You can now apply online for a Illinois Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

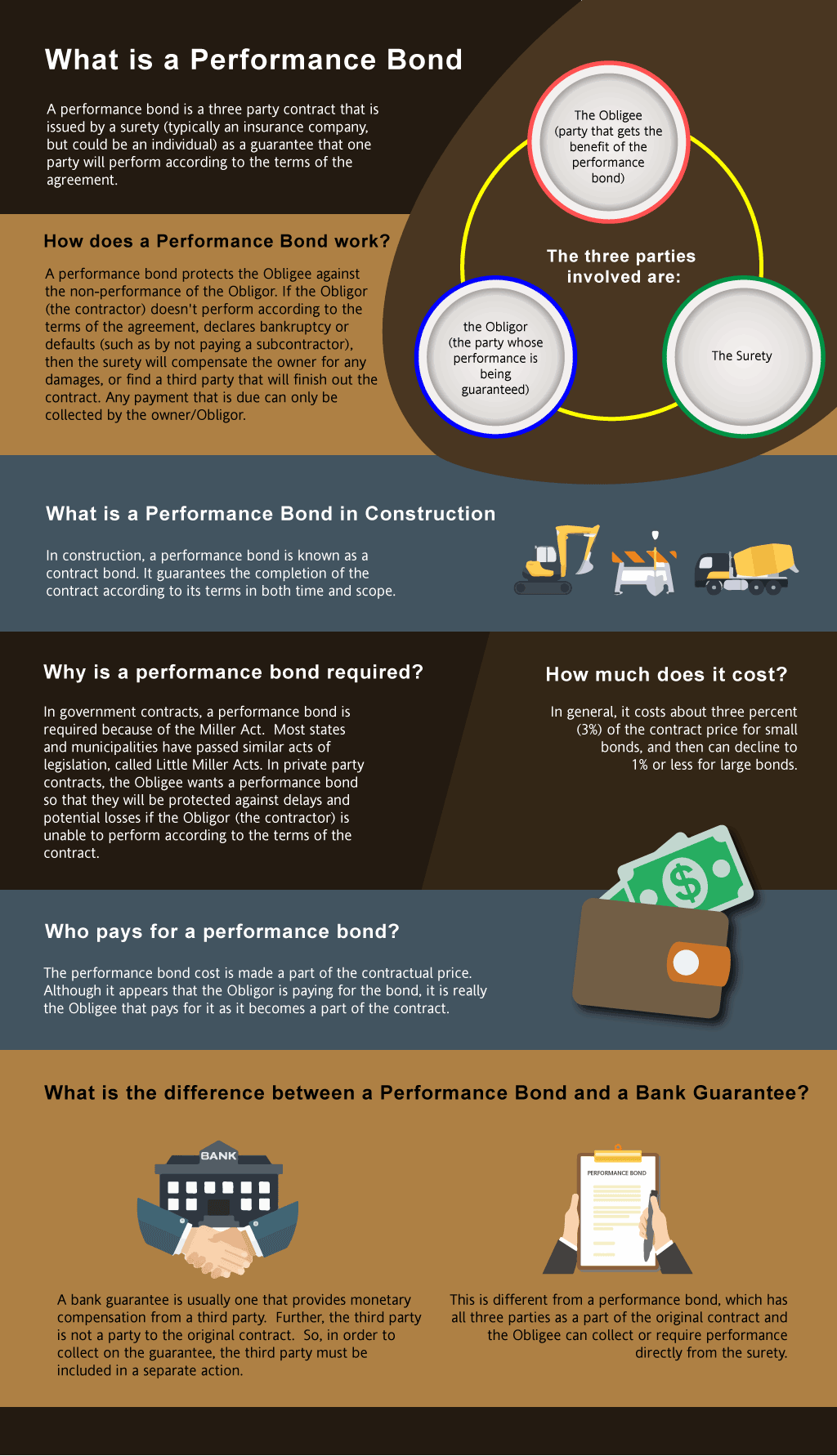

What is a Performance Bond in Illinois?

How do I get a Performance and Payment Bond in Illinois?

