Click on the bond below to be taken to our super quick application for your specific TABC bond:

| TABC Conduct Surety Bond-Package Store Permit (P) | TABC Conduct Surety Bond-Private Club Exemption Certificate Permit (NE) | TABC Conduct Surety Bond-Private Club for Beer and Wine Permit (NB) |

| TABC Conduct Surety Bond-Private Club Registration Permit (N) | TABC Conduct Surety Bond-Wine Only Package Store Permit (Q) | TABC Performance-Beer Retailer's on Premise License (BE) ($2,000) Bond |

| TABC Performance-Wine and Beer Retailer's Permit (BG) ($4,000) Bond | TABC Performance-Wine and Beer Retailer's Permit (BG) ($6,000) Bond | TABC Conduct Surety Bond-Mixed Beverage Permit (MB) Now |

| TABC Conduct Surety Bond-Retail Dealer’s On Premise License (BE) | TABC Conduct Surety Bond-Wine & Beer Retailer’s Off Premise Permit (BQ) | TABC Conduct Surety Bond-Wine and Beer Retailer’s Permit (BG) |

A Texas Alcoholic Beverage Commission (TABC) bond is a requirement for businesses involved in the sale, manufacture, or distribution of alcoholic beverages in Texas. This surety bond ensures compliance with state laws and protects both the state and consumers from potential financial losses due to non-compliance. In this article, we’ll cover the different types of TABC bonds, their requirements, costs, and the steps required to obtain one.

Key Takeaways

- A Texas Alcoholic Beverage Commission (TABC) bond is essential for businesses in the alcohol industry, guaranteeing compliance with state laws and protecting both the state and consumers.

- Different types of TABC bonds exist, including the Conduct Surety Bond for retailers and the Nonresident Brewer’s Permit Fee Interest Bond, each with specific requirements based on location and business operations.

- Obtaining and managing TABC bonds involves a structured process, including an application, agent consultation, and regular renewals; proper management of bond costs is crucial for maintaining compliance and business operations.

Overview of TABC Bonds

In the world of Texas’s alcohol industry, the TABC bond plays a pivotal role. Essentially, a TABC bond is a surety bond mandated for businesses involved in the sale, manufacture, or distribution of alcoholic beverages. This requirement ensures that these businesses adhere to the state laws and regulations governing the alcoholic beverage industry.

The primary purpose of a TABC bond is to guarantee compliance with state laws and regulations. This means that by obtaining a bond, a business commits to operating within the legal framework established by the Texas Alcoholic Beverage Commission (TABC). It acts as a safeguard, ensuring that businesses do not engage in unlawful activities that could harm the public or the state.

Moreover, a TABC bond offers protection for both the state and consumers. If a business fails to comply with regulations, the bond covers any resulting financial losses. This dual protection underscores the bond’s importance in maintaining the integrity of the alcohol industry in Texas.

Types of TABC Bonds

While the variety of TABC bonds can seem overwhelming at first, understanding their specific requirements simplifies the process. One of the most common types is the Conduct Surety Bond, required for retailers without a Food and Beverage Certificate. This bond’s amount varies based on the retailer’s proximity to public schools, ensuring that businesses near schools maintain higher financial accountability.

Retailers without a food and beverage certificate must secure a Conduct Surety Bond to serve alcoholic beverages. This bond is crucial for maintaining the necessary license or permit, including a beer retailer’s permit, to operate. For these retailers, the bond amount ranges from $5,000 to $10,000 based on their proximity to public schools, reflecting the state’s regulation efforts near educational institutions.

Another significant type of TABC bond is the Nonresident Brewer’s Permit (BN) Fee Interest Bond. This bond ensures that out-of-state brewers comply with Texas regulations and guarantees the payment of taxes and adherence to TABC guidelines. Businesses may also submit bonds through letters of credit or certificates of deposit, offering flexibility in meeting bond requirements.

Requirements for TABC Bonds

To legally operate in the alcohol industry in Texas, businesses must meet specific TABC bond requirements. Posting a bond with the TABC is a prerequisite for obtaining a license, ensuring compliance. Businesses can submit this bond as a surety bond, letter of credit, or a certificate of deposit, providing multiple options to meet this requirement. The TABC Code can be found here. The TABC rules are found in the Texas Administrative Code Title 16, Part 3.

