You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

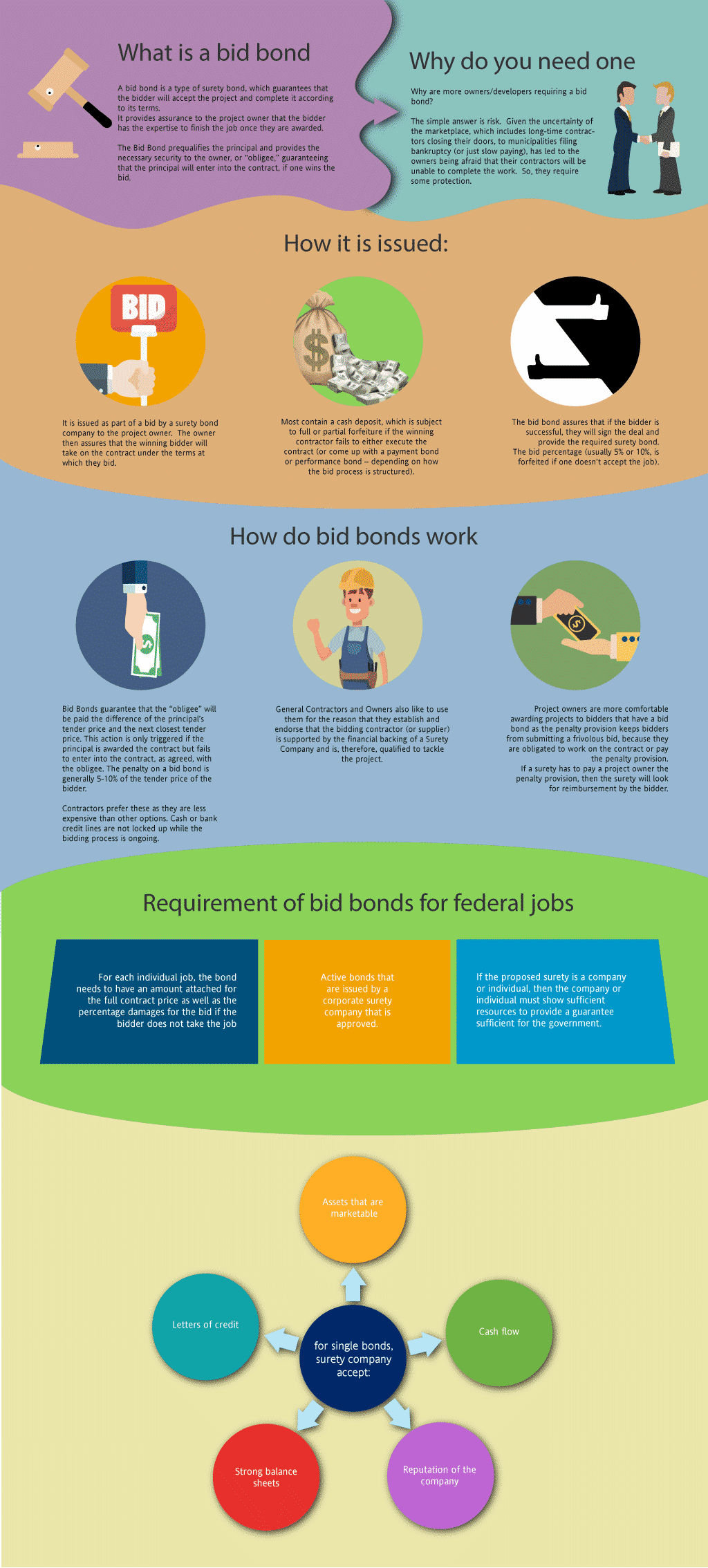

What is a Bid Bond in North Carolina?

