You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in Massachusetts?

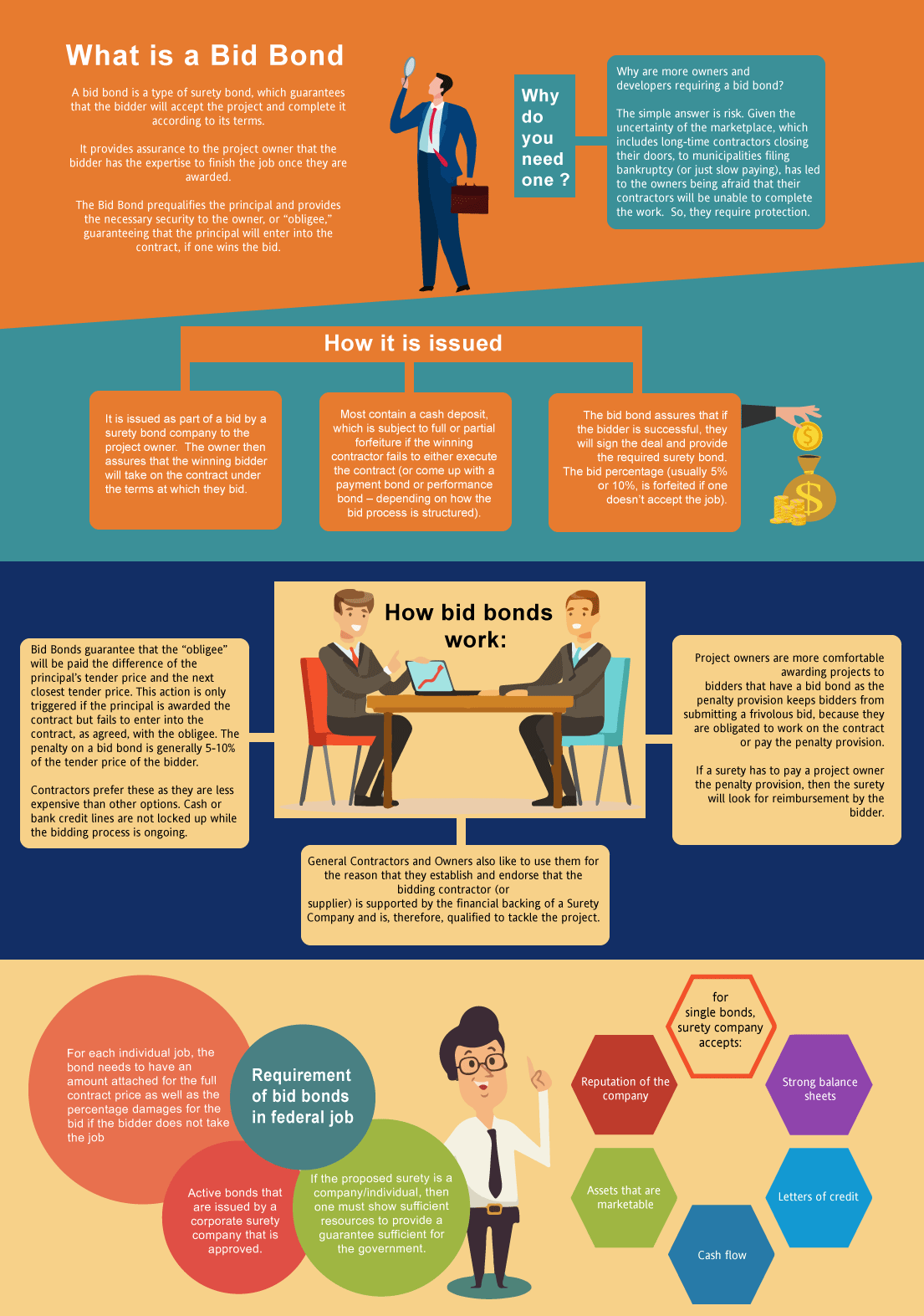

A bid bond is one of the types of surety bonds, which guarantees that the bidder will accept the contract and complete the agreement according to its terms. It provides assurance to the project owner that the bidder has the ability and ability to finish the job once you are selected after winning the bidding process. The simple reason is that you need one so that you get the job. However, the bigger question is why are more owners/developers requiring a bid bond? The answer is risk. Given the uncertainty of the marketplace, which includes long-time contractors closing shop, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to complete the job. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Massachusetts Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Massachusetts?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the contract bond if you get the job. The cost of a P&P bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in MA?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Massachusetts. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Massachusetts?

We make it easy to get a contract bid bond. Just click here to get our Massachusetts Bid Bond Application. Fill it out and then email it and the Massachusetts bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each and every application for surety bonds and then submit it to the surety that we believe will provide the best bid and P&P bond for your company. We have a great success rate in getting our clients bid and P&P bonds at the very best rates possible.