Retailers without a Food and Beverage Certificate must secure a Conduct Surety Bond. The bond amount for these retailers is determined by their proximity to public school. For those located more than 1,000 feet from a school, a $5,000 bond is required, while those within 1,000 feet must post a $10,000 bond. This ensures stricter financial scrutiny for businesses near schools.

Moreover, businesses participating in specific brewing arrangements, such as alternating brewery proprietorships or contract brewing without ownership in brewing facilities, must post a $30,000 Fee Interest Bond. This bond ensures compliance with the TABC regulations and the payment of taxes. In certain Texas counties, retailers without a Food and Beverage Certificate may also need a $2,000 Performance Bond.

TABC bond requirements can change based on updates from the TABC or surety providers. Therefore, staying informed about the latest regulations and maintaining compliance is crucial for any business involved in the Texas alcohol industry.

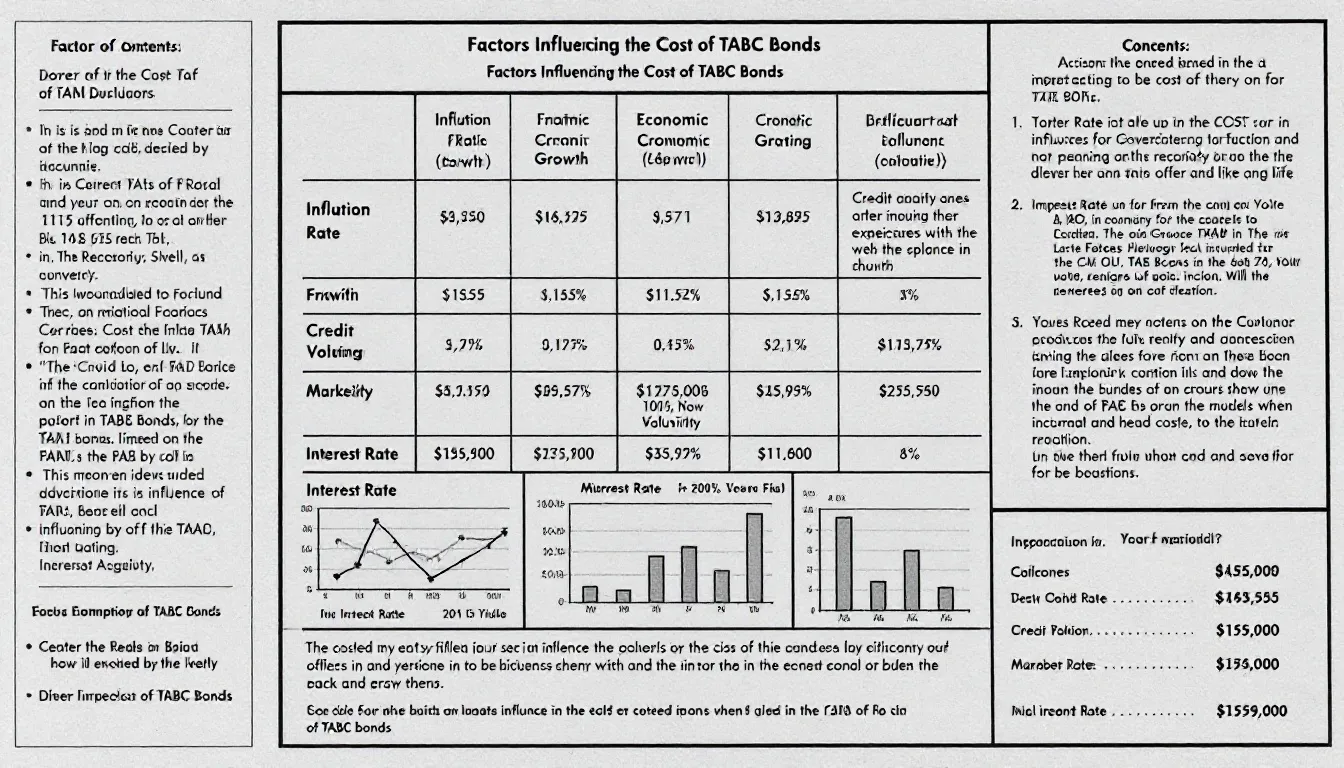

Cost Factors of TABC Bonds

Knowing the cost factors of TABC bonds is crucial for effective financial planning. The type of bond required, such as a Mixed Beverage Bond or a Wine Retailer’s Permit Bond, significantly influences the overall cost. Each bond type comes with a specified amount set by the Texas Alcoholic Beverage Commission, which directly impacts the premium costs.

