You can now apply online for a Idaho Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

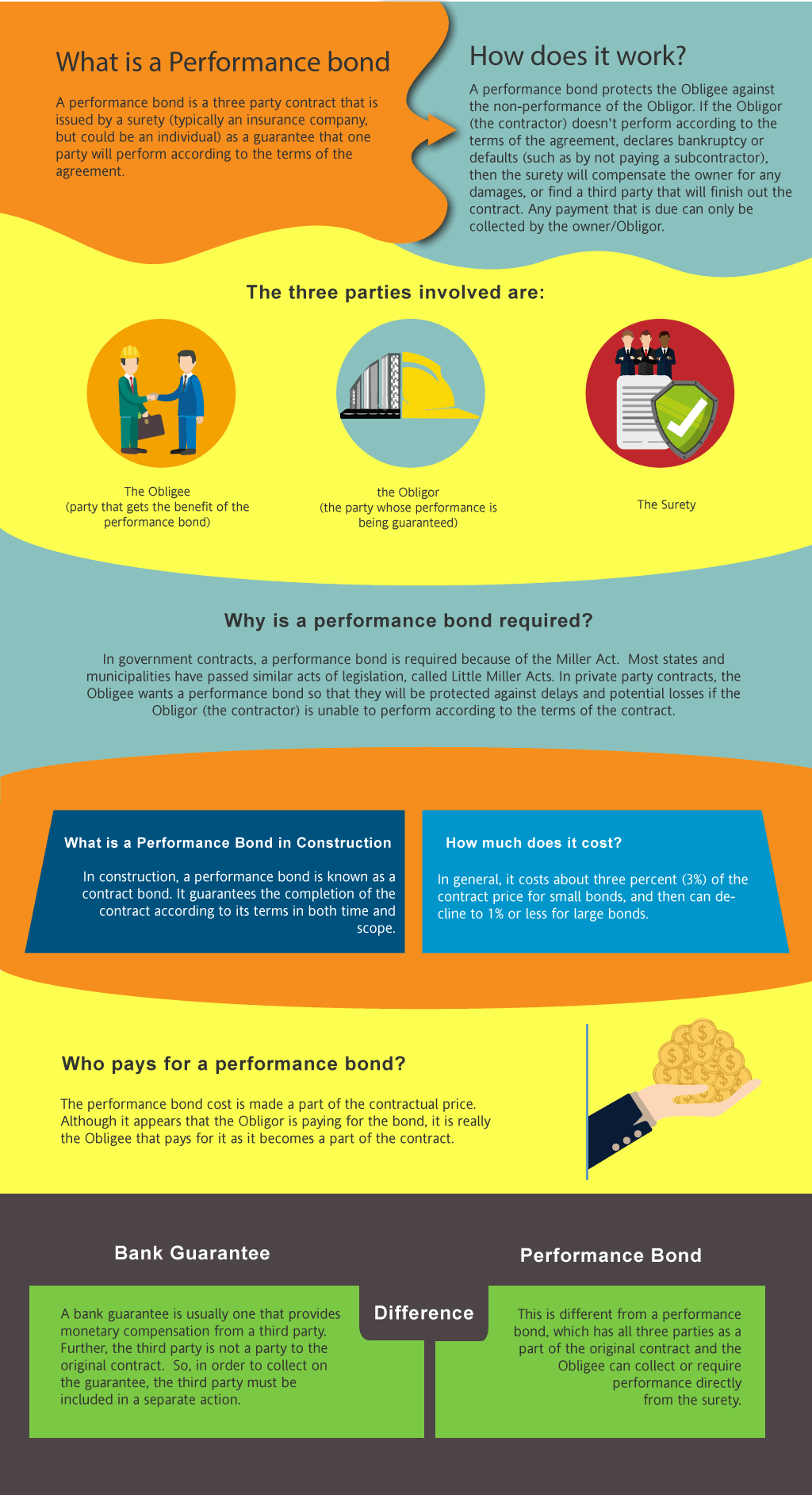

What is a Performance Bond in Idaho?

