You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in Oregon?

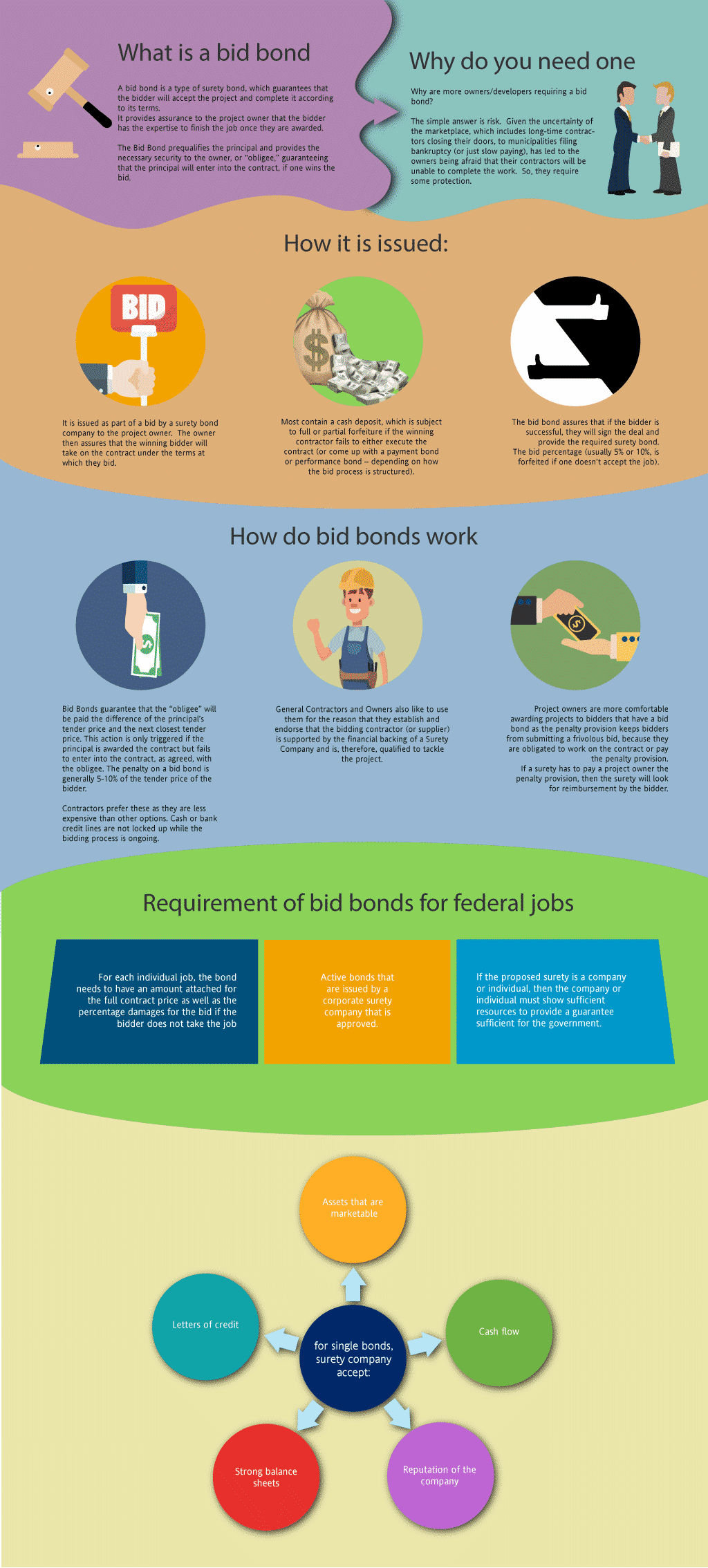

A bid bond is a type of surety bond, that guarantees that the bidder will take the job and complete the contract according to its terms. The bid bond provides assurance to the project owner that the bidder has the ability and ability to complete the job once the bidder is selected after winning the bidding process. The basic reason is that you need one to get the contract. But the bigger question is why are more owners/developers requiring a bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes experienced contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable complete the job. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Oregon Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Oregon?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the contract bond if you get the job. The cost of a surety bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond covering the contract.

How much do bonds cost in OR?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Oregon. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Oregon?

We make it easy to get a contract bid bond. Just click here to get our Oregon Bid Bond Application. Fill it out and then email it and the Oregon bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We thoroughly review all application for bid bonds and then submit it to the surety that we believe will provide the best surety bond for your company. We have a excellent success rate in getting our clients bid bonds at the best rates possible.

Discover What an Oregon Bid Bond Can Do for You

From our perspective, an Oregon Bid Bond is a financial guarantee that plays a pivotal role in the state’s construction and contracting industries. It ensures that if a contractor wins a bid on a public or private project, they will follow through with the contract's terms. We’ve often noticed that this bond protects project owners from losses if the contractor backs out or fails to secure necessary performance bonds. This bond also acts as a safety net for municipalities, as they can quickly move to the next bidder if necessary, without financial loss.

