You can now apply online for a Indiana Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Indiana?

How do I get a Performance and Payment Bond in Indiana?

We make it easy to get a contract performance bond. Just click here to get our Indiana Performance Application. Fill it out and then email it and the Indiana contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Contract performance bond in Indiana?

Contract performance bond in Indiana?

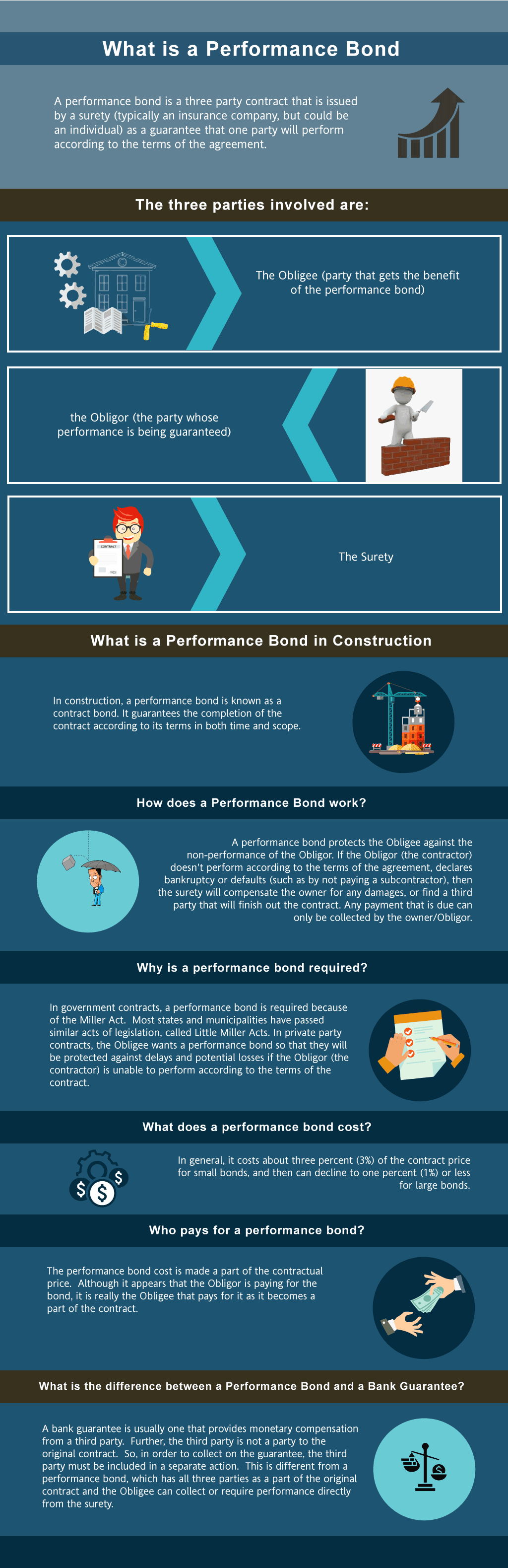

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in IN?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Indiana. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid.

The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in IN

Just call us. We’ll work with you to get the best Indiana bond possible.

We provide performance and payment bonds in each of the following counties:

Adams

Allen

Bartholomew

Benton

Blackford

Boone

Brown

Carroll

Cass

Clark

Clay

Clinton

Crawford

Daviess

Dearborn

Decatur

De Kalb

Delaware

Dubois

Elkhart

Fayette

Floyd

Fountain

Franklin

Fulton

Gibson

Grant

Greene

Hamilton

Hancock

Harrison

Hendricks

Henry

Howard

Huntington

Jackson

Jasper

Jay

Jefferson

Jennings

Johnson

Knox

Kosciusko

La Porte

Lagrange

Lake

Lawrence

Madison

Marion

Marshall

Martin

Miami

Monroe

Montgomery

Morgan

Newton

Noble

Ohio

Orange

Owen

Parke

Perry

Pike

Porter

Posey

Pulaski

Putnam

Randolph

Ripley

Rush

St. Joseph

Scott

Shelby

Spencer

Starke

Steuben

Sullivan

Switzerland

Tippecanoe

Tipton

Union

Vanderburgh

Vermillion

Vigo

Wabash

Warren

Warrick

Washington

Wayne

Wells

White

Whitley

And Cities:

Indianapolis

Fort Wayne

Evansville

Bloomington

South Bend

Carmel

Columbus

Terre Haute

Muncie

Elkhart

Gary

See our Iowa Performance Bond page here.

Discover what is performance bond refundable today for peace of mind tomorrow!

Why Understanding the Distinction Between Performance Bonds and Letters of Credit is Crucial

In our professional life, we’ve often noticed that businesses sometimes confuse performance bonds with bank letters of credit. While both financial instruments provide assurance, they serve different purposes. A performance bond guarantees the completion of a project or purchase contract according to the terms of the agreement, protecting the obligee if the contractor fails to perform. On the other hand, a bank letter of credit is a payment guarantee, ensuring that the contractor will be paid if the work is completed as specified. We’ve found that understanding these distinctions is crucial for businesses to choose the right financial tool for their projects.

In our professional life, we’ve often noticed that businesses sometimes confuse performance bonds with bank letters of credit. While both financial instruments provide assurance, they serve different purposes. A performance bond guarantees the completion of a project or purchase contract according to the terms of the agreement, protecting the obligee if the contractor fails to perform. On the other hand, a bank letter of credit is a payment guarantee, ensuring that the contractor will be paid if the work is completed as specified. We’ve found that understanding these distinctions is crucial for businesses to choose the right financial tool for their projects.

