You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in Missouri?

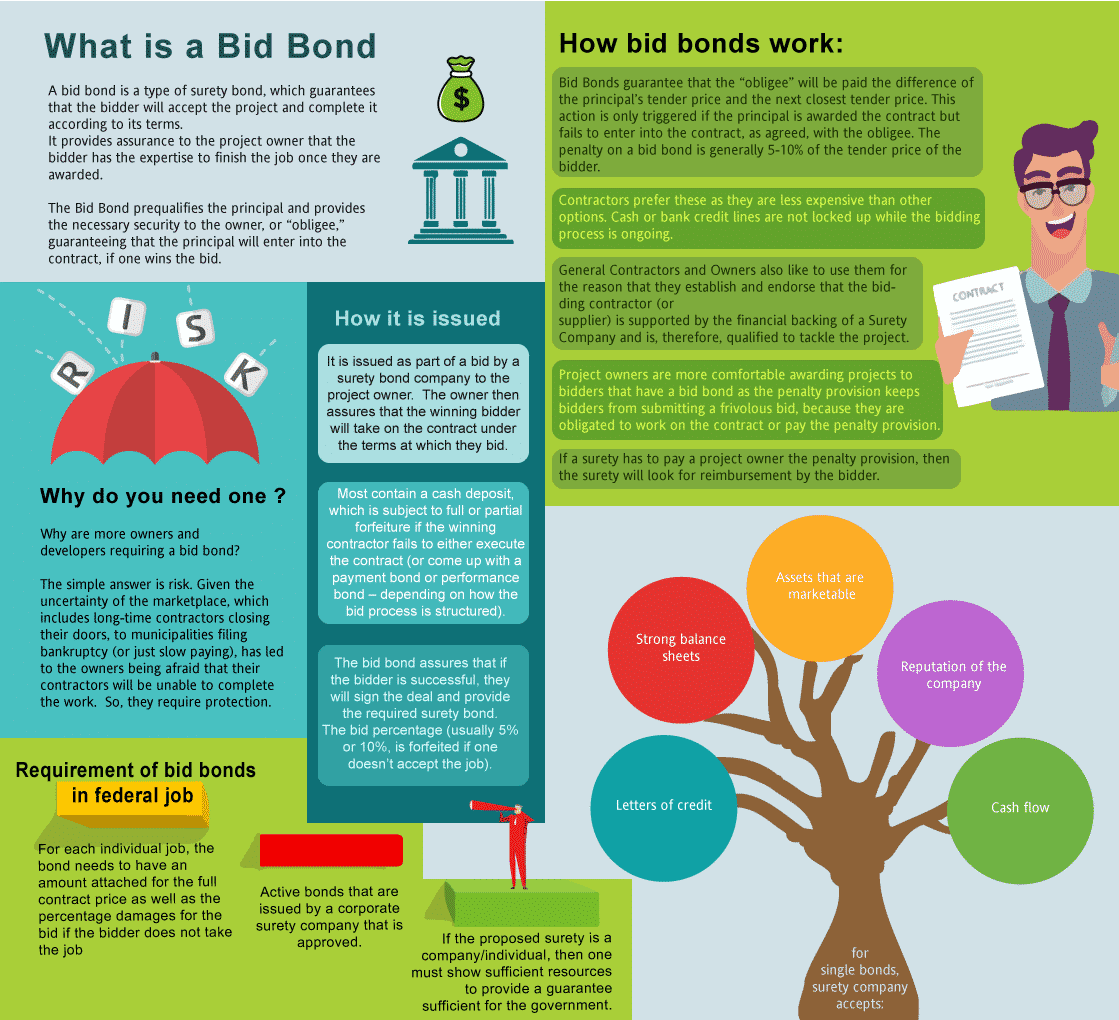

A bid bond is a type of surety bond, which guarantees that the bidder will accept the project and complete the contract according to its terms. The bid bond provides assurance to the project owner that the bidder has the ability and wherewithal to complete the job once you are selected after the bidding process. The simple reason is that you need one so that you get the contract. But the larger question is why are more owners/developers requiring a bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes experienced contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to finish the job. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Missouri Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Missouri?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in MO?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Missouri. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Missouri?

We make it easy to get a contract bid bond. Just click here to get our Missouri Bid Bond Application. Fill it out and then email it and the Missouri bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We will review each application for bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a great success rate in getting our clients surety bonds at the very best rates possible.

Engineer Your Understanding of Missouri Bid Bonds

What is a Missouri Bid Bond?

From our perspective, Missouri bid bonds engineer a sense of financial security for project owners during the bidding process. These bonds ensure that contractors follow through on their bids, providing a layer of assurance to the project owner. We’ve consistently observed that these bonds are required for public projects, particularly when government entities are involved, helping to prevent contractors from withdrawing or defaulting on their commitments.

Establish the Importance of Bid Bonds Near You

In our experience, finding a bid bond provider in Missouri is a simple process when you know where to look. We’ve come to understand that both local and online resources are great options. Here's how to engineer your search:

- Local Surety Agencies: We’ve worked closely with agencies that specialize in construction surety bonds in Missouri, which often have a deep understanding of state-specific regulations.

- Online Platforms: We’ve noticed through our work that online platforms make applying for bid bonds fast and easy, often reducing paperwork and streamlining the approval process.

