You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in South Carolina?

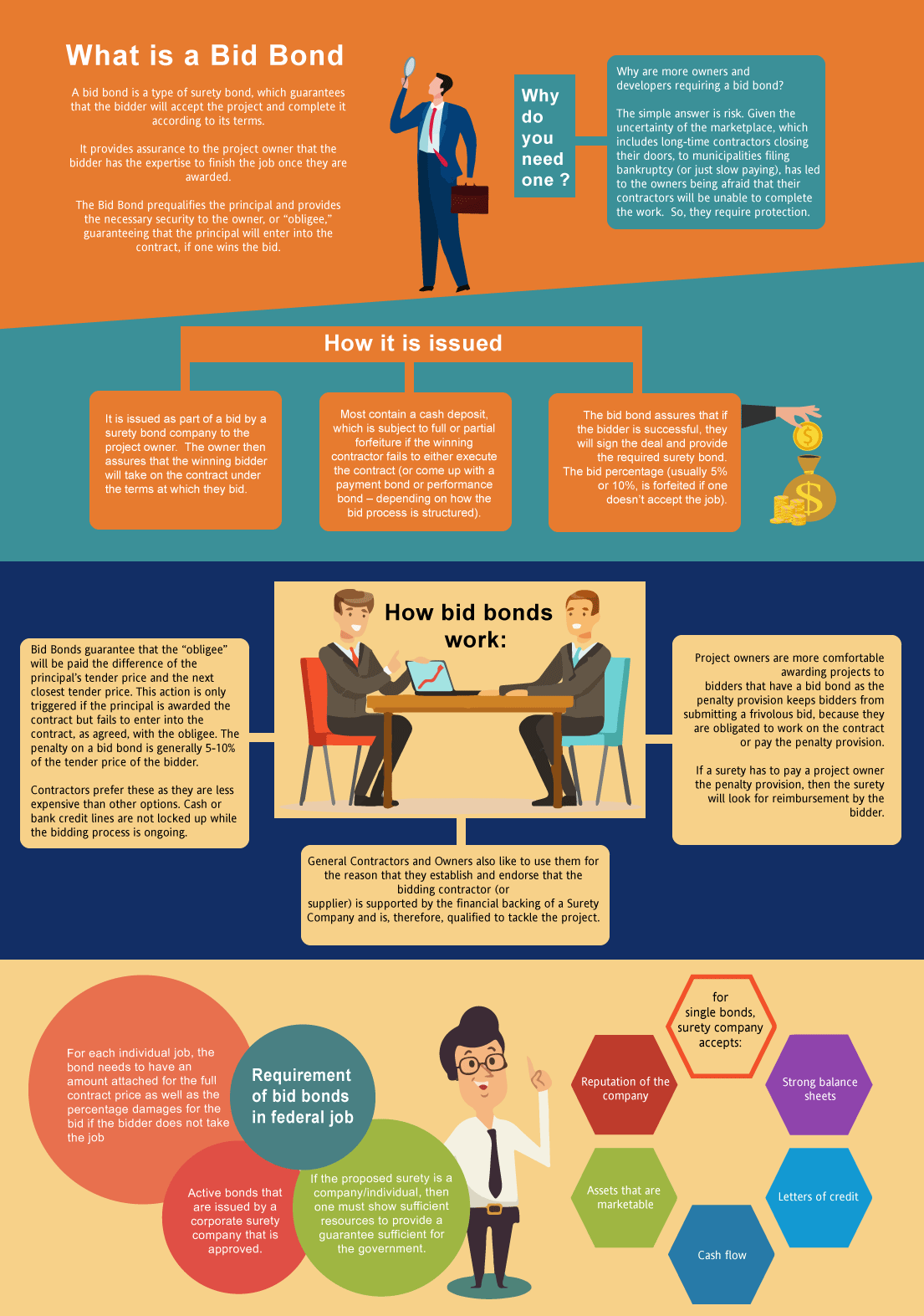

A bid bond is a type of surety bond, which guarantees that the bidder will accept the project and complete the agreement according to its terms. It provides assurance to the project owner that the bidder has the ability and capability to finish the job once the bidder is selected after winning the bid. The basic reason is that you need one in order to get the work. But the bigger question is why are more owners/developers requiring a bid bond in the first place? The simply explanation is risk. Given the uncertainty of the marketplace, which includes long-term contractors closing shop, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to complete the work. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our South Carolina Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in South Carolina?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the contract bond if you get the job. The cost of a P&P bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in SC?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of South Carolina. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in South Carolina?

We make it easy to get a contract bid bond. Just click here to get our South Carolina Bid Bond Application. Fill it out and then email it and the South Carolina bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review all application for bid bonds and then submit it to the surety that we believe will provide the best surety bid bond for your contract. We have a great success rate in getting our clients surety bonds at the very best rates possible.

Understanding South Carolina Bid Bonds: A Key to Successful Bidding

When it comes to securing construction projects or large contracts in South Carolina, one crucial step is obtaining a bid bond. Bid bonds act as a guarantee that the bidder will enter into the contract and provide the required performance bonds if they win the bid. In our view, these bonds serve as an essential tool for ensuring that the bidding process is fair and that only serious bidders participate. South Carolina contractors frequently rely on bid bonds to gain trust and credibility during the bidding process.

Where to Find Bid Bonds in South Carolina

Finding a bid bond provider near you is easier than you might think. Whether you are in Columbia, Charleston, or Greenville, numerous local surety agencies and national providers offer tailored services for South Carolina contractors. We’ve noticed that working with an experienced local surety bond company can streamline the process, as they understand the state’s legal requirements. Many of these agencies offer quick approvals and competitive rates, making it simple to get a bond within a few hours or days.

