You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in New Jersey?

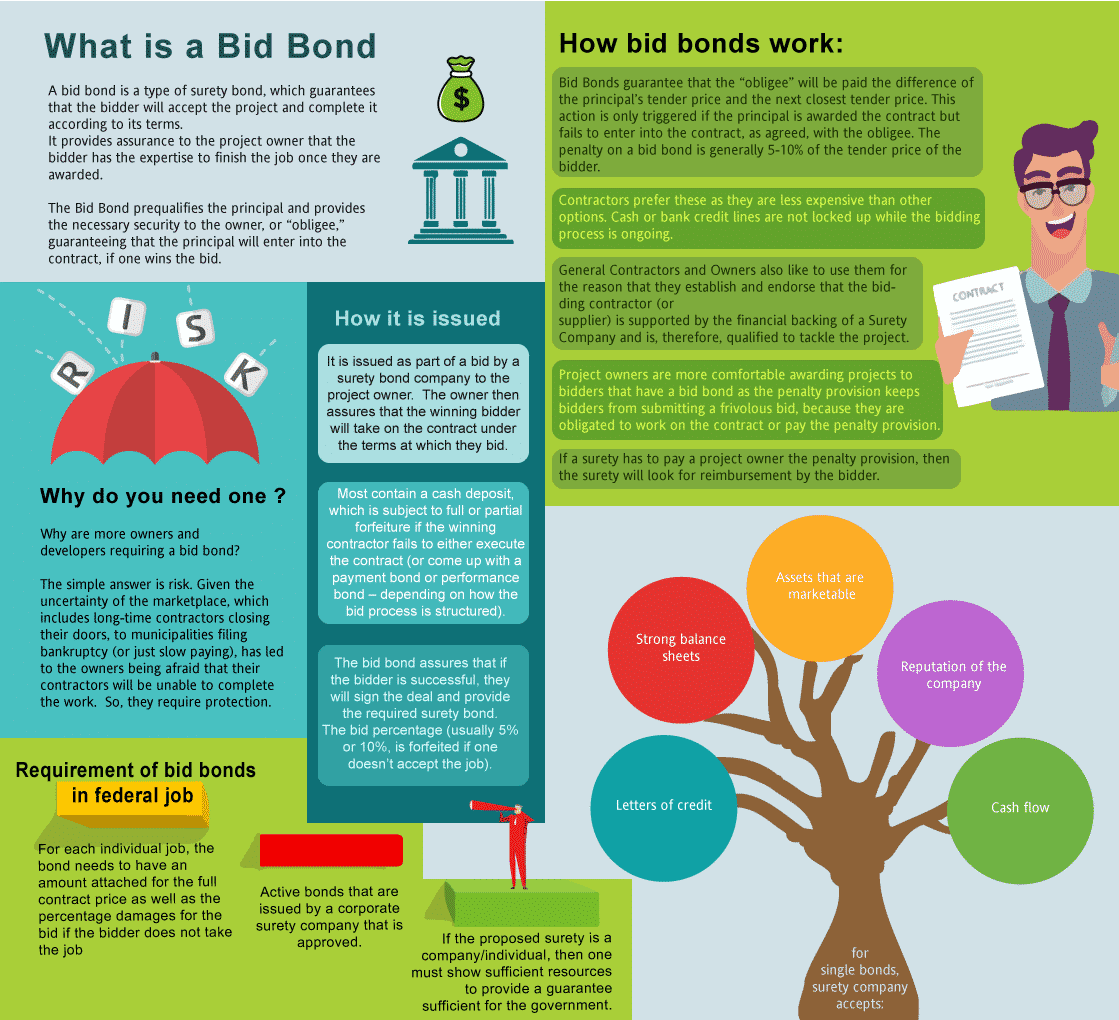

A bid bond is a type of surety bond, which guarantees that the bidder will accept the contract and complete the contract according to its terms. The bid bond provides assurance to the project owner that the bidder has the expertise and ability to finish the job once you are selected after the bidding process. The simple reason is that you need one to get the job. However, the bigger question is why are more owners/developers requiring a surety bid bond? The simply explanation is risk. Given the uncertainty of the marketplace, which includes long-term contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable complete the work. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our New Jersey Bid Bond Application

bid bond? - This is an infographic image explaining what is a bid bond with a guy holding a contract, red umbrella, shapes and dollar logo on multi colored background." width="1119" height="1020" />

bid bond? - This is an infographic image explaining what is a bid bond with a guy holding a contract, red umbrella, shapes and dollar logo on multi colored background." width="1119" height="1020" />

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in New Jersey?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the bond on the contract if you get the job. The cost of a surety bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a contract bond.

How much do bonds cost in NJ?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of New Jersey. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in New Jersey?

We make it easy to get a contract bid bond. Just click here to get our New Jersey Bid Bond Application. Fill it out and then email it and the New Jersey bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We thoroughly review each and every application for surety bonds and then submit it to the surety that we believe will provide the best bid and P&P bond for your company. We have a very high success rate in getting our clients bid bonds at the best rates possible.

