You can now apply online for an Alaska Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in Alaska?

How do I get a Performance and Payment Bond in Alaska?

We make it easy to get a contract performance bond. Just click here to get our Alaska Performance Application. Fill it out and then email it and the Alaska contract documents to [email protected] or fax to 855-433-4192.

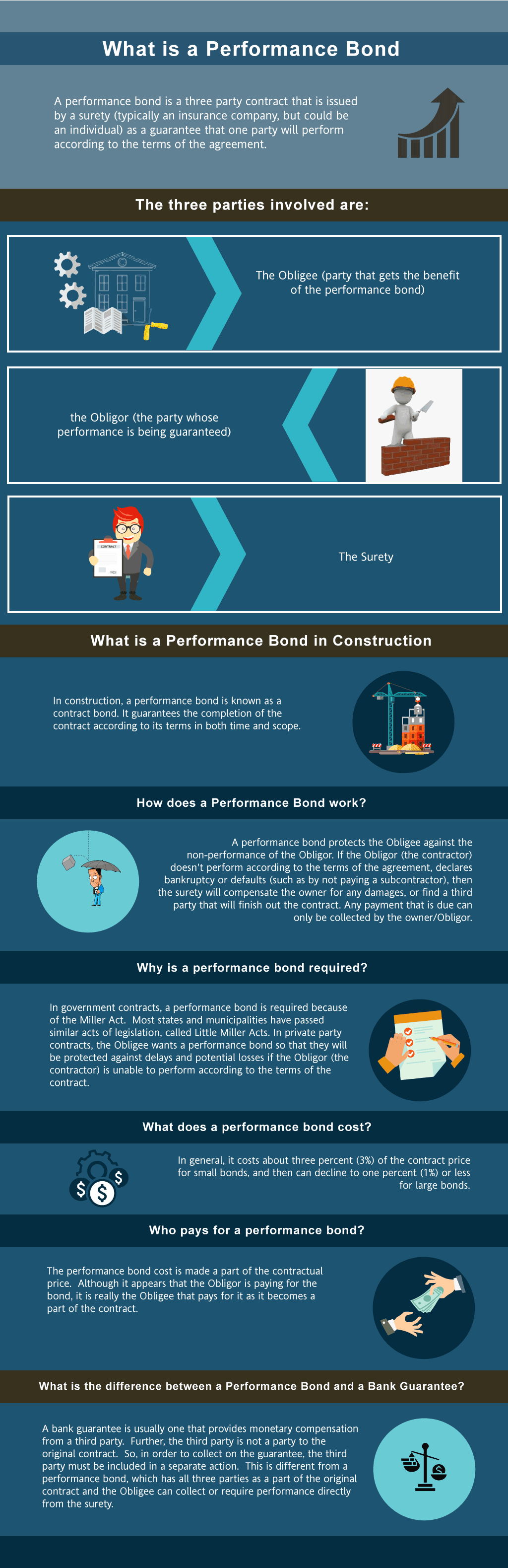

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible. a performance bond? This infographic shows a logo of a house, contractor, agent holding a contract document, construction site, person holdin an umbrella, dollars, signing of document, old fashioned scale in a multi colored background." width="1024" height="3158" />

a performance bond? This infographic shows a logo of a house, contractor, agent holding a contract document, construction site, person holdin an umbrella, dollars, signing of document, old fashioned scale in a multi colored background." width="1024" height="3158" />

Contractor performance bond in Alaska?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in AK?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Alaska. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond?

A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in AK

Just call us. We’ll work with you to get the best Alaska bond possible.

We provide performance and payment bonds in each of the following counties:

Aleutians East

Aleutians West

Anchorage

Bethel

Bristol Bay

Denali

Dillingham

Fairbanks North Star

Haines

Juneau

Kenai Peninsula

Ketchikan Gateway

Kodiak Island

Lake And Peninsula

Matanuska-Susitna

Nome

North Slope

Northwest Arctic

Prince of Wales-Outer Ketchikan

Sitka

Skagway

Southeast Fairbanks

Valdez-Cordova

Wade Hampton

Wrangell

Yakutat

And Cities:

Anchorage

Juneau

See our Arizona performance bond page here.

Unlocking the Essentials of Performance Bonds: Key Insights and Practical Considerations

Distinct Financial Instruments: Performance Bonds vs. Bank Letters of Credit

Distinct Financial Instruments: Performance Bonds vs. Bank Letters of Credit

From our perspective, performance bonds and bank letters of credit (LCs) are distinct financial instruments that serve different purposes in contract fulfillment. While both provide security to project owners, a performance bond involves a third-party guarantor who ensures that the contractor completes the project as agreed. In contrast, a bank LC involves the bank directly paying the project owner upon demand, regardless of the underlying issue. We’ve often noticed that performance bonds offer more comprehensive protection, particularly for large projects, making them a preferred choice in the construction industry.

The Non-Refundable Nature of Performance Bonds: What to Know

In our experience, performance bonds are generally non-refundable. The premium paid for the bond is earned by the surety company upon issuance, covering the risk and administrative costs. We’ve come to understand that once the bond is in effect, whether used or not, the contractor is not entitled to a refund. However, we’ve noticed in our work that in rare cases where the bond is canceled early, a partial refund might be possible, though this is quite uncommon and at the surety’s discretion.