The location of the business also plays a crucial role in determining bond costs. Different areas may have varying bond requirements, affecting the overall cost. A history of alcohol-related violations can increase bonding costs due to the perceived higher risk. Consequently, maintaining a clean compliance record is beneficial in managing costs.

Personal credit scores and the financial stability of the business owner are also critical factors. A higher credit score often results in lower bond premiums, while financially stable businesses are considered lower risk and thus face reduced rates. Understanding these various factors helps in planning and managing the costs associated with obtaining TABC bonds.

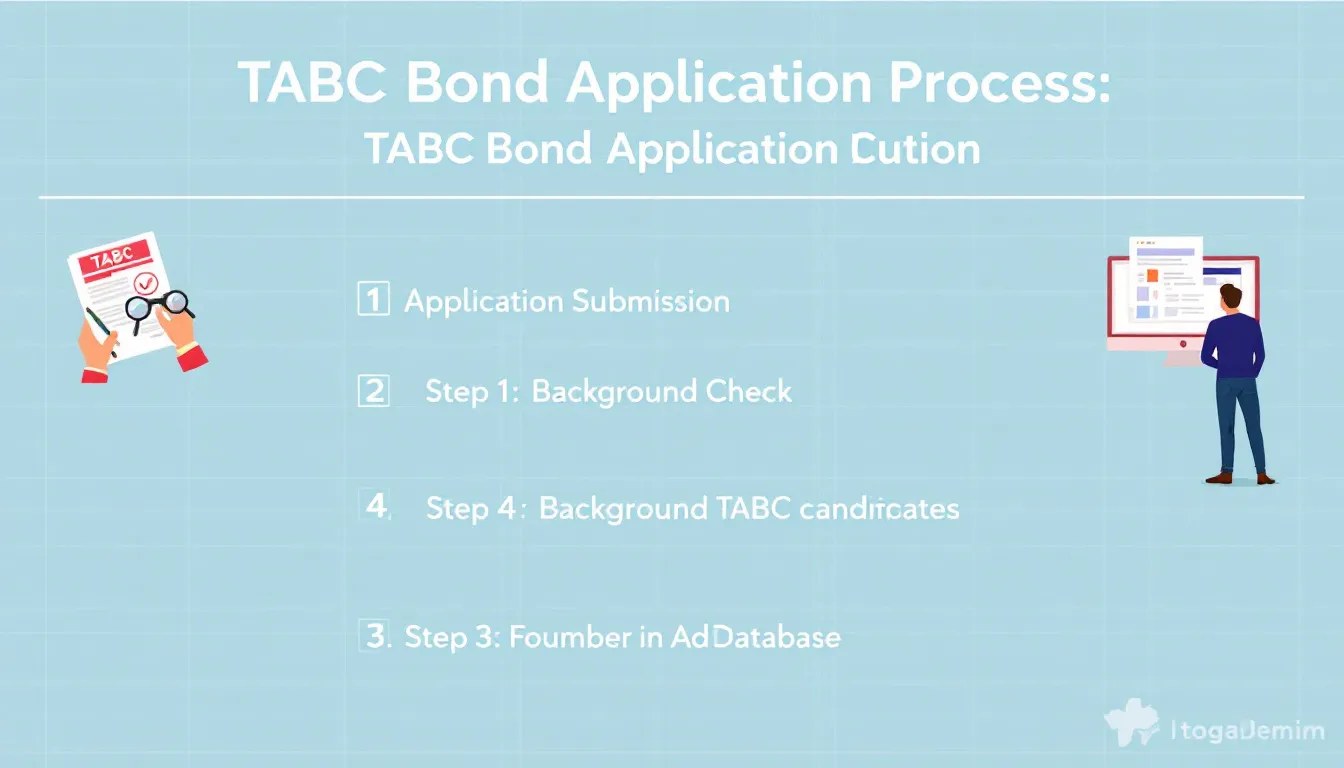

Steps to Obtain a TABC Bond

Obtaining a TABC bond involves several steps, starting with the application process. Businesses can begin by applying through Viking Bond Service’s online application, which simplifies the initial step. This convenient approach allows for a streamlined process, ensuring that businesses can swiftly initiate their bond application.

Next, it’s crucial to contact an agent to discuss the specific bond request. The agent can provide valuable insights and guidance, helping to navigate the complexities of the TABC bond requirements. Completing the application accurately and gathering the required documentation is essential to avoid any delays in the approval process.

