You can now apply online for an Arkansas Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Arkansas?

How do I get a Performance and Payment Bond in Arkansas?

We make it easy to get a contract performance bond. Just click here to get our Arkansas Performance Application. Fill it out and then email it and the Arkansas contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

Swiftbonds Performance Bonds in Arkansas?

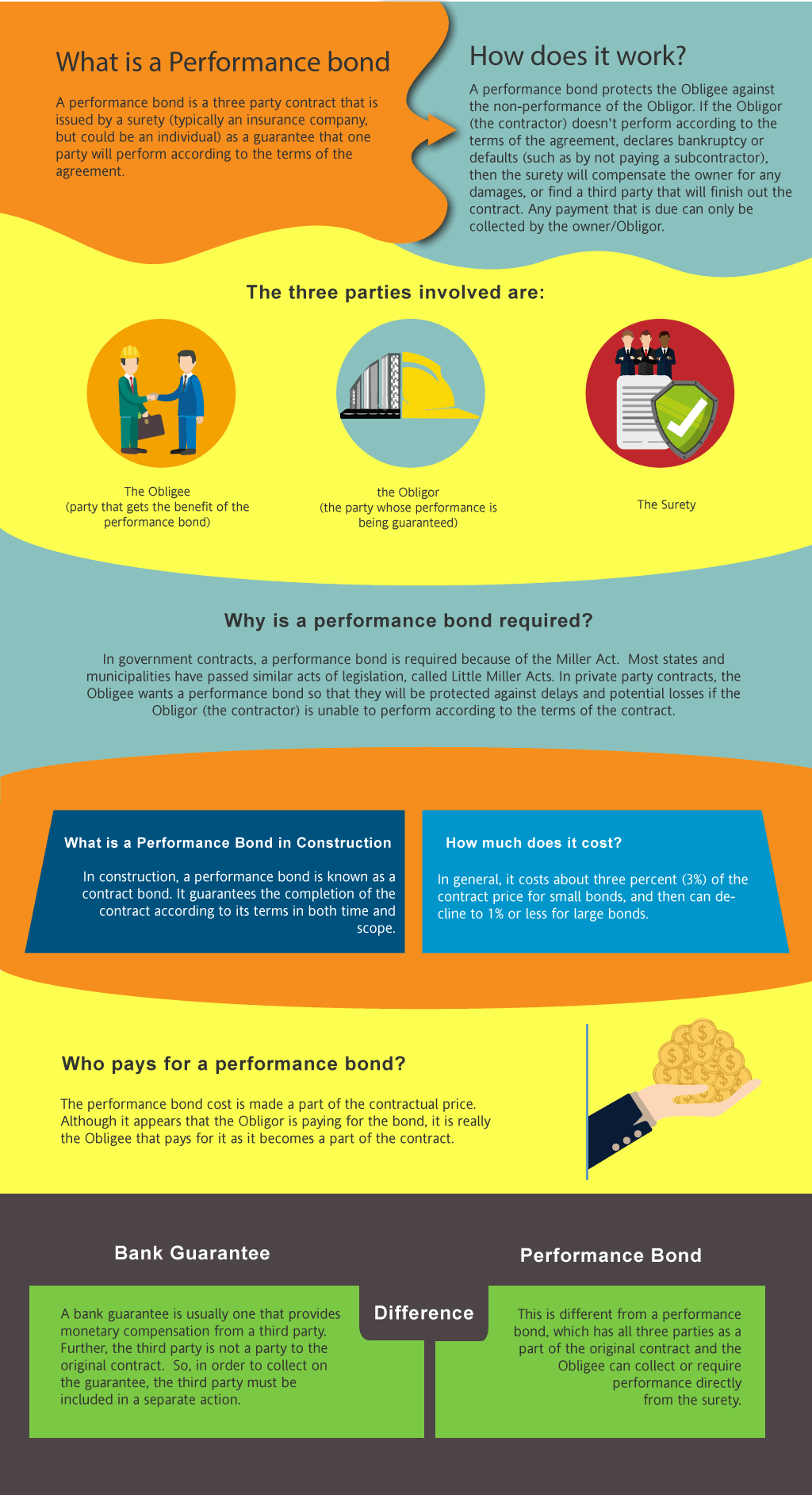

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in AR?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Arkansas. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond?

