You can now apply online for a Delaware Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Delaware?

How do I get a Performance and Payment Bond in Delaware?

We make it easy to get a contract performance bond. Just click here to get our Delaware Performance Application. Fill it out and then email it and the Delaware contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Performance bonding in Delaware?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in DE?

How much do bonds cost in DE?

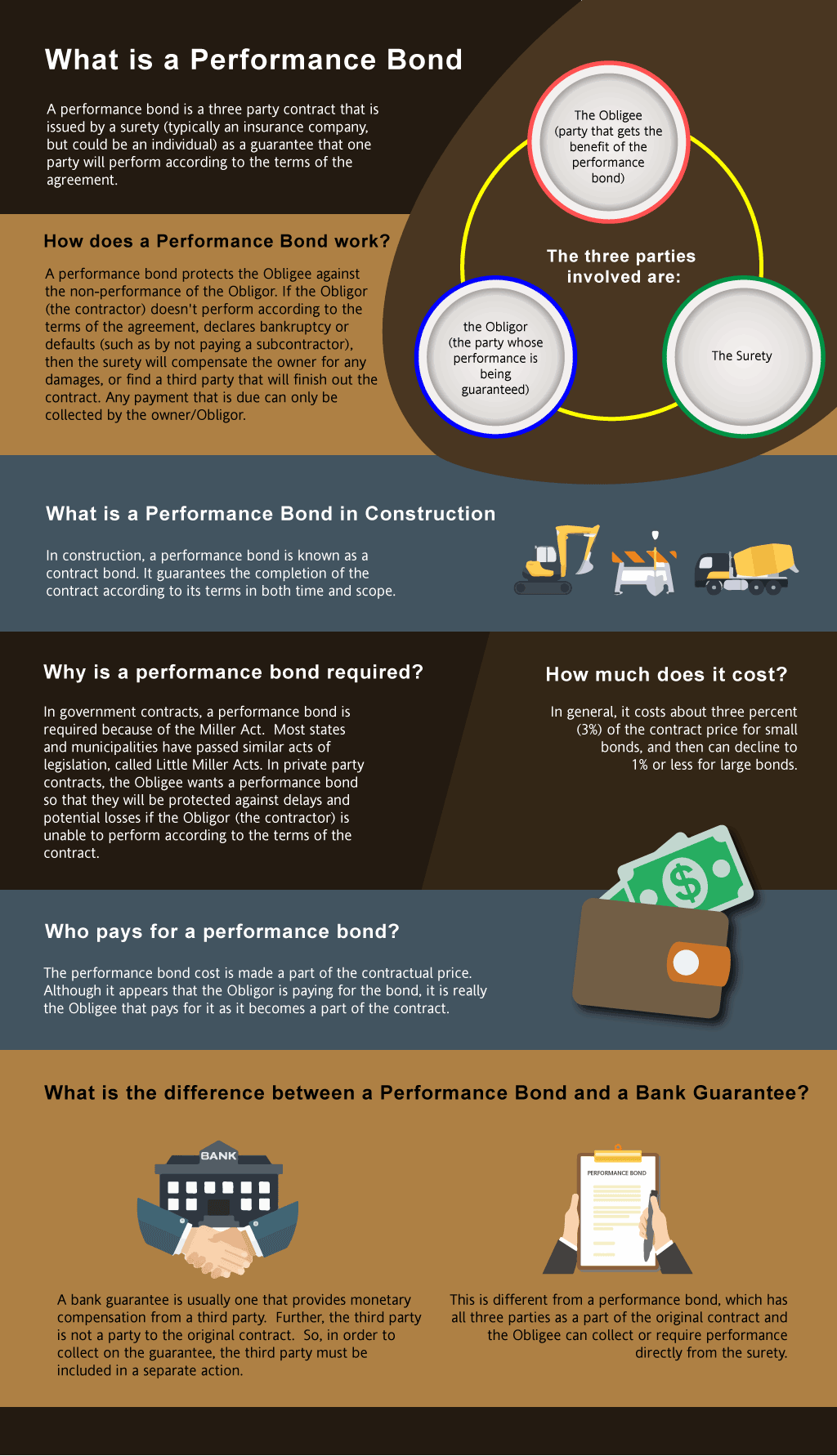

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Delaware. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity).

It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in DE

Just call us. We’ll work with you to get the best Delaware bond possible.

We provide performance and payment bonds in each of the following counties:

Kent

New Castle

Sussex

And Cities:

Delaware City

Wilmington

Newark

Dover

Smyrna

Middletown

Lewes

Milford

New Castle

Elsmere

Seaford

See our Florida performance bond page here.

Secure your project’s success with our performance bond guarantee today!

Performance Bonds Explained: Key Insights and Practical Observations

Distinguishing Performance Bonds from Bank Letters of Credit: Essential Insights for Project Success

Distinguishing Performance Bonds from Bank Letters of Credit: Essential Insights for Project Success

In our experience, the distinctions between performance bonds and bank letters of credit are crucial for anyone involved in construction or large-scale projects. Performance bonds are issued by a surety company and guarantee the completion of a project according to the contract terms. On the other hand, a bank letter of credit is a financial document issued by a bank, ensuring payment to the contractor if they fulfill the contract obligations. We’ve consistently found that while both instruments offer protection, performance bonds tend to be more favorable to project owners due to the additional oversight provided by the surety company.

