You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

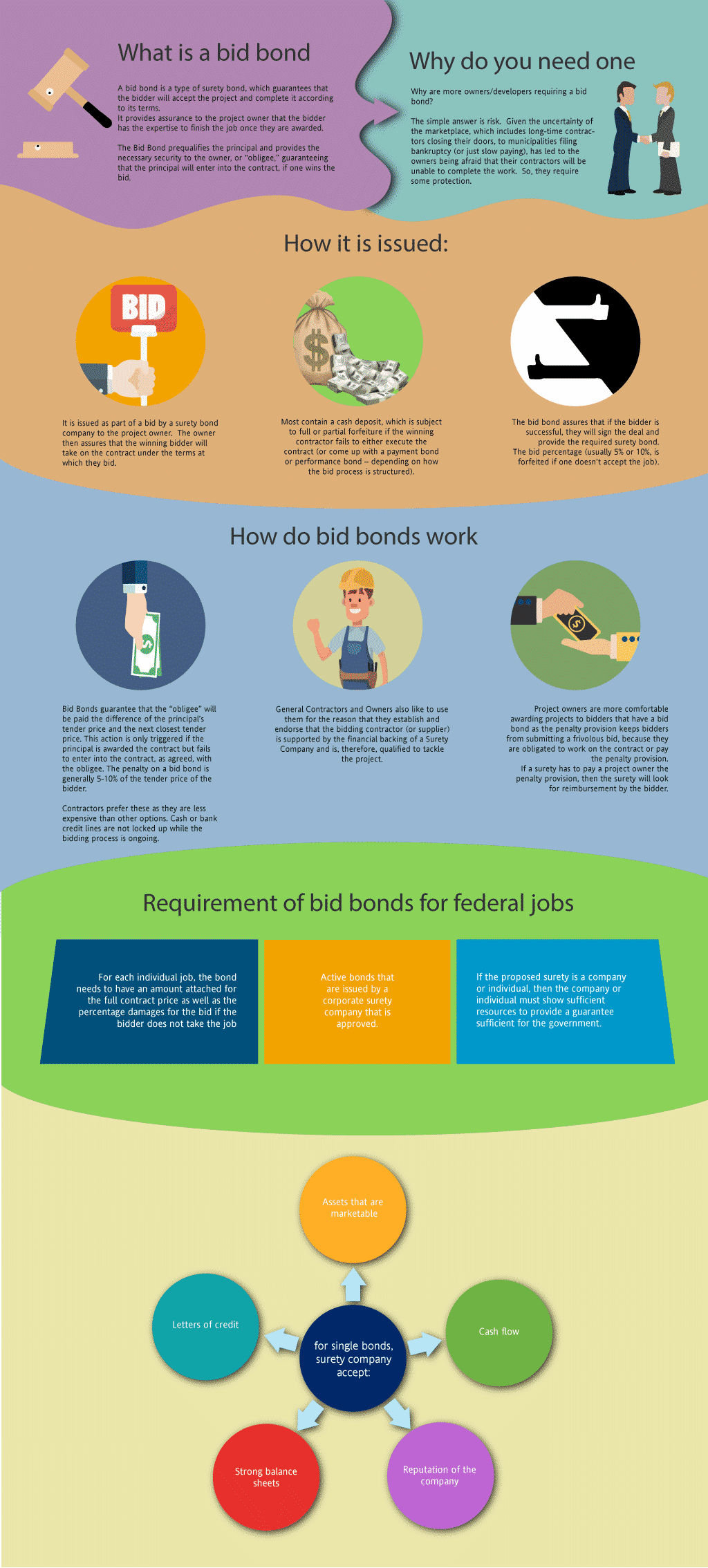

What is a Bid Bond in Tennessee?

A bid bond is one of the types of surety bonds, which guarantees that the bidder will enter into the agreement and complete the agreement according to its terms. The bid bond provides assurance to the project owner that the bidder has the knowhow and capability to complete the job once you are selected after the bidding process. The basic reason is that you need one to get the contract. But the bigger question is why are more owners/developers requiring a bid bond in the first place? The simple answer is risk. Given the uncertainty of the marketplace, which includes long-term contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the job. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Tennessee Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Tennessee?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the contract bond if you win the bid. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond covering the contract.

How much do bonds cost in TN?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Tennessee. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Tennessee?

We make it easy to get a contract bid bond. Just click here to get our Tennessee Bid Bond Application. Fill it out and then email it and the Tennessee bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We will review each application for surety bid bonds and then submit it to the surety that we believe will provide the best surety bid bond for your company. We have a high success rate in getting our clients surety bonds at the very best rates possible.

