You can now apply online for a California Performance Bond – it only takes three (3) minutes! (Yep, we timed it.) Click here:

Or you Can download our Express Performance Bond Application (click to download form)

- Complete the form and email to [email protected]

- Be sure to include the Contract and Notice of Award letter (bid specs from the obligee).

- Send the bid results if you have them

What is a Performance Bond in California?

How do I get a Performance and Payment Bond in California?

We make it easy to get a contract performance bond. Just click here to get our California Performance Application. Fill it out and then email it and the California contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 562-6992. We thoroughly review each and every application for commercial bonds and then submit it to the surety that we believe will provide the best p & p bond for your matter. The surety broker will perform a credit check. We have a high success rate in getting our clients a contract performance bond and payment bonds at the best rates possible.

What is the Cost for a Performance Bond in California?

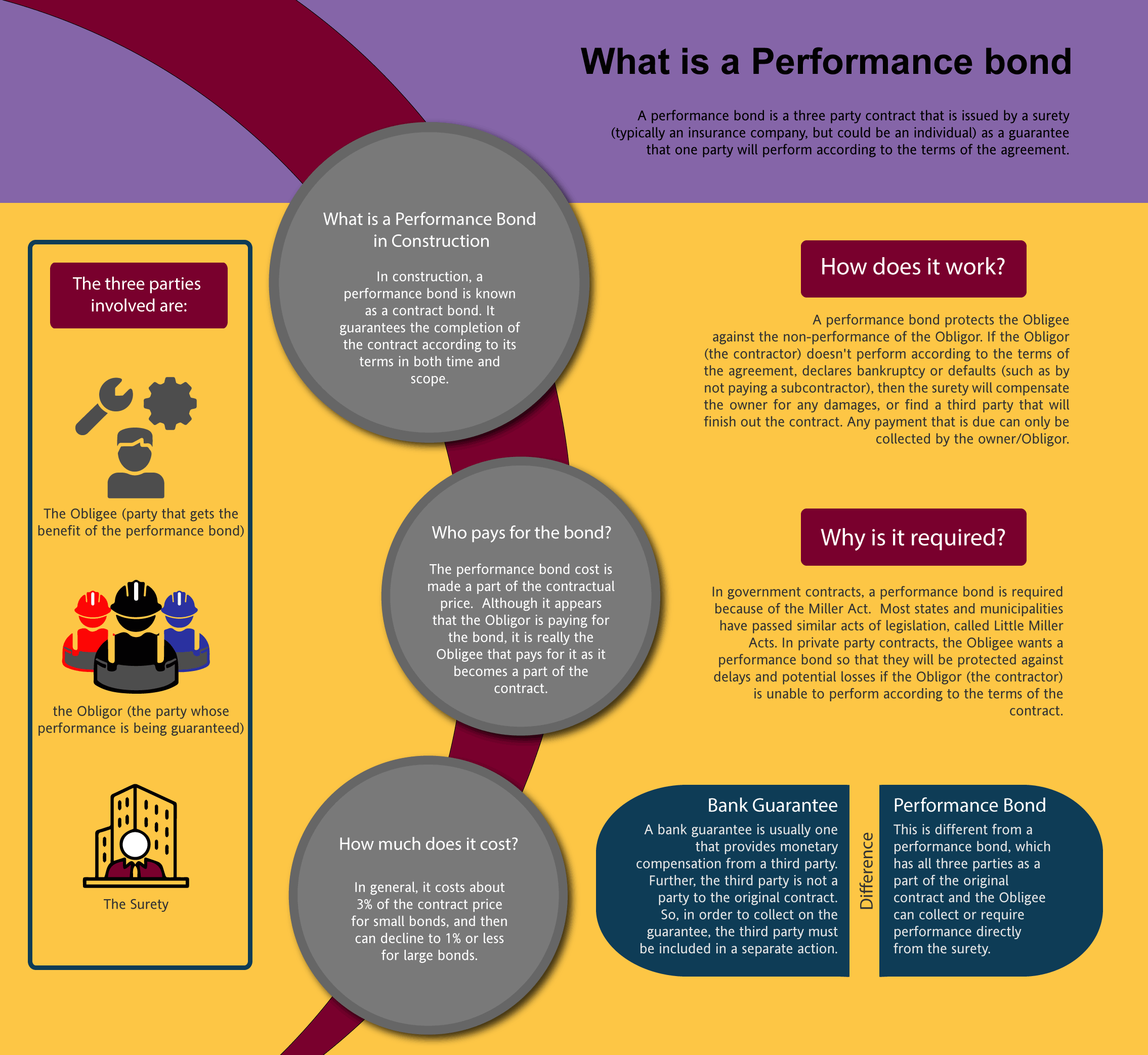

Performance bond rates can vary widely depending on the amount of coverage that is required. It is based on the total amount of the contract. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

Come on, How much do bonds cost in CA?

