You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

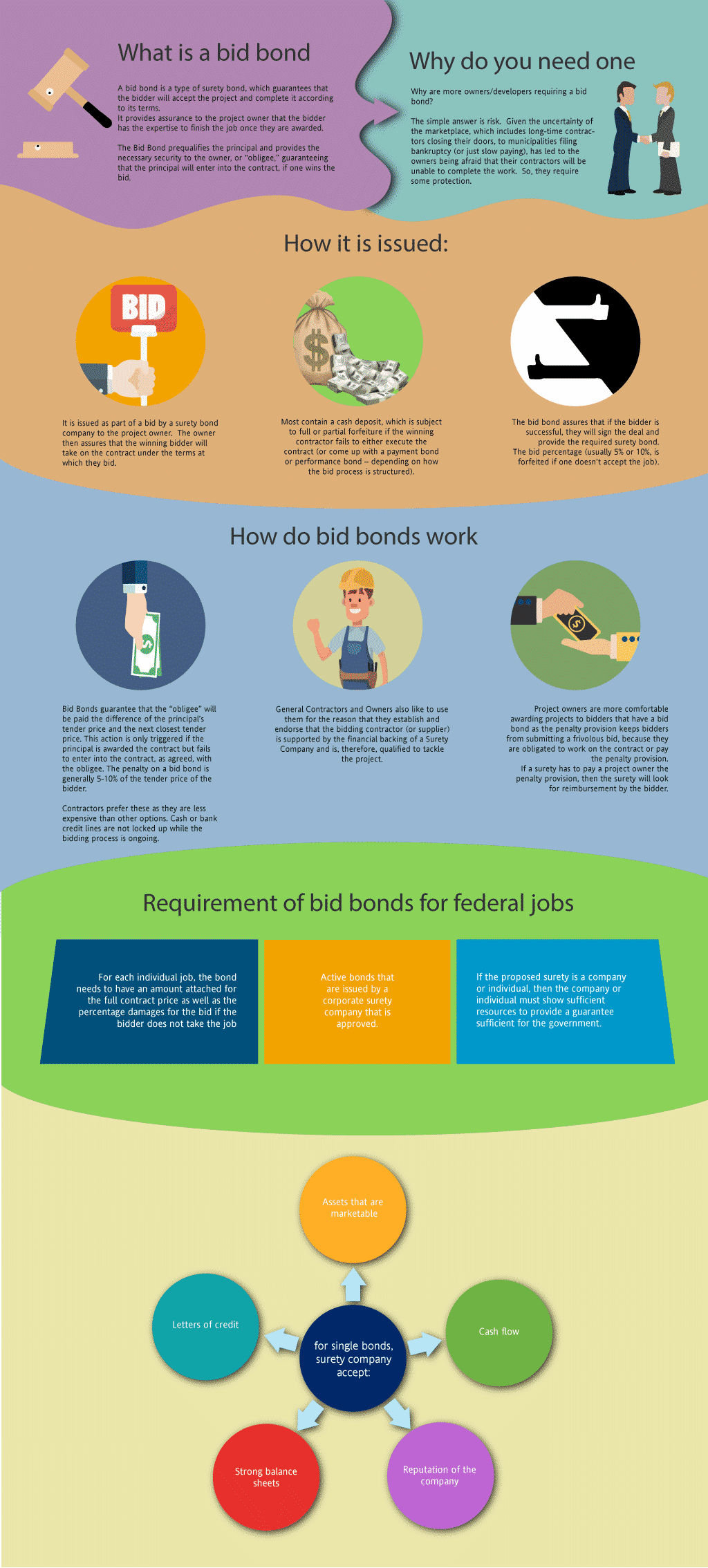

What is a Bid Bond in Minnesota?

A bid bond is one of the types of surety bonds, which guarantees that the bidder will enter into the agreement and complete the contract according to its terms. The bid bond provides assurance to the project owner that the bidder has the ability and wherewithal to finish the job once you are selected after the bidding process. The simple reason is that you need one so that you get the contract. But the larger question is why are more owners/developers requiring a surety bid bond? The basic answer is risk. Given the uncertainty of the marketplace, which includes long-term contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to finish the work. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Minnesota Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Minnesota?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you win the contract. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a contract bond.

How much do bonds cost in MN?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Minnesota. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Minnesota?

We make it easy to get a contract bid bond. Just click here to get our Minnesota Bid Bond Application. Fill it out and then email it and the Minnesota bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We thoroughly review each application for bid and P&P bonds and then submit it to the surety that we believe will provide the best surety bond for your company. We have a very high success rate in getting our clients bid bonds at the best rates possible.

Overhaul Your Understanding of Minnesota Bid Bonds

What Exactly is a Minnesota Bid Bond?

In our professional lives, we’ve consistently observed that a Minnesota bid bond acts as a crucial form of protection for project owners. A bid bond guarantees that if a contractor is awarded the project, they will enter into the contract and provide the required performance and payment bonds. Without a bid bond, project owners could face financial losses if a contractor backs out after securing a bid. From our experience, we’ve noticed that this bond not only secures the project owner’s interests but also adds credibility to the contractor’s bid, ensuring they are committed to completing the project.

Refine Your Search for Bid Bonds in Minnesota

Where to Find Bid Bonds Near You

From our perspective, finding the right bid bond in Minnesota can seem overwhelming with so many providers available. However, we’ve identified several trusted sources that can help streamline your search:

- Local Surety Companies: These specialized firms provide bonds tailored to Minnesota’s specific legal and regulatory requirements.

- Insurance Agencies: We’ve come to understand that many general insurance agencies offer bonding services, giving you the convenience of working with a provider you already trust.