Mastering Bid Bonds in Tennessee: A Comprehensive Guide for Contractors

In our experience, bid bonds play a pivotal role in Tennessee’s construction and contracting industry. They serve as a guarantee that a contractor bidding on a project will fulfill the terms of their bid if awarded the contract. Without a bid bond, project owners are left vulnerable to financial losses if the selected contractor fails to follow through. We’ve found that contractors seeking to work on government or large-scale private projects in Tennessee are often required to secure a bid bond, making it an essential part of the bidding process.

This article will provide a comprehensive overview of bid bonds in Tennessee, including how they work, the application process, costs, potential for denial, and practical advice for contractors.

The Importance of Bid Bonds in Tennessee’s Construction Landscape

From our perspective, understanding what a Tennessee bid bond entails is essential for any contractor looking to bid on government contracts. A bid bond is a type of surety bond required by government agencies to ensure that contractors commit to following through with their bid if accepted. In Tennessee, bid bonds are commonly used to protect the public entity or project owner from financial losses if the winning bidder fails to honor their bid or perform the contract terms. We've noticed that these bonds are often seen as a safeguard against poor project management or unqualified contractors.

Finding Reliable Bid Bonds in Tennessee: Your Local Guide

In our observation, finding a reliable source for bid bonds in Tennessee has become increasingly accessible due to numerous providers across the state. Companies specializing in surety bonds can guide contractors through the application process, ensuring they meet state-specific requirements. What we’ve discovered is that many local insurance agencies and national surety companies offer competitive rates on bid bonds, allowing contractors to secure the necessary financial backing without significant hassle.

Understanding Who Benefits from Bid Bonds in Tennessee

We’ve come across a common question: who actually benefits from the bid bond? In our experience, the project owner in Tennessee is the main beneficiary of the bid bond. The bond guarantees that if the contractor with the winning bid does not enter the contract or provide required performance bonds, the project owner can seek compensation from the surety provider. What we’ve experienced is that this arrangement helps create trust between contractors and public entities, ensuring projects move forward without unnecessary financial risks.

We provide bid bonds bonds in each of the following counties:

Anderson

Bedford

Benton

Bledsoe

Blount

Bradley

Campbell

Cannon

Carroll

Carter

Cheatham

Chester

Claiborne

Clay

Cocke

Coffee

Crockett

Cumberland

Davidson

Decatur

DeKalb

Dickson

Dyer

Fayette

Fentress

Franklin

Gibson

Giles

Grainger

Greene

Grundy

Hamblen

Hamilton

Hancock

Hardeman

Hardin

Hawkins

Haywood

Henderson

Henry

Hickman

Houston

Humphreys

Jackson

Jefferson

Johnson

Knox

Lake

Lauderdale

Lawrence

Lewis

Lincoln

Loudon

McMinn

McNairy

Macon

Madison

Marion

Marshall

Maury

Meigs

Monroe

Montgomery

Moore

Morgan

Obion

Overton

Perry

Pickett

Polk

Putnam

Rhea

Roane

Robertson

Rutherford

Scott

Sequatchie

Sevier

Shelby

Smith

Stewart

Sullivan

Sumner

Tipton

Trousdale

Unicoi

Union

Van Buren

Warren

Washington

Wayne

Weakley

White

Williamson

Wilson

And Cities:

Nashville

Memphis

Knoxville

Chattanooga

Clarksville

Murfreesboro

Jackson

Gatlinburg

Pigeon Forge

Johnson City

See our Texas Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Insider Tips for Evaluating Bid Bonds: What Tennessee Contractors Need to Know

In our view, bid bonds are a must-have for contractors, but not all bonds are created equal. We’ve consistently found that understanding the terms and conditions of the bond, as well as the surety company's reputation, is key to making an informed decision. Contractors should ensure they fully comprehend the bond’s limitations and coverage. Based on our experience, it’s also a good practice to work closely with a surety agent who can guide you through Tennessee-specific regulations and prevent costly mistakes.

What is a Surety Bid Bond? An In-Depth Look at This Key Assurance

We’ve come to appreciate that a surety bid bond acts as a financial guarantee provided by a surety company on behalf of the contractor. It ensures that the contractor will enter the contract and execute the project per the terms laid out in their bid. We’ve gained insight into how this type of bond not only protects the project owner but also demonstrates the contractor's credibility and commitment to the project.

