You can now apply online for a Georgia Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Georgia?

How do I get a Performance and Payment Bond in Georgia?

We make it easy to get a contract performance bond. Just click here to get our Georgia Performance Application. Fill it out and then email it and the Georgia contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

What are performance bonds in Georgia?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in GA?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Georgia. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in GA

Just call us. We’ll work with you to get the best Georgia bond possible.

We provide performance and payment bonds in each of the following counties:

Appling

Atkinson

Bacon

Baker

Baldwin

Banks

Barrow

Bartow

Ben Hill

Berrien

Bibb

Bleckley

Brantley

Brooks

Bryan

Bulloch

Burke

Butts

Calhoun

Camden

Candler

Carroll

Catoosa

Charlton

Chatham

Chattahoochee

Chattooga

Cherokee

Clarke

Clay

Clayton

Clinch

Cobb

Coffee

Colquitt

Columbia

Cook

Coweta

Crawford

Crisp

Dade

Dawson

De Kalb

Decatur

Dodge

Dooly

Dougherty

Douglas

Early

Echols

Effingham

Elbert

Emanuel

Evans

Fannin

Fayette

Floyd

Forsyth

Franklin

Fulton

Gilmer

Glascock

Glynn

Gordon

Grady

Greene

Gwinnett

Habersham

Hall

Hancock

Haralson

Harris

Hart

Heard

Henry

Houston

Irwin

Jackson

Jasper

Jeff Davis

Jefferson

Jenkins

Johnson

Jones

Lamar

Lanier

Laurens

Lee

Liberty

Lincoln

Long

Lowndes

Lumpkin

Macon

Madison

Marion

McDuffie

McIntosh

Meriwether

Miller

Mitchell

Monroe

Montgomery

Morgan

Murray

Muscogee

Newton

Oconee

Oglethorpe

Paulding

Peach

Pickens

Pierce

Pike

Polk

Pulaski

Putnam

Quitman

Rabun

Randolph

Richmond

Rockdale

Schley

Screven

Seminole

Spalding

Stephens

Stewart

Sumter

Talbot

Taliaferro

Tattnall

Taylor

Telfair

Terrell

Thomas

Tift

Toombs

Towns

Treutlen

Troup

Turner

Twiggs

Union

Upson

Walker

Walton

Ware

Warren

Washington

Wayne

Webster

Wheeler

White

Whitfield

Wilcox

Wilkes

Wilkinson

Worth

And Cities:

Atlanta

Savannah

Marietta

Athens

Augusta

Alpharetta

Macon

Decatur

Lawrenceville

Stone Mountain

Kennesaw

See our Hawaii performance bond page here.

Secure your project's future with a reliable performance bond in construction today!

