You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in Utah?

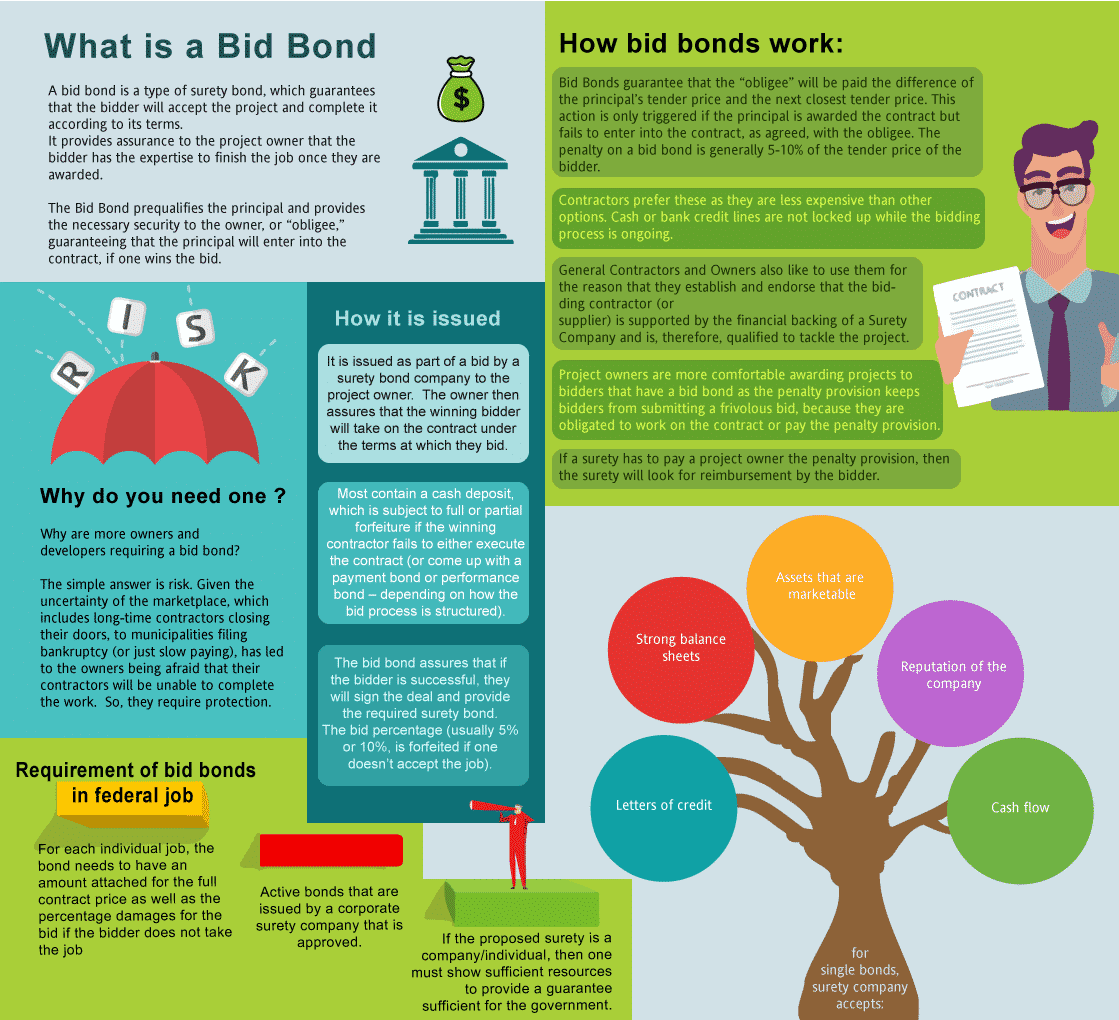

A bid bond is a type of surety bond, which guarantees that the bidder will accept the project and complete it according to its terms. It provides assurance to the project owner that the bidder has the knowhow and wherewithal to complete the job once you are selected after winning the bidding process. The basic reason is that you need one so that you get the work. But the bigger question is why are more owners/developers requiring a bid bond in the first place? The answer is risk. Given the uncertainty of the marketplace, which includes experienced contractors going out of business, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. Thus, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Utah Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Utah?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the bond on the contract if you win the bid. The cost of a surety bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a contract bond.