Bond prices fluctuate based on the job size. Here is how we try and break down the cost. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work really hard to find the lowest premiums possible in the state of California. Please call us today at (913) 562-6992. We’ll find you the very best rate possible for your maintenance bond or completion bond.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

Just fill out our bond application here and email it to [email protected]

Find a Performance Bond near Me

What is a Payment Bond? Is it included with the Performance Bond?

A payment bond is a bond that assures that the subcontractors and material vendors are paid. The payment provides that if the subcontractors are not paid timely and they make a valid claim, then the surety will pay them (and then collect and try from the general contractor).

What is a payment and performance bond? What is a contract bond?

Typically, a payment and performance bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is performance security for the benefit of the owner.

Who Gets the Bond?

The general contractor is the entity that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the performance and payment bond is written by the surety. This is also known as bonding a business.

California Performance Bond Requirements

The requirements for getting a California surety performance bond are not that strict. For bonds under $500,000, all that is usually required is a bond application, plus a copy of the contract. For bonds greater than $500,000, the information required progresses: from financial statement information, to personal financial statement, to work-in-progress reports, etc.

California Construction Performance Bond

California Construction Performance Bond

Construction Performance Bonds are another name for P&P bonds. It’s the same thing, except that construction is the specified industry for the bond. There really isn’t anything extra special about these bonds, other than the name.

How to Get a Performance Bond in California

Just call us. We’ll work with you to get the best California bond possible.

We provide performance and payment bonds in each of the following counties:

Alameda

Alpine

Amador

Butte

Calaveras

Colusa

Contra Costa

Del Norte

El Dorado

Fresno

Glenn

Humboldt

Imperial

Inyo

Kern

Kings

Lake

Lassen

Los Angeles

Madera

Marin

Mariposa

Mendocino

Merced

Modoc

Mono

Monterey

Napa

Nevada

Orange

Placer

Plumas

Riverside

Sacramento

San Benito

San Bernardino

San Diego

San Francisco

San Joaquin

San Luis Obispo

San Mateo

Santa Barbara

Santa Clara

Santa Cruz

Shasta

Sierra

Siskiyou

Solano

Sonoma

Stanislaus

Sutter

Tehama

Trinity

Tulare

Tuolumne

Ventura

Yolo

Yuba

And Cities:

Los Angeles

San Francisco

San Diego

Sacramento

San Jose

Santa Barbara

Oakland

Beverly Hills

Santa Monica

Palm Springs

Long Beach

Santa Cruz

Malibu

Anaheim

See our Colorado Performance Bond page here and our Alabama Performance Bond page.

Understanding Performance Bonds in Construction: Key Insights

Understanding the Key Distinctions: Performance Bonds vs. Bank Letters of Credit

Understanding the Key Distinctions: Performance Bonds vs. Bank Letters of Credit

From our perspective, one of the most important distinctions in performance bond construction is between performance bonds and bank letters of credit. While both serve as financial assurances, they operate quite differently. Performance bonds, issued by a surety company, guarantee that a contractor will complete a project according to the agreed-upon terms. In contrast, a bank letter of credit is a direct payment method where the bank agrees to cover any financial defaults. We’ve often noticed that performance bonds are more favorable in construction projects because they offer a more structured and legally binding assurance of project completion, rather than just providing funds in case of default.

The Refundability Question: Are Performance Bonds Ever Refundable?

In our observation, many contractors and project owners wonder if performance bonds are refundable. We’ve consistently found that once a performance bond is issued, it typically isn’t refundable. The premium paid to the surety company is the cost for assuming the risk, and this fee is generally non-refundable, even if the project is completed without any claims. We’ve found through experience that understanding this aspect early in the process helps in better financial planning and avoids unexpected costs down the line.

Navigating the Claims Process: What Happens When a Performance Bond is Called Upon?

Navigating the Claims Process: What Happens When a Performance Bond is Called Upon?