Are Performance Bonds Refundable? What You Need to Know Before You Buy

Through our own efforts, we’ve discovered that performance bonds are generally considered non-refundable. Once the bond is issued, the premium paid to the surety company is earned, regardless of whether the bond is utilized or not. This is because the surety assumes a risk upon issuance of the bond, and the premium compensates for this risk. We’ve observed that this non-refundable nature is a common point of confusion, but understanding it upfront can prevent misunderstandings later.

Filing a Claim on a Performance Bond: What to Expect and How to Prepare

From our perspective, when a claim is filed on a performance bond, it triggers a process that involves an investigation by the surety company. The surety will assess the validity of the claim and, if justified, will step in to either complete the project or compensate the project owner for the losses incurred. We’ve encountered situations where claims led to significant delays and additional costs, which underscores the importance of ensuring that project terms are met to avoid such scenarios.

When Are Performance Bonds Released? Understanding the Process and Timelines

We’ve had firsthand experience with the process of releasing performance bonds, and it typically occurs upon the satisfactory completion of the project. This means all contractual obligations must be fulfilled, including any warranty periods that may apply. We’ve learned that premature release requests are usually denied by the surety, emphasizing the need for thorough compliance with all contract terms before seeking bond release.

100 Percent Performance and Payment Bonds: Comprehensive Coverage for High-Stakes Projects

In our observation, a 100 percent performance and payment bond is a dual bond that covers the full amount of the contract. We’ve come to understand that this bond ensures both the completion of the project and the payment to subcontractors and suppliers. We’ve consistently observed that these bonds provide comprehensive protection to project owners, making them a preferred option in many large-scale projects.

How Long Does It Take to Get a Performance Bond? Factors That Influence the Timeline

We’ve noticed through our work that obtaining a performance bond can vary in time, depending on several factors such as the complexity of the project, the financial stability of the contractor, and the responsiveness of the surety company. Typically, the process can take anywhere from a few days to a few weeks. We’ve been in situations where delays occurred due to incomplete documentation, so we recommend ensuring all necessary paperwork is prepared in advance.

Delaware Performance Bonds: Key Considerations for Contractors and Project Owners

What Happens if a Performance Bond Expires? Managing Risks and Ensuring Continuous Protection

What Happens if a Performance Bond Expires? Managing Risks and Ensuring Continuous Protection

We’ve found that if a performance bond expires before the completion of the project, it can lead to significant complications. The project owner may be left without the protection the bond provides, and the contractor could face difficulties in securing a replacement bond. We’ve been in a position where the expiration of a bond led to urgent efforts to secure a renewal or extension, highlighting the importance of monitoring bond expiration dates closely.

Conclusion: The Crucial Role of Performance Bonds in Construction Success

Our experience has shown us that performance bonds are a critical component in the construction industry, providing assurance and protection for both project owners and contractors. Understanding the nuances of these bonds can help prevent potential issues and ensure the smooth completion of projects. We’ve consistently found that being proactive and informed about performance bonds can save time, money, and headaches down the road.

See more at our Louisiana Performance Bond page.

Contact us for Delaware surety bonds.

1. What are the performance bond requirements under Delaware’s Little Miller Act?

Delaware’s Little Miller Act (Del. Code tit. 29, § 6962) governs performance bond requirements for public construction projects. Key provisions include:

- For public works contracts exceeding $100,000, contractors must provide both a performance bond and a payment bond.

- The performance bond ensures contract completion as per agreed terms.

- The payment bond guarantees that subcontractors, laborers, and suppliers receive payment.

2. How does Delaware’s procurement process handle performance bonds for city contracts?

Local governments in Delaware follow procurement guidelines outlined in Title 29, Chapter 69 of the Delaware Code and municipal procurement regulations. Typically:

- For contracts exceeding $100,000, performance bonds are required under Del. Code tit. 29, § 6962(d)(8).

- Municipalities may impose additional bonding requirements through local procurement rules.

- Contractors must submit bonding proof before the contract is awarded.

3. What government agencies regulate performance bonds for construction projects in Delaware?

Performance bonds in Delaware are regulated based on project type:

- Public Projects: Governed by the Delaware Office of Management and Budget (OMB) and municipal procurement agencies.

- State-Funded Projects: Managed by agencies such as the Delaware Department of Transportation (DelDOT) for infrastructure projects.

- Private Projects: Typically regulated by contractual agreements, though some lenders may require performance bonds.

4. Are subcontractors required to carry performance bonds in Delaware?

Subcontractors are not generally required to obtain performance bonds under the Little Miller Act, which applies to prime contractors. However:

- General contractors may require subcontractors to obtain bonds under private agreements.

- On federal projects, larger subcontracting agreements may require bonding under the Miller Act.

- Local government contracts may have additional bonding requirements for subcontractors.

5. How can I verify a performance bond’s validity for a public project?

To verify the authenticity of a performance bond:

- Request a copy of the bond from the contractor or project owner.

- Confirm with the surety company—bonds are issued by licensed sureties, which should be registered with the Delaware Department of Insurance.

- Check with the contracting agency—most public projects maintain records of bonded contracts.

- Review procurement portals, such as DelDOT’s bid and contract system or municipal purchasing departments.