You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

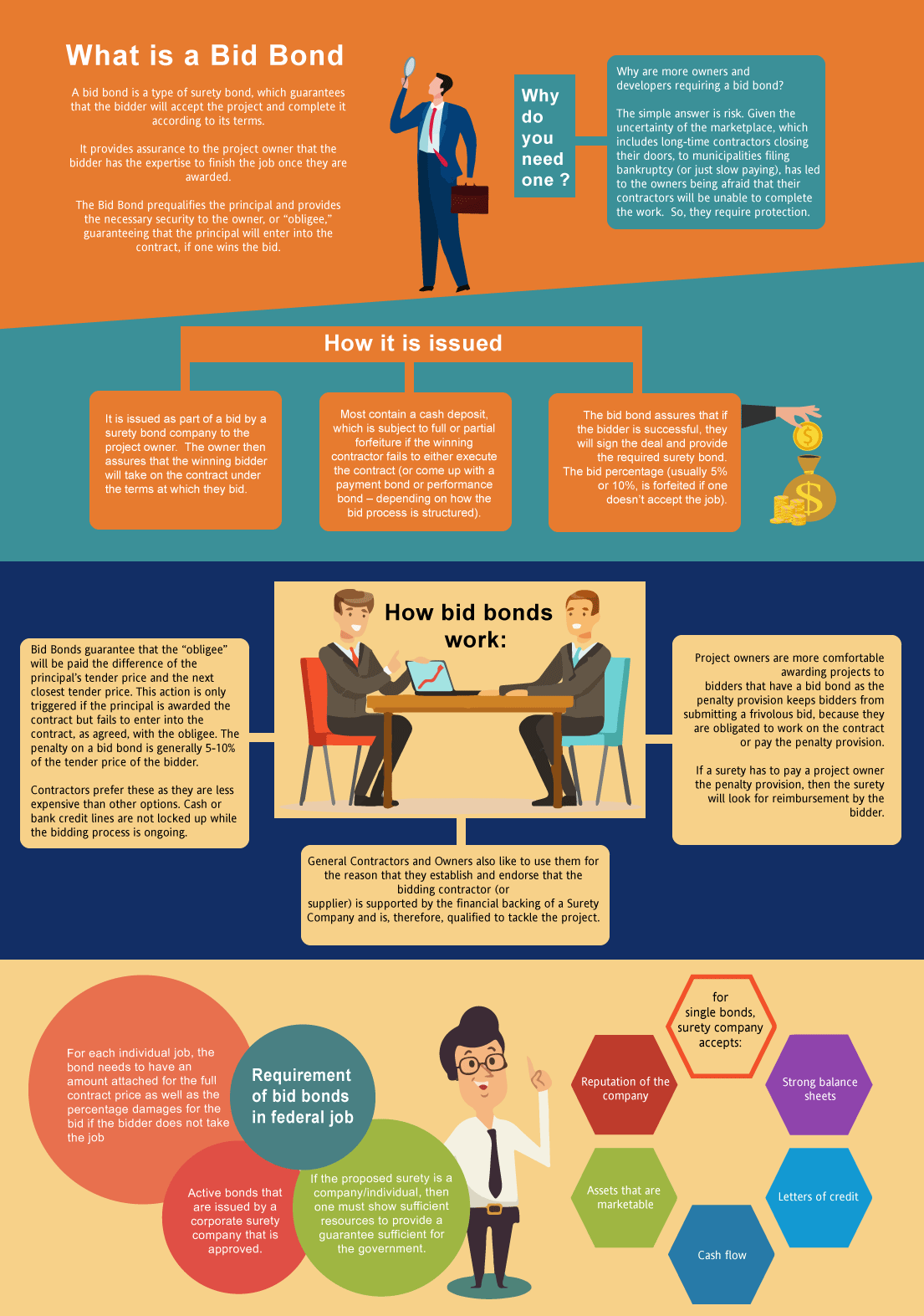

What is a Bid Bond in Vermont?

A bid bond is a type of surety bond, that guarantees that the bidder will enter into the agreement and complete it according to its terms. The bid bond provides assurance to the project owner that the bidder has the expertise and capability to complete the job once you are selected after winning the bidding process. The simple reason is that you need one in order to get the job. However, the larger question is why are more owners/developers requiring a bid bond in the first place? The simple answer is risk. Given the uncertainty of the marketplace, which includes long-time contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to complete the work. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Vermont Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Vermont?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the surety contract bond if you get the job. The cost of a P&P bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond covering the contract.

How much do bonds cost in VT?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Vermont. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Vermont?

We make it easy to get a contract bid bond. Just click here to get our Vermont Bid Bond Application. Fill it out and then email it and the Vermont bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for surety bid bonds and then submit it to the surety that we believe will provide the best bid and P&P bond for your job. We have a high success rate in getting our clients bid bonds at the very best rates possible.

Unboxing Vermont Bid Bonds: Essential for Contractor Success

When it comes to securing public and private contracts in Vermont, bid bonds play an essential role. These bonds ensure that contractors follow through on their commitments once they win a project bid. They’re a safety net for project owners and a necessary tool for any serious contractor in the state. In our view, Vermont bid bonds are more than just a formality—they’re a crucial part of the bidding process that protects both sides of the deal.

Uncovering the Best Vermont Bid Bond Providers

From what we’ve seen, Vermont offers many avenues for contractors to obtain bid bonds. Whether you’re working with local insurance agencies or national surety bond providers, it’s essential to find a partner that understands Vermont’s specific requirements. We've often noticed that contractors benefit from working with bond providers who have experience with local regulations. This ensures smoother processing and a higher chance of approval. Exploring trusted networks can help contractors find the right bond provider with ease.

