Smart Solutions for Performance Bonds in Arlington Heights, Illinois

From our perspective, Arlington Heights, Illinois, is a dynamic hub for construction and development. Whether you’re building new infrastructure or managing a complex service contract, understanding performance bonds is a key element of success. These bonds offer protection and peace of mind, but they can often seem confusing or daunting. That’s why we’re here—to guide you through the details step by step, making the process clear and actionable.

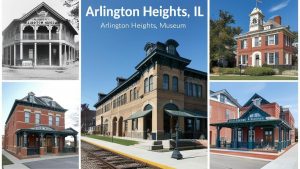

Arlington Heights, Illinois: A Thriving Community with Unique Challenges

Why Performance Bonds Matter Here

We’ve noticed that Arlington Heights, with its thriving local economy and robust development, demands a high standard for project execution. Whether it’s a municipal project or a private venture, performance bonds are often a requirement to ensure contractors fulfill their obligations.

Here’s why performance bonds are especially relevant in Arlington Heights:

| Factor | Impact on Bonds |

|---|---|

| Public Projects | Bonds ensure taxpayer money is protected against risk. |

| Private Developments | Investors demand guarantees for on-time, on-budget work. |

| Stringent Regulations | Local ordinances often require performance bond coverage. |

Breaking Down the Confusion Around Bonds

Common Misunderstandings

We’ve noticed that people in Arlington Heights often face similar questions about performance bonds:

- What exactly is a performance bond?

It’s a three-party agreement between the principal (contractor), the obligee (project owner), and the surety (bond provider). It guarantees the contractor will meet contractual obligations. - Do I need one for every project?

Not every project requires a bond, but most public projects in Illinois and many private contracts in Arlington Heights do. - What happens if I can’t get a bond?

Without a bond, you may lose project opportunities or face penalties. It’s critical to work with an expert to address any application hurdles.

See our Performance Bonds in Bloomington, Illinois page

How Swiftbonds Guides You Step by Step

Based on our experience, a clear process can transform performance bond challenges into manageable tasks. Here’s a practical plan for getting your bond in Arlington Heights:

1. Understanding the Basics

We’ve discovered that many people feel overwhelmed because they don’t start with the fundamentals. Let’s break it down with performance bonds explained:

| Term | Definition |

|---|---|

| Principal | The contractor or party required to provide the bond. |

| Obligee | The entity that receives the protection, usually the project owner. |

| Surety | The bond provider that guarantees the principal’s performance. |

2. Assessing Your Requirements

Every project is unique. Here’s how to evaluate your specific needs:

- Public Projects: Almost always require a performance bond due to Illinois laws.

- Private Projects: May depend on the size, scope, and owner’s preferences.

- Bond Amount: Typically 100% of the contract value but can vary.

3. Preparing Your Application

Applying for a bond involves providing detailed information. We’ve found that complete and accurate documentation speeds up approvals:

- Personal and Business Financials: Tax returns, financial statements, and credit scores.

- Project Details: Contract value, timelines, and scope.

- Experience Record: Your history of successful project completions.

4. Submitting Your Application

We’ve discovered that working with a knowledgeable provider simplifies this step. At Swiftbonds, we guide you in preparing and submitting the required paperwork.

5. Obtaining and Maintaining Your Bond

Once approved, your bond remains in effect as long as the project is active. Regular communication with your provider ensures everything stays on track.

The Risks of Avoiding Proper Guidance

In our observation, neglecting to secure a proper performance bond in Arlington Heights can lead to several pitfalls:

- Missed Opportunities: Without a bond, you may lose access to lucrative public contracts.

- Legal and Financial Penalties: Failing to meet bond requirements can result in fines or project delays.

- Reputation Damage: Contractors who fail to comply with bond terms may face long-term trust issues.

The Benefits of Partnering with Swiftbonds in Arlington Heights, IL

We’ve learned that success with performance bonds comes down to having the right partner. Here’s how Swiftbonds helps Arlington Heights residents thrive:

| Benefit | How Swiftbonds Helps |

|---|---|

| Expert Guidance | We simplify complex processes and clarify requirements. |

| Tailored Solutions | Every client receives a customized plan for their unique situation. |

| Fast Approvals | Our efficient systems get your bond issued quickly. |

| Local Knowledge | We understand Arlington Heights regulations and project demands. |

Frequently Asked Questions About Performance Bonds in Arlington Heights, IL

We’ve often noticed that people have similar questions when starting out with performance bonds. Let’s address them here:

How much does a performance bond cost?

Typically, bond premiums range between 1% and 3% of the total contract value. Your creditworthiness and project specifics will play a role.

How long does it take to get a bond?

We’ve found that most bonds can be approved within 24 to 48 hours, provided all documentation is ready.

Are performance bonds refundable?

No, performance bonds are generally non-refundable once issued.

Do performance bonds cover subcontractors?

The bond covers the obligations of the principal contractor. Separate bonds or agreements may be needed for subcontractors.

Moving Forward with Confidence: Performance Bonds in Arlington Heights, Illinois

We’ve come to appreciate that understanding performance bonds isn’t just about compliance—it’s about empowering you to take on projects with clarity and assurance. Arlington Heights deserves contractors and businesses equipped with the tools to succeed, and Swiftbonds is here to provide them.

If you’re ready to secure your performance bond and take on new opportunities, contact Swiftbonds today. Let us help you turn a complex requirement into a simple step toward success.

See our Performance Bonds in Evanston, Illinois page