You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

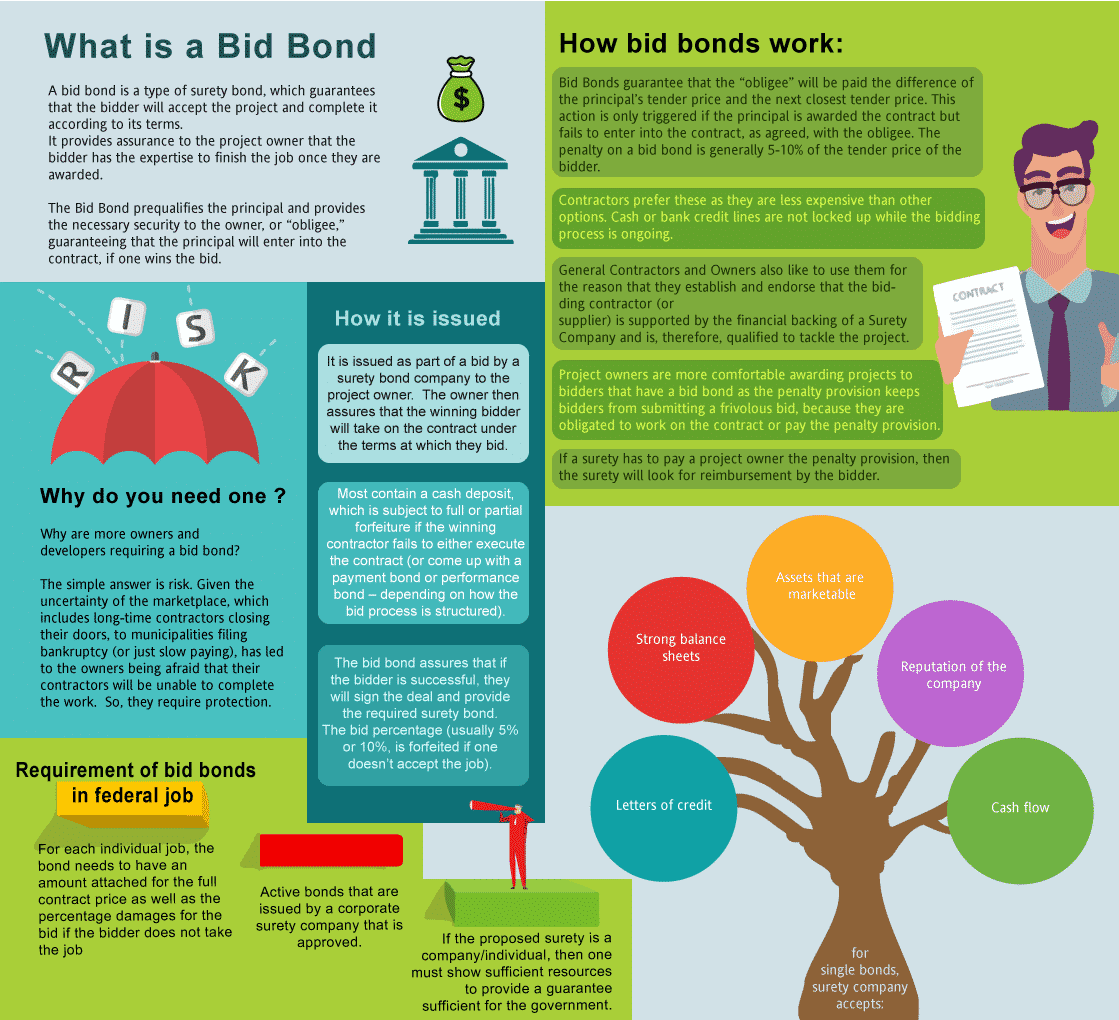

What is a Bid Bond in Wyoming?

A bid bond is one of the types of surety bonds, which guarantees that the bidder will take the job and complete it according to its terms. It provides assurance to the project owner that the bidder has the ability and wherewithal to complete the job once you are selected after the bidding process. The basic reason is that you need one so that you get the contract. But the bigger question is why are more owners/developers requiring a bid bond? The basic answer is risk. Given the uncertainty of the marketplace, which includes long-term contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable complete the work. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Wyoming Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Wyoming?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the P&P bond if you win the contract. The cost of a surety bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond covering the contract.

How much do bonds cost in WY?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Wyoming. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher See our Swiftbonds Performance Bonds page for more.

How do I get a Bid Bond in Wyoming?

We make it easy to get a contract bid bond. Just click here to get our Wyoming Bid Bond Application. Fill it out and then email it and the Wyoming bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for surety bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a very high success rate in getting our clients bid bonds at the best rates possible.