How do I get a Performance and Payment Bond in Idaho?

We make it easy to get a contract performance bond. Just click here to get our Idaho Performance Application. Fill it out and then email it and the Idaho contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How do performance bonds work in Idaho?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in ID?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Idaho. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in ID

Just call us. We’ll work with you to get the best Idaho bond possible.

We provide performance and payment bonds in each of the following counties:

Ada

Adams

Bannock

Bear Lake

Benewah

Bingham

Blaine

Boise

Bonner

Bonneville

Boundary

Butte

Camas

Canyon

Caribou

Cassia

Clark

Clearwater

Custer

Elmore

Franklin

Fremont

Gem

Gooding

Idaho

Jefferson

Jerome

Kootenai

Latah

Lemhi

Lewis

Lincoln

Madison

Minidoka

Nez Perce

Oneida

Owyhee

Payette

Power

Shoshone

Teton

Twin Falls

Valley

Washington

And Cities:

Boise

Coeur d'Alene

Nampa

Meridian

Twin Falls

Idaho Falls

Pocatello

Lewiston

Caldwell

Moscow

Sandpoint

See our Illinois Performance Bond page here.

The Key Distinction: Performance Bonds vs. Bank Letters of Credit

From our perspective, understanding the fundamental differences between performance bonds and bank letters of credit is crucial for anyone involved in large-scale projects. We’ve come to recognize that while both tools serve as financial guarantees, they operate differently. Performance bonds are insurance products provided by a surety company, ensuring that the contractor fulfills their obligations. In contrast, bank letters of credit involve a financial institution guaranteeing payment to the project owner if the contractor defaults. What we’ve found through experience is that performance bonds offer a broader scope of protection, covering additional costs if a new contractor needs to be hired, whereas bank letters of credit are strictly financial instruments with no performance oversight.

Is a Refund Possible? Understanding the Refundability of Performance Bonds

Is a Refund Possible? Understanding the Refundability of Performance Bonds

In our observation, one of the most common questions regarding performance bonds is whether they are refundable. We’ve learned through doing that performance bonds are generally non-refundable, as the premium paid to secure the bond is considered fully earned once the bond is issued. What we’ve discovered is that the risk assumed by the surety company begins immediately, regardless of whether the bond is utilized. However, in rare cases, if a project is canceled before it starts and no claims have been made, some sureties might offer a partial refund, but we’ve consistently observed this to be an exception rather than the norm.

The Consequences of a Claim: What Happens When a Performance Bond is Invoked?

We’ve personally dealt with situations where a claim is filed on a performance bond, and our experience has shown us that the process can be complex. We’ve noticed that when a claim is made, the surety company first investigates to determine the validity of the claim. If the claim is justified, the surety will either provide financial compensation up to the bond’s limit or arrange for a new contractor to complete the project. In our professional life, we’ve seen that this can lead to significant delays and additional costs for all parties involved. We’ve concluded that understanding this process is vital for project owners and contractors alike to mitigate potential risks.

We’ve personally dealt with situations where a claim is filed on a performance bond, and our experience has shown us that the process can be complex. We’ve noticed that when a claim is made, the surety company first investigates to determine the validity of the claim. If the claim is justified, the surety will either provide financial compensation up to the bond’s limit or arrange for a new contractor to complete the project. In our professional life, we’ve seen that this can lead to significant delays and additional costs for all parties involved. We’ve concluded that understanding this process is vital for project owners and contractors alike to mitigate potential risks.

Timing is Everything: When Are Performance Bonds Released?

We’ve consistently found that timing plays a critical role in the release of performance bonds. Our experience tells us that these bonds are typically released upon the satisfactory completion of the project, once all contractual obligations have been met and any defects have been rectified. In our view, this often involves a final inspection and the issuance of a completion certificate. We’ve come to appreciate that having clear communication and documentation throughout the project lifecycle can expedite the bond release process, minimizing potential disputes and delays.

