You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

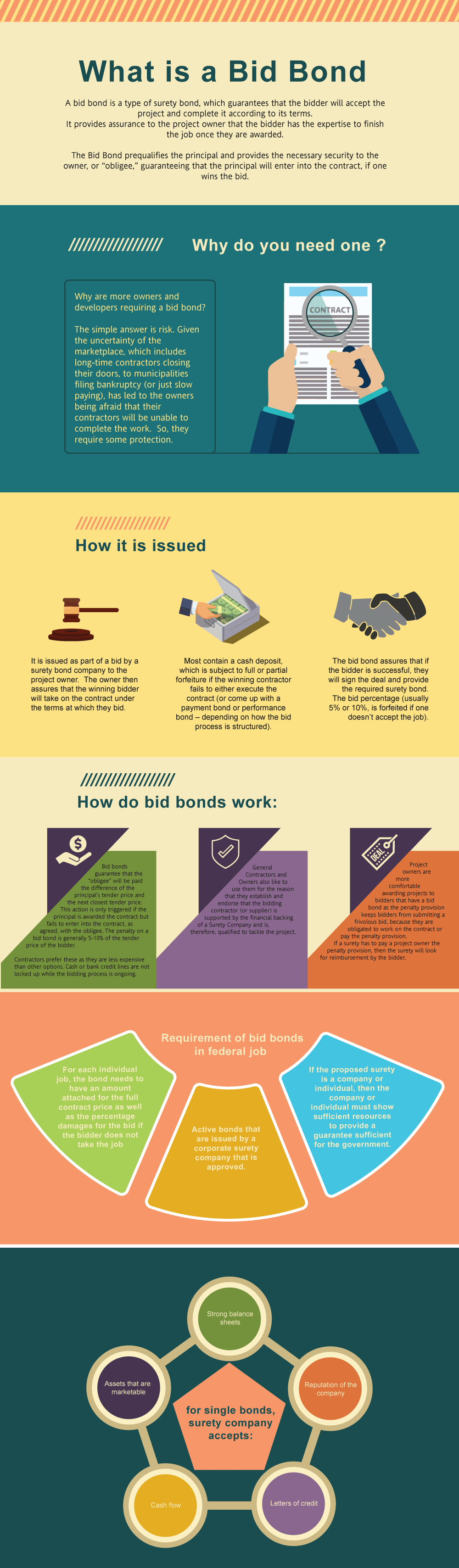

What is a Bid Bond in North Dakota?

A bid bond is one of the types of surety bonds, that guarantees that the bidder will accept the contract and complete the contract according to its terms. The bid bond provides assurance to the project owner that the bidder has the knowhow and wherewithal to finish the job once the bidder is selected after winning the bidding process. The simple reason is that you need one so that you get the work. But the bigger question is why are more owners/developers requiring a bid bond? The answer is risk. Given the uncertainty of the marketplace, which includes long-time contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the job. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our North Dakota Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in North Dakota?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the contract bond if you win the bid. The cost of a surety bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond covering the contract.

How much do bonds cost in ND?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of North Dakota. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in North Dakota?

We make it easy to get a contract bid bond. Just click here to get our North Dakota Bid Bond Application. Fill it out and then email it and the North Dakota bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We will review each and every application for surety bonds and then submit it to the surety that we believe will provide the best bid and P&P bond for your company. We have a very high success rate in getting our clients surety bid bonds at the very best rates possible.

Unveiling the Importance of North Dakota Bid Bonds

When it comes to public projects in North Dakota, a Bid Bond plays a vital role in securing the bidding process. From our perspective, a North Dakota Bid Bond is essentially a guarantee from a surety company that the bidder on a project will enter into the contract and provide the necessary performance bonds if their bid is accepted. These bonds protect the project owner by ensuring that the contractor is financially able to undertake the project and has the backing of a surety company to fulfill the obligations.

Why Does It Matter?

We’ve consistently found that bid bonds are crucial in preventing financial risks. Without this bond, project owners could face significant losses if a bidder fails to commit after winning the bid. This security measure ensures that only serious and capable contractors participate in the bidding process.

Discover How to Find a Bid Bond Near You

Finding a bid bond in North Dakota might seem overwhelming, but it’s easier than you think. What we’ve experienced is that working with a trusted surety bond provider can make a significant difference. Swiftbonds, for instance, is a reliable option that ensures you have a seamless experience while securing a bond.

Aligning with the Right Bid Bond Provider

We’ve been able to determine that not all bond providers are created equal. Key factors to evaluate include the provider’s expertise in North Dakota’s construction laws, their reputation for processing bonds quickly, and their ability to offer competitive rates.