Navigating Claims: What Happens When a Performance Bond is Activated?

We’ve encountered situations where a claim is filed on a performance bond, leading to an investigation by the surety company to determine the claim’s validity. If the claim is found to be justified, the surety steps in to ensure project completion or compensate the owner for losses. We’ve come to recognize that the contractor remains liable for the claim amount, as the surety typically seeks reimbursement for any payments made, emphasizing the importance of contractors understanding their obligations fully.

Timelines for Release: When Are Performance Bonds Freed?

Timelines for Release: When Are Performance Bonds Freed?

Through our own efforts, we’ve learned that performance bonds are released once the contractor has fulfilled all contractual obligations to the project owner’s satisfaction. This typically includes completing the project on time, meeting quality standards, and resolving any related issues. We’ve observed that in some cases, a bond may remain in effect during a maintenance period to cover any defects, ensuring long-term project integrity.

Understanding the 100 Percent Performance and Payment Bond: A Comprehensive Guarantee

In our practice, we’ve encountered the term "100 percent performance and payment bond," which refers to a bond that guarantees both the completion of the project and the payment of all subcontractors, laborers, and suppliers. We’ve consistently found that this type of bond is often required for large public projects where the stakes are high, providing full coverage equivalent to the total contract value. This dual bond protects both the project owner and all parties involved, ensuring the project’s financial and operational success.

Timing Matters: How Long Does It Take to Secure a Performance Bond?

In our line of work, we’ve noticed that the time required to obtain a performance bond can vary. For well-established contractors, it may take just a few days to a week, while newer or less financially stable contractors might face a longer process. We’ve been in the position where a complex or large-scale project required more detailed information, extending the time needed for the surety’s underwriting process to several weeks.

Consequences of Expiration: What Happens if a Performance Bond Lapses?

Consequences of Expiration: What Happens if a Performance Bond Lapses?

We’ve learned through doing that if a performance bond expires before the project is completed, the project owner may be left without financial protection, leading to significant risks. We’ve often found ourselves advising contractors to ensure that their bonds are extended or renewed if the project timeline is extended. Our experience tells us that failing to maintain an active bond can result in legal and financial penalties, including contract termination or claims for damages.

Conclusion: The Vital Role of Performance Bonds in Construction

In our professional life, we’ve consistently observed that performance bonds are crucial in the construction industry, providing essential protection and ensuring contractual obligations are met. From understanding the differences between bonds and letters of credit to the implications of bond expiration, our experience has shown us that knowledge and careful management of these bonds are key to the successful completion of projects.

See more at our Montana Performance Bond page.

What are the performance bond requirements under Alaska’s Little Miller Act?

Under Alaska’s Little Miller Act (Alaska Stat. §36.25.010 et seq.), contractors working on public construction projects exceeding $100,000 must obtain a performance bond. This bond guarantees the contractor's compliance with contractual obligations, including proper project completion and adherence to all legal requirements. The bond must be equal to 100% of the contract price and issued by a surety company authorized to operate in Alaska. Contractors must provide this bond to the appropriate government contracting authority before work commences.

In what way Alaska's procurement process handle performance bonds for city contracts?

For city contracts, performance bonds are mandatory for publicly funded projects under municipal procurement regulations and the Alaska Little Miller Act. Local governments may establish specific bonding criteria, bid requirements, and contractor qualifications. Typically, a city's procurement department is responsible for reviewing and approving performance bonds before finalizing contracts. Contractors should consult the Alaska Department of Business & Professional Regulation (DBPR) or the local procurement office for details on bonding requirements for specific projects.

What government agencies regulate performance bonds for construction projects in Alaska?

Several state and local agencies oversee performance bond regulations in Alaska, including:

- Alaska Department of Business & Professional Regulation (DBPR) – Regulates contractor licensing and bonding mandates.

- Alaska Department of Transportation & Public Facilities (DOT&PF) – Enforces bonding requirements for state-funded projects.

- Alaska Legislature – Establishes statutory requirements through the Little Miller Act.

- Local Municipal and County Procurement Offices – Govern performance bond requirements for city and county contracts. Contractors should verify bonding regulations with the relevant regulatory body based on their project location.

Are subcontractors required to carry performance bonds in Alaska?

The Little Miller Act primarily applies to prime contractors, but certain projects may require subcontractors to obtain performance bonds. Subcontractor bonding requirements depend on:

- Project owner or general contractor stipulations.

- Contractual terms outlined in the agreement.

- State, county, or municipal procurement rules. Prime contractors should review their contractual obligations and consult a surety provider or legal expert to ensure compliance.

Ways that I can verify performance bond's validity for public project?

To verify a performance bond, follow these steps:

- Contact the contracting government agency (state, county, or municipal procurement office) that issued the contract.

- Obtain documentation or confirmation from the surety company that issued the bond.

- Check the Alaska Department of Business & Professional Regulation’s registry for licensed surety providers.

- Confirm that the bond amount and conditions meet the project’s legal requirements.

If further verification is needed, consult an official procurement officer or a licensed attorney specializing in construction law.