Find the Right Bid Bond Near You: Make an Informed Choice

We’ve come to understand that finding the right Bid Bond in Oregon requires careful consideration. Look for surety companies with a strong reputation for handling contractor bonds. In our opinion, it's crucial to choose a provider with experience in Oregon laws and the specific requirements of local municipalities. Consider their customer service, bond rates, and financial stability.

Locate the Best Bid Bonds in Oregon

Through our own efforts, we’ve discovered that finding the right bond can be as simple as researching online or speaking with your local insurance broker. Many surety bond companies offer online applications, making it easy to secure a bond from the comfort of your office. Additionally, reaching out to construction associations in Oregon may provide leads on trusted bond providers.

Understand Who Gets the Bond in Oregon and Why It Matters

In our professional life, we’ve identified that there are three main parties involved in an Oregon Bid Bond:

- Principal (Contractor): The contractor who is bidding on the project.

- Obligee (Project Owner): The entity, often a public agency, requiring the bond to ensure the contractor will honor the bid.

- Surety: The bond company that guarantees the principal will follow through on their obligations.

Each party plays a crucial role in ensuring the project’s success. We’ve consistently found that understanding this structure helps contractors and project owners navigate the process with confidence.

We provide bid bonds in each of the following counties:

Baker

Benton

Clackamas

Clatsop

Columbia

Coos

Crook

Curry

Deschutes

Douglas

Gilliam

Grant

Harney

Hood River

Jackson

Jefferson

Josephine

Klamath

Lake

Lane

Lincoln

Linn

Malheur

Marion

Morrow

Multnomah

Polk

Sherman

Tillamook

Umatilla

Union

Wallowa

Wasco

Washington

Wheeler

Yamhill

And Cities:

Portland

Salem

Eugene

Bend

Medford

Beaverton

Corvallis

Hillsboro

Albany

Grants Pass

See our Pennsylvania Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Things to Keep in Mind When Securing Bid Bonds

We’ve gathered from our experience that contractors should keep the following in mind when considering Bid Bonds:

- Evaluate Your Bonding Capacity: Make sure your business can handle the bond’s requirements.

- Work with Reputable Sureties: Choose well-established bond companies with a solid track record.

- Understand the Application Process: Be prepared with financial documents and proof of your company’s performance history.

- Consult with Legal Experts: Make sure you fully understand the contract’s terms before bidding.

Unlock the Benefits of a Surety Bid Bond

We’ve realized through our work that a Surety Bid Bond is a type of surety bond specifically used for bidding purposes. It guarantees that the contractor will honor their bid and execute the contract if awarded. If the contractor defaults, the surety steps in to cover any additional costs incurred by the obligee in hiring another contractor.

Learn How a Bid Bond Works in Oregon’s Construction Landscape

From our own observations, a Bid Bond is activated when a contractor wins a bid but fails to follow through on the project. The surety company compensates the project owner, ensuring the project can continue with minimal disruption. We’ve noticed that having this bond in place gives project owners peace of mind, knowing that their project is financially secure.

How to Apply for a Surety Bid Bond in Oregon: Get Started Today

We’ve been in situations where understanding the requirements for an Oregon Bid Bond application can save contractors time and headaches. Typically, contractors need to provide financial statements, credit scores, and project details.

Follow These Steps to Apply for a Bid Bond in Oregon

We’ve gained knowledge from working with Oregon contractors on how to apply for a bid bond:

- Prepare Financial Documents: Submit recent financial statements to prove your company’s financial health.

- Provide Past Project Performance: Demonstrate your ability to complete similar projects.

- Work with a Surety Agent: Find a local agent familiar with Oregon’s laws and regulations.

- Submit the Application: Fill out all forms and await approval from the surety company.

Explore the Cost of Surety Bid Bonds in Oregon

In our observation, the cost of a Surety Bid Bond in Oregon is typically a small percentage of the total project bid, usually ranging between 1% and 5%. We’ve found that larger projects tend to have lower rates, while smaller projects may incur slightly higher costs. The bond premium is often determined by the contractor’s credit score and financial history.

Avoid Bid Bond Denials: Know the Common Pitfalls

We’ve come to notice that several factors can lead to the denial of a bid bond in Oregon. These include:

- Poor Credit History: Contractors with low credit scores may find it difficult to secure a bond.

- Insufficient Financial Statements: A lack of financial transparency can hinder approval.

- Limited Project Experience: If your company has limited experience in similar projects, the surety may see you as a risk.

In our dealings with contractors, we’ve always found that being upfront with financial documents and showing a solid history of completed projects significantly improves the chances of approval.

Concluding Thoughts: Why Bid Bonds Are Critical for Your Next Oregon Project

We’ve been able to determine that Bid Bonds in Oregon are an essential tool for both contractors and project owners. These bonds not only provide financial security but also ensure that the bidding process remains fair and transparent. From our perspective, understanding the nuances of Oregon’s bonding requirements can help contractors bid confidently while project owners can trust that their projects will be completed smoothly. Whether you're a contractor or a project owner, Bid Bonds are a crucial part of safeguarding your investment.