You can now apply online for a Colorado Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Colorado?

How do I get a Performance and Payment Bond in Colorado?

We make it easy to get a contract performance bond. Just click here to get our Colorado Performance Application. Fill it out and then email it and the Colorado contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Ensure project success with our performance bonds in construction projects – secure, reliable, and efficient.

Performance surety bonds in Colorado?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in CO?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Colorado. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond?

A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in CO

Just call us. We’ll work with you to get the best Colorado bond possible.

We provide performance and payment bonds in each of the following counties:

Adams

Alamosa

Arapahoe

Archuleta

Baca

Bent

Boulder

Broomfield

Chaffee

Cheyenne

Clear Creek

Conejos

Costilla

Crowley

Custer

Delta

Denver

Dolores

Douglas

Eagle

Elbert

El Paso

Fremont

Garfield

Gilpin

Grand

Gunnison

Hinsdale

Huerfano

Jackson

Jefferson

Kiowa

Kit Carson

Lake

La Plata

Larimer

Las Animas

Lincoln

Logan

Mesa

Mineral

Moffat

Montezuma

Montrose

Morgan

Otero

Ouray

Park

Phillips

Pitkin

Prowers

Pueblo

Rio Blanco

Rio Grande

Routt

Saguache

San Juan

San Miguel

Sedgwick

Summit

Teller

Washington

Weld

Yuma

And Cities:

Denver

Colorado Springs

Boulder

Aspen

Fort Collins

Aurora

Steamboat Springs

Littleton

Grand Junction

Pueblo

Vail

See our Connecticut performance bond page here.