Uncovering Wyoming Bid Bonds: Essential Insights for Contractors

When it comes to construction projects in Wyoming, bid bonds are a critical component of the bidding process. These bonds ensure that contractors submit serious bids and are financially capable of fulfilling their contractual obligations. In our view, bid bonds play an essential role in securing both the project owner and the contractor.

Navigate the World of Wyoming Bid Bonds: What You Must Know

A Wyoming bid bond is a type of surety bond required for contractors bidding on public or private construction projects. From our experience, these bonds serve as a financial guarantee to the project owner, ensuring that the winning contractor will honor their bid and sign the contract. If the contractor backs out or fails to comply with the bid terms, the owner can claim the bond to cover the difference when selecting a new contractor.

Partner with Experts: Find Bid Bonds Near You in Wyoming

We’ve often noticed that finding the right bid bond provider in Wyoming can seem overwhelming, but it doesn’t have to be. Many local surety bond agencies specialize in bid bonds, offering tailored services for contractors. A quick online search or referral from a trusted industry contact can lead you to a nearby provider who understands Wyoming’s specific bonding requirements. Working with a local expert ensures you get accurate advice and a bond that meets your project’s needs.

Unleashing the Power of Wyoming Bid Bonds: Who Benefits?

In Wyoming, bid bonds primarily protect the project owner, ensuring they don’t suffer financially if the winning bidder fails to proceed. In our professional life, we’ve seen that these bonds also benefit contractors, as they demonstrate a contractor’s reliability and commitment to the project. By obtaining a bid bond, contractors signal that they are serious about their bid and financially stable enough to complete the project if selected.

Who Needs Wyoming Bid Bonds? Unlocking the Essentials

We’ve consistently observed that a variety of professionals and entities require bid bonds in Wyoming. These individuals and businesses need them to ensure both compliance with project regulations and protection for the project owners:

- General contractors bidding on public works projects: They need bid bonds as a guarantee to the government or municipal project owners that they are financially stable and committed to executing the project if awarded.

- Subcontractors working on large-scale projects: Often, subcontractors bidding on big projects need bid bonds to prove they can meet their contractual responsibilities and are reliable in completing their portion of the project.

- Construction companies involved in government contracts: These firms need bid bonds to ensure that public funds are protected if they are awarded the contract but fail to start or complete the project.

- Private contractors handling high-value jobs: Even in private-sector projects, bid bonds are often required to mitigate risk and ensure contractor reliability.

- Contractors bidding on state or county construction projects: Public sector jobs at the state and county levels in Wyoming often require bid bonds as a safeguard against unqualified or unreliable contractors.

We provide bid bonds in each of the following counties:

Albany

Big Horn

Campbell

Carbon

Converse

Crook

Fremont

Goshen

Hot Springs

Johnson

Laramie

Lincoln

Natrona

Niobrara

Park

Platte

Sheridan

Sublette

Sweetwater

Teton

Uinta

Washakie

Weston

And Cities:

Cheyenne

Casper

Jackson

Laramie

Gillette

Sheridan

Cody

Rock Springs

Riverton

Lander

See our Alabama Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Streamline Success: Key Considerations for Wyoming Bid Bonds

Before diving into the bidding process, contractors should understand the implications of bid bonds. Through our own efforts, we’ve come to realize that securing a bid bond is not just about meeting project requirements; it’s about positioning yourself as a credible and trustworthy bidder.

Crucial Factors for Wyoming Bid Bonds: Ensure You’re Ready

- Ensure your financials are in order: Surety companies will evaluate your financial history and stability. This includes reviewing your balance sheets, credit reports, and any outstanding debt, which means it’s crucial to keep clean, organized financial records.

- Work with a reputable surety company: We’ve consistently found that working with a trusted surety provider ensures a smoother bonding process and helps in getting bonds approved, even for larger projects. Choose companies with experience in your region.

- Maintain a strong credit history: Sureties use your credit score as a key metric. From what we’ve seen, a strong credit history boosts your chances of approval and may even lower the cost of your bond.

- Understand the bid requirements for your project: Each project might have specific bond requirements, so make sure you understand the percentage or amount of the bid bond required to avoid under or over-bonding, which could hurt your chances of winning the bid.

- Have relevant project experience: Our experience tells us that contractors with a proven track record of handling similar projects are more likely to be approved for bid bonds. Having substantial experience in the specific type of project you’re bidding on makes a huge difference.

