You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

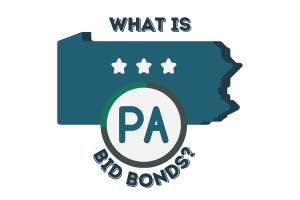

What is a Bid Bond in Pennsylvania?

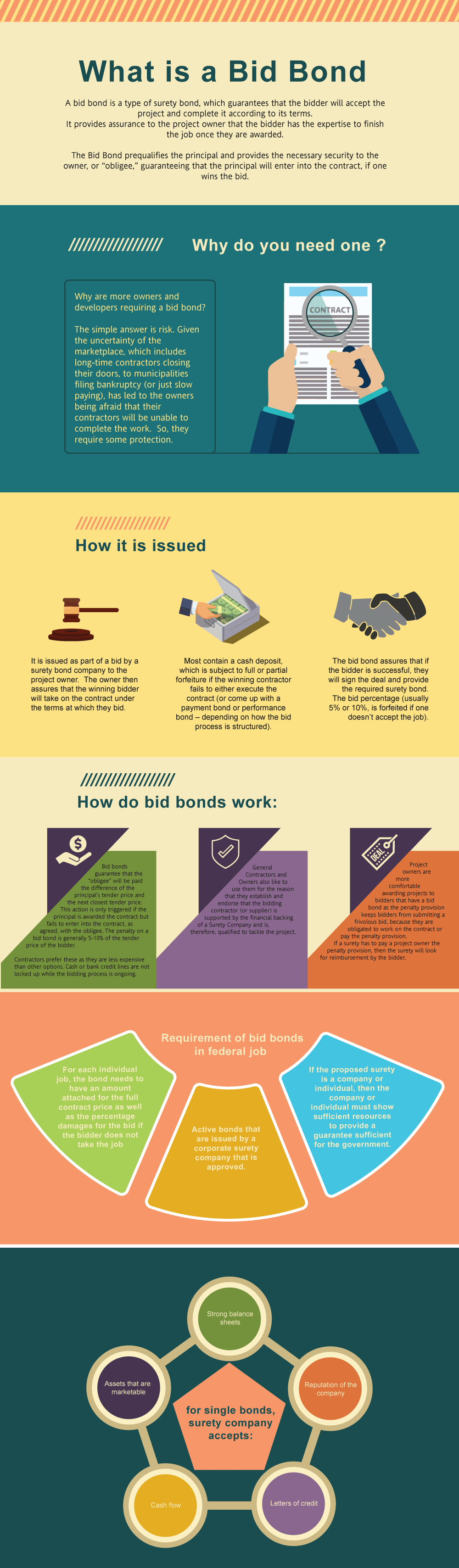

A bid bond is a type of surety bond, that guarantees that the bidder will enter into the contract and complete the contract according to its terms. It provides assurance to the project owner that the bidder has the ability and capability to finish the job once you are selected after winning the bidding process. The basic reason is that you need one so that you get the contract. But the bigger question is why are more owners/developers requiring a bid bond in the first place? The simply explanation is risk. Given the uncertainty of the marketplace, which includes long-term contractors closing shop, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Pennsylvania Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Pennsylvania?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the contract bond if you win the bid. The cost of a surety bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in PA?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Pennsylvania. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Pennsylvania?

We make it easy to get a contract bid bond. Just click here to get our Pennsylvania Bid Bond Application. Fill it out and then email it and the Pennsylvania bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We review each application for bid bonds and then submit it to the surety that we believe will provide the best bid and bid bond for your contract. We have a excellent success rate in getting our clients bid bonds at the best rates possible.

Unleashing the Power of Pennsylvania Bid Bonds

From our perspective, a Pennsylvania Bid Bond is an essential component in public construction projects. This type of bond acts as a financial guarantee that ensures contractors will honor their bids. When a contractor submits a bid and is awarded a project, the bid bond protects the project owner if the contractor fails to begin the work or withdraws their bid after acceptance. We’ve noticed that Pennsylvania bid bonds are critical for mitigating financial risks in competitive bidding scenarios, providing project owners with peace of mind.

Kickstart Your Search for the Right Bid Bond Provider

From our perspective, locating the right bid bond provider in Pennsylvania is crucial for a seamless bidding process. Whether you are new to the construction industry or have years of experience, selecting a trusted surety company makes a significant difference. We’ve come to understand that navigating through local options or finding a provider online requires some knowledge about the market and its specific requirements.

Key Considerations When Finding a Bid Bond Provider

- Unveil Licensed Surety Providers: We’ve often noticed that it’s vital to work with a licensed surety company authorized to issue bonds in Pennsylvania. This ensures that the bid bond meets all legal and regulatory standards, avoiding complications down the road.

- Explore Reputable Providers: What we’ve discovered is that finding a provider with a solid track record is crucial. Choose one that has experience in handling bid bonds for projects similar to yours. This helps in securing the right terms for your bond.

- Compare Competitive Rates: We’ve consistently found that comparing rates from different providers can save you money. Make sure the provider offers transparent pricing with no hidden fees.

- Ensure Efficient Customer Support: We’ve personally witnessed that a responsive and helpful customer support team can make the bid bond application process smoother and faster. It’s a sign of a reliable company.

- Look for Flexibility with Credit Issues: We’ve come to appreciate companies that offer flexible terms for contractors with varying credit scores. Some providers can still work with you, even if your credit is less than ideal.

