What is an Employment Bond?

An employment bond is a type of surety bond that employers can use to protect themselves against potential losses caused by employee dishonesty or misconduct. These bonds are particularly useful for businesses that handle large sums of money or valuable assets, as they provide a financial safety net in case of theft, fraud, or other unethical behavior by employees. By securing an employment bond, employers can safeguard their assets and maintain trust within their organization. Employment bonds help protect a company's assets from financial losses due to employee misconduct, such as embezzlement.

Benefits of Employment Bonds

- Increased Trust: Employment bonds help build trust between employers and employees by providing a financial guarantee against potential losses.

- Access to the Federal Bonding Program: The Federal Bonding Program ensures that wages for bonded employees have federal taxes automatically deducted, emphasizing the program's legitimacy.

- Enhanced Security: These bonds offer an additional layer of security for businesses, making it easier to hire individuals who may have a history of criminal activity or other risk factors.

- Financial Protection: Employment bonds provide financial protection for businesses, helping to cover losses that may occur due to employee dishonesty or misconduct.

- Improved Employee Morale: Knowing that their employer has taken steps to protect the company's assets can improve overall employee morale and create a more positive work environment.

What is an Employment Bond?

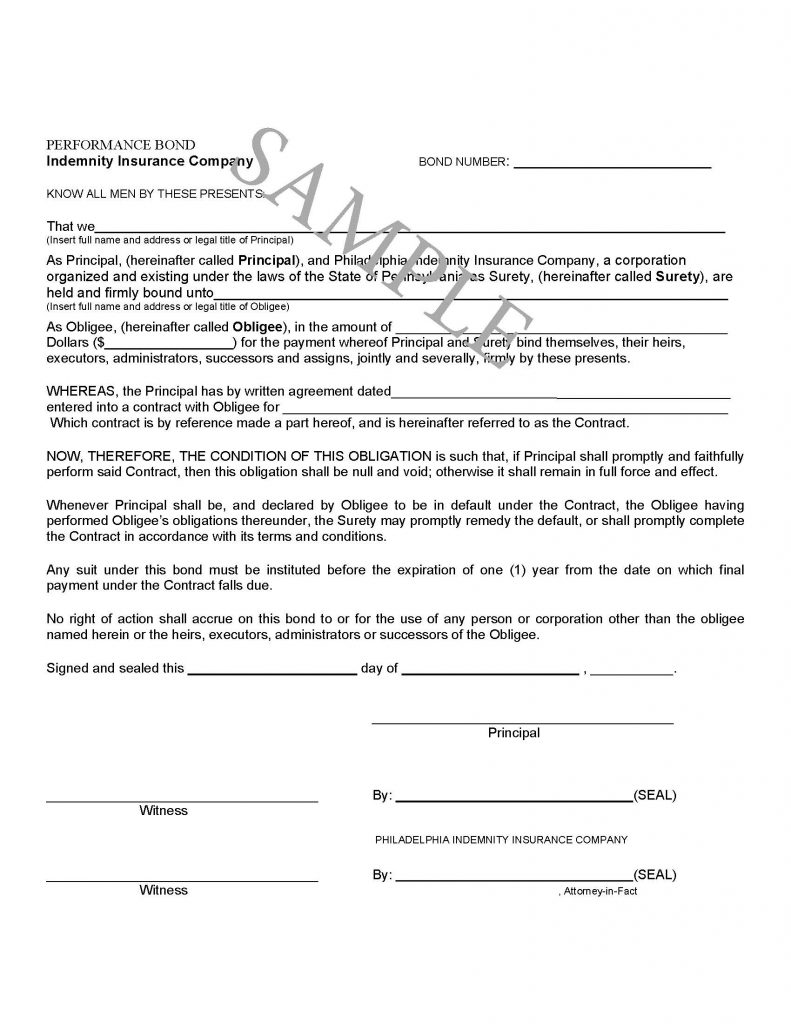

An employment bond is a type of fidelity bond that provides insurance against fraudulent or dishonest acts by specific individuals. It is a contractual agreement between three parties: the principal (the employee), the obligee (the employer), and the surety (the insurance company). This bond offers protection against employee dishonesty, theft, or other malicious acts that can result in financial loss or property damage to the employer. By securing an employment bond, employers can safeguard their assets and maintain trust within their organization.