Decoding Performance Bonds: Expert Insights from the Field

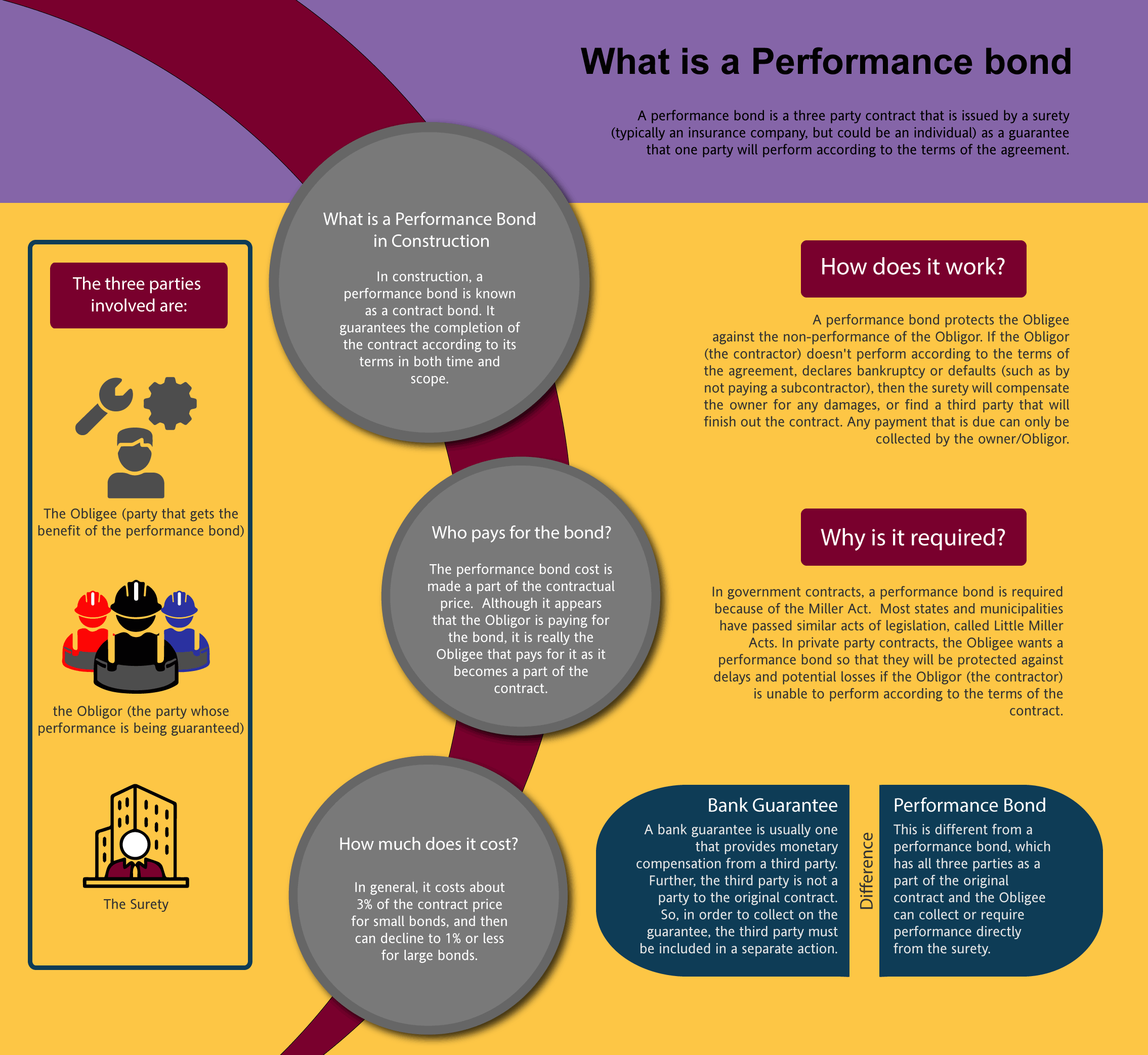

Performance bonds are an essential tool in the construction and contracting industries, providing assurance that a contractor will fulfill their obligations under a contract. However, there are many nuances to performance bonds that are often misunderstood. Through our extensive work with these bonds, we’ve gained valuable insights that can help clarify these critical aspects.

Navigating Performance Bonds in Georgia: What Contractors Need to Know

Performance Bonds vs. Bank Letters of Credit: Understanding the Key Differences for Project Security

Performance Bonds vs. Bank Letters of Credit: Understanding the Key Differences for Project Security

In our observation, one of the most common misconceptions is the difference between performance bonds and bank letters of credit (LOCs). While both provide financial security, they operate differently. Performance bonds are surety bonds that guarantee the completion of a project according to the contract’s terms. If the contractor fails, the surety company steps in. On the other hand, a bank LOC is a direct financial commitment from a bank, ensuring payment up to the LOC’s value if the contractor defaults. We’ve consistently found that performance bonds offer broader protection for project owners, covering not just financial losses but also ensuring project completion.

Are Performance Bonds Refundable? Clearing Up the Confusion for Contractors

We’ve come to recognize that many contractors wonder if performance bonds are refundable. Typically, the premium paid for a performance bond is non-refundable. This is because the bond serves as a financial guarantee throughout the project’s duration, and the surety company bears the risk from the moment the bond is issued. Based on our experience, once the bond is executed, the premium is earned, regardless of whether the project is completed ahead of schedule or the bond is no longer needed.

What to Expect When a Claim is Filed on a Performance Bond: A Contractor’s Guide

In our professional life, we’ve encountered situations where claims have been filed on performance bonds. When a claim is made, the surety company conducts an investigation to determine the validity of the claim. If the claim is legitimate, the surety may either finance the contractor to complete the project or hire another contractor to do so. We’ve observed that, depending on the bond’s terms, the surety may also pay damages directly to the project owner. However, the contractor is ultimately responsible for reimbursing the surety for any costs incurred, a fact that many contractors don’t fully appreciate until they face such a situation.

