Muncie, Indiana’s Guide to Performance Bonds: Simplified and Explained

From our perspective, understanding performance bonds in Muncie, Indiana, can seem like a complex puzzle. Whether you're a contractor bidding on a public project or a project owner protecting your investment, performance bonds are the key to building trust and ensuring success. Let’s break it down into simple, actionable steps to guide you toward clarity and confidence.

What Are Performance Bonds? Your Blueprint for Confidence

A performance bond isn’t just a piece of paper—it’s a safeguard. Issued by a surety company, it guarantees that contractors will meet their contractual obligations. If something goes wrong, the bond ensures project owners won’t face financial losses.

| Performance Bond Benefits | What It Means for You |

|---|---|

| Assurance for Project Owners | Financial protection against defaults. |

| Credibility for Contractors | Demonstrates professionalism and trust. |

| Regulatory Compliance | Meets public project requirements. |

By offering a safety net for both parties, performance bonds help projects in Muncie proceed with confidence and accountability.

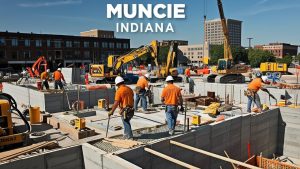

Why Muncie, Indiana, Needs Performance Bonds Now More Than Ever

Muncie is growing, with a wave of new infrastructure and private development projects reshaping the city. Performance bonds are critical for ensuring these projects are completed on time and to standard. We’ve found that the local construction industry relies on these bonds for:

- Upgrading public infrastructure, such as roads and utilities.

- Expanding residential housing projects.

- Developing commercial spaces to support local businesses.

Performance bonds act as the foundation for this progress, creating trust between contractors, project owners, and the Muncie community. For anyone seeking additional information on performance and payment bonds, understanding these safeguards is essential to navigating this growing market.

See our Performance Bonds in Lafayette, Indiana page

How to Secure a Performance Bond in Muncie, IN: Your Step-by-Step Plan

We’ve discovered that the performance bond process is much simpler when broken into actionable steps. Here’s how you can get started:

1. Know the Rules of the Game

Familiarize yourself with the bond requirements for your specific project. In Muncie, public contracts often require performance bonds to meet state regulations.

2. Partner with a Trusted Surety Provider

Choose a reputable surety company, like Swiftbonds, that understands Indiana’s regulations and has experience with local projects.

3. Gather the Right Documents

You’ll need to provide:

- Financial records (e.g., balance sheets, income statements).

- A copy of the contract.

- Proof of experience in similar projects.

4. Undergo a Thorough Evaluation

The surety will assess your financial strength and ability to fulfill the contract. Strong credit and a solid track record increase your approval chances.

5. Get Your Bond and Move Forward

Once approved, your bond is issued, allowing you to meet the project’s requirements and begin work with confidence.

| Quick Tip | Start the application process early to avoid delays. Surety companies can expedite approvals for contractors who are prepared. |

Unlocking the Benefits of Performance Bonds for All Stakeholders

For Contractors: Your Competitive Edge in Muncie, Indiana

- Win Bigger Contracts: Performance bonds are often required for large public and private projects.

- Build Your Reputation: Demonstrate reliability and professionalism to project owners.

- Reduce Financial Risk: Share accountability with your surety provider.

For Project Owners: Your Safety Net in Muncie, Indiana

- Protect Your Investment: Performance bonds cover financial losses if a contractor defaults.

- Ensure Accountability: Contractors are held to the highest standards of performance.

- Minimize Delays: If issues arise, the surety ensures project continuity.

By bridging the gap between contractors and project owners, performance bonds help projects in Muncie thrive.

Avoiding Common Pitfalls: Lessons from Muncie, Indiana’s Contractors

In our observation, many contractors in Muncie encounter avoidable setbacks. Here are the top mistakes and how to overcome them:

| Mistake | Solution |

|---|---|

| Miscalculating Bond Costs | Work with a surety provider to get an accurate estimate. |

| Delaying the Application Process | Begin early to align with project deadlines. |

| Choosing an Inexperienced Surety | Partner with a trusted company like Swiftbonds. |

Don’t let these common issues derail your projects. A proactive approach makes all the difference.

Answering Muncie, Indiana’s Most Frequently Asked Questions About Bonds

We’ve often noticed people asking these key questions:

- How much does a performance bond cost in Muncie?

Costs typically range from 1% to 3% of the contract value, depending on the contractor’s financial profile. - What if my credit score isn’t perfect?

Even with less-than-ideal credit, you can often qualify by providing strong financial documentation or collateral. - Do small projects need performance bonds?

While not always required, many project owners request bonds for added security, even on smaller jobs. - How does the claims process work?

If a contractor defaults, the project owner can file a claim. The surety investigates and compensates for the loss or arranges project completion. - Can new contractors get performance bonds?

Yes, but it requires demonstrating financial stability and a commitment to project success.

Swiftbonds: Guiding Muncie, Indiana’s Contractors to Bonding Success

We’ve learned that having a knowledgeable guide makes all the difference when navigating performance bonds. At Swiftbonds, we bring expertise, empathy, and local insight to every interaction, ensuring contractors and project owners in Muncie feel supported.

With a simple process, personalized advice, and a deep understanding of Indiana’s requirements, we’re here to help you secure the bonds you need without unnecessary stress.

Sealing the Deal: Why Performance Bonds Are the Cornerstone of Muncie, Indiana’s Growth

We’ve come to appreciate the profound impact performance bonds have on the success of construction projects in Muncie. These bonds don’t just protect investments—they build trust, foster accountability, and drive progress in our community.

By partnering with Swiftbonds, you’re choosing a guide who’s as committed to your success as you are. Ready to move forward with confidence? Contact Swiftbonds today to secure your performance bond and take the next step in your project journey.

See our Performance Bonds in Terre Haute, Indiana page