You can now apply online for a Connecticut Performance Bond - it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

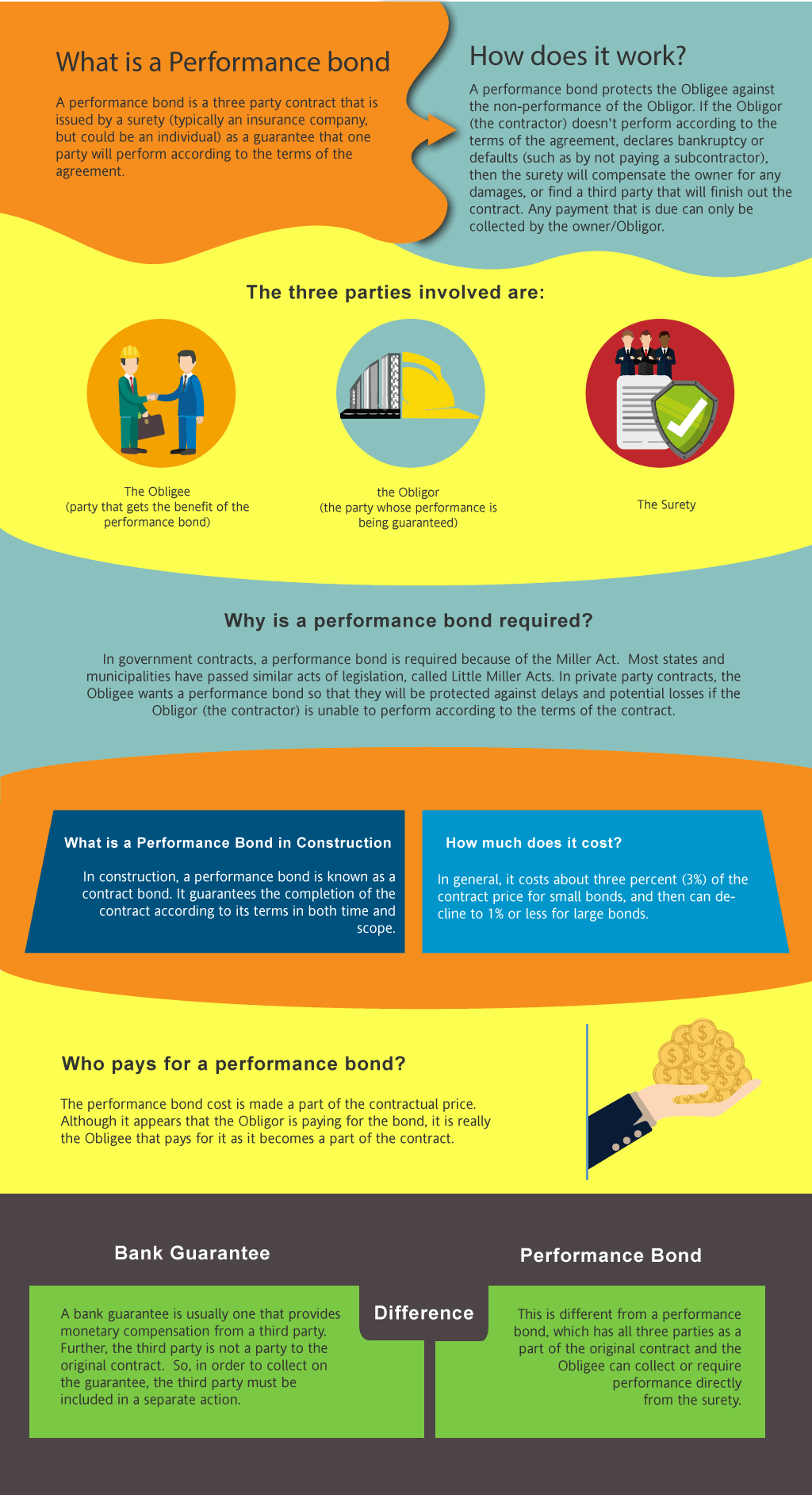

What is a Performance Bond in Connecticut?

How do I get a Performance and Payment Bond in Connecticut?

We make it easy to get a contract performance bond. Just click here to get our Connecticut Performance Application. Fill it out and then email it and the Connecticut contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients performance and payment bonds at the best rates possible.

How does a performance bond work in Connecticut?

The cost of a performance bond can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

How much do bonds cost in CT?

Bond prices fluctuate based on the job size. The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Delaware. Please call us today at (913) 562-6992. We'll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond? A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It's the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

How to Get a Performance Bond in CT

Just call us. We’ll work with you to get the best Connecticut bond possible.

