For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

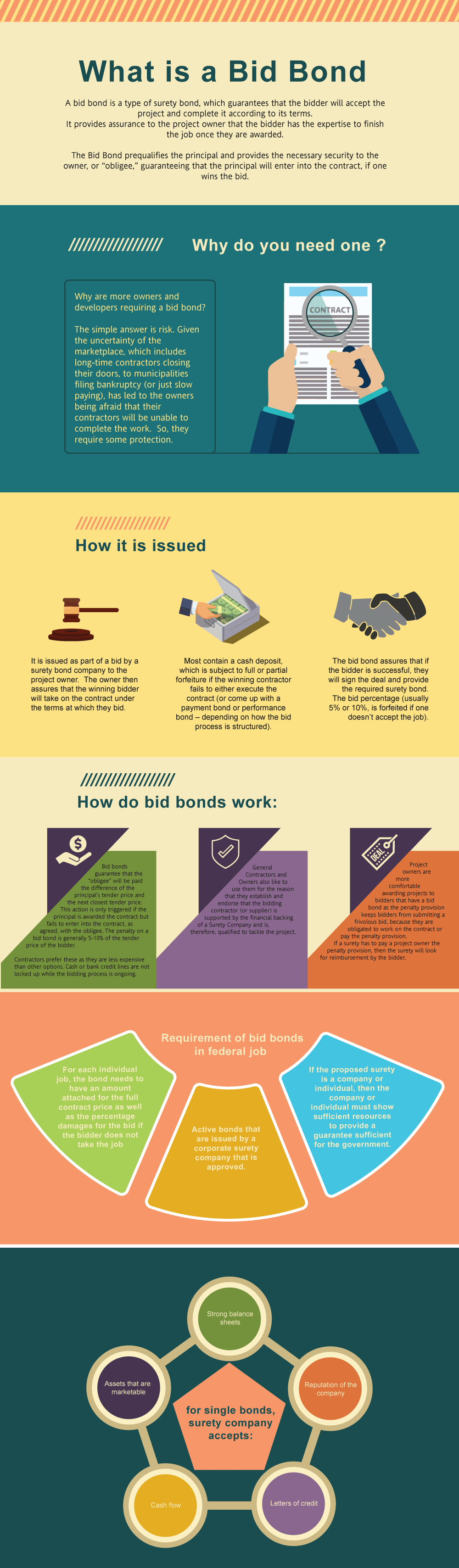

What is a Bid Bond in Wisconsin?

A bid bond is one of the types of surety bonds, that guarantees that the bidder will accept the project and complete it according to its terms. The bid bond provides assurance to the project owner that the bidder has the knowhow and ability to finish the job once the bidder is selected after winning the bid. The simple reason is that you need one in order to get the work. However, the bigger question is why are more owners/developers requiring a bid bond in the first place? The basic answer is risk. Given the uncertainty of the marketplace, which includes long-term contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the job. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Wisconsin Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Wisconsin?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the contract bond if you win the bid. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in WI?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Wisconsin. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Wisconsin?

We make it easy to get a contract bid bond. Just click here to get our Wisconsin Bid Bond Application. Fill it out and then email it and the Wisconsin bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for surety bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a excellent success rate in getting our clients bid and P&P bonds at the best rates possible.

Unlocking the Power of Wisconsin Bid Bonds: Your Ultimate Guide

In our experience, Bid Bonds are more than just paperwork; they are a critical part of securing your place in Wisconsin’s competitive construction industry. We’ve found that these bonds provide essential protection for both contractors and project owners, ensuring that everyone involved can proceed with confidence. What we’ve discovered is that the right bid bond can open doors to new opportunities, whether you’re bidding on small local projects or large-scale public works contracts. In this guide, we’ll explore the ins and outs of Wisconsin bid bonds—from how to apply for one to avoiding common pitfalls—so you can make informed decisions and protect your business.

Why Every Contractor Needs to Understand Wisconsin Bid Bonds

From our perspective, a Wisconsin Bid Bond is not just a requirement—it's a key to securing public projects and earning trust in the construction industry. These bonds ensure that the contractor, if awarded the bid, will follow through with their commitments. Without it, owners risk financial loss if the chosen bidder backs out. We’ve consistently found that understanding and utilizing these bonds is essential for any serious contractor looking to build a reputation in Wisconsin.

Finding the Right Bid Bond Provider Near You

We’ve learned that when it comes to securing a Bid Bond in Wisconsin, working with the right provider can make all the difference. Whether you're in Milwaukee, Madison, or Green Bay, we’ve noticed that local surety bond agents often offer a more tailored approach, understanding the nuances of Wisconsin laws. Don’t just choose any bond provider—find one that’s an expert in your area and can guide you through the process smoothly.

Who Really Benefits From Wisconsin Bid Bonds?

We’ve come to see that Bid Bonds don’t just protect the project owner—they also protect the contractor. By ensuring the project’s financial security and showing the contractor’s commitment, both parties benefit. The owner gets peace of mind, knowing the bidder is serious, and the contractor gains credibility. From our experience, having this level of trust in place can make or break a contractor's ability to secure future projects.

Which Wisconsin Projects Require Bid Bonds?

We’ve been able to determine that Bid Bonds are a necessity for:

- Contractors bidding on public construction projects like highways and government buildings.

- Subcontractors working on larger-scale developments.

- Private owners who require added security for high-value projects.

- Companies aiming for major bids and wanting to ensure project accountability.

These bonds ensure all involved parties can confidently move forward, knowing financial risks are mitigated.

