You can now apply online for an Arizona Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

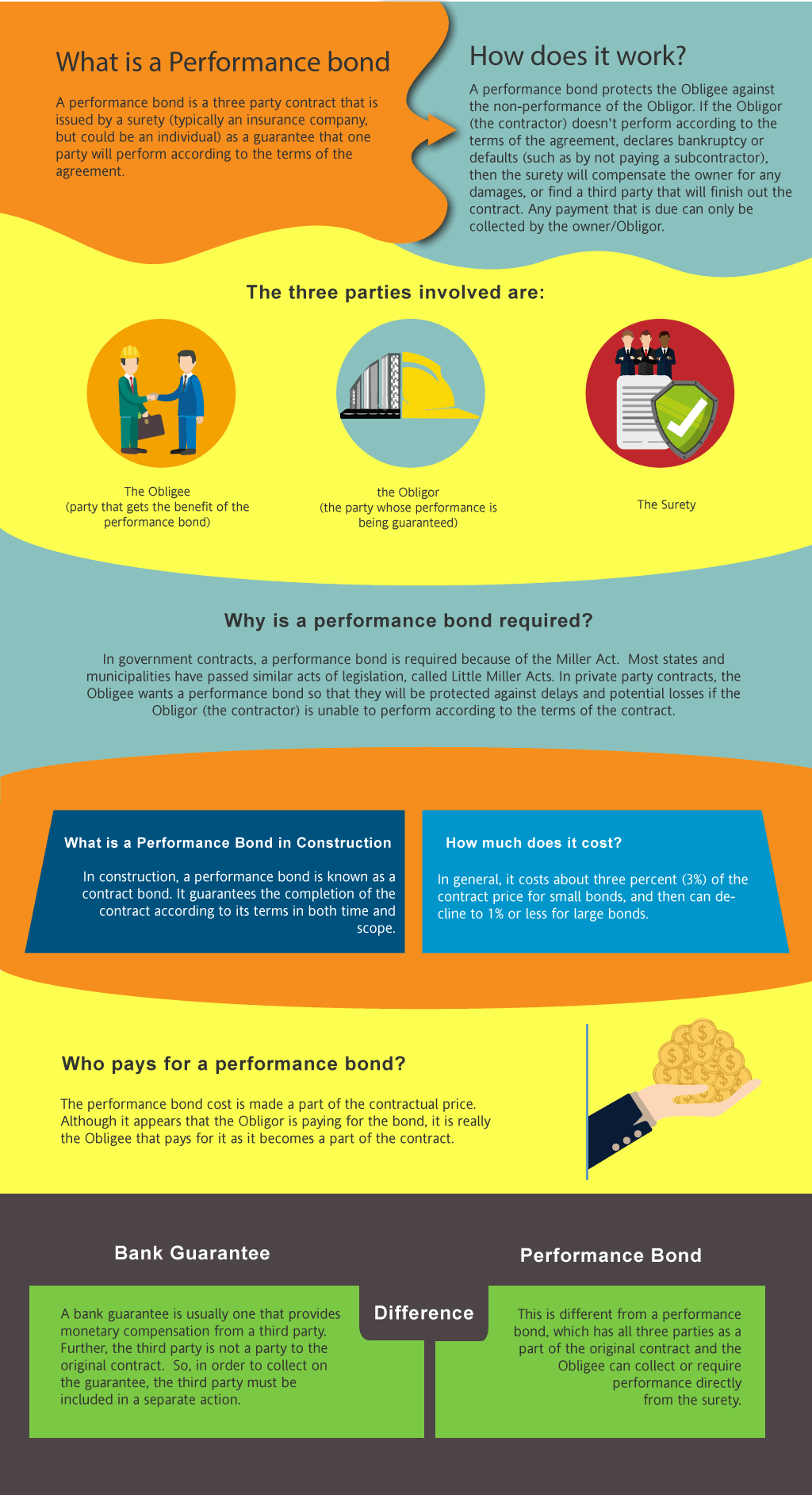

What is a Performance Bond in Arizona?

How do I get a Performance and Payment Bond in Arizona?

We make it easy to get a contract performance bond. Just click here to get our Arizona Performance Application. Fill it out and then email it and the Arizona contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How much does a Performance Bond Cost in Arizona?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in AZ?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Arizona. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond?

A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

Ensure project success and mitigate risks with contractor performance bonds – safeguard your investment today!

How to Get a Performance Bond in AZ

Just call us. We’ll work with you to get the best Arizona bond possible.

We provide performance bond insurance and payment bonds in each of the following counties:

Apache

Cochise

Coconino

Gila

Graham

Greenlee

La Paz

Maricopa

Mohave

Navajo

Pima

Pinal

Santa Cruz

Yavapai

Yuma

And Cities:

Phoenix

Tucson

Scottsdale

Mesa

Tempe

Sedona

Chandler

Flagstaff

Glendale

Gilbert

Prescott

Yuma

See our Arkansas performance bond page here.

Unpacking Performance Bonds: Essential Insights and Practical Implications

Clarifying the Distinction: Performance Bonds vs. Bank Letters of Credit

In our professional life, we’ve often noticed that clients are confused between performance bonds and bank letters of credit. While both serve as financial guarantees, their fundamental differences lie in their structure and purpose. A performance bond is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor. On the other hand, a bank letter of credit is a financial tool used primarily to ensure payment to a seller in a commercial transaction. From our perspective, performance bonds provide a more specialized assurance related to project completion, whereas bank letters of credit focus on financial transactions and payment security.

Understanding Refundability: Are Performance Bonds Refundable?

