You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

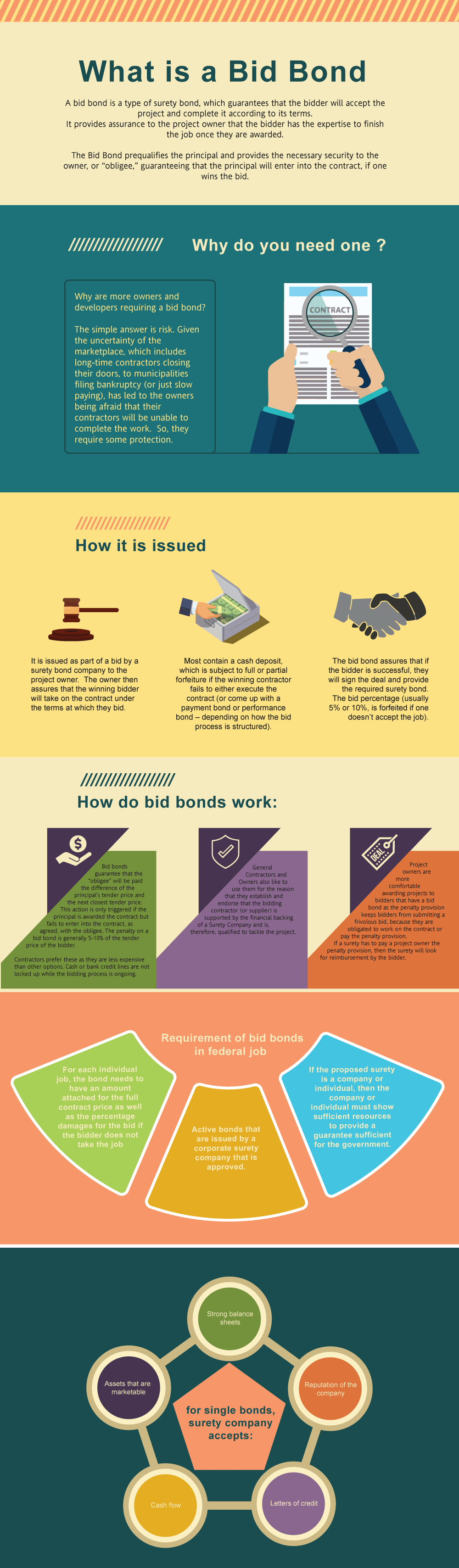

What is a Bid Bond in New Hampshire?

A bid bond is one of the types of surety bonds, which guarantees that the bidder will enter into the agreement and complete the agreement according to its terms. It provides assurance to the project owner that the bidder has the ability and wherewithal to finish the job once the bidder is selected after winning the bid. The simple reason is that you need one so that you get the contract. However, the larger question is why are more owners/developers requiring a bid bond in the first place? The answer is risk. Given the uncertainty of the marketplace, which includes long-time contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our New Hampshire Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in New Hampshire?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the contract bond if you get the job. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in NH?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of New Hampshire. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in New Hampshire?

We make it easy to get a contract bid bond. Just click here to get our New Hampshire Bid Bond Application. Fill it out and then email it and the New Hampshire bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We thoroughly review each and every application for bid bonds and then submit it to the surety that we believe will provide the best bid and P&P bond for your job. We have a high success rate in getting our clients bid bonds at the best rates possible.

Revolutionize Your Understanding of a New Hampshire Bid Bond

In our experience, a New Hampshire bid bond is a pivotal tool in the construction and contracting industry. It guarantees that a contractor will honor their bid if awarded a project. Essentially, it acts as a safeguard for project owners, ensuring that contractors are serious about their proposals. We've often noticed that these bonds protect against financial loss if a contractor fails to commit after winning the bid.

Elevating Trust and Security in New Hampshire Projects

We’ve observed that these bonds not only provide financial protection but also elevate the level of trust between project owners and contractors. By utilizing a bid bond, contractors prove their reliability and commitment to completing the project as specified. This heightened trust leads to smoother project execution and better working relationships.

Amplify Your Search for a Bid Bond Near You

We’ve come to understand that finding a trusted bid bond provider in New Hampshire is crucial for a smooth bidding process. Many local surety bond companies offer tailored solutions to contractors and developers. In our opinion, searching for a provider who understands state-specific regulations and has a proven track record can save time and ensure compliance. We've consistently observed that proximity and personalized service are key factors when selecting the right provider.

