You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in New Mexico?

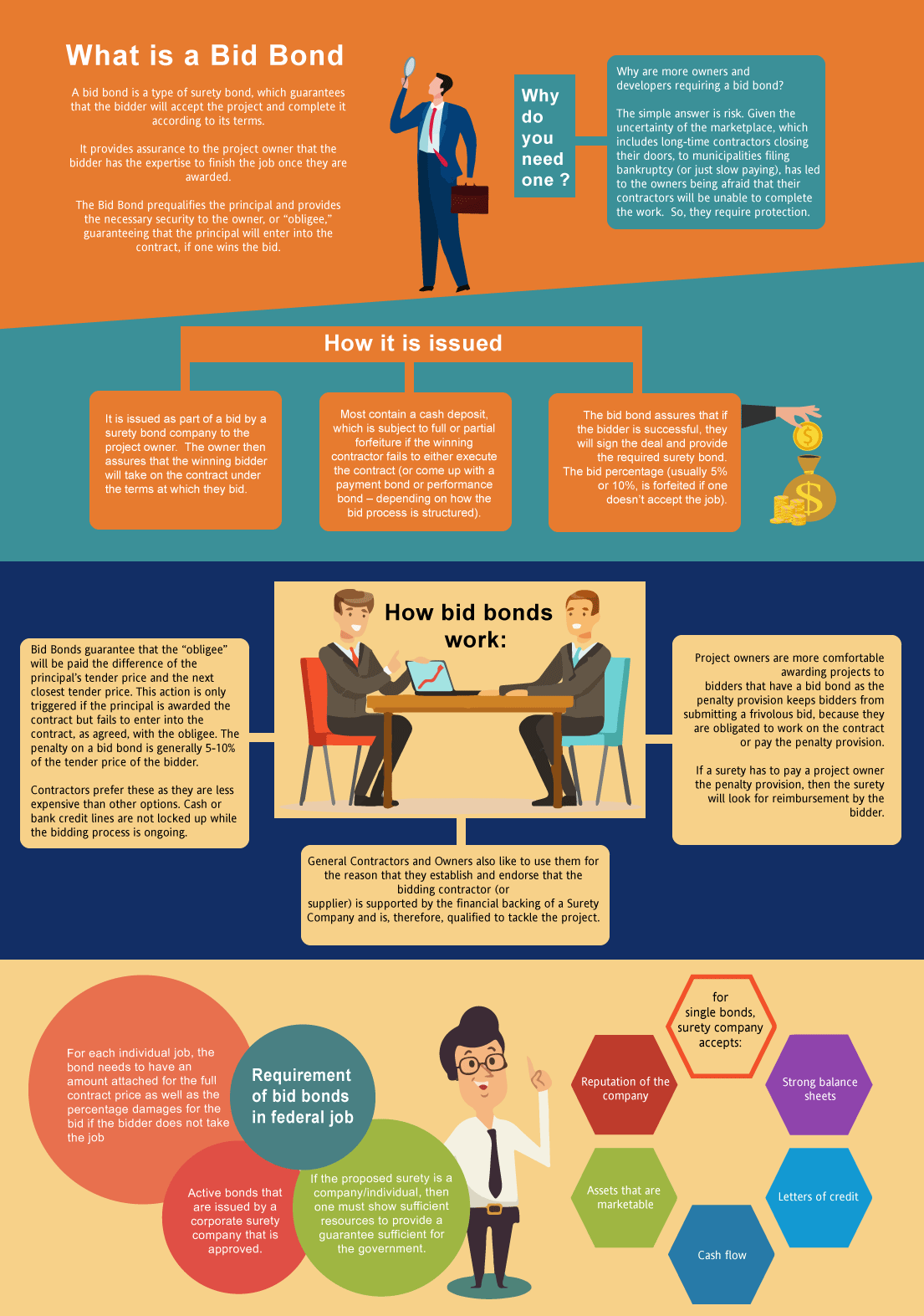

A bid bond is one of the types of surety bonds, that guarantees that the bidder will accept the project and complete the agreement according to its terms. It provides assurance to the project owner that the bidder has the expertise and capability to complete the job once you are selected after winning the bid. The basic reason is that you need one to get the job. However, the larger question is why are more owners/developers requiring a surety bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes long-time contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to finish the job. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our New Mexico Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in New Mexico?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a P&P bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in NM?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of New Mexico. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in New Mexico?

We make it easy to get a contract bid bond. Just click here to get our New Mexico Bid Bond Application. Fill it out and then email it and the New Mexico bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for bid and P&P bonds and then submit it to the surety that we believe will provide the best bid and P&P bond for your contract. We have a great success rate in getting our clients bid bonds at the best rates possible.

Unfolding the Essentials of Bid Bonds in New Mexico: What You Need to Know

Understanding the New Mexico Bid Bond

In our observation, a bid bond in New Mexico is a crucial safeguard for public projects and private ventures alike. Essentially, this bond ensures that contractors who submit bids on construction or service projects are financially backed to follow through. If the contractor fails to begin the project after being awarded the bid, the bond covers any losses or additional costs incurred. We’ve noticed that bid bonds play a pivotal role in maintaining trust and accountability within the bidding process, making it essential for contractors and project owners alike.

