You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

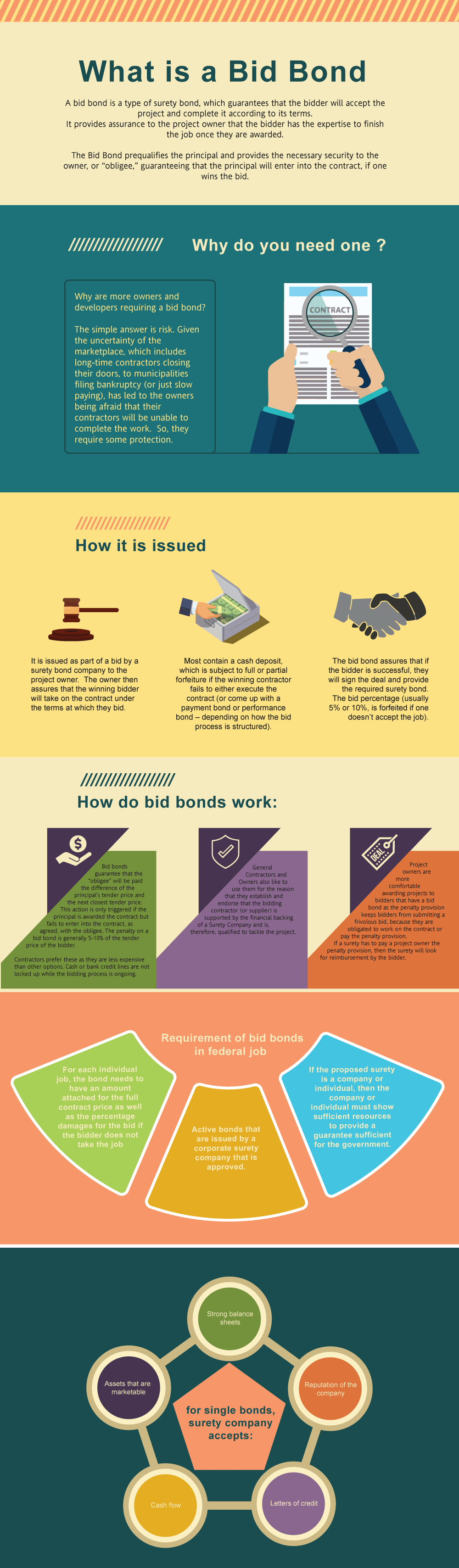

What is a Bid Bond in Mississippi?

A bid bond is one of the types of surety bonds, that guarantees that the bidder will take the job and complete the agreement according to its terms. The bid bond provides assurance to the project owner that the bidder has the expertise and ability to finish the job once the bidder is selected after winning the bidding process. The basic reason is that you need one to get the job. However, the bigger question is why are more owners/developers requiring a surety bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes long-time contractors closing shop, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to complete the job. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Mississippi Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Mississippi?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the P&P bond if you win the contract. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in MS?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Mississippi. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Mississippi?

We make it easy to get a contract bid bond. Just click here to get our Mississippi Bid Bond Application. Fill it out and then email it and the Mississippi bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each and every application for bid bonds and then submit it to the surety that we believe will provide the best surety bid bond for your job. We have a great success rate in getting our clients surety bonds at the very best rates possible.

Sculpting a Strong Understanding of Mississippi Bid Bonds

When engaging in the construction industry in Mississippi, one of the essential components for project bidding is securing a bid bond. This bond plays a crucial role in ensuring that contractors are committed to their proposals and capable of fulfilling contract obligations if awarded. In our experience, understanding the details of Mississippi bid bonds can significantly enhance your chances of project success.

Kickstarting Your Search for a Mississippi Bid Bond Provider

Discover Reliable Bid Bond Providers Near You

Finding a reliable bid bond provider in Mississippi is a key consideration. From our own dealings with contractors, we’ve found that local insurance agencies and surety companies are often your best bet. Some notable names in the region include:

- Mississippi Surety Bond Agency – A local expert in providing bid bonds.

- Nationwide Surety Companies – These larger organizations offer broader resources, often catering to various types of contractors.

- Regional Independent Agents – In our observation, working with independent agents can provide more personalized guidance.

We’ve consistently found that exploring multiple options before deciding ensures the best rates and terms.

Bolstering Your Knowledge of Mississippi Bid Bond Beneficiaries

Unleash Who Gets the Bid Bond in Mississippi

A common question contractors ask is who benefits from the bid bond process. From our perspective, several key players are involved:

- The Obligee – This is usually the project owner or government entity that requires the bond.

- The Principal – The contractor who applies for the bond.

- The Surety – The company that guarantees the bond.

We’ve noticed that by understanding each party's role, contractors can navigate the bid bond process more effectively.