We’ve come across many instances where clients inquire whether performance bonds are refundable. From our experience, performance bonds are generally non-refundable. Once issued, the bond premium is earned by the surety company, regardless of whether a claim is made against it or the project is completed successfully. However, there are certain rare circumstances where a partial refund might be possible, such as if the bond is canceled before the project starts. Our experience tells us that understanding the terms of the bond agreement is crucial to avoid any misconceptions regarding refunds.

Navigating the Claim Process: What Happens if a Claim is Filed on a Performance Bond?

Navigating the Claim Process: What Happens if a Claim is Filed on a Performance Bond?

We’ve learned through doing that filing a claim on a performance bond can be a complex process with serious implications. If a claim is filed, the surety company will investigate to determine the validity of the claim. If the claim is found to be legitimate, the surety will cover the costs up to the bond’s value to ensure the project’s completion. We’ve been in situations where the contractor then becomes liable to reimburse the surety for the amount paid out. In our observation, this underscores the importance of contractors fulfilling their obligations to avoid the financial repercussions of a bond claim.

The Bond Release Timeline: When Are Performance Bonds Released?

We’ve often experienced that clients are eager to know when their performance bonds will be released. Performance bonds are typically released upon the satisfactory completion of the project, as determined by the project owner. We’ve found that this usually occurs after the final inspection and once all contractual obligations have been met. In our dealings with various projects, we’ve seen firsthand that the bond release process can sometimes take time, especially if there are disputes or unresolved issues regarding the project’s completion.

Complete Assurance: Exploring the 100 Percent Performance and Payment Bond

Through our own efforts, we’ve come to understand that a 100 percent performance and payment bond offers full coverage for both the performance and payment aspects of a construction project. This type of bond ensures that the contractor will complete the project as per the terms of the contract and that all subcontractors, suppliers, and laborers will be paid. We’ve gained insight into the fact that this bond is particularly valuable in large-scale projects, where the financial risks are significant, and the assurance of full coverage is crucial to all parties involved.

The Application Process: How Long Does it Take to Get a Performance Bond?

The Application Process: How Long Does it Take to Get a Performance Bond?

We’ve been in the position where clients need to secure a performance bond quickly to meet project deadlines. Based on our experience, the time it takes to obtain a performance bond can vary. We’ve consistently found that for straightforward projects with a solid contractor track record, the process can be completed within a few days. However, for more complex projects or contractors with less experience, it may take longer, sometimes up to several weeks. We’ve come to appreciate the importance of starting the bond application process early to avoid delays that could impact the project timeline.

Monitoring Expiration: What Happens if a Performance Bond Expires?

We’ve observed that the expiration of a performance bond can lead to significant concerns for all parties involved. If a performance bond expires before the project is completed, the contractor might be required to obtain a new bond, which can be challenging and costly. We’ve personally witnessed situations where an expired bond led to project delays and additional expenses, as the project owner may refuse to continue work without an active bond in place. Our experience has taught us the importance of monitoring bond expiration dates closely to ensure continuous coverage throughout the life of the project.

Gaining Valuable Insights into Performance Bonds in Arizona

Gaining Valuable Insights into Performance Bonds in Arizona

In our professional practice, these insights into performance bonds have proven invaluable, offering both project owners and contractors the knowledge needed to navigate their complexities effectively. We’ve realized through our work that understanding these key aspects can help prevent potential pitfalls and ensure a smoother project completion process.

See more at our Perfromance Bond page.

Learn more about AZ surety bond.

Arizona’s Little Miller Act, what are the requirements for the performance bond?

Under Arizona’s Little Miller Act (A.R.S. §34-222), contractors engaged in public construction projects valued at $100,000 or more must obtain a performance bond. This bond ensures that the contractor completes the project as agreed upon in the contract and meets all legal and regulatory requirements. The bond must be equal to the total contract amount and issued by a licensed surety company authorized to operate in Arizona. Contractors must submit proof of the bond to the public contracting authority before work begins.

How does Arizona’s procurement process handle performance bonds for city contracts?

For city contracts, performance bonds are mandated for publicly funded projects under local procurement laws and Arizona’s Little Miller Act. Municipalities often have specific procurement rules detailing bonding requirements, bid submission procedures, and contractor eligibility criteria. Generally, a city’s procurement department is responsible for reviewing and approving performance bonds before awarding contracts. Contractors should consult the Arizona Department of Business & Professional Regulation (DBPR) or the specific city procurement office for precise requirements.

What agencies of government that control performance bonds for construction project in AZ?

Performance bonds for construction projects in Arizona are regulated by various state and local agencies, including:

- Arizona Department of Business & Professional Regulation (DBPR) – Oversees contractor licensing and bonding compliance.

- Arizona Department of Administration (ADOA) – General Services Division – Manages state procurement and contract compliance.

- Arizona Legislature – Establishes and enforces statutory bonding requirements through the Little Miller Act.

- County and Municipal Procurement Offices – Enforce performance bond regulations at local government levels.

Contractors should contact the appropriate regulatory authority based on the project type and location.

Are subcontractors required to carry performance bonds in Arizona?

While the Little Miller Act primarily applies to prime contractors, certain projects may require subcontractors to obtain performance bonds. Whether a subcontractor must carry a bond depends on:

- The contracting authority or prime contractor’s requirements.

- The specific terms of the project contract.

- Applicable county, city, or state procurement policies. Prime contractors should thoroughly review their contract terms and consult a surety provider or legal expert for compliance guidance.

How can I verify a performance bond’s validity for a public project?

To verify a performance bond, follow these steps:

- Contact the government agency overseeing the contract (state, county, or city procurement office).

- Obtain documentation or confirmation of the bond from the surety company.

- Check the Arizona Department of Business & Professional Regulation’s database for licensed surety providers.

- Ensure the bond amount and terms align with the project requirements.

If additional verification is required, consult an official procurement officer or a licensed attorney specializing in construction law.