What is a Transportation Bond?

These bonds, also known as transport bonds, provide assurance for payment regarding shipments of goods within any of the United States. These bonds make sure that carriers can get paid, which helps facilitate the flow of commerce.

Types of Transportation Bonds

Transportation bonds can be classified into several types, each with its own unique characteristics and uses. The main types of transportation bonds include:

- General Obligation (GO) Bonds: Backed by the full faith and credit of the issuing municipality, these bonds are used to finance a wide range of transportation projects, such as highway construction, bridge repair, and public transit system development. GO bonds are typically considered low-risk investments due to the strong backing of the issuing entity.

- Revenue Bonds: Supported by a specific revenue source, such as income from a toll road or sewer system, revenue bonds are used to finance projects that generate revenue. These bonds are attractive to investors because they are tied to a dedicated revenue stream, which can provide a steady return on investment.

- Transportation and Export (T&E) Bonds: These bonds are used for goods entering the US only to be exported to another country and do not enter US commerce. T&E bonds ensure that the bonded carrier complies with all customs regulations and pays any required duties and taxes.

- Immediate Transport (IT) Bonds: Allowing goods to move from one port of entry to another without paying duties and taxes initially, IT bonds facilitate the efficient movement of goods within the US. This type of bond is particularly useful for bonded carriers who need to transport goods across multiple states.

- Immediate Exportation (IE) Bonds: Used for goods that need to be exported from the same port they arrived at, IE bonds help streamline the export process and ensure compliance with customs regulations. These bonds are essential for bonded carriers involved in international trade.

Benefits of Transportation Bonds

Transportation bonds offer several benefits to both issuers and investors. Some of the key benefits include:

- Financing for Transportation Projects: Transportation bonds provide a crucial source of funding for transportation projects, helping to improve infrastructure and promote economic growth. By issuing these bonds, state and local governments can finance the construction and maintenance of roads, bridges, and public transit systems.

- Tax-Exempt Status: Many transportation bonds offer tax-exempt status, which can help reduce the cost of borrowing for issuers and provide a tax-free investment opportunity for investors. This tax-exempt status makes transportation bonds an attractive option for both parties, as it can lead to significant savings.

- Low Risk: Generally considered low-risk investments, transportation bonds are backed by the full faith and credit of the issuing municipality or a specific revenue source. This strong backing provides investors with a sense of security, knowing that their investment is protected.

- Liquidity: Transportation bonds can provide liquidity for issuers, as they can be used to finance projects that generate revenue. This liquidity is essential for state and local governments, allowing them to fund critical infrastructure projects without depleting their reserves.

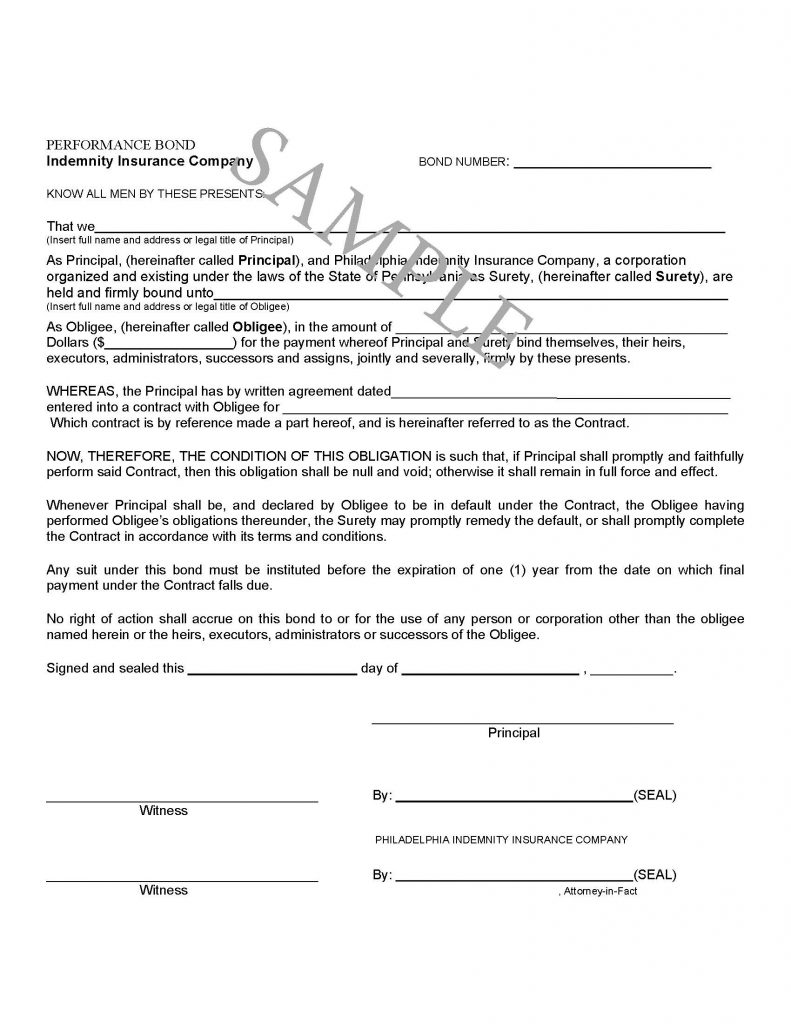

Working with a Surety Company

Working with a surety company is an essential step in obtaining a transportation bond. Surety companies act as guarantors, ensuring that the bonded carrier will comply with all customs regulations and pay any required duties and taxes. When working with a surety company, it is important to:

- Research and Compare Different Surety Companies: It is essential to research and compare different surety companies to find one that meets your needs and provides the best rates. Look for companies with a strong reputation and experience in the transportation sector.

- Understand the Bond Conditions: It is crucial to understand the bond conditions and requirements, including the premium rate, bond amount, and any additional fees. Make sure you are fully aware of the terms before committing to a surety company.

- Provide Accurate Information: To avoid delays or rejections, it is essential to provide accurate and comprehensive information to the surety company. This includes details about the bonded carrier, the type of bond needed, and the specific transportation routes involved.

- Maintain Accurate Records: Keeping accurate records of all bonded shipments is vital. This includes documentation of transportation routes, bonded warehouse details, and customs documentation. Proper record-keeping ensures compliance with regulations and can help resolve any issues that may arise.

Bond Issuance and Limitations

Bond issuance and limitations are critical factors to consider when obtaining a transportation bond. Some key considerations include:

- Bond Issuance: Transportation bonds can be issued by local, regional, state, and federal government agencies, as well as private companies. Understanding the issuer’s background and credibility is essential for making informed investment decisions.

- Bond Limitations: There are limitations on the amount of bonds that can be issued, and these limitations can vary depending on the issuer and the type of bond. It is important to be aware of these limitations to ensure compliance with regulations and avoid potential legal issues.

- Credit Ratings: Credit ratings can affect the interest rate and terms of the bond. It is essential to understand the credit rating of the issuer, as higher-rated bonds typically offer lower interest rates and more favorable terms. This information can help investors assess the risk associated with the bond.

- Tax-Exempt Status: Many transportation bonds offer tax-exempt status, but it is essential to understand the tax implications of the bond and any potential risks. Investors should consult with financial advisors to determine the best investment strategy based on their individual tax situation.

By considering these factors, both issuers and investors can make informed decisions about transportation bonds, ensuring they meet their financial goals and contribute to the improvement of transportation infrastructure.