Releasing Performance Bonds in Georgia: Steps to Ensure a Smooth Process

When Are Performance Bonds Released? Understanding the Process and Timing

When Are Performance Bonds Released? Understanding the Process and Timing

We’ve consistently observed that the release of a performance bond occurs only after the project is satisfactorily completed and all contractual obligations are met. This includes any warranties or maintenance periods specified in the contract. We’ve noticed that project owners are often cautious about releasing bonds too early, ensuring all potential issues are resolved before doing so. From our perspective, this process provides a safeguard for both parties, ensuring the project’s long-term success.

100 Percent Performance and Payment Bonds: Full Protection for High-Value Projects

In our line of work, we’ve often dealt with 100 percent performance and payment bonds, which cover the full value of the contract. These bonds guarantee that the contractor will perform the work as specified and that all subcontractors, suppliers, and laborers will be paid. We’ve found that these bonds are particularly important in large-scale projects where the financial stakes are high, providing comprehensive protection for the project owner against potential defaults and payment issues.

How Long Does It Take to Secure a Performance Bond? Key Factors and Timelines

We’ve come across cases where the time to obtain a performance bond varies significantly. Generally, it can take anywhere from a few days to a couple of weeks, depending on the complexity of the project and the contractor’s financial standing.

We’ve come across cases where the time to obtain a performance bond varies significantly. Generally, it can take anywhere from a few days to a couple of weeks, depending on the complexity of the project and the contractor’s financial standing.

In our experience, contractors who maintain strong financial records and a good relationship with their surety provider can expedite the process. However, we’ve learned through doing that delays can occur if additional documentation or further evaluation of the contractor’s capabilities is required.

The Risks of an Expired Performance Bond: How to Prevent Lapses in Coverage

We’ve been in situations where performance bonds have reached their expiration before the project’s completion. If a bond expires without renewal or replacement, the project owner may be left without financial protection, and the contractor could be in breach of contract. We’ve found it useful to advise contractors to monitor bond expiration dates closely and ensure renewals are processed well in advance. This proactive approach prevents lapses in coverage and maintains the project’s integrity.

Conclusion: Mastering Performance Bonds for Successful Project Outcomes

In conclusion, performance bonds are a vital aspect of construction and contracting, providing security for both contractors and project owners. From our experience, understanding the intricacies of these bonds, from issuance to expiration, can prevent costly misunderstandings and ensure successful project outcomes.

Learn more on How to get bonded in GA?

See more at our Kansas Performance Bond page.

1. What are the performance bond requirements under Georgia’s Little Miller Act?

The Georgia Little Miller Act (O.C.G.A. § 13-10-1 et seq.) order performance bonds for public works contracts exceeding $100,000 to ensure project completion and compliance with contract terms. The key requirements include:

- Applicability: Applies to state and local government contracts.

- Minimum Bond Amount: The performance bond must cover at least 100% of the contract price.

- Purpose: Protects government agencies against contractor default.

- Exemptions: Contracts below $100,000 may not require a performance bond, though some local jurisdictions impose stricter rules.

2. How does Georgia’s procurement process handle performance bonds for city contracts?

Municipalities in Georgia follow state procurement laws while also adopting their own bond policies. The general process includes:

- Bid Submission: Contractors must furnish bid bonds before bidding on public contracts.

- Awarding Contracts: Winning bidders must secure performance bonds as a condition for contract execution.

- Bond Filing: Bonds must be submitted to the contracting authority before work begins.

- Enforcement: Local procurement officers oversee compliance with bond requirements.

3. What government agencies regulate performance bonds for construction projects in Georgia?

The primary agencies overseeing performance bonds in Georgia include:

- Georgia Department of Administrative Services (DOAS) – Regulates state procurement and contract compliance.

- Georgia State Financing and Investment Commission (GSFIC) – Manages construction projects for state agencies.

- Local Government Procurement Offices – Cities and counties have their own regulations; check their official websites for details.

4. In the state of Georgia is it required to have performance bonds for subcontractors?

Under Georgia law, subcontractors are generally not required to carry performance bonds unless:

- The prime contract explicitly requires bonded subcontractors.

- The government agency mandates it for specific high-risk projects.

- A private project owner includes bonding requirements in contract terms.

5. How can I verify a performance bond’s validity for a public project?

To confirm the legitimacy of a performance bond:

- Request a Copy – Obtain a certified copy of the bond from the contractor or project owner.

- Verify with the Surety Company – Contact the issuing surety company and confirm bond details.

- Check with the Contracting Agency – Government agencies maintain records of approved performance bonds.

- Review the Bond Language – Ensure it complies with O.C.G.A. § 13-10-1 requirements.