Performance Bonds Unveiled: The Backbone of Construction Security

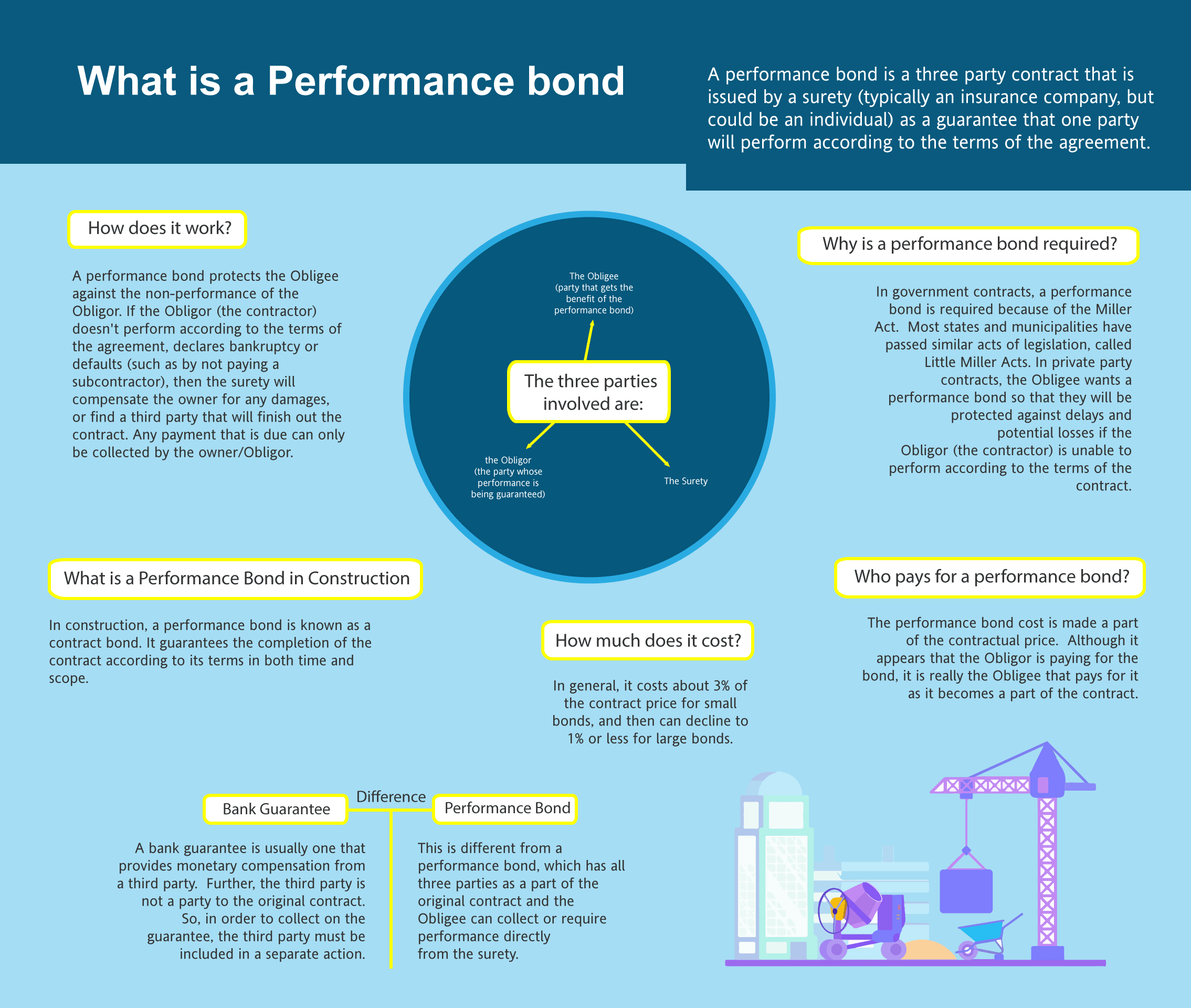

Performance bonds are a cornerstone of the construction industry, ensuring that projects are completed according to the terms of a contract. From our perspective, understanding the nuances of these bonds is crucial for contractors, project owners, and anyone involved in large-scale projects. This article delves into key aspects of performance bonds, providing clarity on their function, differences from other financial instruments, and the implications for all parties involved.

Bank Letters of Credit vs. Performance Bonds: A Comparative Insight

In our experience, performance bonds and bank letters of credit are often compared because they both serve as financial guarantees. However, they are fundamentally different. A performance bond is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor. In contrast, a letter of credit is a promise from a bank to pay the project owner if the contractor fails to meet contractual obligations. We've consistently observed that performance bonds offer more protection to the project owner, as they involve a third-party surety who will step in to fulfill the contract if necessary, while a letter of credit merely ensures payment without guaranteeing project completion.

The Refund Conundrum: Are Performance Bonds Ever Refundable?

We’ve noticed through our work that the question of whether performance bonds are refundable comes up frequently. Generally, performance bonds are not refundable. The premium paid to secure the bond is typically considered earned once the bond is issued, regardless of whether the bond is ultimately called upon. In our dealings with clients, we've encountered situations where contractors request refunds if a project is canceled or completed early, but the answer remains the same—once the bond is in place, the premium is non-refundable, as it compensates the surety for taking on the risk.

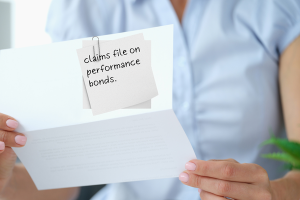

Dealing with Claims: The Aftermath of a Performance Bond Filing

We've found that when a claim is filed on a performance bond, it signals a serious issue with the project's completion. The surety company, upon receiving a claim, will investigate to determine its validity. In our observation, if the claim is justified, the surety has a few options: it can finance the contractor to ensure project completion, hire another contractor to finish the job, or pay the bond amount to the project owner. From our perspective, this process is designed to protect the project owner while holding the contractor accountable for their contractual obligations.

Completing the Circle: When Are Performance Bonds Released?

We’ve had the opportunity to work on projects where the release of performance bonds is a critical milestone. Typically, performance bonds are released once the project is completed to the satisfaction of the project owner and all contractual obligations have been met. In our professional life, we’ve consistently found that the bond release process may also involve a period of time where the project is observed for defects or issues before the bond is fully released. This ensures that the work meets the required standards and that any potential problems are addressed.

Full Coverage: Exploring the 100% Performance and Payment Bond

In our view, a 100 percent performance and payment bond provides the highest level of security for project owners. This type of bond guarantees that the contractor will complete the project as specified in the contract and that all suppliers and subcontractors will be paid in full. We've come to understand that this bond covers the total cost of the contract, providing comprehensive protection against default. We’ve personally witnessed how this bond structure reassures project owners that they are financially protected against both incomplete work and unpaid subcontractors.

The Timeline of Trust: How Long Does It Take to Secure a Performance Bond?

Based on our experience, the time it takes to obtain a performance bond can vary depending on several factors, including the contractor’s financial health, the complexity of the project, and the requirements of the surety company. We’ve consistently observed that, for well-prepared contractors with strong financials, the process can be completed in a matter of days. However, we've also seen firsthand that more complicated projects or less financially stable contractors might require a longer underwriting process, potentially taking weeks.

The Expiry Concern: Navigating the Challenges of Performance Bond Expiration

We've encountered situations where contractors are concerned about what happens if a performance bond expires before the project is completed. In our observation, if a bond is set to expire, it must be renewed to avoid any lapse in coverage. We’ve learned that an expired bond could leave the project owner unprotected and the cont

ractor at risk of default. In our practice, ensuring that bonds are renewed or replaced before expiration is critical to maintaining the integrity of the project’s financial safeguards.

Wrapping Up: The Essential Nature of Performance Bonds in Construction

Performance bonds are essential tools that provide security and peace of mind in the construction industry. We’ve had firsthand experience with these bonds and understand their importance in ensuring projects are completed successfully. By understanding the differences between performance bonds and letters of credit, the conditions for refunds, and the implications of claims and expiration, all parties involved can navigate their responsibilities with confidence. In our line of work, we’ve consistently found that a well-managed performance bond is key to a project's success.

See more at our Maryland Performance Bond page.