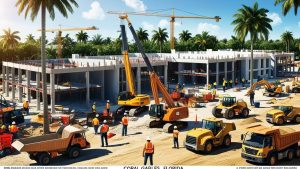

Don’t Break Ground Without It: The Role of Performance Bonds in Coral Gables, Florida

From our perspective, navigating the intricacies of performance bonds in Coral Gables, Florida, can be challenging—especially for contractors and developers who are balancing deadlines, budgets, and compliance requirements. You want clear, actionable guidance to understand what performance bonds mean for your project. Let us be your guide, showing how these bonds safeguard your interests and contribute to the unique charm and professionalism Coral Gables is known for.

Understanding Performance Bonds: A Game-Changer for Coral Gables, Florida

We’ve noticed that many businesses in Coral Gables are uncertain about performance bonds—what they are, when they’re required, and why they’re vital. One of the most common questions we hear is, “How much are performance bonds?” Here’s a quick overview of the essentials:

| Aspect | Explanation |

|---|---|

| Definition | A performance bond guarantees a contractor will fulfill the terms of a project. |

| Who Needs It? | Contractors working on public projects or large private developments. |

| Why It Matters | Protects project owners from financial loss if a contractor fails to perform. |

| Local Requirements | Coral Gables often mandates performance bonds for projects to preserve its architectural integrity and high standards. |

Example:

Imagine you’re a contractor bidding on a public restoration project in Coral Gables’ historic district. A performance bond assures city officials and stakeholders that you’ll meet the contract’s requirements—preserving trust in both you and the community.

The Role of Performance Bonds in Coral Gables, Florida

What we’ve discovered is that performance bonds serve as critical safeguards, particularly in a city like Coral Gables, known for its Mediterranean-inspired architecture and rigorous standards. One key concern is determining how much are performance bonds and understanding the factors that affect their cost. Here are their key roles:

- Compliance with Local Regulations:

Coral Gables enforces stringent guidelines for public and private projects. Performance bonds ensure you meet these requirements, whether it’s a municipal construction project or a private development in the exclusive Venetian neighborhood. - Financial Security:

If a contractor defaults, the performance bond compensates the project owner, covering losses and mitigating financial risk. - Strengthening Stakeholder Confidence:

A performance bond demonstrates professionalism and reliability, reassuring clients, investors, and local authorities.

See our Performance Bonds in Pinellas Park, Florida page

A Step-by-Step Plan to Simplify Performance Bonds in Coral Gables, Florida

Based on our experience, we’ve crafted a streamlined approach to help Coral Gables contractors and developers understand and secure performance bonds with ease:

1. Assess Your Project’s Needs

- Public or Private Project? Determine whether your project requires a performance bond based on contractual or municipal regulations.

- Project Value: Performance bonds are often mandatory for contracts above certain thresholds.

2. Gather Documentation

- Financial Statements: Your company’s financial health affects bond approval and rates.

- Project Details: Include timelines, costs, and the scope of work.

- Experience Records: Highlight your past successes to bolster your application.

3. Choose a Trusted Provider

- Look for providers who specialize in Coral Gables projects. At Swiftbonds, we tailor bonds to meet both state and local requirements.

4. Apply for the Bond

- Submit your application, ensuring all documents are accurate and complete to avoid delays.

- Be prepared to answer follow-up questions from the underwriter.

5. Monitor and Maintain Your Bond

- Keep open communication with your provider throughout the project to address changes or extensions.

Common Missteps and How to Avoid Them

In our observation, overlooking the details of performance bonds can lead to unnecessary hurdles. Another common mistake is not fully understanding how much are performance bonds and how their rates are calculated. Here are the most common mistakes and how to sidestep them:

| Pitfall | Consequence | Solution |

|---|---|---|

| Skipping Bond Requirements | Project delays, legal penalties, or contract cancellations. | Always confirm whether a performance bond is required during project planning. |

| Choosing an Inexperienced Provider | Risk of incomplete coverage or application rejection. | Partner with experts like Swiftbonds who understand Coral Gables’ specific needs. |

| Incomplete Documentation | Prolonged application process or higher rates. | Submit a complete, accurate application with all supporting documents upfront. |

FAQs About Performance Bonds in Coral Gables, Florida

We’ve often noticed these questions from contractors and developers:

What happens if the contractor defaults?

If the contractor fails to meet the contract terms, the performance bond compensates the project owner, covering financial losses and ensuring project completion.

Are performance bonds required for small projects?

Not always. Requirements typically depend on project value, type, and contractual agreements.

How much are performance bonds?

Costs vary widely depending on the project’s value, the contractor’s credit score, and financial history. On average, the price ranges from 0.5% to 3% of the total contract value.

Can I apply for a bond if I have poor credit?

Yes, though rates may be higher. Swiftbonds specializes in finding solutions for clients with varying credit profiles.

Protect, Perform, and Prosper: The Final Word on Coral Gables, FL Performance Bonds

We’ve come to appreciate how performance bonds empower contractors and developers to bring their visions to life in Coral Gables, a city where quality and trust are paramount. By securing a performance bond, you’re not just fulfilling a requirement—you’re demonstrating your commitment to excellence and ensuring your project runs smoothly.

For those wondering how much are performance bonds, the answer depends on factors like the project size, your financial history, and the bond provider you choose. Swiftbonds can help clarify the process and provide competitive rates tailored to your needs.

If you’re ready to take the next step, Swiftbonds is here to provide expert guidance and support. Whether you need answers, assistance with the application process, or help finding the right bond, we’re just a call or click away. Let us handle the complexities while you focus on building something extraordinary in the beautiful city of Coral Gables, Florida.

See our Performance Bonds in Bonita Springs, Florida page