Refocus Your Understanding of Massachusetts Bid Bonds

Bid bonds are an essential part of the competitive bidding process in Massachusetts. In our experience, they provide a layer of security and trust between project owners and contractors. Whether you’re a contractor bidding on a public project or a project owner seeking to protect your investment, understanding the intricacies of Massachusetts bid bonds is crucial.

Elevate Your Knowledge of Local Bid Bonds

From what we’ve seen, finding a bid bond provider in Massachusetts is easier than ever. Many surety companies offer specialized services to cater to local contractors and project owners. With online platforms and local agencies, we’ve observed that securing a Massachusetts bid bond can often be done in a matter of hours, making the process more convenient and streamlined.

Capitalize on Who Benefits from Bid Bonds in Massachusetts

We’ve encountered various parties in Massachusetts who benefit from bid bonds:

Project Owners

They gain security knowing the contractor will commit to the project if awarded.

Contractors

We’ve often noticed that contractors use bid bonds to demonstrate their credibility.

Surety Companies

By underwriting these bonds, surety companies provide a safety net for all parties involved.

Taxpayers/Public Entities

Public projects require accountability, and bid bonds ensure that funds are used efficiently.

In our dealings with different projects, these groups consistently rely on bid bonds to maintain trust and financial integrity throughout the bidding process.

We provide bid bonds in each of the following counties:

Barnstable

Berkshire

Bristol

Dukes

Essex

Franklin

Hampden

Hampshire

Middlesex

Nantucket

Norfolk

Plymouth

Suffolk

Worcester

And Cities:

Boston

Cambridge

Worcester

Springfield

Salem

Lowell

Plymouth

Quincy

Waltham

Framingham

See our Michigan Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Navigate Bid Bonds with Practical Tips

We’ve gained a lot from our experiences with bid bonds, and here are a few practical tips:

- Compare Providers: Not all surety companies offer the same rates and terms. Shop around for the best deal.

- Understand the Fine Print: Always read the conditions of the bond carefully.

- Get Prequalified: Prequalification with a surety company can speed up the process when bidding on multiple projects.

- Stay Organized: Keep all documentation up-to-date and easily accessible.

These strategies have helped countless contractors successfully navigate bid bonds and minimize potential setbacks.

Leverage the Power of Surety Bid Bonds

We’ve come to appreciate that a surety bid bond isn’t just about providing financial coverage—it’s about trust and credibility. The surety bond guarantees that if the contractor fails to fulfill their bid obligations, the surety company will step in, ensuring the project owner isn’t left in a lurch. Based on our experience, this trust-building mechanism is crucial in Massachusetts, especially for public works projects.

Stimulate Your Understanding of How Bid Bonds Work

In our line of work, we’ve often found that the process of a surety bid bond is straightforward yet vital. The contractor provides a bond during the bidding phase, and if their bid is accepted, they must enter into the contract. If they fail to do so, the surety company compensates the project owner for the difference between the defaulted bid and the next-lowest bid. This protection ensures fairness and financial stability, something we’ve consistently observed in Massachusetts projects.

Refine the Application Process for Bid Bonds in Massachusetts

We’ve been able to outline the steps contractors must follow to apply for a surety bid bond:

- Choose a Surety Provider: We’ve consistently observed that picking the right surety provider is critical.

- Complete an Application: Contractors must provide financial statements and project details.

- Underwriting Process: The surety will evaluate the contractor’s creditworthiness and financial health.

- Get the Bond: If approved, the surety issues the bond, and the contractor can submit their bid.

Enhance Your Chances with Prequalification

Prequalification is a game-changer. We’ve found that contractors who get pre-approved by a surety company often secure bids faster and with fewer complications. This step adds a layer of trust and expedites the process, giving you an edge over competitors.

Optimize the Cost of Bid Bonds

We’ve discovered through trial and error that the cost of a bid bond usually ranges from 1% to 5% of the total bid amount. The exact price depends on the contractor’s financial standing, the size of the bid, and the project’s scope. In Massachusetts, we’ve observed that contractors with strong financials tend to pay lower rates, reinforcing the importance of maintaining a solid credit history.

Unveil the Risk of Denial

In our practice, we’ve encountered situations where a contractor’s bid bond application was denied. Reasons for denial include poor credit, insufficient financial history, or a lack of experience with similar projects. We’ve learned that improving credit scores and demonstrating a history of successful project completions can significantly increase approval chances.

Shape Your Conclusion on Bid Bonds in Massachusetts

In our professional life, we’ve consistently found that bid bonds are a key part of the construction bidding process in Massachusetts. They protect project owners from financial loss and help contractors demonstrate their credibility. From ensuring trust to providing financial security, bid bonds are an essential tool for both public and private projects in the state.