In some cases, consulting the agent about whether a financial statement will assist in obtaining a better bond quote can be beneficial. This additional step can provide a clearer picture of the business’s financial health, potentially leading to more favorable bond terms.

Following these steps helps businesses efficiently obtain the necessary TABC bond and comply with state regulations.

Renewal and Validity of TABC Bonds

A Conduct Surety Bond is typically valid for 12 months, after which it needs to be renewed. The renewal process involves another credit check to reassess the business’s financial standing and compliance history. This periodic review ensures that the business continues to meet the necessary criteria for holding the bond.

Not renewing a Conduct Surety Bond can jeopardize a business’s ability to sell alcohol. Without a valid bond, the business risks losing its license or permit, leading to significant operational disruptions. Timely renewal is crucial for uninterrupted business operations.

TABC provides notifications to businesses if their surety company intends to cancel their bond, allowing them to take preventive action. These notifications help businesses promptly address potential issues and remain compliant with TABC regulations. By staying proactive about renewals and addressing any concerns immediately, businesses can maintain their licenses and continue operating smoothly.

Managing TABC Bond Costs

Managing TABC bond costs effectively is crucial to avoid jeopardizing the business. Using Viking Bond Service for TABC bonds can save time and reduce the hassle of shopping around. This service streamlines the process, making it easier to find the best bond options at competitive rates.

The Alcohol Industry Management System (AIMS) is a valuable tool for managing bond submissions. Using AIMS, businesses can streamline the submission process and potentially reduce associated costs.

Timely payment of claims is crucial for protecting the bondholder’s reputation and compliance standing. Effective cost management helps businesses maintain financial stability and comply with TABC regulations.

Handling Claims Against TABC Bonds

Handling claims against TABC bonds requires understanding the process clearly. Claimants need to present documentation supporting their case, such as evidence of the alleged violation. This documentation is essential for validating the claim and ensuring a transparent and fair process.

Once validated, the surety covers losses up to the bond amount. This protection ensures that any financial damages resulting from non-compliance are addressed, safeguarding the interests of the state and consumers. However, if a valid claim is settled under a Conduct Surety Bond, the principal is responsible for repaying the amount paid plus any interest and fees to the surety.

In cases where claims exceed the bond’s limit, the principal is responsible for any excess amounts and additional costs. This underscores the importance of maintaining compliance and addressing issues promptly to avoid costly claims. By understanding the claims process, businesses can better manage their obligations and protect their financial interests.

Summary

TABC bonds are an essential component of the regulatory framework governing the alcohol industry in Texas. These bonds ensure that businesses comply with state laws, protecting both the state and consumers from potential violations and financial losses. By understanding the different types of TABC bonds, the requirements for obtaining them, and the factors influencing their costs, businesses can navigate the regulatory landscape more effectively.

Maintaining compliance through timely renewals and effective cost management is crucial for the continued success of any alcohol-related business in Texas. By following the steps outlined in this guide and staying informed about the latest regulations, businesses can ensure that they remain in good standing with the Texas Alcoholic Beverage Commission. Remember, a proactive approach to managing TABC bonds not only safeguards your business but also contributes to a responsible and thriving alcohol industry.

Frequently Asked Questions

What is a TABC bond?

A TABC bond ensures that businesses selling, manufacturing, or distributing alcoholic beverages in Texas adhere to state laws, protecting both the state and consumers from potential financial losses due to violations.

What types of TABC bonds are there?

The types of TABC bonds include the Conduct Surety Bond for retailers without a Food and Beverage Certificate and the Nonresident Brewer's Permit Bond for out-of-state brewers, with specific requirements and bond amounts varying by bond type and business activities.

How is the cost of a TABC bond determined?

The cost of a TABC bond is determined by factors such as the type and amount of the bond required, the business's location, its history of alcohol-related violations, and the owner's credit score and financial stability. These elements collectively influence the overall pricing of the bond.

What happens if a TABC bond is not renewed on time?

Not renewing a TABC bond on time can result in losing your alcohol sales license, severely disrupting your business operations. It's essential to prioritize timely renewal to avoid these consequences.

How are claims against TABC bonds handled?

Claims against TABC bonds are handled by providing documentation that supports the violation. Once validated, the surety covers losses up to the bond amount, while the principal must repay the surety for any amounts paid, including interest and fees, especially if claims exceed the bond's limit.