Benefits of Local Providers

In our observation, local providers often offer a personal touch that national providers may lack. Their knowledge of state-specific regulations and familiarity with local project requirements can help contractors avoid potential pitfalls during the bonding process. This can lead to faster approvals and more favorable rates for contractors.

Working with National Providers

On the other hand, we’ve found that national surety bond providers often offer a broader range of services and greater financial backing. This can be particularly beneficial for contractors working on larger or more complex projects, where the bond requirements might be higher. In either case, finding a reputable provider is key to securing your bid bond in South Carolina.

Who Benefits from a Bid Bond in South Carolina?

Bid bonds in South Carolina are designed to protect the project owner (also known as the obligee) from financial losses if the contractor fails to follow through. In our observation, project owners benefit most from these bonds, as they can confidently award contracts without the risk of the winning bidder backing out. For contractors, securing a bid bond shows professionalism and commitment, which can increase their chances of winning the project.

Protecting the Project Owner

We’ve consistently found that the main beneficiary of a bid bond is the project owner. The bond acts as insurance, ensuring that if the winning bidder does not proceed with the project, the owner can recover any financial losses incurred during the bidding process. This security encourages project owners to accept bids with confidence.

Advantages for Contractors

For contractors, our experience tells us that having a bid bond increases their credibility. It reassures project owners that the contractor is financially stable and capable of completing the project as promised. This can be a deciding factor in winning competitive bids.

We provide bid bonds in each of the following counties:

Abbeville

Aiken

Allendale

Anderson

Bamberg

Barnwell

Beaufort

Berkeley

Calhoun

Charleston

Cherokee

Chester

Chesterfield

Clarendon

Colleton

Darlington

Dillon

Dorchester

Edgefield

Fairfield

Florence

Georgetown

Greenville

Greenwood

Hampton

Horry

Jasper

Kershaw

Lancaster

Laurens

Lee

Lexington

McCormick

Marion

Marlboro

Newberry

Oconee

Orangeburg

Pickens

Richland

Saluda

Spartanburg

Sumter

Union

Williamsburg

York

And Cities:

Charleston

Columbia

Greenville

Myrtle Beach

Spartanburg

Florence

Hilton Head Island

Rock Hill

Summerville

Mount Pleasant

See our South Dakota Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Learn more about a plus bonding Lexington SC.