We make it easy to get a contract performance bond. Just click here to get our Illinois Performance Application. Fill it out and then email it and the Illinois contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

What is performance bond in Illinois?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in IL?

How much do bonds cost in IL?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Illinois. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract (thus, no liens by any contractor, subcontractor or material vendor). The bond is performance security for the benefit of the owner.

Who Gets the Bond?

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Discover what is a performance bond and safeguard your projects with confidence.

How to Get a Performance Bond in IL

Just call us. We’ll work with you to get the best Illinois bond possible.

We provide performance and payment bonds in each of the following counties:

Adams

Alexander

Bond

Boone

Brown

Bureau

Calhoun

Carroll

Cass

Champaign

Christian

Clark

Clay

Clinton

Coles

Cook

Crawford

Cumberland

DeKalb

De Witt

Douglas

DuPage

Edgar

Edwards

Effingham

Fayette

Ford

Franklin

Fulton

Gallatin

Greene

Grundy

Hamilton

Hancock

Hardin

Henderson

Henry

Iroquois

Jackson

Jasper

Jefferson

Jersey

Jo Daviess

Johnson

Kane

Kankakee

Kendall

Knox

La Salle

Lake

Lawrence

Lee

Livingston

Logan

McDonough

McHenry

McLean

Macon

Macoupin

Madison

Marion

Marshall

Mason

Massac

Menard

Mercer

Monroe

Montgomery

Morgan

Moultrie

Ogle

Peoria

Perry

Piatt

Pike

Pope

Pulaski

Putnam

Randolph

Richland

Rock Island

Saline

Sangamon

Schuyler

Scott

Shelby

St. Clair

Stark

Stephenson

Tazewell

Union

Vermilion

Wabash

Warren

Washington

Wayne

White

Whiteside

Will

Williamson

Winnebago

Woodford

And Cities:

Chicago

Peoria

Rockford

Champaign

Naperville

Joliet

Elgin

Schaumburg

Evanston

Belleville

Arlington Heights

See our Indiana Performance Bond page here.

Understanding the Distinction: Performance Bonds vs. Bank Letters of Credit

In our observation, distinguishing between performance bonds and bank letters of credit is crucial for those involved in contractual agreements. Performance bonds are surety bonds issued by a third party to guarantee that a contractor will fulfill their obligations under a contract. On the other hand, bank letters of credit are financial instruments that provide a payment guarantee to the beneficiary if the principal fails to meet contractual terms. We’ve noticed that while both serve to protect the interests of the project owner, performance bonds typically offer broader coverage, including project completion, while letters of credit primarily secure financial obligations. Additionally, in our dealings with the bonding market, we’ve observed that it plays a significant role in determining the availability and terms of performance bonds, influencing the overall costs and conditions contractors might face.

The Refundability of Performance Bonds: What You Need to Know

The Refundability of Performance Bonds: What You Need to Know

From our perspective, a common question surrounding performance bonds is whether they are refundable. We’ve consistently found that performance bonds are generally non-refundable. Once issued, the bond premium, which is the cost paid for the bond, is earned by the surety company for the risk they undertake. We’ve learned that even if the bond is never used, the premium is not returned, as it covers the surety’s risk during the bond’s term. This underscores the importance of understanding the commitment involved when securing a performance bond.

Consequences of Filing a Claim on a Performance Bond

We’ve encountered situations where claims are filed on performance bonds, and it’s essential to understand the ramifications. In our experience, when a claim is filed, the surety company investigates the validity of the claim. If the claim is justified, the surety will cover the cost of completing the project or compensating the project owner, up to the bond amount. We’ve noticed through our work that this can have significant consequences for the contractor, including financial liability to the surety for the amount paid out and potential difficulty in securing future bonds.

Timing of Performance Bond Release: When is it Freed?

We’ve observed that the release of performance bonds is a critical aspect of project closure. Based on our experience, performance bonds are typically released once the project is completed to the satisfaction of the project owner and all contractual obligations are met. We’ve come to appreciate that the bond is only released after a thorough inspection and approval from the project owner, ensuring that all work is completed according to the agreed standards.