Transcend the Basics: Understanding New Jersey Bid Bonds

In our experience, bid bonds transcend simple contractual requirements in New Jersey, becoming an essential safety net in the construction and contracting world. These bonds protect project owners, ensuring that contractors will follow through with their bids and contractual commitments. We've found that understanding the importance of bid bonds can significantly elevate the bidding process for contractors and project owners alike.

The Core Elements of a New Jersey Bid Bond

From our perspective, the core of a New Jersey bid bond involves three primary parties: the obligee, the principal, and the surety. Each plays a critical role in maintaining the integrity of the bidding process. We've observed that when these parties synchronize their responsibilities, it leads to successful project outcomes.

Why Bid Bonds Matter for Contractors

We’ve encountered numerous instances where bid bonds serve as a trust mechanism between project owners and contractors. We've come to believe that the financial backing provided by the surety reassures project owners, making contractors with bid bonds more attractive.

Empathize with Your Search: Finding a Bid Bond Near You

We've noticed that finding a local bid bond provider can feel overwhelming, especially when deadlines are looming. From what we've experienced, connecting with agents who understand the specific needs of New Jersey contractors can ease the process. Empathizing with your challenges, many providers offer streamlined online options to help you get your bid bond efficiently.

Local vs. Online Providers

In our observation, contractors benefit from both local and online surety bond providers. While local agents may offer a personal touch, we’ve consistently found that online options provide speed and convenience, especially for urgent projects. We’ve had firsthand experience with both, and we recommend choosing the provider that best aligns with your timeline and comfort level.

Ignite Your Knowledge: Who Benefits from Bid Bonds in New Jersey?

In our view, bid bonds ignite security for all parties involved in a contract. The obligee (project owner), principal (contractor), and surety (bonding company) each play critical roles. We've seen firsthand how this structured partnership ensures the project's success, with each party contributing to the integrity of the contract.

The Role of the Obligee

The obligee, often a project owner or government entity, demands the bid bond to protect against losses if the contractor fails to fulfill their commitment. From our dealings with public and private contracts, we’ve observed that this layer of protection allows obligees to feel secure in their selection process.

How the Principal and Surety Collaborate

We’ve worked closely with both contractors (principals) and surety companies and learned that their collaboration is key to the successful execution of the project. The surety guarantees the contractor’s bid, which adds weight to the principal's proposal and builds confidence with the project owner.

We provide bid bonds in each of the following counties:

Atlantic

Bergen

Burlington

Camden

Cape May

Cumberland

Essex

Gloucester

Hudson

Hunterdon

Mercer

Middlesex

MoNJouth

Morris

Ocean

Passaic

Salem

Somerset

Sussex

Union

Warren

And Cities:

Newark

Jersey City

Trenton

Princeton

Paterson

Toms River

Atlantic City

Morristown

Cherry Hill

Clifton

Montclair

See our New Mexico Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Practical Steps to Actualize Your Bid Bond Success

We’ve often found that contractors need actionable advice when considering a bid bond. In our dealings with surety bonds, we've identified key points to actualize your success:

- Understand the bond’s terms before agreeing

- Evaluate your financial situation to secure favorable rates

- Partner with reputable sureties for seamless transactions

Revolutionize Your Approach to Surety Bid Bonds

From our perspective, revolutionizing the way contractors approach surety bid bonds is essential. These bonds provide a financial guarantee from the surety company to the obligee, creating a solid foundation for project execution. We've been involved in numerous cases where this level of protection revolutionized the project's outlook for all stakeholders.

Sculpt Your Strategy: How Bid Bonds Work

We've sculpted a step-by-step guide to help you navigate how bid bonds function in New Jersey:

- Submit your bid alongside a bid bond.

- The obligee evaluates all bids, including bond-backed ones.

- If awarded, the surety ensures the contractor fulfills their obligations.

Curate a Smooth Application Process for a Surety Bid Bond in New Jersey

Curating the right approach for applying for a surety bid bond involves key steps. We’ve found through experience that contractors can streamline the process by:

- Submitting accurate financial reports.

- Highlighting successful past projects.

- Demonstrating creditworthiness.

Elevate Your Budget: The Price of a Bid Bond

From our perspective, understanding the cost of a bid bond can elevate your planning. While bid bonds are affordable, typically costing between 1% and 5% of the total bid amount, factors like financial stability and project size influence the final price. We've concluded that being prepared for these costs ensures smooth project bidding.

Reimagine the Possibility of Being Denied a Bid Bond

We've reimagined the reasons contractors may face bid bond denials. In our practice, we’ve identified common hurdles:

- Poor credit history

- Inexperience in handling large projects

- Weak financials

To avoid denial, we’ve often advised contractors to build their financial strength and track record over time.

Reawaken Your Perspective on New Jersey Bid Bonds

In our professional life, we’ve reawakened to the essential role bid bonds play in the New Jersey construction landscape. These bonds safeguard project owners and elevate contractors’ reputations. Through our own work, we've come to appreciate that securing bid bonds not only protects all parties but also enriches the overall contracting process.