A bid bond is a type of surety bond, which guarantees that the bidder will enter into the agreement and complete the agreement according to its terms. The bid bond provides assurance to the project owner that the bidder has the expertise and ability to finish the job once the bidder is selected after winning the bid. The basic reason is that you need one in order to get the job. However, the larger question is why are more owners/developers requiring a surety bid bond? The basic answer is risk. Given the uncertainty of the marketplace, which includes long-term contractors going out of business, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the job. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our North Carolina Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in North Carolina?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a performance bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a performance bond.

How much do bonds cost in NC?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of North Carolina. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in North Carolina?

We make it easy to get a contract bid bond. Just click here to get our North Carolina Bid Bond Application. Fill it out and then email it and the North Carolina bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review all application for bid and P&P bonds and then submit it to the surety that we believe will provide the best surety bond for your job. We have a high success rate in getting our clients bid and performance bonds at the best rates possible.

In-depth Look at What a North Carolina Bid Bond Is

From our experience, a bid bond in North Carolina is a form of surety bond that ensures that contractors are financially able to fulfill their contract obligations. If a contractor fails to sign the contract or provide the required performance and payment bonds after winning the bid, the project owner can claim against the bid bond to recover their losses. We’ve consistently found that these bonds protect the project owner from financial risk while also ensuring that contractors have a serious commitment to their bids.

Unveil the Search Results for Finding a Bid Bond Near You

Unwrapped Factors to Consider

When searching for a bid bond provider in North Carolina, we’ve realized that not all providers offer the same level of service or coverage. It’s essential to consider factors such as the bond provider’s reputation, financial stability, and customer service. We’ve often noticed that local expertise is valuable, as North Carolina’s bond requirements can sometimes differ from those in other states. It’s also important to look for a provider that can issue bonds quickly, as bidding timelines can be tight.

Streamline Your Search: Step-by-Step Guide to Locating a Bid Bond Provider

- Research Online: Start by searching for surety bond companies that specialize in North Carolina construction projects.

- Compare Providers: We’ve found through experience that it’s beneficial to get quotes from multiple providers to compare rates and services.

- Check Reviews: Look for feedback from contractors who have worked with the provider to ensure they have a positive track record.

- Contact Providers: Once you’ve narrowed down your choices, reach out to the companies for detailed information about their bid bond process.

- Apply Online or In-Person: Many providers offer online applications, making the process smoother and more efficient.

Discover Who Receives a Bid Bond in North Carolina

We’ve consistently observed that three main parties are involved in any bid bond agreement in North Carolina:

- Project Owner: The entity requiring the bond for protection. This could be a government agency or private company.

- Contractor: The party obtaining the bid bond to demonstrate their financial capability and intention to fulfill the contract.

- Surety Company: The financial institution or bond provider that guarantees the contractor’s performance.

We provide bid, performance and payment bonds in each of the following counties:

Alamance

Alexander

Alleghany

Anson

Ashe

Avery

Beaufort

Bertie

Bladen

Brunswick

Buncombe

Burke

Cabarrus

Caldwell

Camden

Carteret

Caswell

Catawba

Chatham

Cherokee

Chowan

Clay

Cleveland

Columbus

Craven

Cumberland

Currituck

Dare

Davidson

Davie

Duplin

Durham

Edgecombe

Forsyth

Franklin

Gaston

Gates

Graham

Granville

Greene

Guilford

Halifax

Harnett

Haywood

Henderson

Hertford

Hoke

Hyde

Iredell

Jackson

Johnston

Jones

Lee

Lenoir

Lincoln

McDowell

Macon

Madison

Martin

Mecklenburg

Mitchell

Montgomery

Moore

Nash

New Hanover

Northampton

Onslow

Orange

Pamlico

Pasquotank

Pender

Perquimans

Person

Pitt

Polk

Randolph

Richmond

Robeson

Rockingham

Rowan

Rutherford

Sampson

Scotland

Stanly

Stokes

Surry

Swain

Transylvania

Tyrrell

Union

Vance

Wake

Warren

Washington

Watauga

Wayne

Wilkes

Wilson

Yadkin

Yancey

And Cities:

Charlotte

Raleigh

Greensboro

Wilmington

Asheville

Durham

Fayetteville

Winston-Salem

Cary

Chapel Hill

See our North Dakota Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Practical Gem: Key Advice for Bid Bonds in North Carolina

We’ve gathered from our experience a few essential tips to consider when dealing with bid bonds in North Carolina:

- Read the Contract Requirements Carefully: Ensure that the bond covers the exact amount required by the project.