- Online Bond Providers: What we’ve experienced is that online platforms can significantly speed up the process by offering fast quotes and easy application submissions.

Align with the Right Provider

We’ve consistently observed that selecting the right provider is just as important as securing the bond itself. Ensuring that your surety company is reputable and understands local nuances can make all the difference in a seamless bidding process.

Who Gets Bid Bonds in Minnesota? Reshape Your Approach

Who Typically Needs Bid Bonds?

We’ve encountered that general contractors, subcontractors, and suppliers are the primary candidates who need a bid bond when bidding for public works projects. In our observation, public sector projects, especially those funded by government bodies, almost always require a bid bond. We’ve realized that this bond not only protects project owners but also ensures that only financially stable and committed contractors are awarded significant contracts.

Empower Your Business by Using Bid Bonds

In our experience, bid bonds empower contractors by giving them the confidence to bid on large, complex projects without fear of financial penalties. We’ve seen firsthand how these bonds can expand a contractor’s portfolio by allowing them to bid on larger contracts and secure more business.

We provide bid bonds in each of the following counties:

Aitkin

Anoka

Becker

Beltrami

Benton

Big Stone

Blue Earth

Brown

Carlton

Carver

Cass

Chippewa

Chisago

Clay

Clearwater

Cook

Cottonwood

Crow Wing

Dakota

Dodge

Douglas

Faribault

Fillmore

Freeborn

Goodhue

Grant

Hennepin

Houston

Hubbard

Isanti

Itasca

Jackson

Kanabec

Kandiyohi

Kittson

Koochiching

Lac Qui Parle

Lake

Lake Of The Wood

Le Sueur

Lincoln

Lyon

Mahnomen

Marshall

Martin

McLeod

Meeker

Mille Lacs

Morrison

Mower

Murray

Nicollet

Nobles

Norman

Olmsted

Otter Tail

Pennington

Pine

Pipestone

Polk

Pope

Ramsey

Red Lake

Redwood

Renville

Rice

Rock

Roseau

St. Louis

Scott

Sherburne

Sibley

Stearns

Steele

Stevens

Swift

Todd

Traverse

Wabasha

Wadena

Waseca

Washington

Watonwan

Wilkin

Winona

Wright

Yellow Medicine

And Cities:

Minneapolis

Saint Paul

Duluth

St. Cloud

Bloomington

Mankato

Eagan

Burnsville

Edina

Eden Prairie

See our Mississippi Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Practical Tips to Refine Your Strategy for Bid Bonds

We’ve come across several factors that contractors need to keep in mind when navigating bid bonds. Here are some practical tips to help streamline your bonding experience:

- Understand the Project Requirements: Always review the bond requirements outlined by the project owner.

- Choose a Trustworthy Surety: A reliable surety can facilitate a smooth bonding process and ensure you meet deadlines.

- Prepare Financial Documents: We’ve consistently observed that well-organized financials are key to securing quick bond approval.

- Know Your Credit Score: Contractors with strong credit will often pay lower bond premiums and receive faster approvals.

Innovate Your Knowledge of Surety Bid Bonds

What is a Surety Bid Bond?

We’ve gained insight into surety bid bonds, which act as a three-party agreement between the contractor, project owner, and the surety company. What we’ve learned is that the surety ensures the contractor will honor the terms of the bid and the project, providing financial assurance to the project owner.

How Does a Surety Bid Bond Work?

In our dealings with bid bonds, we’ve seen that the process works like this: a contractor submits a bid with the bond attached. If the contractor is awarded the project, the surety ensures the contractor fulfills the bid. If the contractor fails to do so, the surety steps in to pay the bond amount. We’ve learned that this system triggers accountability and encourages contractors to commit fully to their bids.

Launch Your Application Process for a Surety Bid Bond in Minnesota

The Application Process

We’ve participated in several bid bond applications and can confidently state that the process follows a few key steps:

- Application Submission: Contractors must provide details about their project and financials.

- Underwriting Review: The surety reviews the contractor’s creditworthiness and experience.

- Bond Issuance: Once the contractor passes underwriting, the surety issues the bid bond.

Uncover Ways to Streamline Your Application

From our own efforts, we’ve found that preparing financial documents and ensuring you have a solid credit score can significantly speed up the application process. We’ve realized through our work that contractors who are prepared are more likely to receive faster approvals.

Elevate Your Understanding of the Cost of Surety Bid Bonds

The Cost Breakdown

We’ve been fortunate to work with many bid bonds and can tell you that costs are generally a small percentage of the project value, ranging from 1-3%. However, we’ve been in situations where the contractor’s credit score, financial stability, and the complexity of the project influenced the final price. From our perspective, maintaining good financial health will help keep costs down.

Is There a Chance of Denial? Motivate Yourself to Avoid Common Pitfalls

Common Reasons for Denial

We’ve worked closely with contractors who’ve faced denial of their bid bond applications. Common reasons include:

- Poor Credit: We’ve noticed that contractors with low credit scores often have a harder time securing bonds.

- Inexperience: From our experience, surety companies prefer contractors with a proven track record.

- Financial Instability: Contractors lacking financial resources are often denied due to the risk they pose to the surety company.

Concluding Thoughts: Sustain Your Bid Bond Success in Minnesota

From our experience, we’ve come to believe that bid bonds are an essential tool for both project owners and contractors in Minnesota. They provide a layer of financial security that ensures the bidding process remains transparent and reliable. We’ve consistently found that securing a bid bond not only increases a contractor’s chances of winning a bid but also strengthens their reputation. By aligning with a reliable surety and understanding the bid bond process, contractors can reshape their approach to public projects and stimulate greater success.