We provide bid bonds in each of the following counties:

Adams

Ashland

Barron

Bayfield

Brown

Buffalo

Burnett

Calumet

Chippewa

Clark

Columbia

Crawford

Dane

Dodge

Door

Douglas

Dunn

Eau Claire

Florence

Fond Du Lac

Forest

Grant

Green

Green Lake

Iowa

Iron

Jackson

Jefferson

Juneau

Kenosha

Kewaunee

La Crosse

Lafayette

Langlade

Lincoln

Manitowoc

Marathon

Marinette

Marquette

Menominee

Milwaukee

Monroe

Oconto

Oneida

Outagamie

Ozaukee

Pepin

Pierce

Polk

Portage

Price

Racine

Richland

Rock

Rusk

St. Croix

Sauk

Sawyer

Shawano

Sheboygan

Taylor

Trempealeau

Vernon

Vilas

Walworth

Washburn

Washington

Waukesha

Waupaca

Waushara

Winnebago

Wood

And Cities:

Madison

Milwaukee

Green Bay

Appleton

Eau Claire

La Crosse

Racine

Kenosha

Janesville

Wausau

See our Wyoming Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Learn more on how to Bid Wisconsin.

Must-Know Tips Before Securing Your Bid Bond

In our professional life, we’ve often noticed that contractors new to Bid Bonds face a learning curve. Our advice? Get familiar with the project’s requirements and ensure your financial health is in top shape. We’ve consistently found that contractors who invest time in understanding these bonds can avoid common mistakes, such as underestimating bond costs or overextending on financial obligations. Set yourself up for success by preparing well in advance.

Key Factors to Consider Before Applying

We’ve found through experience that certain key points should be top of mind when seeking a Bid Bond:

- Organize your financial documents and ensure they’re up-to-date.

- Aim for a strong business credit score.

- Understand the complete project requirements.

- Work with a highly reputable and experienced surety bond provider.

- Prepare all necessary documentation ahead of time, including financial history and project scope.

By addressing these factors upfront, contractors can streamline the bond approval process and increase their chances of success.

Surety Bid Bonds Unveiled: What You Need to Know

We’ve come across many contractors unfamiliar with the workings of a Surety Bid Bond. Essentially, it’s a guarantee from a surety company that the contractor will honor their bid if awarded the contract. We’ve personally witnessed how this builds confidence within the bidding system, ensuring that only committed contractors enter the competition. Without this bond, owners could be left scrambling to find a new contractor, costing time and money.

How Wisconsin Bid Bonds Keep Projects on Track

We’ve consistently observed that Bid Bonds act as a safety net for project owners. Should the contractor fail to follow through on their bid, the bond ensures the owner won’t suffer financial loss. From what we’ve seen, this encourages responsible bidding, helping prevent delays and ensuring projects stay on track. It’s a win-win for everyone involved—owners, contractors, and surety companies alike.

Applying for a Surety Bid Bond in Wisconsin: A Quick Guide

We’ve had firsthand experience with contractors who find the Surety Bid Bond application process overwhelming. But don’t worry—it’s simpler than it seems if you’re prepared. You’ll need to gather financial documents, project details, and submit an application to a reputable surety company. From our own observations, a well-organized application speeds up approval, helping you secure the bond without unnecessary delays.

Step-by-Step to Securing Your Bid Bond

We’ve gained a lot from understanding the application process for Bid Bonds, and here’s the breakdown:

- Collect your financial documents, such as balance sheets and income statements.

- Complete the bid bond application with a surety provider you trust.

- Review all project details to avoid missing any key requirements.

- Double-check that your financial health aligns with the surety’s requirements.

- Work closely with your provider to finalize the bond and submit it before the bid deadline.

This step-by-step process can greatly increase your chances of a smooth, hassle-free experience.

What Does a Wisconsin Surety Bid Bond Really Cost?

We’ve consistently found that the cost of a Surety Bid Bond in Wisconsin varies but typically ranges between 1% and 3% of the bid amount. From what we’ve seen, factors like the contractor’s financial stability, project complexity, and creditworthiness all impact the final cost. Keep in mind that planning for these costs ahead of time is essential to avoid unwelcome surprises down the road.

Facing Rejection? Here’s Why You Might Be Denied a Bid Bond

We’ve had occasions where contractors are surprised by a Bid Bond denial, but the reasons are often avoidable. Poor financial standing, weak credit, or insufficient project experience can all lead to rejection. We’ve come to believe that being proactive with your financial health and partnering with a knowledgeable surety provider can mitigate these risks and improve your chances of approval.

Top Reasons Why Bid Bonds Are Denied

We’ve identified several common reasons for Bid Bond denial:

- Inadequate credit score or financial stability.

- Limited experience with similar projects.

- Incomplete or inaccurate financial documentation.

- History of defaults on previous projects or bonds.

- Legal issues or poor work history.

Understanding these pitfalls can help you prepare better and avoid being denied when it matters most.

How to Improve Your Chances and Avoid Denial

We’ve worked closely with contractors to help them avoid Bid Bond denial, and here are our best tips:

- Keep your credit score strong and your financials in good order.

- Ensure that all documentation is complete and accurate.

- Start with smaller projects to build a reliable track record.

- Make sure your financial capacity meets the surety’s standards.

- Work with a trusted, experienced surety provider.

By following these steps, you can greatly improve your chances of getting the bond approved without any hiccups.

Final Takeaways on Wisconsin Bid Bonds: Secure Your Future

We’ve come to the conclusion that Bid Bonds are essential for contractors aiming to succeed in Wisconsin’s public and private project sectors. These bonds protect project owners while also enhancing your credibility and chances of securing high-value projects. From our perspective, contractors who understand the importance of Bid Bonds will not only safeguard their business but also open doors to more opportunities in this competitive industry.