- Choose a Reliable Surety: Opt for a well-established surety company with experience in your industry.

- Organize Financial Documents: We’ve noticed that many contractors get delayed in obtaining their bid bonds due to incomplete financial statements.

- Plan for Timing: Apply for your bond well ahead of the bid deadline to avoid any last-minute issues.

Explore the World of Surety Bid Bonds

A surety bid bond serves as a promise that the contractor will not withdraw their bid or refuse to sign the contract if awarded. We’ve had firsthand experience with these bonds in North Carolina, and what we’ve learned is that surety bid bonds ensure the integrity of the bidding process, giving project owners confidence that contractors are serious about their proposals.

Unbox How a Surety Bid Bond Works in North Carolina

In our professional life, we’ve observed that surety bid bonds work by involving three parties—the principal (contractor), the obligee (project owner), and the surety (bond provider). When the contractor wins the bid but fails to fulfill the contract’s requirements, the project owner can make a claim against the bond. Based on our experience, this mechanism protects project owners from financial losses and prevents contractors from submitting frivolous bids.

Journey Through the Application Process for a Surety Bid Bond in North Carolina

Unwrapping the Application Process

The process for applying for a bid bond in North Carolina typically involves submitting financial documents, such as balance sheets and profit and loss statements, to demonstrate the contractor’s financial health. In our dealings with contractors, we’ve seen that surety companies use this information to assess the risk of issuing the bond. The stronger the financials, the more favorable the bond terms.

Wrapping Up the Steps to Apply

- Prepare Financials: From what we’ve seen, contractors must present comprehensive financial statements.

- Submit Application: We’ve observed that this step involves filling out an online or paper form with project and financial details.

- Underwriting Process: The surety reviews the contractor’s financial health, industry experience, and capacity to complete the project.

- Issuance of the Bond: Once approved, the bond is issued to the contractor, allowing them to submit their bid.

Reasonable Pricing: How Much Does a Surety Bid Bond Cost in North Carolina?

From our perspective, the cost of a bid bond in North Carolina is generally a small percentage of the total contract value, typically ranging from 1% to 3%. However, we’ve come across situations where the cost may vary depending on the contractor’s financial stability and the size of the project. We’ve consistently observed that larger, more financially stable contractors often pay less for their bonds compared to smaller contractors with limited financial resources.

Unveil the Possibility: Can Your Bid Bond Be Denied?

We’ve had occasions where bid bonds were denied due to a few key reasons:

- Poor Credit History: We’ve personally dealt with contractors who faced difficulties because of bad credit.

- Lack of Financial Stability: Surety companies tend to reject applications from contractors who do not demonstrate sufficient financial strength.

- Incomplete Applications: Based on our experience, we’ve noticed that incomplete or inaccurate applications often result in denial.

While North Carolina may have its own nuances in the bonding process, the factors leading to denial are often universal across different regions.

Wrapping Up Our Thoughts on Bid Bonds in North Carolina

In our view, bid bonds are an essential component of the bidding process in North Carolina, offering security to project owners and ensuring only qualified contractors participate. Whether you’re new to bid bonds or have been through the process before, it’s crucial to understand the steps, costs, and requirements. By following the practical advice outlined above, you can enhance your chances of success and avoid potential pitfalls.

We’ve come to the conclusion that staying informed about evolving surety bond requirements, especially in states like North Carolina, is essential for any contractor aiming to succeed in today’s competitive market.

Learn more on what is the purpose of a bid bond.