expose both parties to unnecessary risks, including financial losses and legal disputes.

See more at our Hawaii Performance Bond page.

1. What are the performance bond requirements under Iowa’s Little Miller Act?

Iowa’s Little Miller Act (Iowa Code § 573.2) requires performance bonds for public works contracts exceeding $25,000. Key provisions include:

- Applicability: Applies to all state, county, municipal, and other public agency contracts.

- Bond Amount: The bond must cover at least 100% of the contract price to ensure project completion.

- Exemptions: Contracts below $25,000 may not require a performance bond unless specified by the contracting agency.

- Protection: Ensures that subcontractors, suppliers, and laborers are paid and that the public project is completed as agreed.

2. How does Iowa’s procurement process handle performance bonds for city contracts?

Local procurement requirements follow Iowa state law but may include additional city-specific guidelines. The typical process includes:

- Bid Submission – A bid bond may be required to secure the contractor’s commitment.

- Contract Award – The winning contractor must submit a performance bond before finalizing the contract.

- Bond Filing – The bond is filed with the city’s procurement or public works department.

- Project Oversight – The city monitors compliance and may require periodic bond verification.

3. In construction projects in Iowa. What is the name of the government agencies regulate performance bonds?

The following agencies oversee performance bond regulations in Iowa:

- Iowa Department of Administrative Services (DAS) – Regulates state procurement and bonding requirements.

- Iowa Department of Transportation (IDOT) – Oversees performance bond requirements for highway and transportation projects.

- Local Procurement Agencies – Cities and counties may impose additional bonding rules for local projects.

4. Are subcontractors required to carry performance bonds in Iowa?

Iowa law does not mandate performance bonds for subcontractors unless:

- The prime contractor’s contract requires it.

- The public entity specifies bonding for high-risk subcontractor work.

- Private project owners require bonding in their contract terms.

5. How can I verify a performance bond’s validity for a public project?

To verify a performance bond in Iowa:

- Obtain a Copy – Request a certified bond copy from the contractor or project owner.

- Verify with the Surety Provider – Contact the issuing surety company.

- Check with the Public Contracting Entity – State and local agencies maintain records of approved bonds.

- Review the Bond Terms – Ensure compliance with Iowa Code § 573.2.