You can now apply online for a Hawaii Performance Bond - it only takes three (3) minutes! (We timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

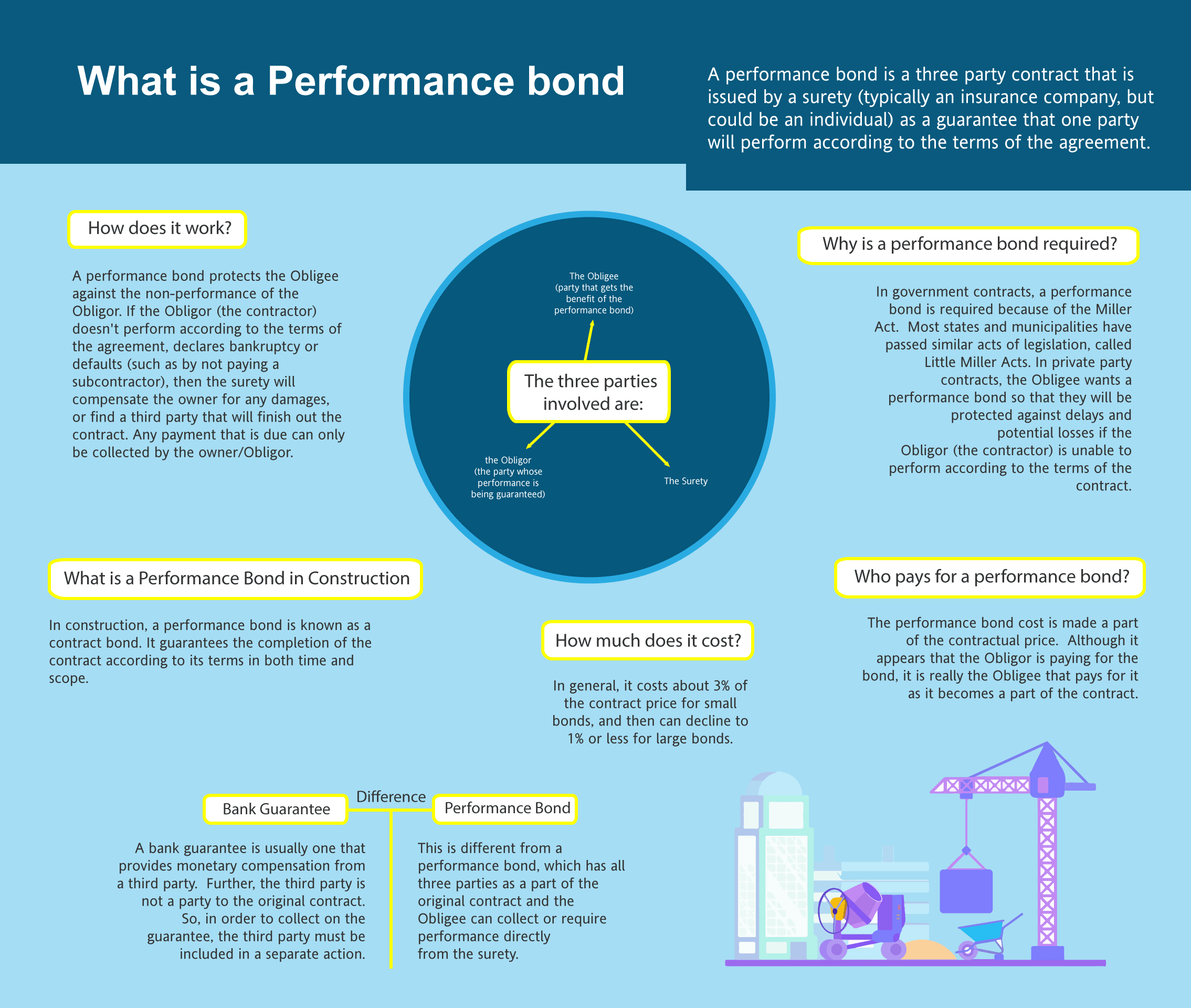

What is a Performance Bond in Hawaii?

How do I get a Performance and Payment Bond in Hawaii?

We make it easy to get a contract performance bond. Just click here to get our Hawaii Performance Application. Fill it out and then email it and the Hawaii contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Secure your project's success with our comprehensive payment and performance bond construction.

Performance bond in construction in Hawaii?

Performance bond in construction in Hawaii?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in HI?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Hawaii. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid.

The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in HI

Just call us. We’ll work with you to get the best Hawaii bond possible.

We provide performance and payment bonds in each of the following counties:

Hawaii

Honolulu

Kalawao

Kauai

Maui

And Cities:

Honolulu

Kailua

Kapolei

Kaneohe

Haleiwa

Waipahu

Mililani

Ewa Beach

Pearl City

See our Idaho Performance Bond page here.

Unlocking the Secrets of Performance Bonds: What Every Contractor Needs to Know

Performance Bonds Demystified: Your Comprehensive Guide to Construction Guarantees

Performance Bonds Demystified: Your Comprehensive Guide to Construction Guarantees

From our perspective, understanding the distinction between performance bonds and bank letters of credit (LOCs) is crucial for anyone involved in construction or large-scale contracting projects. A surety company issues performance bonds to guarantee that a contractor will fulfill their contractual obligations, ensuring the project is completed as agreed. On the other hand, bank letters of credit serve as a financial guarantee, typically focusing on securing payment rather than project completion. We’ve noticed that while both instruments offer protection, performance bonds are more aligned with ensuring the successful execution of a project, whereas LOCs provide a direct financial assurance to the project owner.