A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Ensure the success of your construction project with our comprehensive completion bond construction services.

How to Get a Performance Bond in AR

Just call us. We’ll work with you to get the best Arkansas bond possible.

We provide performance and payment bonds in each of the following counties:

Arkansas

Ashley

Baxter

Benton

Boone

Bradley

Calhoun

Carroll

Chicot

Clark

Clay

Cleburne

Cleveland

Columbia

Conway

Craighead

Crawford

Crittenden

Cross

Dallas

Desha

Drew

Faulkner

Franklin

Fulton

Garland

Grant

Greene

Hempstead

Hot Spring

Howard

Independence

Izard

Jackson

Jefferson

Johnson

Lafayette

Lawrence

Lee

Lincoln

Little River

Logan

Lonoke

Madison

Marion

Miller

Mississippi

Monroe

Montgomery

Nevada

Newton

Ouachita

Perry

Phillips

Pike

Poinsett

Polk

Pope

Prairie

Pulaski

Randolph

St. Francis

Saline

Scott

Searcy

Sebastian

Sevier

Sharp

Stone

Union

Van Buren

Washington

White

Woodruff

Yell

And Cities:

Little Rock

Fayetteville

Hot Springs

Fort Smith

Bentonville

North Little Rock

Conway

See our California performance bond page here.

Insights on Performance Bonds: Lessons Learned from Our Experience

Understanding the Key Distinctions: Performance Bonds vs. Bank Letters of Credit

Understanding the Key Distinctions: Performance Bonds vs. Bank Letters of Credit

From our perspective, one of the key differences between performance bonds and bank letters of credit lies in their structure and purpose. Performance bonds are surety bonds issued by a third-party guarantor to ensure the completion of a project according to the contract terms. This bond covering the project's performance guarantees that the contractor will fulfill their obligations. On the other hand, bank letters of credit are financial instruments issued by a bank, guaranteeing that the buyer's payment to a seller will be received on time and for the correct amount. We’ve noticed that while performance bonds are more commonly used in construction and public projects, bank letters of credit are often employed in international trade. The choice between the two depends on the nature of the agreement and the parties involved.

Understanding Refundability: Can You Get Your Performance Bond Premium Back?

Is the Performance bond refundable? In our experience, performance bonds are generally non-refundable once issued. We’ve learned that this bond covering the project is non-refundable because the premium paid for a performance bond is the fee for the surety's risk in guaranteeing the project’s completion. Even if the project is completed successfully without any claims, the bond premium is typically non-refundable, as it compensates the surety for underwriting the bond and taking on the associated risk. However, some partial refunds may be possible under certain conditions, such as early cancellation, but these are rare and depend on the surety’s policies.

Navigating Claims: The Implications of Filing on a Performance Bond

We’ve come across situations where a claim is filed on a performance bond, and it can lead to significant consequences. If the bonded contractor fails to fulfill their obligations, the project owner can file a claim against the bond covering the project. We’ve been involved in cases where the surety company steps in to investigate the claim and determine its validity. If the claim is found to be valid, the surety may cover the costs of completing the project or compensating the project owner, up to the bond’s limit. This process can strain the contractor's relationship with the surety and potentially lead to increased bond premiums or difficulty obtaining bonds in the future.

Timing the Release: When Can You Expect Your Performance Bond to Be Released?

We’ve been in a position where the release of a performance bond depends on the completion of the project and the fulfillment of all contractual obligations. In our line of work, we’ve often noticed that performance bonds are typically released once the project is completed to the satisfaction of the project owner, and all conditions of the contract are met. The bond covering the performance of the contractor is usually held until all terms are fulfilled. We’ve consistently observed that it’s crucial for contractors to obtain a formal release or discharge from the bond to ensure they are no longer liable under the bond terms.