Bridge Your Way to Finding a Bid Bond Near You

From what we’ve seen, finding a reliable bid bond provider in New Mexico involves thorough research and comparing several options. Many surety companies across the state offer competitive rates, but selecting the right one depends on your specific needs, project size, and financial standing. Most contractors benefit from working with a surety company that understands the nuances of local laws and regulations. We’ve consistently found that reaching out to local construction associations or financial institutions can streamline this process and help you secure a bond more efficiently.

Who Can Mold the Application for a Bid Bond in New Mexico?

We’ve discovered through experience that bid bonds are typically sought by contractors, developers, and construction companies. In New Mexico, any party participating in the bidding process for public or private projects may need a bid bond to demonstrate their credibility. Here are some of the key applicants:

- General Contractors – They often secure bid bonds to participate in large-scale construction projects.

- Subcontractors – In some cases, subcontractors might also need to apply for bid bonds to demonstrate reliability in their respective trades.

- Project Owners – Occasionally, project owners might require a bond from potential bidders to ensure financial security for their projects.

We’ve come to appreciate that each of these parties benefits from having a bid bond in place as it helps prevent financial risks and potential project delays.

We provide bid bonds bonds in each of the following counties:

Bernalillo

Catron

Chaves

Cibola

Colfax

Curry

De Baca

Dona Ana

Eddy

Grant

Guadalupe

Harding

Hidalgo

Lea

Lincoln

Los Alamos

Luna

McKinley

Mora

Otero

Quay

Rio Arriba

Roosevelt

Sandoval

San Juan

San Miguel

Santa Fe

Sierra

Socorro

Taos

Torrance

Union

Valencia

And Cities:

Albuquerque

Santa Fe

Las Cruces

Roswell

Farmington

Carlsbad

Taos

Hobbs

Gallup

Ruidoso

See our New York Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Instigate Success: Practical Advice for Navigating Bid Bonds

In our professional life, we’ve found that keeping a few key tips in mind can make the bid bond process smoother:

- Work with a Trusted Surety Company – Partner with companies that have experience with bid bonds and a track record of reliability.

- Understand the Project Requirements – Read through all project bid requirements to ensure you meet every stipulation before applying for the bond.

- Maintain a Strong Financial Profile – Surety companies assess your financial health, so having stable financials will make the approval process easier.

- Plan Ahead – Securing a bond can take time, so plan well in advance of project deadlines.

Illuminate the Purpose of a Surety Bid Bond

We’ve learned that a surety bid bond acts as a financial guarantee provided by a surety company on behalf of a contractor bidding on a project. This bond ensures that, if the contractor wins the bid, they will enter into a contract and fulfill the obligations. We’ve been through countless bonding processes, and we’ve realized that these surety bonds are essential in maintaining project timelines and mitigating financial risks.

Elevating Your Understanding: How Does a Surety Bid Bond Work?

In our experience, the way bid bonds function can be broken down into a few essential steps:

- Step 1: Bid Submission – The contractor applies for a bid bond from a surety company and submits it alongside their project bid.

- Step 2: Bond Guarantee – The surety company guarantees that the contractor will honor their bid and, if selected, enter into a contract.

- Step 3: Compensation – If the contractor fails to honor the bid or contract, the surety compensates the project owner up to the bond’s amount.

We’ve consistently found that having a clear understanding of how these bonds operate is crucial for contractors aiming to build trust and win projects.

Initiating the Process: How to Apply for a Surety Bid Bond in New Mexico

Based on our experience, the application process for a surety bid bond in New Mexico generally involves the following steps:

- Submit an Application – You’ll need to provide financial statements, project details, and personal/business information.

- Underwriting Process – The surety will review your financial health and experience to determine your risk level.

- Receive Approval – Once approved, you will be issued a bid bond to include with your bid package.

Application Requirements

We’ve noticed that most surety companies will require you to meet specific criteria, including:

- Proof of financial stability

- A strong credit score

- Experience in similar projects

- Business licenses and relevant certifications

These requirements, as we’ve encountered, ensure that the contractor can fulfill the obligations of the contract should they win the bid.

Invigorating the Price Discussion: How Much Does a Surety Bid Bond Cost?

We’ve been involved in many bid bond applications, and pricing typically varies. The cost is usually a small percentage of the total project bid, often ranging from 1% to 5%. From our perspective, factors such as the project size, your credit history, and the surety’s risk assessment can all impact the final price. It’s essential to get multiple quotes to ensure you’re receiving the most competitive rate for your bond.

Is There a Risk of Denial? Realigning Your Expectations

We’ve encountered situations where a contractor’s application for a bid bond was denied. Some common reasons include:

- Poor Credit History – Surety companies often look closely at your credit score.

- Lack of Experience – If you lack experience in similar projects, you may be seen as a higher risk.

- Financial Instability – Weak financial statements can raise red flags during the underwriting process.

Avoiding Denial

We’ve found through experience that being proactive helps in avoiding denial:

- Improve Your Credit Score – Work on strengthening your credit well before you apply.

- Demonstrate Experience – Highlight previous successful projects that align with the bid requirements.

- Prepare Your Financial Statements – Ensure your financials are in order and reflect stability.

Concluding Thoughts: Cultivating Confidence with New Mexico Bid Bonds

In our view, bid bonds are an essential part of the construction landscape in New Mexico. They not only protect project owners but also provide contractors with the credibility needed to win bids. We’ve come to understand that being well-prepared with strong financials, a solid credit score, and experience will significantly improve your chances of securing a bid bond. With the right approach and knowledge, navigating the bid bond process can be a smooth and rewarding experience.

Contact us for New Mexico bonds.