- Leverage Online Applications: In our experience, many surety companies offer online applications, allowing you to obtain a bid bond without visiting their office. This can save valuable time and enable you to focus on your project.

Framing Who Benefits from Pennsylvania Bid Bonds

We’ve had the opportunity to work with various parties involved in bid bonds, and we’ve observed that three main groups benefit from this financial tool:

- Project Owners – They are assured that the contractor will follow through on their bid.

- Contractors – By having a bid bond, contractors can compete in public and private bidding projects.

- Surety Companies – These firms provide the bond and hold the contractor accountable if they fail to meet their obligations.

We provide bid bonds in each of the following counties:

Adams

Allegheny

Armstrong

Beaver

Bedford

Berks

Blair

Bradford

Bucks

Butler

Cambria

Cameron

Carbon

Centre

Chester

Clarion

Clearfield

Clinton

Columbia

Crawford

Cumberland

Dauphin

Delaware

Elk

Erie

Fayette

Forest

Franklin

Fulton

Greene

Huntingdon

Indiana

Jefferson

Juniata

Lackawanna

Lancaster

Lawrence

Lebanon

Lehigh

Luzerne

Lycoming

McKean

Mercer

Mifflin

Monroe

Montgomery

Montour

Northampton

Northumberland

Perry

Philadelphia

Pike

Potter

Schuylkill

Snyder

Somerset

Sullivan

Susquehanna

Tioga

Union

Venango

Warren

Washington

Wayne

Westmoreland

Wyoming

York

And Cities:

Philadelphia

Pittsburgh

Harrisburg

Lancaster

Erie

Allentown

Scranton

Bethlehem

Wilkes-Barre

State College

See our Rhode Island Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Key Considerations: Practical Tips for Bid Bonds

Based on our experience, we’ve compiled the following practical advice when thinking about bid bonds in Pennsylvania:

- Check State Requirements: Each state may have specific requirements for bid bonds.

- Assess Your Financial Situation: Surety companies may evaluate your credit score and financial stability.

- Understand the Bid Bond Amount: Ensure the bond covers the required percentage of the total bid.

- Seek Professional Advice: In our view, consulting a professional helps navigate the application process efficiently.

Unveiling the Importance of Surety Bid Bonds

We’ve come across many different types of bid bonds, but the surety bid bond is particularly significant. This bond acts as a promise from a surety company that the contractor will meet their obligations, or the project owner will be compensated. We’ve found that surety bid bonds play a vital role in protecting project owners from unreliable contractors. The surety effectively steps in as a middleman, offering financial reassurance that the project will proceed as planned.

Streamlining the Process of How a Surety Bid Bond Works

Breaking Down the Journey

We’ve often found ourselves explaining the mechanics of surety bid bonds. Here’s a simplified breakdown:

- Submission: The contractor submits the bid, along with a bid bond, to the project owner.

- Selection: If selected, the contractor must honor the bid.

- Obligation: If the contractor refuses the contract, the surety company compensates the project owner for any losses.

- Resolution: The surety then seeks reimbursement from the contractor.

Kickstarting Your Application for a Surety Bid Bond in Pennsylvania

In-Depth Look at the Application Requirements

We’ve been involved in numerous applications for bid bonds in Pennsylvania, and we’ve found that the process typically involves submitting financial statements, credit checks, and a completed application form to the surety provider. Most surety companies require:

- A solid credit score

- Proof of financial stability

- Experience with similar projects

We’ve noticed through our work that contractors with a positive track record often experience fewer challenges during the application process.

Efficiently Navigating the Application Process

In our professional life, we’ve observed that the process of applying for a surety bid bond involves these key steps:

- Initial Consultation: Discuss your project with a surety company.

- Submission of Financial Documents: Provide all necessary financial documentation.

- Underwriting Process: The surety reviews your financials and project details.

- Approval and Issuance: Once approved, you receive your bid bond.

We’ve had firsthand experience with ensuring all documents are in order before the underwriting process begins, which streamlines approval.

Exploring the Costs of a Surety Bid Bond

We’ve consistently observed that bid bonds in Pennsylvania are relatively affordable. Typically, the cost ranges from 1% to 5% of the total bid value. Our experience tells us that factors like the size of the project and the contractor’s financial history play a significant role in determining the cost of the bond. Larger projects and more complex bids generally involve higher bond costs.

Facing the Challenge: Why Your Bid Bond Application Might Be Denied

Key Challenges Leading to Denial

We’ve come across situations where bid bond applications are denied. Common reasons include:

- Poor Credit History: Surety companies evaluate your credit score, and poor ratings could result in a denial.

- Lack of Experience: In our dealings with contractors, we’ve seen that insufficient experience in similar projects can be a red flag.

- Inadequate Financials: Surety companies require financial stability, and any signs of instability may lead to rejection.

- Incomplete Applications: We’ve often noticed that missing documents or incomplete applications can lead to delays or denials.

Wrapping Up: Final Thoughts on Pennsylvania Bid Bonds

We’ve gathered from our experience that bid bonds are a crucial element of the bidding process in Pennsylvania. They protect project owners and provide contractors with the opportunity to showcase their reliability. Whether you're applying for your first bid bond or have extensive experience, working with a reputable surety company ensures a smooth process and increases the likelihood of success. We’ve come to realize that understanding the nuances of bid bonds is key to securing projects and building trust in the construction industry.