We provide bid bonds in each of the following counties:

Adams

Alcorn

Amite

Attala

Benton

Bolivar

Calhoun

Carroll

Chickasaw

Choctaw

Claiborne

Clarke

Clay

Coahoma

Copiah

Covington

DeSoto

Forrest

Franklin

George

Greene

Grenada

Hancock

Harrison

Hinds

Holmes

Humphreys

Issaquena

Itawamba

Jackson

Jasper

Jefferson

Jefferson Davis

Jones

Kemper

Lafayette

Lamar

Lauderdale

Lawrence

Leake

Lee

Leflore

Lincoln

Lowndes

Madison

Marion

Marshall

Monroe

Montgomery

Neshoba

Newton

Noxubee

Oktibbeha

Panola

Pearl River

Perry

Pike

Pontotoc

Prentiss

Quitman

Rankin

Scott

Sharkey

Simpson

Smith

Stone

Sunflower

Tallahatchie

Tate

Tippah

Tishomingo

Tunica

Union

Walthall

Warren

Washington

Wayne

Webster

Wilkinson

Winston

Yalobusha

Yazoo

And Cities:

Jackson

Hattiesburg

Biloxi

Gulfport

Tupelo

Meridian

Southaven

Vicksburg

Starkville

Madison

See our Missouri Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Cultivating Practical Tips for Securing a Bid Bond in Mississippi

From our professional experience, securing a bid bond can be streamlined by keeping the following tips in mind:

- Ensure Financial Stability: In our observation, financial health plays a critical role in bond approval.

- Work with Reputable Sureties: We’ve found that partnering with experienced surety providers can ease the process.

- Understand Your Contractual Obligations: We’ve learned that thoroughly reviewing project requirements reduces the risk of claim disputes.

- Be Prompt: Time is of the essence, so applying early ensures you don’t miss important deadlines.

Framing What a Surety Bid Bond Means for Mississippi Contractors

Empower Your Understanding of a Surety Bid Bond

A surety bid bond acts as a safety net for the obligee, ensuring the contractor follows through on their bid if selected. From what we’ve seen, this bond acts as an assurance to the project owner that the bid is not just a placeholder but a genuine offer backed by a guarantee. Based on our experience, this protection offers peace of mind to obligees, allowing them to proceed with confidence in their contractor choices.

Sculpting the Mechanics of a Surety Bid Bond

Refocus on How a Surety Bid Bond Works

We’ve often observed that the mechanics behind a surety bid bond are relatively straightforward. The contractor submits the bond as part of their project proposal, ensuring the project owner that if selected, they will sign the contract and provide the necessary performance and payment bonds. If the contractor fails to follow through, the bond compensates the obligee for the difference between the initial bid and the next lowest offer. We’ve come to realize that understanding this mechanism helps contractors fulfill their contractual obligations.

Initiating the Surety Bid Bond Application Process

Craft a Seamless Application for a Surety Bid Bond

In our dealings with contractors, we’ve seen that the application process for a surety bid bond involves several key steps:

- Complete the Application: Contractors must submit details about their business and financial history.

- Undergo a Credit Check: Sureties assess the financial stability of the contractor.

- Submit Project Information: The bond is tied to a specific project, so accurate details are crucial.

We’ve found that providing thorough and accurate information significantly speeds up the approval process.

Shaping the Costs of a Mississippi Bid Bond

Lead Your Knowledge of Bid Bond Pricing

From our own observations, the cost of a bid bond in Mississippi is typically a small percentage of the total project bid, often ranging from 1% to 3%. We’ve noticed that pricing factors include the contractor’s financial standing, the size of the project, and the bond amount. Based on our experience, maintaining a strong financial track record can help lower bond costs.

Driving Away Denials: How to Avoid Bid Bond Rejections

Challenge Bid Bond Denial with These Insights

There’s always the possibility of being denied a bid bond, but from our experience, understanding the common reasons for rejection can help avoid this outcome:

- Poor Credit History: We’ve seen firsthand that sureties are wary of contractors with unstable credit.

- Insufficient Experience: We’ve learned through trial and error that experience with similar projects is a key approval factor.

- Inadequate Financials: We’ve personally dealt with cases where contractors were denied due to insufficient cash flow.

To mitigate these risks, we’ve consistently observed that preparing solid financial documentation and partnering with reputable sureties greatly improves approval chances.

Reigniting Your Path to Securing Bid Bonds in Mississippi

Shape Your Conclusion: Why Mississippi Bid Bonds Matter

We’ve had numerous experiences with bid bonds in Mississippi, and we’ve come to appreciate their critical role in securing contracts. Not only do they provide assurance to project owners, but they also help contractors build credibility and trust in the competitive construction industry. From our perspective, investing the time to understand and properly secure a bid bond is a worthwhile step for any contractor looking to thrive in Mississippi’s construction landscape.

Learn more about Mississippi bids.