Why Bid Bonds Matter to Vermont Stakeholders

We’ve realized that bid bonds not only protect project owners but also offer contractors an added layer of credibility. When a contractor submits a bid bond, it guarantees that the contractor is serious about their bid and has the financial backing to proceed if awarded the contract. In Vermont, this practice ensures fair competition and reduces the likelihood of bids being retracted without consequences. From our perspective, this balance of protection is what keeps the bidding system fair and trustworthy.

Who Needs Bid Bonds in Vermont?

We’ve found through experience that various entities in Vermont are required to obtain bid bonds, including:

- Contractors bidding on public projects.

- Construction companies involved in government contracts.

- Private contractors bidding on high-value projects.

- Subcontractors working under general contractors who require bonding.

These entities benefit from bid bonds as they demonstrate financial stability and commitment to the project.

We provide bid bonds in each of the following counties:

Addison

Bennington

Caledonia

Chittenden

Essex

Franklin

Grand Isle

Lamoille

Orange

Orleans

Rutland

Washington

Windham

Windsor

And Cities:

Burlington

Rutland City

Stowe

Brattleboro

Bennington

Middlebury

Killington

Montpelier

South Burlington

Essex

See our Virginia Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Practical Steps to Unveil Your Vermont Bid Bond Application

In our experience, applying for a bid bond requires careful preparation. Contractors should have their financial documents in order and understand the bond’s terms and conditions. We've consistently found that contractors who take the time to assess their financial standing before bidding are more likely to be approved for a bond. It’s crucial to also understand that once a bid bond is secured, failing to honor the bid can result in financial penalties.

Unveiling the Role of Surety Bid Bonds for Vermont Stakeholders

We’ve been involved in many projects where a surety bid bond was the key factor in ensuring project success. A surety bond involves three parties: the principal (the contractor), the obligee (the project owner), and the surety (the bond provider). This relationship creates a safety net, guaranteeing that the principal will complete the project as promised. Our experience tells us that surety bid bonds are a non-negotiable aspect of most public projects in Vermont, providing a clear line of accountability.

The In-Depth Journey of How Bid Bonds Work in Vermont

From our observation, bid bonds follow a straightforward process. Contractors submit a bond along with their project bid, and if they win the contract, the bond guarantees that they will proceed with the work as outlined. Should the contractor back out, the bond compensates the project owner for the cost difference in awarding the project to the next lowest bidder. We've worked with numerous contractors and seen firsthand how important it is to understand the bond terms to avoid any legal or financial complications.

A Step-by-Step Journey Through the Vermont Bid Bond Application Process

We’ve often found that applying for a surety bid bond in Vermont requires a few essential steps. Contractors must submit their financial records, project history, and sometimes a personal indemnity agreement to the surety provider. In our dealings with surety companies, we’ve learned that a contractor’s creditworthiness and financial stability are critical in determining the bond approval. A well-prepared application can make all the difference in securing the bond in a timely manner.

Step-by-Step Guide to Unveiling Your Vermont Bid Bond

From our perspective, the bid bond application process involves the following key steps:

- Gather Financial Documents – Ensure you have your company’s financial statements, credit history, and project portfolio in order.

- Find a Reputable Surety Provider – Research and choose a surety bond company with a strong track record.

- Complete the Application Form – Provide accurate and comprehensive information about your business and the project bid.

- Submit Documentation – Include your financial documents, proof of experience, and any other required paperwork.

- Review and Approval – The surety provider will assess your financial standing and project history before approving the bond.

What Will a Vermont Bid Bond Cost You?

In our view, the price of a bid bond is often misunderstood. While the bond’s cost is usually a small percentage of the total project bid, the final amount can vary depending on the contractor’s financial standing and the size of the project. We’ve come to see that smaller projects may require only a nominal fee, while larger, more complex projects could result in higher bond premiums. It’s essential for contractors to budget for these costs to avoid any surprises.

Can a Vermont Bid Bond Be Denied? Unveiling the Risks

We’ve encountered situations where contractors have been denied bid bonds, usually due to poor credit or insufficient financial documentation. Based on our experience, it’s crucial for contractors to maintain a solid financial track record and to provide all necessary paperwork when applying. We've learned through trial and error that approaching the bid bond application with complete transparency and preparedness significantly increases the chances of approval.

Tips to Avoid Bid Bond Denial in Vermont

In our experience, there are several steps contractors can take to avoid bid bond denial:

- Maintain Strong Credit – Sureties often check credit reports, so it’s essential to manage your credit responsibly.

- Ensure Accurate Documentation – Provide complete and accurate financial records to the surety provider.

- Prove Project Experience – Demonstrating a successful project history increases your chances of approval.

- Work with Reputable Bond Providers – Choose surety companies that specialize in the type of project you're bidding on.

Key Considerations for a Seamless Vermont Bid Bond Experience

We’ve consistently found that contractors should consider several factors before applying for bid bonds. These considerations ensure that they are fully prepared for the process and can maximize their chances of success.

Must-Know Considerations for a Successful Bid Bond Application

- Financial Standing – Strong financial health is the foundation of any successful bid bond application.

- Project Scope – Ensure the project you're bidding on aligns with your company's expertise.

- Bid Amount – Submit reasonable bids that reflect your company's capabilities and budget.

- Compliance with Regulations – Follow all local and state regulations to avoid unnecessary complications.

Final Thoughts: Learning from Vermont Bid Bond Success Stories

We’ve consistently observed that bid bonds are an indispensable part of the construction and contracting industry in Vermont. They protect project owners, instill confidence in the bidding process, and help contractors demonstrate their commitment. In our professional life, we’ve often noticed that contractors who understand and properly manage their bid bonds tend to win more projects and build stronger reputations. Ultimately, the bid bond is more than just a requirement—it’s a vital tool for successful project bidding.