Streamlining Success in Hartford, Connecticut: A Practical Guide to Performance and Payment Bonds

From our perspective, understanding performance and payment surety bonds in Hartford, Connecticut, is a game-changer for contractors and project owners alike. Whether you’re tackling a public project or managing private developments, knowing the ins and outs of these bonds can set you apart. Let’s simplify the process and make it work for you.

Unraveling the Challenges of Performance and Payment Surety Bonds

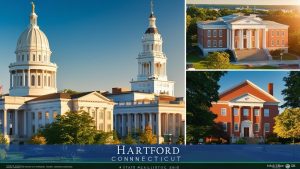

Why Hartford, Connecticut Demands Your Attention

We’ve noticed that contractors in Hartford often face unique challenges. The city’s dynamic mix of historic renovations and modern developments creates a high demand for expertise—and bonding requirements often complicate the process. Performance and payment surety bonds are critical in this environment, ensuring that contractors fulfill their contractual obligations while protecting the interests of subcontractors and suppliers.

Common Missteps: Don’t Let These Misconceptions Hold You Back

Here are some myths we frequently hear—and the truths behind them:

| Misconception | Reality |

|---|---|

| Performance bonds cover all contracts | Many projects also require payment bonds to protect subcontractors. |

| Bonds are only for contractors | Project owners also benefit from the security of payment surety bonds. |

| Obtaining a bond is time-consuming | With the right partner, it’s a straightforward process. |

Why Swiftbonds is Hartford, Connecticut’s Go-To Performance and Payment Bond Expert

Experience Matters: Trust a Proven Guide

Based on our experience, contractors and businesses in Hartford need a partner who understands the local landscape. At Swiftbonds, we make the process seamless and stress-free by bringing clarity to complex regulations surrounding performance and payment surety bonds.

Our Promise: Tailored Solutions for Hartford, Connecticut Professionals

Here’s what sets us apart:

- Local Knowledge: We know Hartford’s municipal bond requirements inside and out, including payment bonds for subcontractor protection.

- Speed and Simplicity: From paperwork to approval, we expedite every step for performance and payment surety bonds.

- Comprehensive Support: Questions? Challenges? We’re with you every step of the way.

Explaining Performance and Payment Surety Bonds: The Key Facts You Need

What Makes Performance and Payment Bonds Critical in Hartford, Connecticut

What we’ve discovered is that performance and payment surety bonds are more than just a requirement—they’re a competitive advantage. These bonds:

- Protect project owners from financial loss due to contractor non-performance.

- Ensure that subcontractors and suppliers are paid on time, maintaining project integrity.

- Demonstrate a contractor’s credibility and readiness to meet contractual obligations.

Who Must Secure These Bonds in Hartford, Connecticut?

If you’re working on public contracts over $100,000 in Connecticut, both performance and payment surety bonds are mandatory. Private contracts often include these bonding requirements too, especially in large-scale or complex projects.

Cost Breakdown: What Should You Expect?

Bond costs typically range from 1-3% of the project’s value. Here’s a cost example for Hartford-based projects:

| Project Value | Credit Score (Excellent) | Credit Score (Fair) |

|---|---|---|

| $500,000 | $5,000 - $7,500 | $10,000 - $15,000 |

| $1,000,000 | $10,000 - $15,000 | $20,000 - $30,000 |

The Step-by-Step Guide to Securing Performance and Payment Surety Bonds

Take the First Step: Understanding the Process

We’ve found that breaking the process into actionable steps makes it far less daunting. Here’s a roadmap tailored for Hartford contractors:

- Learn the Requirements

Start by understanding Hartford’s public and private project bonding expectations for both performance and payment surety bonds. - Partner with Experts

Choosing Swiftbonds ensures local compliance and simplifies the entire journey. - Prepare Your Documents

Have these ready: financial statements, project details, and proof of experience. - Calculate Your Bond Costs

Know your estimated costs based on credit history and project size. - Submit Your Application

Swiftbonds can fast-track your application, ensuring prompt approval.

See our Performance Bonds in Stamford, Connecticut page

Why Acting Now Saves Time and Money

Hartford, Connecticut’s Competitive Edge: Don’t Miss Out

We’ve found that contractors in Hartford who secure performance and payment surety bonds early gain a significant advantage. Whether bidding on city projects or managing private builds, being prepared sets you apart.

The Cost of Procrastination

Delays in securing these bonds can lead to missed opportunities, stalled projects, and higher costs. Don’t let hesitation impact your success.

Avoiding the Risks: Why Bonds Are Non-Negotiable

Don’t Get Caught Without Performance and Payment Surety Bonds

In our observation, failing to secure performance and payment surety bonds leads to:

- Project Stoppages: Many contracts can’t proceed without proper bonding.

- Financial Risks: Without payment bonds, subcontractors and suppliers risk non-payment.

- Reputation Damage: A lack of preparation signals unreliability to potential clients.

Hartford, Connecticut Success Stories: How Contractors Win with Swiftbonds

Real Results: Performance and Payment Bonds in Action

We’ve learned that Hartford contractors thrive when equipped with the right bonds. Consider this:

Case Study: Winning a Hartford City Contract

A contractor needed performance and payment surety bonds for a $1.5 million restoration project. By partnering with Swiftbonds, they secured the bonds within 48 hours and won the contract. The result? A successful project that opened doors to additional opportunities.

Your Questions Answered: Hartford, Connecticut Bond FAQs

Are performance and payment surety bonds required for all Hartford projects?

We’ve often noticed confusion here. Public projects over $100,000 require both performance and payment bonds, while private contracts vary by agreement.

Can I get these bonds if my credit isn’t great?

Yes! Swiftbonds specializes in helping contractors of all credit levels secure performance and payment surety bonds.

What happens if a contractor defaults on payment?

Payment bonds ensure that subcontractors and suppliers are compensated, protecting project owners from additional liability.

How long does the process take?

With Swiftbonds, most performance and payment bonds can be secured within days, ensuring you meet project deadlines.

Secure Your Success: Hartford, Connecticut’s Bonding Experts

We’ve come to appreciate that performance and payment surety bonds are more than a formality—they’re a gateway to project success in Hartford. Whether you’re taking on a public works bid or building a private development, having a trusted partner makes all the difference.

At Swiftbonds, we’re here to simplify the process, protect your interests, and position you for success. Ready to get started? Contact us today and let us help you take the next step with confidence.

See our Performance Bonds in Waterbury, Connecticut page