Innovate Your Approach to Bond Shopping

We’ve found that modern technology has revolutionized how contractors can search for bid bonds. Online platforms now allow contractors to compare providers, check rates, and submit applications with ease. This innovation empowers contractors to make informed decisions, ensuring they get the best bond service tailored to their needs.

Who Benefits From Bid Bonds in New Hampshire?

Based on our experience, multiple parties benefit from bid bonds in New Hampshire, including:

Empower Project Owners with Financial Security

We’ve noticed that project owners gain peace of mind, knowing that the contractor is financially backed to follow through.

Elevate Contractors’ Credibility

From what we’ve seen, contractors benefit because it enhances their credibility, increasing their chances of winning the bid.

Synergize Surety Companies with Qualified Contractors

In our view, surety companies take on the financial risk, making it crucial for them to work with qualified contractors.

Breathe New Life into Construction Relationships

We’ve noticed through our work that bid bonds foster positive relationships between all parties involved in a project. By aligning the interests of contractors, project owners, and surety companies, bid bonds create a framework of accountability and mutual trust, making projects run more smoothly from start to finish.

We provide bid bonds bonds in each of the following counties:

Belknap

Carroll

Cheshire

Coos

Grafton

Hillsborough

Merrimack

Rockingham

Strafford

Sullivan

And Cities:

Manchester

Nashua

Concord

Portsmouth

Keene

Derry

Merrimack

Rochester

Lebanon

Exeter

See our New Jersey Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Cultivate Success with These Practical Bid Bond Tips

Through our own efforts, we’ve identified several tips that can make the process of securing bid bonds smoother:

- Start Early: We've often found that beginning the application process well before the bid deadline avoids unnecessary stress.

- Check Your Credit: We've realized that a strong credit score increases your chances of approval and can lower your bond cost.

- Choose a Reputable Surety: We’ve discovered through experience that working with a well-known surety provides additional security and smooth communication.

- Keep Your Paperwork Ready: In our observation, having all documentation in order (like financial statements) accelerates the process.

Ignite Your Knowledge of How Surety Bid Bonds Work

We’ve come across that surety bid bonds are three-party agreements between the contractor (principal), the project owner (obligee), and the surety company. In our professional life, we’ve observed that the surety company guarantees that the contractor will fulfill the terms of the bid or compensate the obligee if they don’t. Essentially, the surety steps in to provide financial protection for the project owner, creating a safety net in case of non-performance.

Optimize the Application Process for Surety Bid Bonds in New Hampshire

In our dealings with bid bonds, the application process can be broken down into these key steps:

- Gather Documentation: We’ve found that financial statements, business records, and credit information are crucial.

- Submit Application: We've consistently observed that filling out the surety’s application with accurate details ensures a smoother process.

- Underwriting: In our experience, this is where the surety assesses risk. We've often seen that factors like the contractor's financial history and project details are thoroughly evaluated.

- Approval and Issuance: Once the surety approves, the bond is issued, and the contractor is ready to submit their bid.

Chart the Costs of a Surety Bid Bond in New Hampshire

We’ve gathered from our experience that the cost of a surety bid bond depends on several factors, including the size of the bid and the contractor’s financial strength. Typically, we’ve observed that bid bond costs range from 1% to 5% of the contract value. However, for smaller bids, the cost may be a flat fee. In our observation, having solid financials and a good credit score can lead to lower costs.

Unveil the Reasons You Could Be Denied a Bid Bond

We’ve been in situations where denial of a bid bond occurred, often due to the following reasons:

- Poor Credit History: We’ve learned that surety companies are cautious about contractors with a history of defaults or financial instability.

- Incomplete Documentation: We’ve encountered cases where incomplete applications or missing paperwork led to denials.

- Insufficient Experience: We've seen firsthand that contractors lacking experience with similar projects can be deemed too risky by sureties.

- Financial Instability: In our practice, surety companies scrutinize financial records closely, and a shaky financial history can be a red flag.

Embolden Your Bid Strategy with Bid Bonds in New Hampshire

From our perspective, bid bonds in New Hampshire are essential for anyone involved in public or large-scale construction projects. They provide security and build trust between contractors and project owners. In our view, understanding the bid bond process and taking proactive steps, like maintaining good financial health, can significantly increase the chances of approval. By choosing the right surety and following a methodical approach, you can set your construction business up for success.