Types of Employment Bonds

There are various types of employment bonds, each designed to address specific needs and risks. Some common types of employment bonds include:

- Fidelity Bonds: These bonds protect employers against losses due to employee dishonesty, such as theft or embezzlement. They are essential for positions where employees handle cash or sensitive information.

- Blanket Bonds: These bonds cover all employees of a company, providing a blanket of protection against employee dishonesty. This type of bond is ideal for businesses with a large workforce, ensuring comprehensive coverage without the need to name each employee individually.

- Named Individual Bonds: These bonds cover specific employees, typically those in positions of trust or with direct access to company assets. For example, a company might obtain a named individual bond for a financial officer who manages significant funds.

- Employee Commitment Bonds: These bonds require an employee to remain with a company for a specified period, providing a level of assurance for the employer’s investment in training and development. This type of bond helps reduce turnover and ensures that the company benefits from its investment in employee growth.

Benefits of Employment Bonds

Employment bonds offer numerous benefits to employers, including:

- Protection Against Employee Dishonesty and Theft: Employment bonds provide a financial safety net against losses caused by dishonest acts, such as employee theft or embezzlement.

- Reduced Risk of Financial Loss and Property Damage: By mitigating the risk of fraudulent activities, employment bonds help protect a company’s assets and reduce potential property loss.

- Increased Confidence in Hiring and Promoting Employees: Knowing that there is a safety measure in place, employers can confidently hire and promote employees, even in positions with significant responsibility.

- Compliance with Regulatory Requirements: Employment bonds can help businesses meet regulatory requirements, ensuring they operate within legal guidelines.

- Enhanced Reputation and Credibility: Having employment bonds in place can enhance a company’s reputation and credibility with customers and partners, demonstrating a commitment to integrity and security.

- Access to the Federal Bonding Program: This program provides support for justice-involved individuals and other challenged job seekers, helping employers hire from a broader talent pool while minimizing risk.

- Attract and Retain Top Talent: Employment bonds can be a competitive advantage in the job market, helping companies attract and retain top talent by offering a secure and trustworthy work environment.

By understanding and utilizing employment bonds, employers can protect their business, comply with regulations, and foster a trustworthy and stable workforce.

Fidelity Bonds for Employment

An employment bond is a type of fiduciary bond. This type of bond is different from the standard contract bond. In a standard contract bond, the bond is written based on the terms of the underlying contract. So, what the surety looks to if there is a dispute is the contract to determine what needs to be done. The contract itself contains all of the terms of the agreement and the surety will perform according to those terms.

In a fiduciary bond context, the bond is based on a particular individual. For an employment bond, the surety is writing the bond based solely on the person being bonded. So, what the surety looks to is the character of the person being bonded. This includes the financial position of the individual, such as their net worth. In addition, a surety may look at other characteristics, such as whether there are negative issues in the persons past, like a bankruptcy, instances of fraud, drug usage or even a gambling addiction. The Federal Bonding Program can help mitigate concerns about hiring at-risk individuals, such as those with past conviction histories.

A good example of an employment bond is a bank teller. The bank wants to make sure that it won’t lose a ton of money by hiring a bank teller that is taking cash. So, they get a surety to write an employment bond. In the old days, the bank would actually have each teller fill out an application and then the surety would underwrite each teller. In modern times, most employment bonds are written based on a class of employees. That is, a bank would just get an employment bond that covered its tellers and then not have to name each one. The Federal Bonding Program applies to employees receiving paid wages with federal taxes deducted from their pay.

Like in all bond underwriting, the surety is wanting to make sure that there will not be a claim made against the surety. Remember, bonds are written on a no assumed losses basis. What that means is that they are not assuming any losses. This is different than , where losses are assumed.