Why Finding the Right Bid Bond Matters

Based on our experience, finding the right provider impacts the ease and speed of your bidding process. By partnering with reputable companies like Swiftbonds, you’ll secure a bond that meets local legal requirements while avoiding delays that could derail your project.

Unveiling Who Receives Bid Bonds in North Dakota

In our observation, the parties involved in receiving a bid bond in North Dakota include:

- The Project Owner – This is the primary beneficiary of the bid bond. We’ve encountered situations where the owner uses the bond to safeguard their interests.

- The Contractor – The contractor obtains the bond as part of their obligation in the bidding process.

- The Surety Provider – As the issuer of the bond, the surety backs the contractor’s ability to fulfill the contract.

Each party plays a critical role in ensuring that the bidding process remains secure and efficient.

We provide bid bonds in each of the following counties:

Adams

Barnes

Benson

Billings

Bottineau

Bowman

Burke

Burleigh

Cass

Cavalier

Dickey

Divide

Dunn

Eddy

Emmons

Foster

Golden Valley

Grand Forks

Grant

Griggs

Hettinger

Kidder

LaMoure

Logan

McHenry

McIntosh

McKenzie

McLean

Mercer

Morton

Mountrail

Nelson

Oliver

Pembina

Pierce

Ramsey

Ransom

Renville

Richland

Rolette

Sargent

Sheridan

Sioux

Slope

Stark

Steele

Stutsman

Towner

Traill

Walsh

Ward

Wells

Williams

And Cities:

Fargo

Bismarck

Grand Forks

Minot

Williston

Dickinson

Mandan

Devils Lake

West Fargo

Watford City

See our Ohio Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Empower Yourself with Practical Tips for Navigating Bid Bonds

We’ve discovered through trial and error that approaching bid bonds strategically can save you time and money. Here are some practical tips:

- Start Early: Begin the bond application process well before bid deadlines to avoid last-minute complications.

- Understand Requirements: Be clear on the bonding requirements for each project to prevent costly delays.

- Choose the Right Surety: Work with experienced surety providers like Swiftbonds for expert guidance.

Unboxing Surety Bid Bonds: Your Key to Bidding Success

We’ve learned that a Surety Bid Bond is a type of bond provided by a surety company to guarantee that a contractor will accept a project if awarded. In our dealings with surety bonds, we’ve come across how critical these bonds are for protecting project owners and ensuring contractors are serious contenders.

How Surety Bid Bonds Work: Streamlining the Process

In our experience, surety bid bonds work in the following way:

- Bid Submission: Contractors submit the bid bond along with their bid proposal.

- Guarantee: The bond guarantees that if the contractor wins, they will honor the contract.

- Surety Responsibility: If the contractor fails to follow through, the surety covers the costs.

Journey Through the Steps to Apply for a Surety Bid Bond in North Dakota

We’ve been involved in numerous bond applications, and we’ve come to see that the process is straightforward:

- Submit Application: Complete a detailed application with a reputable surety provider.

- Provide Financial Documents: You’ll need to submit financial statements, project details, and other relevant documentation.

- Surety Review: The surety evaluates your financial health and project scope.

- Approval: Once approved, you’ll receive your bid bond.

Unveiling the Requirements for Applying in North Dakota

We’ve noticed that requirements in North Dakota may include specific financial thresholds, as well as adherence to state construction laws, which vary depending on the project’s size and type.

Challenge the Cost of Bid Bonds in North Dakota

From what we’ve seen, the price of a surety bid bond in North Dakota typically ranges from 1% to 3% of the total bid amount. Factors influencing the cost include the contractor’s financial standing, the project size, and the surety provider’s risk assessment.

Can Your Bid Bond Application Be Denied? Uncover the Possibilities

We’ve personally witnessed instances where bid bond applications are denied due to the following reasons:

- Poor Credit History: We’ve often noticed that contractors with financial instability may face challenges.

- Inadequate Documentation: Missing or incomplete paperwork can lead to denial.

- High Project Risk: If the project is deemed too risky, sureties may reject the bond.

What to Do If Your Application is Denied

We’ve come across instances where denials occur, and what we’ve learned is that addressing the reason for denial promptly is critical. Work on improving credit scores or re-evaluating your documentation.

Elevate Your Chances of Avoiding Bid Bond Denials

In our view, taking proactive steps like maintaining a solid financial history and working with an experienced surety provider can help you avoid common pitfalls during the application process.

Concluding Thoughts: Elevating Your Confidence in Securing North Dakota Bid Bonds

We’ve gathered from our experience that bid bonds are an essential component in securing public contracts in North Dakota. By understanding the application process, choosing the right provider, and avoiding common pitfalls, you can navigate the bond process with ease. Whether you’re new to the world of bid bonds or a seasoned contractor, securing the right bid bond with a trusted provider like Swiftbonds will ensure your projects start on solid ground.