How much do bonds cost in UT?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Utah. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Utah?

We make it easy to get a contract bid bond. Just click here to get our Utah Bid Bond Application. Fill it out and then email it and the Utah bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for bid bonds and then submit it to the surety that we believe will provide the best surety bond for your company. We have a Utah high bid bonds success rate in getting our clients surety bonds at the best rates possible.

The Importance of Bid Bonds in Utah’s Construction Sector

In Utah’s booming construction industry, bid bonds play a crucial role in ensuring project integrity. A bid bond serves as a financial guarantee that a contractor will honor their bid if selected for a project. These bonds protect project owners from financial loss, ensuring that the contractor can secure performance and payment bonds if awarded the contract. From our perspective, bid bonds are a safety net for project owners and demonstrate a contractor’s commitment to the bidding process. Understanding how they work in Utah can give you the confidence to navigate the complex world of public and private construction projects.

Finding a Bid Bond Near You: A Simple Approach

Securing a bid bond in Utah is often easier than most anticipate. Many agencies and bonding companies offer accessible services across the state. In our observation, the key is finding a provider that understands the specific regulations of Utah’s construction laws. When searching for a bid bond provider, look for firms that have experience in the local market, offer competitive rates, and are backed by reputable surety companies. It’s also helpful to work with agents who can guide you through the application process, making sure you meet all necessary requirements without stress.

Who Holds the Key to Bid Bonds in Utah?

The party who receives the benefits of the bid bond is typically the project owner. We’ve noticed that in Utah, project owners rely on these bonds to protect themselves from contractors who may back out of their commitments after being awarded a bid. This protection ensures that the project owner will either receive compensation for the financial difference between the original bid and the next lowest bidder or the contractor will fulfill the contractual obligations. Contractors, on the other hand, need to remember that bid bonds are their ticket to competing in large-scale construction projects.

Who Needs Bid Bonds in Utah?

We’ve found that bid bonds are typically required by:

- General contractors bidding on public works projects

- Contractors involved in state-funded projects

- Private construction contractors working on large-scale developments

- Subcontractors bidding on substantial contracts

- Contractors working on federal projects that adhere to the Miller Act

We provide bid bonds in each of the following counties:

Beaver

Box Elder

Cache

Carbon

Daggett

Davis

Duchesne

Emery

Garfield

Grand

Iron

Juab

Kane

Millard

Morgan

Piute

Rich

Salt Lake

San Juan

Sanpete

Sevier

Summit

Tooele

Uintah

Utah

Wasatch

Washington

Wayne

Weber

And Cities:

Salt Lake City

St. George

Ogden

Provo

Park City

Logan

Sandy

Orem

Moab

Layton

See our Vermont Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Essential Tips for Navigating Bid Bonds in Utah

Understanding bid bonds is essential for contractors looking to bid on projects in Utah. We’ve come across many situations where contractors overlook the small details, which can lead to bid rejection. First, ensure you thoroughly read the bid specifications to determine the exact bond requirements. Second, always work with a reputable surety company that understands local regulations. Finally, ensure your finances are in order, as bid bonds often require proof of financial stability. These proactive measures can make the difference between winning a bid and being disqualified.

Key Considerations for Bid Bonds

We’ve learned that several key factors come into play when managing bid bonds in Utah. Some of these considerations include:

- Bid Requirements: Understand the specific bond requirements for the project.

- Surety Selection: Choose a surety company experienced in Utah regulations.

- Financial Readiness: Ensure your finances are in good standing.

- Project Scope: Be clear about the project’s size and scope before bidding.