The Ins and Outs of Performance Bonds: A Contractor's Ultimate Safety Net

The Ins and Outs of Performance Bonds: A Contractor's Ultimate Safety Net

In our opinion, one of the most common questions surrounding performance bonds is their refundability. We’ve found that performance bonds are generally non-refundable. Once the bond is issued, the premium paid is considered earned by the surety, even if the bond is not called upon during the project. This is because the surety company assumes a financial risk as soon as the bond is issued, making refunds unlikely. Understanding this aspect is crucial for contractors and project owners alike to avoid any misconceptions during the bonding process.

From Claims to Expiry: Navigating the World of Performance Bonds with Confidence

What we’ve discovered is that filing a claim on a performance bond can be a complicated process, with significant repercussions for the contractor. If a contractor fails to meet the terms of the contract, the project owner has the right to file a claim against the bond. We’ve learned that the surety company will then investigate the claim to determine its validity. If the claim is upheld, the surety may either provide financial compensation to the owner or hire a new contractor to complete the project. The original contractor is then responsible for reimbursing the surety, which can lead to substantial financial and reputational damage.

Performance Bonds 101: Ensuring Project Success from Start to Finish

We’ve realized that the release of a performance bond is directly tied to the completion and approval of the project it covers. Typically, the bond is released once the project owner confirms that all contractual obligations have been met, including passing final inspections and addressing any outstanding issues. In our observation, this process often includes a maintenance period, during which the bond remains active to cover potential defects or issues that could arise after the project is completed. We’ve consistently found that understanding these milestones is critical for both contractors and project owners to ensure a smooth bond release process.

Beyond the Contract: How Performance Bonds Protect Your Construction Projects

Our experience has shown us that a 100 percent performance and payment bond is a comprehensive financial guarantee that covers both the completion of a project and the payment of all subcontractors, laborers, and suppliers involved. We’ve encountered numerous public projects where this type of bond is required, offering dual protection to the project owner. It ensures that the contractor not only completes the project as agreed but also fulfills all payment obligations. This dual protection makes the 100 percent performance and payment bond an essential tool in mitigating financial risks on large-scale projects.

Performance Bonds Uncovered: Key Insights and Essential Tips for Contractors

In our dealings with performance bonds, we’ve observed that the time it takes to secure one can vary widely. For contractors with a solid financial track record and a good relationship with a surety company, the process can be completed in just a few days. However, we’ve personally witnessed that more complex projects or contractors with less favorable financial histories may face longer processing times, sometimes extending to several weeks. From what we’ve seen, starting the bonding process early is key to ensuring that project timelines are not adversely affected.

Safeguarding Your Projects: The Complete Guide to Performance Bonds

We’ve often noticed that allowing a performance bond to expire before a project is completed can lead to significant challenges. In our professional life, we’ve had firsthand experience with projects where an expired bond created urgent situations requiring immediate renewal or replacement to maintain compliance with the contract. If a bond expires without renewal, the project owner may be left unprotected, and the contractor could be found in breach of contract. Our experience tells us that careful management of bond terms and renewal dates is essential to avoid these costly mistakes.

Conclusion: The Importance of Performance Bonds in Construction

We’ve come to appreciate that performance bonds are not just a formality—they are a vital part of the construction process that ensures projects are completed as agreed and that all parties are financially protected. From securing the right type of bond to understanding the timing and conditions for release, we’ve grown to understand that every detail matters. Whether you’re a contractor looking to secure a bond or a project owner seeking protection, our experience has taught us that having the right performance bond in place is crucial for the success and smooth operation of any project.

See more at our Iowa Performance Bond page.

Learn more on bonded Hawaii.

1. What are the performance bond requirements under Hawaii’s Little Miller Act?

Hawaii’s Little Miller Act (HRS § 103D-324) governs performance bond requirements for public works projects. Key provisions include:

- Applicability: Required for state and county construction contracts exceeding $50,000.

- Bond Amount: Must be 100% of the contract price to guarantee completion and compliance with contract terms.

- Purpose: Protects government agencies against contractor default.

- Exemptions: Contracts below $50,000 generally do not require a performance bond, unless specified by the contracting agency.

2. How does Hawaii’s procurement process handle performance bonds for city contracts?

Hawaii’s city procurement offices follow the state’s Hawaii Public Procurement Code (HRS Chapter 103D) but may have additional local bond requirements. The general process includes:

- Bid Submission – Bidders must provide a bid security (often 5% of the bid amount).

- Contract Award – The winning bidder must secure a performance bond before the contract is finalized.

- Bond Filing – The bond must be submitted to the contracting agency before work begins.

- Monitoring & Enforcement – City procurement offices oversee compliance throughout the project.

3. What government agencies regulate performance bonds for construction projects in Hawaii?

The primary agencies overseeing performance bonds in Hawaii include:

- Hawaii Department of Accounting and General Services (DAGS) – Oversees state construction projects and ensures bond compliance.

- State Procurement Office (SPO) – Regulates procurement processes, including bond requirements for public contracts.

- County Procurement Offices – Each county has its own procurement guidelines, which may impose additional bonding requirements.

4. In the state of Hawaii is it required to have performance bonds for subcontractors?

Hawaii law does not generally require subcontractors to carry performance bonds unless:

- The prime contractor’s agreement mandates it.

- The government agency requires subcontractor bonding for certain high-value or high-risk subcontracts.

- A private project owner specifies bonding in the contract terms.

5. How can I verify a performance bond’s validity for a public project?

To confirm the legitimacy of a performance bond in Hawaii:

- Request a Copy – Obtain a certified copy of the bond from the contractor or project owner.

- Verify with the Surety Company – Contact the issuing surety to confirm bond details.

- Check with the Contracting Agency – State and county agencies maintain records of approved performance bonds.

- Review the Bond Language – Ensure compliance with HRS § 103D-324 requirements.