Revolutionize Your Approach to Securing Bid Bonds

Who Needs to Get a Bid Bond?

We’ve often found that Missouri contractors need to secure bid bonds to compete for public contracts. In our view, this practice ensures that only qualified and financially capable contractors can submit bids. It has revolutionized how public entities protect themselves from non-committed bidders, reshaping the landscape of contractor-project owner relationships.

We provide surety bid bonds in each of the following counties:

Adair

Andrew

Atchison

Audrain

Barry

Barton

Bates

Benton

Bollinger

Boone

Buchanan

Butler

Caldwell

Callaway

Camden

Cape Girardeau

Carroll

Carter

Cass

Cedar

Chariton

Christian

Clark

Clay

Clinton

Cole

Cooper

Crawford

Dade

Dallas

Daviess

De Kalb

Dent

Douglas

Dunklin

Franklin

Gasconade

Gentry

Greene

Grundy

Harrison

Henry

Hickory

Holt

Howard

Howell

Iron

Jackson

Jasper

Jefferson

Johnson

Knox

Laclede

Lafayette

Lawrence

Lewis

Lincoln

Linn

Livingston

Macon

Madison

Maries

Marion

McDonald

Mercer

Miller

Mississippi

Moniteau

Monroe

Montgomery

Morgan

New Madrid

Newton

Nodaway

Oregon

Osage

Ozark

Pemiscot

Perry

Pettis

Phelps

Pike

Platte

Polk

Pulaski

Putnam

Ralls

Randolph

Ray

Reynolds

Ripley

St. Charles

St. Clair

Ste. Genevieve

St. Francois

St. Louis

St. Louis City

Saline

Schuyler

Scotland

Scott

Shannon

Shelby

Stoddard

Stone

Sullivan

Taney

Texas

Vernon

Warren

Washington

Wayne

Webster

Worth

Wright

And Cities:

St. Louis

Kansas City

Springfield

Columbia

Branson

Joplin

Jefferson City

Saint Charles

Saint Joseph

Independence

See our Montana Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Practical Advice for Bid Bond Success

In our professional life, we’ve noticed some key strategies that revolutionize the bid bond process. Here’s our advice to make the process easier:

- Start Early: Based on our experience, getting the bond requirements sorted before the bid deadline is essential.

- Partner With Trusted Sureties: We’ve worked with sureties that are financially strong and have excellent customer support.

- Prepare Financials: Surety companies need confidence in your financial stability.

- Budget for the Bond: We’ve found that preparing for the bond premium as part of your bid package ensures you’re not caught off guard.

Activate the Power of Surety Bid Bonds

What is a Surety Bid Bond?

We’ve learned that surety bid bonds are a critical element in construction projects. A surety bond involves three parties— the contractor (principal), the project owner (obligee), and the surety (bond provider). We’ve come to understand that the surety guarantees the obligee that the principal will meet the obligations of their bid, effectively activating protection for the project owner.

How Does a Surety Bid Bond Work?

We’ve been able to determine that a surety bid bond operates through a straightforward process. Here are the essential steps:

- Contractor Application: The contractor applies for the bid bond.

- Bid Submission: The bid bond is submitted with the bid to the project owner.

- Winning the Bid: If the contractor wins, they must fulfill the terms or the surety compensates the project owner.

- Surety Responsibility: Should the contractor fail, the surety covers the financial gap.

Build a Successful Application for a Bid Bond in Missouri

The Application Process for a Surety Bid Bond

We’ve consistently found that applying for a surety bid bond in Missouri follows specific steps. Here's how to construct a smooth application process:

- Submit Financials: We’ve had firsthand experience that providing accurate financial documents is key.

- Project Details: Ensure that project information, including bid details, is provided.

- Credit Check: We’ve observed that a solid credit score boosts approval odds.

- Underwriting: The surety evaluates the risk, determining whether to issue the bond.

In our dealings with contractors, we’ve found that preparing all documents in advance and working with experienced bond agents can accelerate the approval process, reducing stress and potential delays.

Amplify Your Knowledge of Bid Bond Costs

The Price of a Surety Bid Bond

We’ve come across bid bond premiums that range from 1% to 5% of the total project bid. The final cost depends on several factors, including the contractor’s financial status and the project scope. In our observation, the affordability of bid bonds makes them accessible for contractors while still providing robust protection for project owners.

Instigate Confidence: Can a Surety Bid Bond Be Denied?

Reasons for Bid Bond Denial

We’ve encountered contractors denied bid bonds due to issues such as poor financial history, lack of project experience, or questionable credit records. In our experience, preparing all necessary documentation, maintaining good credit, and demonstrating a strong work portfolio can significantly reduce the risk of denial. We’ve had numerous experiences with sureties where these factors make the difference between approval and denial.

Dominate Missouri’s Construction Bidding Scene with Bid Bonds

Concluding Thoughts

We’ve consistently observed that Missouri bid bonds play a pivotal role in construction projects, providing project owners with peace of mind and ensuring contractors are held accountable for their bids. Our experience tells us that understanding how these bonds work, from the application process to the cost and potential denial reasons, is essential for any contractor looking to dominate the bidding process in Missouri. We’ve come to appreciate that a proactive, informed approach is the key to success in this industry.