We provide performance and payment bonds in each of the following counties:

Fairfield

Hartford

Litchfield

Middlesex

New Haven

New London

Tolland

Windham

And Cities:

Hartford

New Haven

Stamford

Bridgeport

Greenwich

Norwalk

Danbury

Waterbury

Fairfield

Milford

Westport

See our Delaware performance bond page here.

Understanding Performance Bonds: Expert Insights and Connecticut's Perspective

Performance Bonds vs. Bank Letters of Credit: Key Differences and Benefits Explained

From our perspective, the key difference between performance bonds and bank letters of credit lies in their purpose and function. A performance bond guarantees that a contractor will complete a project as per the agreed terms, while a bank letter of credit is a financial document that ensures payment to a beneficiary. We’ve noticed that performance bonds provide more security to project owners, as they ensure the completion of the project, whereas letters of credit are primarily concerned with financial compensation. In our experience, many project owners prefer performance bonds due to the comprehensive protection they offer against contractor default.

Are Performance Bonds Refundable? Industry Practices and What You Need to Know

In our opinion, performance bonds are typically non-refundable. What we’ve discovered is that once the bond premium is paid, it is considered earned by the surety, regardless of whether the project is completed without any claims. We’ve found that this is because the surety takes on the risk of the contractor defaulting from the moment the bond is issued. In our observation, the non-refundable nature of these bonds is a standard practice across the industry, reflecting the surety’s commitment and the risk undertaken.

What Happens When a Performance Bond Claim is Filed? Process and Implications

We’ve learned that when a claim is filed on a performance bond, it triggers a process that can significantly impact both the contractor and the project owner. Our experience tells us that the surety will first investigate the claim to determine its validity. If the claim is found to be valid, the surety may step in to either complete the project or compensate the project owner for the costs of hiring a new contractor. In our view, the filing of a claim can lead to delays and additional costs, which is why it’s crucial for contractors to fulfill their obligations to avoid such scenarios.

Ensure project success with our reliable contract performance bonds today!

When Are Performance Bonds Released? Key Timelines and Best Practices

We’ve come to understand that performance bonds are released once the project is completed to the satisfaction of the project owner and any contractual obligations are fulfilled. From what we’ve seen, this usually happens after the final inspection and approval of the completed work. We’ve had firsthand experience with projects where the bond was only released after the project owner confirmed that all work was done according to the contract terms. In our practice, ensuring clear communication between all parties involved can help expedite the release of the bond.

Releasing Performance Bonds in Connecticut: A Guide for Contractors and Owners

Understanding 100 Percent Performance and Payment Bonds: Full Coverage for Your Projects

We’ve encountered situations where a 100 percent performance and payment bond was required, meaning the bond covers the full contract amount. We’ve consistently found that these bonds provide maximum protection for project owners by ensuring that both the performance of the work and the payment to subcontractors and suppliers are guaranteed. In our line of work, this type of bond is often mandated for large public projects where the financial stakes are high, and the risk of default needs to be fully mitigated.

How Long Does It Take to Obtain a Performance Bond? Factors and Timelines

Through our own efforts, we’ve determined that the time it takes to obtain a performance bond can vary depending on several factors, including the contractor’s financial standing and the complexity of the project. We’ve been in situations where the process was completed within a few days, especially when the contractor had an established relationship with the surety. However, we’ve also encountered cases where the process took longer due to additional underwriting requirements or financial reviews. Our experience has shown us that starting the bond application process early can help avoid delays in project commencement.

What to Do If a Performance Bond Expires: Strategies for Continuous Coverage

We’ve personally witnessed instances where a performance bond expired before the completion of a project, leading to complications. We’ve realized that if a bond expires, it can leave the project owner unprotected, which might necessitate securing a new bond or extending the existing one. In our dealings with expired bonds, we’ve consistently observed that communication with the surety and proactive management of the bond’s timeline are crucial to ensure continuous coverage throughout the project’s duration.

Conclusion: Navigating the Complexities of Performance Bonds with Confidence

Drawing from our professional experience, this structured insight into performance bonds provides a comprehensive understanding of their role and the considerations involved in managing them effectively. By recognizing the importance of timely bond release, understanding the full coverage offered by 100 percent performance and payment bonds, and ensuring continuous protection through proactive bond management, contractors and project owners can safeguard their projects and minimize risks. In today’s construction industry, a well-handled performance bond is not just a financial guarantee but a vital tool for project success.

See more at our Maine Performance Bond page.

Learn more on surety bond CT.