Things to Consider Before Applying for a Bid Bond

We’ve consistently found that careful planning is essential before applying for a bid bond. For one, you need to ensure that your business has a strong financial standing. The surety company will evaluate your credit, experience, and ability to perform the job. Additionally, it’s essential to thoroughly review the project’s requirements and ensure that you meet all qualifications. Our experience has shown us that contractors who prepare adequately have smoother application processes and stronger relationships with surety providers.

Financial Preparation

One of the key factors in securing a bid bond is the financial health of your business. We’ve come to realize that surety companies will closely examine your credit history, financial statements, and overall stability before issuing a bond. Ensuring your financial records are up to date and free of red flags can significantly improve your chances of approval.

Review Project Requirements

Before applying for a bid bond, we’ve often noticed that contractors who thoroughly review project requirements are more likely to secure their bonds quickly. This step ensures you meet all qualifications set by the project owner, reducing the likelihood of delays or complications during the application process.

Unpacking Surety Bid Bonds: A Fundamental Piece of the Puzzle

Surety bid bonds are the backbone of the bidding process in South Carolina. Essentially, a surety bond is an agreement between three parties: the obligee (project owner), the principal (contractor), and the surety (the bonding company). In our line of work, we’ve often noticed that having a surety bond provides a solid safety net for the obligee. The surety ensures that, if the contractor defaults, financial damages are covered up to the bond’s limit, giving everyone involved peace of mind.

How Surety Bid Bonds Work: A Simple Breakdown

So, how exactly do surety bid bonds work? We’ve observed that the process starts when a contractor submits a bid for a project and includes a bid bond as part of their proposal. If the contractor wins the bid but later decides not to proceed with the project, the surety bond kicks in, and the project owner is compensated. The bond amount is typically a percentage of the bid, which can range from 5% to 10%. This financial protection ensures the project owner can move forward with an alternative contractor without taking a significant loss.

Navigating the Bid Bond Application Process in South Carolina

Applying for a surety bid bond in South Carolina requires specific documentation and financial details. We’ve found that having a clean credit history, strong financial statements, and relevant experience significantly boosts your chances of approval. The process generally involves submitting a bid bond application, along with a copy of the project’s bid requirements. It’s essential to work closely with a reliable surety bond provider to ensure all paperwork is in order and to avoid delays.

What Is the Cost of a Bid Bond in South Carolina?

Bid bond prices can vary based on several factors. We’ve come to appreciate that in South Carolina, the cost of a bid bond is usually a small percentage of the total project bid, typically ranging from 1% to 5%. However, contractors with a strong financial background and good credit can often secure bonds at the lower end of that range. It’s important to note that the bid bond premium is a one-time payment and doesn’t require any recurring fees.

Can You Be Denied a Bid Bond? Yes, and Here’s Why

Yes, contractors can be denied a bid bond, and we’ve encountered such situations. Common reasons for denial include poor credit history, insufficient financial resources, and lack of experience in the industry. Surety companies need to ensure that contractors can complete the project as promised, so they conduct thorough evaluations. In our view, preparing all necessary documents and addressing any potential financial weaknesses beforehand can significantly improve your chances of approval.

Final Thoughts: Why Bid Bonds Are Critical in South Carolina

In conclusion, bid bonds are an indispensable part of the bidding process in South Carolina, offering protection to both contractors and project owners. From our perspective, these bonds are more than just a formality—they are a crucial indicator of a contractor’s reliability and commitment to the project. For contractors, understanding the ins and outs of bid bonds is key to succeeding in competitive bidding processes and building long-term relationships with project owners.