- Deadlines: Meet all deadlines for bid submission and bond approval.

The Surety Bid Bond: What Sets It Apart

A surety bid bond acts as a promise that the contractor will honor their bid if selected. In our experience, this type of bond creates a triangular relationship between the contractor, the project owner, and the surety company. The surety guarantees that if the contractor fails to fulfill their obligations, the project owner will not suffer financially. It’s essentially a financial risk mitigation tool that protects the project owner from non-compliance or withdrawal by the contractor. This assurance is particularly important in Utah, where public projects often have stringent bonding requirements.

Breaking Down the Mechanics: How Bid Bonds Work

Bid bonds might sound complex, but their functioning is straightforward once you understand the basics. We’ve realized that these bonds provide financial security to project owners by ensuring that the winning contractor will follow through with the project. Contractors submit the bond along with their bid, and if awarded the contract, the bond guarantees that the contractor will sign the agreement and provide additional performance and payment bonds. If the contractor fails to meet these obligations, the project owner can claim the bid bond for compensation.

Navigating the Application Process in Utah

Applying for a bid bond in Utah involves several critical steps. We’ve consistently found that having your financial records in order is the first requirement. Surety companies will evaluate your credit score, financial stability, and previous work history to determine eligibility. After securing approval from the surety, you can submit your bid with the bond included. The process is typically straightforward, but working with a knowledgeable bond agent can help ensure that you meet all requirements and avoid common mistakes that can lead to delays or rejections.

How to Apply for a Bid Bond: Step-by-Step

We’ve come to appreciate that the application process is easier when broken down into steps:

- Gather Financial Documentation: Ensure your financial records are in order.

- Work with a Reputable Agent: Find an experienced bond agent familiar with Utah’s regulations.

- Complete the Application Form: Provide accurate details about your business and the project.

- Submit to the Surety Company: Your agent will forward your application to the surety for review.

- Undergo Credit Evaluation: The surety will assess your financial standing and credit history.

- Receive Bond Approval: Once approved, submit your bid bond with your bid proposal.

What You Need to Know About Bid Bond Costs

The cost of a bid bond is a fraction of the bid amount, typically ranging between 1% and 5% of the project’s value. We’ve observed that factors like your financial history, the size of the project, and the surety company you choose can affect the price. For smaller projects, the cost is minimal, but larger contracts may require a more significant investment. It’s essential to shop around and compare rates to find the best deal without compromising the bond’s quality or security.

Understanding Potential Denials: Can Your Bid Bond Be Rejected?

Yes, there is a possibility that your bid bond application could be denied. We’ve seen firsthand that most rejections occur due to poor credit scores, financial instability, or an insufficient track record of completing similar projects. Working with a knowledgeable agent can help you navigate these challenges and improve your chances of approval. If you’re worried about being denied, it’s important to address these factors before applying by improving your financial standing and ensuring all paperwork is accurate.

How to Avoid Bid Bond Denials

We’ve encountered several strategies to avoid bid bond application denials:

- Improve Your Credit: Ensure your credit score is strong.

- Provide Accurate Documentation: Submit thorough and accurate paperwork.

- Build a Strong Portfolio: Show a solid history of successful projects.

- Work with a Reputable Agent: Choose a bond agent experienced in navigating the complexities of bid bonds in Utah.

- Strengthen Financial Standing: Demonstrate a stable financial position to the surety company.

Final Thoughts on Bid Bonds in Utah

Bid bonds are essential for contractors in Utah looking to participate in competitive bidding processes. We’ve gathered from our experience that securing a reliable bid bond can provide peace of mind for both contractors and project owners, ensuring project commitments are met. By working with an experienced bonding agency and maintaining a strong financial history, contractors can increase their chances of success in winning bids and avoiding potential pitfalls. Whether you’re new to bidding or a seasoned pro, understanding the nuances of bid bonds can make a significant difference in your project outcomes.