Ensuring Complete Security: The Significance of 100 Percent Performance and Payment Bonds

Ensuring Complete Security: The Significance of 100 Percent Performance and Payment Bonds

We’ve had firsthand experience with 100 percent performance and payment bonds, which are surety bonds that cover the full contract amount. In our professional life, we’ve found that these bonds ensure both the performance of the contract and the payment of subcontractors, suppliers, and laborers. The bond covering both performance and payment is comprehensive, providing protection against contractor default. We’ve worked closely with clients who prefer these bonds for large or critical projects, as they provide complete protection, offering peace of mind that all aspects of the contract will be fulfilled.

Timelines Unveiled: How Long Does it Really Take to Obtain a Performance Bond?

We’ve been in situations where the time it takes to get a performance bond can vary, depending on several factors. We’ve often experienced that the underwriting process for a bond covering a project can take anywhere from a few days to several weeks. Factors that influence this timeframe include the contractor’s financial stability, experience, the complexity of the project, and the responsiveness of the parties involved. From what we’ve seen, well-prepared contractors who provide all necessary documentation promptly can expedite the process. However, we’ve learned through doing that any delays in submitting required information can prolong the issuance of the bond.

Managing Risks: What to Do if a Performance Bond Expires

We’ve come to the realization that if a performance bond expires before the project is completed, it can lead to significant risks for the project owner. We’ve encountered situations where an expired bond covering the project leaves the project owner without financial protection if the contractor fails to complete the work. In our dealings with bond issuers, we’ve discovered that it’s crucial to monitor the bond’s expiration date and take steps to renew or replace it if the project extends beyond the original timeline. Failing to do so could result in unprotected liabilities and increased costs for all parties involved.

Gaining Clarity on Performance Bonds in Arkansas

Gaining Clarity on Performance Bonds in Arkansas

By integrating our experiences and observations, we hope this article provides valuable insights into the nuances of performance bonds, helping you navigate the complexities of these essential financial instruments.

See more at our Nevada Performance Bond page.

Under Arkansas's Little Miller Act. What are the performance bond requirements?

Under Arkansas’s Little Miller Act (Ark. Code Ann. §22-9-401 et seq.), contractors working on public construction projects valued at $50,000 or more must secure a performance bond. The bond guarantee that the contractor fulfills their contractual obligations, including completing the project as specified and meeting all legal requirements. The performance bond must be at least equal to the total contract price and must be issued by a licensed surety company authorized to operate in Arkansas. Contractors must submit the bond to the relevant government contracting authority before beginning work.

How does state of Arkansas procurement acquiring process handle performance bonds for a city contracts?

For city contracts, performance bonds are typically required for publicly funded projects in accordance with local procurement laws and the Arkansas Little Miller Act. Cities and municipalities may have specific procurement guidelines outlining the bonding requirements, bid submission process, and contractor qualifications. Generally, the city’s procurement department oversees the verification and approval of performance bonds before awarding contracts. Contractors should refer to the Arkansas Department of Business & Professional Regulation (DBPR) or the relevant city procurement office for project-specific requirements.

What government agencies regulate performance bonds for construction projects in Arkansas?

Several state and local government agencies oversee performance bond regulations in Arkansas, including:

Arkansas Department of Business & Professional Regulation (DBPR) – Regulates contractor licensing and bonding requirements.

Arkansas Department of Finance and Administration (DFA) – Oversees state procurement regulations.

Arkansas Legislature – Establishes and enforces statutory bonding requirements through the Little Miller Act.

County and Municipal Procurement Offices – Administer performance bond requirements for local projects.

Contractors should check with the relevant regulatory body based on their project location and type.

Are subcontractors required to carry performance bonds in Arkansas?

While the Little Miller Act applies primarily to prime contractors, some public and private contracts may require subcontractors to obtain performance bonds. The requirement for subcontractor bonds depends on:

The project’s owner or general contractor

The contract terms and conditions

Specific city, county, or state procurement guidelines Prime contractors should review their contractual obligations and consult with their surety provider or legal counsel for compliance.

How can I verify a performance bond’s validity for a public project?

Verifying a performance bond by following the steps:

Contact the contracting government agency (state, county, or city procurement office) that issued the contract.

Request documentation or confirmation of the bond from the surety company.

Check the Arkansas Department of Business & Professional Regulation’s database for licensed surety providers.

Verify that the bond amount and terms match the project requirements.

If further verification is needed, consult an official procurement officer or a licensed attorney specializing in construction law.