Unbox the Mystery of Surety Bid Bonds in Wyoming

A surety bid bond involves three parties: the contractor (the principal), the project owner (the obligee), and the surety company. In our dealings with bid bonds, we’ve learned that the surety company guarantees that the contractor will follow through with the bid if awarded the contract. The surety bond provides peace of mind to the project owner, as they can make a claim if the contractor fails to meet their obligations.

How Surety Bid Bonds Work: Unlock the Process

We’ve gained from our experience that the process of obtaining a bid bond is straightforward. Once a contractor decides to bid on a project, they apply for a bid bond from a surety company. The surety evaluates the contractor’s financial health, project history, and ability to complete the work. If approved, the surety issues the bond, guaranteeing the contractor’s bid to the project owner.

Elevate Your Chances: How to Apply for a Surety Bid Bond in Wyoming

The application process for a bid bond in Wyoming can be seamless when you are prepared. We’ve found it useful to gather essential documents, including financial statements, project details, and personal information upfront. The surety company will assess your financial stability and capacity to handle the project’s demands. Working with an experienced surety agent can streamline this process, ensuring a quick approval time.

Step-by-Step Guide: Unlocking the Application Process for a Bid Bond

- Prepare Financial Documentation: We’ve personally learned that surety companies need your financial statements to assess risk. Make sure your profit and loss statements, balance sheets, and tax returns are ready for review.

- Choose a Surety Agent: Selecting the right surety provider with experience in Wyoming is crucial. We’ve worked closely with sureties who specialize in regional bonding requirements, ensuring a smoother process.

- Complete the Application: Fill out the bid bond application accurately, detailing your company’s experience, project specifics, and financial information. The more thorough you are, the faster the application will process.

- Undergo the Surety’s Evaluation: The surety will assess your company's ability to complete the project based on your financials and track record. In our experience, being transparent helps ensure approval.

- Receive Your Bond: Upon approval, the bond is issued, and you can submit it with your bid proposal. We’ve found that having this ready on time strengthens your bid.

What’s the Cost? Key Considerations for Wyoming Bid Bond Pricing

We’ve observed over time that the cost of a bid bond typically ranges from 1% to 5% of the project’s total bid amount. Wyoming contractors should note that larger projects with higher bid amounts usually have lower percentage rates. Surety companies determine the cost based on factors like the contractor’s financial standing, credit score, and project scope. It’s essential to budget for the bond when preparing your bid proposal.

Unlock Potential Denials: Can You Be Denied a Bid Bond?

We’ve been in situations where contractors were denied bid bonds due to poor credit or insufficient financial documentation. Surety companies will closely examine your financial stability, experience, and ability to manage the project. From what we’ve seen, contractors with strong financials and a proven track record of successful projects rarely face rejection. However, if you are denied, working on your credit and gaining more project experience can improve future approval chances.

Reasons for Denial: Why You Might Not Qualify for a Bid Bond

- Poor credit history: We’ve personally witnessed that contractors with low credit scores are often denied because they’re viewed as high risk. Surety companies want to ensure contractors can meet their financial obligations.

- Lack of sufficient financial resources: Contractors without enough cash flow or assets may not be approved for bonds, as sureties want assurance that the contractor can handle project costs.

- Limited project experience: Contractors bidding on projects beyond their typical scope or scale might be denied because they lack the relevant experience to complete the job successfully.

- Incomplete or inaccurate financial documentation: We’ve come across cases where contractors were denied due to errors in their financial paperwork, so accuracy is key.

- Previous bond claims or legal issues: If you have had claims against you on previous bonds or legal troubles, sureties may hesitate to issue a new bond.

How to Avoid Bid Bond Denial: Vital Steps for Success

- Maintain Good Credit: Ensure your credit report is strong and free from significant negative marks. We’ve always believed that strong credit history is the backbone of securing bid bonds.

- Prepare Comprehensive Documentation: Provide clear, accurate, and complete financial and project information. We’ve come to realize that incomplete or inaccurate records often lead to delays or denials.

- Gain Experience: Focus on acquiring relevant project experience before bidding on larger contracts. In our line of work, we’ve consistently found that contractors with similar project experience face fewer challenges in securing bonds.

- Work with a Reputable Surety: Choose a surety company that understands your business and Wyoming’s project requirements. **We’ve foundthat** sureties with local expertise help prevent unnecessary denials.

Concluding Thoughts: Elevate Your Wyoming Bid Bond Journey with Confidence

In our understanding, Wyoming bid bonds are a vital part of securing construction projects, benefiting both contractors and project owners. As a contractor, securing a bid bond not only improves your credibility but also gives the project owner confidence in your ability to fulfill the contract. By preparing thoroughly, understanding the process, and working with a reliable surety provider, you’ll be well-equipped to handle the bid bond requirements in Wyoming.