We’ve observed that the release of performance bonds is a critical aspect of project closure. Based on our experience, performance bonds are typically released once the project is completed to the satisfaction of the project owner and all contractual obligations are met. We’ve come to appreciate that the bond is only released after a thorough inspection and approval from the project owner, ensuring that all work is completed according to the agreed standards.

Deciphering the 100 Percent Performance and Payment Bond

In our professional life, we’ve often worked on projects requiring a 100 percent performance and payment bond. This type of bond guarantees both the completion of the project and payment to subcontractors and suppliers. We’ve consistently observed that this dual protection is crucial for large-scale projects, ensuring that all parties involved are compensated and that the project reaches completion without financial disruptions. From our understanding, it offers a comprehensive safety net for project owners and stakeholders.

Timeframe for Securing a Performance Bond: What to Expect

We’ve found through experience that the time it takes to secure a performance bond can vary depending on several factors. From what we’ve seen, the process can take anywhere from a few days to a couple of weeks. We’ve often noticed that the complexity of the project, the contractor’s financial standing, and the responsiveness of the surety company all play significant roles in determining the timeline. We’ve always believed that early planning and preparation are key to avoiding delays in obtaining the bond.

The Impact of Performance Bond Expiration: What Comes Next?

In our view, understanding what happens when a performance bond expires is crucial for contractors and project owners alike. We’ve realized that the project owner will be unprotected if a bond expires before the project is completed. We’ve been involved in cases where an expired bond required immediate renewal or replacement to continue providing security for the project. We’ve observed over time that maintaining continuous bond coverage is vital to avoiding potential disputes and ensuring the smooth progression of the project.

You can obtain a performance bond even if your credit rating is bad, but you’ll pay an interest rate of 10 to 20 percent.

If you have a need to apply for a performance bond, you need to understand the process so you won’t make a mistake. It will not be simple to apply, but if your requirements are complete and you are eligible, you can obtain a surety bond.

1. What are the performance bond requirements under Illinois’s Little Miller Act?

Illinois’s Little Miller Act (30 ILCS 550/1) order performance bonds for public works projects. Key provisions include:

- Applicability: Required for all public construction contracts exceeding $50,000 awarded by the state, municipalities, or local government agencies.

- Bond Amount: Must be 100% of the contract price, ensuring project completion and compliance with contract terms.

- Purpose: Protects the public entity against contractor default and ensures payment to subcontractors and suppliers.

- Exemptions: Projects under $50,000 may not require a performance bond unless specified in the contract.

2. How does Illinois’s procurement process handle performance bonds for city contracts?

Illinois municipalities follow both state procurement laws and local procurement ordinances. The general process includes:

- Bid Submission – Contractors may need to submit a bid bond before being considered for the contract.

- Contract Award – Winning bidders must provide a performance bond before contract execution.

- Bond Filing – The bond must be submitted to the municipal procurement office before work begins.

- Oversight – City procurement departments enforce compliance with bonding requirements throughout the project.

3. What government agencies regulate performance bonds for construction projects in Illinois?

The primary agencies regulating performance bonds in Illinois include:

- Illinois Department of Central Management Services (CMS) – Oversees state procurement and bonding requirements for public projects.

- Illinois Department of Transportation (IDOT) – Manages bonding requirements for highway and transportation-related construction contracts.

- Local Government Procurement Offices – Each county and city establishes its own procurement guidelines, which may include additional bonding requirements.

4. Are subcontractors required to carry performance bonds in Illinois?

Illinois law does not typically require subcontractors to carry performance bonds unless:

- The prime contractor’s contract mandates it.

- The government agency requires bonding for certain high-value or high-risk subcontracts.

- A private project owner specifies bonding in the contract terms.

5. How can I verify a performance bond’s validity for a public project?

To confirm the legitimacy of a performance bond in Illinois:

- Request a Copy – Obtain a certified copy of the bond from the contractor or project owner.

- Verify with the Surety Company – Contact the issuing surety to confirm bond details.

- Check with the Contracting Agency – State and local agencies maintain records of approved performance bonds.

- Review the Bond Language – Ensure compliance with 30 ILCS 550/1 requirements.