We’ve encountered situations where a claim is filed on a performance bond, and it’s important to know what happens next. When a claim is made, the surety company first investigates the validity of the claim. If the claim is justified, the surety will either arrange for the completion of the project or compensate the project owner for the losses incurred. We’ve seen firsthand that this process can be complex and time-consuming, which is why it’s crucial to work with a reliable surety company to navigate these challenges.

The Timing of Release: When and How Are Performance Bonds Released?

We’ve gained insight into the process of releasing performance bonds and learned that it occurs once the project is completed to the satisfaction of the project owner and all contractual obligations have been met. In our experience, this release is not automatic; the contractor must formally request the release, often accompanied by a certificate of completion or similar documentation. We’ve consistently observed that delays in providing necessary documents can prolong the release process, so timely and thorough communication is essential.

The Assurance of Full Coverage: What is a 100% Performance and Payment Bond?

In our professional life, we’ve come across the term “100 percent performance and payment bond” often in construction projects. This type of bond covers the full contract value, ensuring that both the performance and payment obligations of the contractor are fully secured. We’ve realized through our work that this bond is particularly beneficial for project owners who want maximum assurance that the project will be completed as agreed and that all subcontractors and suppliers will be paid.

Speeding Up the Process: How Long Does It Take to Secure a Performance Bond?

We’ve been involved in securing performance bonds for various projects, and the time it takes to obtain one can vary. From what we’ve seen, the process can range from a few days to several weeks, depending on the complexity of the project and the contractor’s financial standing. We’ve found that starting the bonding process early and providing all required documentation promptly can significantly expedite the process, ensuring that project timelines are not adversely affected.

Avoiding Expiration Pitfalls: What Happens if a Performance Bond Expires?

Avoiding Expiration Pitfalls: What Happens if a Performance Bond Expires?

We’ve observed over time that performance bond expiration can be a critical issue in construction projects. If a performance bond expires before the project is completed, the contractor may be in breach of contract, potentially leading to legal and financial repercussions. We’ve come to the conclusion that it’s crucial for contractors to keep track of bond expiration dates and ensure that extensions are secured if needed, to maintain continuous coverage until the project is fully completed and accepted by the project owner.

These insights into performance bonds highlight the importance of understanding their role and function in the construction industry. From ensuring project completion to managing potential claims, performance bonds are an essential component of risk management for both contractors and project owners.

.

See more at our Nebraska Performance Bond page.

Learn more on bond California.

Under California’s Little Miller Act. What are the performance bond requirements?

Under California’s Little Miller Act (California Public Contract Code § 10221 et seq.), contractors awarded public construction projects valued at $25,000 or more must furnish a performance bond. This bond guarantees the contractor will complete the project according to the contract terms and legal requirements. The performance bond must be 100% of the total contract amount and issued by a California-licensed surety company. Contractors must provide the bond before work begins and submit it to the relevant government contracting authority for approval.

How does California’s procurement process handle performance bonds for city contracts?

For city contracts, performance bond requirements are governed by local procurement ordinances and the California Little Miller Act. Each city may have distinct rules regarding bonding, bidding processes, and contractor qualifications. Generally, the city’s procurement department ensures performance bond compliance before awarding contracts. Contractors should consult the California Department of Business & Professional Regulation (DBPR) or their local city procurement office for specific project guidelines.

What government agencies regulate performance bonds for construction projects in California?

Several state and local government agencies oversee performance bond regulations in California, including:

- California Department of Business & Professional Regulation (DBPR) – Manages contractor licensing and bonding requirements.

- California Department of General Services (DGS) – Regulates state procurement contracts.

- California Legislature – Establishes bonding laws under the California Public Contract Code.

- County and Municipal Procurement Offices – Administer performance bond requirements for local projects. Contractors should verify project-specific requirements with the appropriate government agency.

In the state of California is it required to have performance bonds for subcontractors?

California’s Little Miller Act primarily applies to prime contractors on public projects. However, project owners or general contractors may require subcontractors to obtain performance bonds based on:

- Project scope and funding requirements

- Contractual agreements

- Local, state, or federal procurement regulations General contractors should review contract terms and consult a surety provider or legal expert to ensure compliance.

In what way I can verify a performance bond is validity for a public projects?

To verify a performance bond, follow these steps:

- Contact the contracting government agency (state, county, or city procurement office) overseeing the project.

- Request verification directly from the surety company that issued the bond.

- Check the California Department of Business & Professional Regulation’s database for licensed surety providers.

- Ensure the bond amount and terms align with project requirements.

For additional verification, consult an official procurement officer or a licensed attorney specializing in California construction law.