Unpacking the 100 Percent Performance and Payment Bond: What It Means

We’ve observed that a 100 percent performance and payment bond is often misunderstood, but we’ve gained insight into its significance through our work. We’ve learned that this type of bond ensures that the contractor will both perform the work according to the contract and pay all laborers, subcontractors, and material suppliers in full.

We’ve observed that a 100 percent performance and payment bond is often misunderstood, but we’ve gained insight into its significance through our work. We’ve learned that this type of bond ensures that the contractor will both perform the work according to the contract and pay all laborers, subcontractors, and material suppliers in full.

In our experience, this dual guarantee provides comprehensive protection for the project owner, ensuring that the project is completed as agreed and that no unpaid claims arise against the property.

The Waiting Game: How Long Does It Take to Obtain a Performance Bond?

From our experience, obtaining a performance bond can vary in time, depending on several factors. We’ve had firsthand experience with the process and we’ve realized that it can take anywhere from a few days to several weeks. We’ve noticed in our work that the timeline largely depends on the contractor’s financial stability, the complexity of the project, and the surety’s underwriting process. What we’ve found is that having all necessary documentation in place can significantly expedite the process, ensuring that the bond is issued promptly.

The Impact of Expiration: What Happens When a Performance Bond Expires?

The Impact of Expiration: What Happens When a Performance Bond Expires?

We’ve come to understand that the expiration of a performance bond can have serious implications. In our dealings with expired bonds, we’ve noticed that if a bond expires before the project is completed, the project owner may be left unprotected, which can lead to legal and financial complications. We’ve personally witnessed situations where the lack of active coverage has caused project delays and disputes. Our experience has taught us the importance of ensuring that performance bonds are renewed or extended as necessary to cover the entire duration of the project, avoiding gaps in protection.

See more at our Illinois Performance Bond page.

Learn more about Idaho surety bonds.

1. What are the performance bond requirements under Idaho’s Little Miller Act?

Idaho’s Little Miller Act (Idaho Code § 54-1926) mandates performance bonds for public works projects. Key provisions include:

- Applicability: Required for all public construction contracts over $50,000 with state or local government agencies.

- Bond Amount: Must be at least 85% of the contract price, ensuring project completion and contract compliance.

- Purpose: Protects the public entity from financial loss due to contractor default.

- Exemptions: Projects below $50,000 may not require a performance bond unless specified in the contract.

2. How does Idaho’s procurement process handle performance bonds for city contracts?

City contracts in Idaho follow both state procurement laws and local procurement guidelines. The general process includes:

- Bid Submission – Contractors may need to submit a bid bond before being considered.

- Contract Award – Winning bidders must provide a performance bond before contract execution.

- Bond Filing – The bond must be submitted to the contracting agency before work begins.

- Oversight – City procurement offices secure compliance with bond requirements throughout the project.

3. What government agencies regulate performance bonds for construction projects in Idaho?

The primary agencies overseeing performance bonds in Idaho include:

- Idaho Division of Purchasing (DOP) – Regulates procurement and contract compliance for state projects.

- Idaho Transportation Department (ITD) – Requires performance bonds for highway and transportation-related contracts.

- Local Government Procurement Offices – Each county and city has its own procurement guidelines that may impose additional bonding requirements.

4. In the state of Idaho is it required to have performance bonds for subcontractors?

Idaho law does not generally require subcontractors to carry performance bonds unless:

- The prime contractor’s agreement mandates it.

- The government agency requires bonding for certain high-value or high-risk subcontracts.

- A private project owner specifies bonding in the contract terms.

5. How can I verify a performance bond’s validity for a public project?

To confirm the legitimacy of a performance bond in Idaho:

- Request a Copy – Obtain a certified copy of the bond from the contractor or project owner.

- Verify with the Surety Company – Contact the issuing surety to confirm bond details.

- Check with the Contracting Agency – State and local agencies maintain records of approved performance bonds.

- Review the Bond Language – Ensure compliance with Idaho Code § 54-1926 requirements.