Exploring the Refundability of Performance Bonds

We’ve come across numerous situations where clients have asked if performance bonds are refundable. Based on our experience, performance bonds are typically non-refundable. The premium paid for a performance bond is considered earned once the bond is issued, much like an insurance policy. However, there are instances where partial refunds may be available, especially if the project is completed early or the bond is canceled before its term. We’ve observed over time that clarity in bond terms is essential to manage expectations regarding refunds.

Filing a Claim on a Performance Bond: What’s at Stake for Contractors

From our perspective, one of the most critical aspects of performance bonds is what happens when a claim is filed. We’ve been involved in cases where contractors failed to meet contractual obligations, leading to claims on their performance bonds. When a claim is filed, the surety company investigates the claim to determine its validity.

From our perspective, one of the most critical aspects of performance bonds is what happens when a claim is filed. We’ve been involved in cases where contractors failed to meet contractual obligations, leading to claims on their performance bonds. When a claim is filed, the surety company investigates the claim to determine its validity.

If the claim is justified, the surety may either cover the costs to complete the project or compensate the obligee for financial losses up to the bond amount. Our experience has shown us that contractors must understand the potential consequences of claims on their bonds, including possible impacts on their future bonding capacity.

The Process of Releasing Performance Bonds: Key Considerations

In our line of work, we’ve consistently found that the release of performance bonds is a topic of great interest to contractors and project owners alike. We’ve had the privilege to work on projects where the exact bond was released only after the completion of all contractual obligations, including any warranty periods. The release typically occurs once the obligee is satisfied that the contractor has fulfilled the contract terms and no further claims are anticipated. Our experience tells us that clear communication and documentation are key to ensuring the timely release of performance bonds.

A Closer Look at 100 Percent Performance and Payment Bonds

We’ve learned through doing that a 100 percent performance and payment bond provides comprehensive protection for both the obligee and subcontractors. This type of bond covers the full contract amount, ensuring that the project will be completed and that all subcontractors and suppliers will be paid. We’ve encountered situations where this bond type was essential for large-scale projects, providing peace of mind to all parties involved. We’ve gained insight into the importance of securing such bonds, especially in complex construction projects where financial risks are significant.

Securing a Performance Bond: How Long Will It Take?

Securing a Performance Bond: How Long Will It Take?

In our observation, the timeline for securing a performance bond varies depending on several factors, including the contractor’s financial standing and the project’s scope. We’ve had firsthand experience with bond applications that were processed within a few days, while others took weeks due to additional documentation requirements. We’ve realized that being well-prepared with financial statements, project details, and references can significantly expedite the process. We’ve consistently observed that early engagement with a surety provider is beneficial in avoiding delays.

See more at our Idaho Performance Bond page.

The Consequences of an Expired Performance Bond: What You Should Know

From our own observations, we’ve identified that the expiration of a performance bond can have serious implications for contractors and obligees. We’ve been directly involved with projects where bond expiration led to lapses in coverage, leaving parties vulnerable to financial losses. If a bond expires before the project is completed, it may need to be renewed or replaced to maintain compliance with contractual requirements. We’ve come to recognize that managing bond terms and expiration dates is critical to ensuring continuous protection throughout the project’s lifecycle.

1. What are the performance bond requirements under Indiana’s Little Miller Act?

Indiana’s Little Miller Act (Indiana Code § 5-16-5-2) requires contractors to obtain performance bonds for public works projects exceeding $200,000. Key provisions include:

- Applicability: Applies to all state, county, municipal, and public agency contracts.

- Bond Amount: Must be at least 100% of the contract price, ensuring completion of the project.

- Exemptions: Contracts below $200,000 may not require a performance bond unless specified.

- Protection: Ensures that subcontractors and suppliers receive payment and that the public project is completed as agreed.

2. How does Indiana’s procurement process handle performance bonds for city contracts?

Local procurement requirements follow Indiana state law but may include additional city-specific guidelines:

- Bid Submission – Some cities necessitate a bid bond before awarding a contract.

- Contract Award – The contractor must submit a performance bond before signing the contract.

- Bond Filing – The bond must be provided to the city’s procurement or public works department.

- Project Oversight – The city monitors compliance and may require periodic bond verification.

3. What government agencies regulate performance bonds for construction projects in Indiana?

Regulation of performance bonds falls under the following entities:

- Indiana Department of Administration (IDOA) – Oversees state procurement and bonding rules.

- Indiana Department of Transportation (INDOT) – Manages bonding for state road and infrastructure projects.

- Local Procurement Agencies – Each county and municipality may carry out additional bonding rules.

4. Are subcontractors required to carry performance bonds in Indiana?

Indiana law does not require subcontractors to obtain performance bonds unless:

- The prime contractor’s contract mandates it.

- The public entity requires subcontractor bonding for high-risk or high-value work.

- Private owners specify bonding in contract terms.

5. How can I verify a performance bond’s validity for a public project?

To ensure a performance bond is valid in Indiana:

- Obtain a Copy – Request a certified bond copy from the contractor or project owner.

- Verify with the Surety Provider – Contact the issuing surety company.

- Check with the Public Contracting Entity – State and local agencies maintain records of approved bonds.

- Review the Bond Terms – Confirm compliance with Indiana Code § 5-16-5-2.