How Bid Bonds Work in Tennessee’s Contracting Sector

From what we’ve seen, the functionality of a bid bond is straightforward but vital. The bid bond ensures that if a contractor is awarded the project, they will adhere to the bid terms. If the contractor fails to do so, the surety company steps in, typically covering the difference between the contractor's bid and the next lowest bid. We've often found that this mechanism ensures project owners feel secure in moving forward with the selected contractor, knowing that financial risks are minimized.

Step-by-Step Guide to Applying for a Surety Bid Bond in Tennessee

We’ve been fortunate to guide many contractors through the application process for surety bid bonds. Typically, this involves submitting detailed financial information, including credit history, financial statements, and project experience. We've seen firsthand that the process can vary slightly depending on the bond provider, but being prepared with all required documentation ensures a smoother and quicker approval. We’ve consistently observed that contractors with strong financial profiles and a history of successful project completion receive more favorable terms.

Streamlined Steps for Securing Your Bid Bond in Tennessee

From our perspective, applying for a surety bid bond in Tennessee is a systematic process that requires attention to detail. Here’s a step-by-step guide:

- Prepare Financial Documents – In our experience, you’ll need to gather your business financial statements, including balance sheets, profit and loss statements, and cash flow records. Ensure they’re updated and accurate.

- Evaluate Your Credit Score – We’ve noticed that surety companies place significant weight on the credit score of the business owner. It’s a good idea to check your score beforehand and resolve any potential issues.

- Submit the Application – Fill out the bond application, which includes details about the project, the bid amount, and your company’s financial background. We've learned that it’s essential to be thorough and honest in this step to avoid delays.

- Work With a Surety Agent – In our view, partnering with a knowledgeable surety agent can streamline the process. The agent will guide you through the application, ensuring all required information is included.

- Underwriting Review – We’ve found that after submission, the surety company will conduct an underwriting review to assess your financial standing and determine risk. They might request additional documents during this phase.

- Receive Approval or Request Revisions – If everything checks out, you’ll receive approval. If not, you may be asked to provide more details or make corrections. We’ve had the chance to assist contractors in revising their applications to meet bond criteria.

- Finalize the Bond – Once approved, the surety will issue the bond, and you’ll be ready to move forward with your project bid.

We’ve personally witnessed that a step-by-step approach helps simplify what could otherwise be a complex process. By being well-prepared and seeking expert guidance, you can secure your bid bond efficiently and increase your chances of winning the project.

Breaking Down the Costs of Bid Bonds in Tennessee

In our line of work, we’ve often noticed that contractors worry about the cost of surety bid bonds. We’ve found through experience that the cost typically ranges between 1% and 5% of the total bid amount, depending on the contractor's financial stability and project scope. We’ve had firsthand experience with this variation and always recommend shopping around for quotes, as even small percentage differences can significantly impact the overall cost.

Denied Bid Bonds in Tennessee? Here’s Why It Happens

We’ve gained from our experience that it is possible for contractors to be denied a bid bond in Tennessee, usually due to poor credit history, weak financials, or a lack of experience. In our professional life, we’ve often worked with contractors to help them improve their financial standing to meet the surety provider's requirements. What we’ve learned is that transparency during the application process can also help avoid any surprises or last-minute denials.

Top Reasons for Bid Bond Denial: What You Need to Know

We’ve encountered several reasons why a contractor may be denied a bid bond in Tennessee. These include:

- Poor Credit History – We've noticed through our work that a low credit score often raises red flags for surety companies, as it indicates potential financial risk.

- Inadequate Financial Statements – We’ve come across situations where incomplete or inaccurate financial records lead to denial. Surety providers require detailed financials to assess a contractor's ability to fulfill the project.

- Insufficient Work Experience – From our experience, surety companies value a contractor’s track record. A lack of relevant project experience can cause concerns about the contractor’s capability to complete the project successfully.

- High Debt Levels – In our dealings with contractors, we’ve observed that excessive debt may result in denial, as it indicates financial instability and a higher risk of default.

- Discrepancies in Application – We’ve consistently found that any inconsistencies in the bid bond application can lead to delays or outright denial. Ensuring the accuracy of the provided information is crucial.

Understanding these factors can help contractors prepare more effectively for the bid bond process and increase their chances of approval.

Final Thoughts: The Vital Role of Bid Bonds in Tennessee’s Construction Industry

In our practice, we’ve come to recognize that bid bonds are a vital part of the bidding process in Tennessee. These bonds not only protect project owners but also showcase a contractor’s reliability and financial strength. We've often found that understanding the details of a bid bond and partnering with an experienced surety agent can make all the difference in securing high-profile contracts. With the right approach, bid bonds become a powerful tool for success in Tennessee’s competitive construct