You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

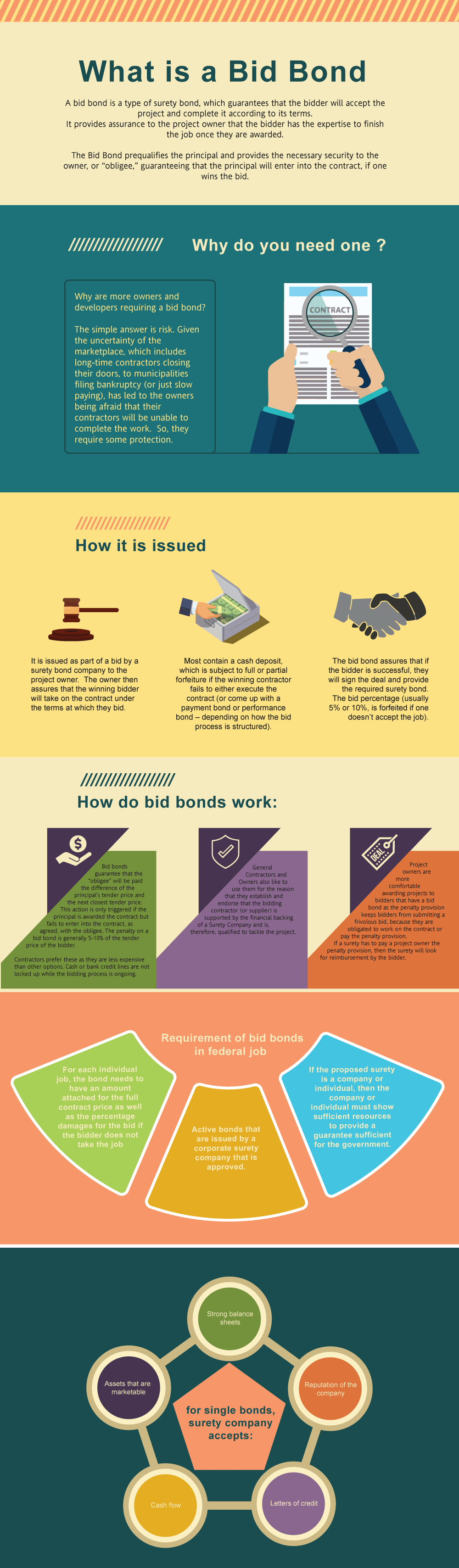

What is a Bid Bond in Maine?

A bid bond is a type of surety bond, which guarantees that the bidder will enter into the contract and complete it according to its terms. The bid bond provides assurance to the project owner that the bidder has the knowhow and wherewithal to finish the job once the bidder is selected after the bidding process. The basic reason is that you need one in order to get the work. But the larger question is why are more owners/developers requiring a surety bid bond? The basic answer is risk. Given the uncertainty of the marketplace, which includes long-time contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to finish the job. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Maine Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Maine?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in ME?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Maine. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher. See our Performance Bond Cost page for more.

How do I get a Bid Bond in Maine?

We make it easy to get a contract bid bond. Just click here to get our Maine Bid Bond Application. Fill it out and then email it and the Maine bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We review each application for bid bonds and then submit it to the surety that we believe will provide the best bid bond for your job. We have a excellent success rate in getting our clients bid and P&P bonds at the very best rates possible.

Advance Your Understanding of Maine Bid Bonds

From our perspective, a Maine Bid Bond is an essential tool that advances both project owners’ and contractors’ interests. This bond acts as a financial safeguard, ensuring contractors stick to their commitments once they submit a bid for a project. For project owners, it minimizes the risk of time and money loss due to non-compliant bids. For contractors, it signals reliability and commitment, building trust in their professionalism and capacity to deliver.

Broaden the Role of Bid Bonds in Maine

We’ve noticed that Bid Bonds do more than just protect project owners; they broaden the scope of responsible bidding practices across the state. Contractors who secure bid bonds position themselves as serious players in the industry, offering owners peace of mind during the bidding phase.

Strategize: Finding a Bid Bond Near You in Maine

We’ve often noticed that finding the right bid bond provider in Maine requires strategic planning. Contractors must consider the surety company’s reputation, terms, and local expertise to ensure a smooth bidding process.

Prioritize Local Surety Providers

From our experience, prioritizing local surety bond providers offers significant advantages. Local providers are often more attuned to Maine’s specific legal and construction environments, making the entire process more efficient and tailored.

Maximize Search Efficiency

In our opinion, to maximize your search for a bid bond provider, consult local construction associations or perform targeted online searches focused on Maine-based companies. This ensures that you’re working with providers who understand the unique requirements of the state’s construction industry.

Clarify Who Gets the Bid Bond in Maine

We’ve found that it’s essential to clarify that the Bid Bond primarily benefits the project owner. The contractor secures the bond, but it is the project owner who reaps the rewards if a contractor fails to fulfill their obligations after winning a bid.

Build Trust Through Bid Bonds

In our dealings with bid bonds, we’ve observed that these bonds build trust between project owners and contractors. The presence of a bond reassures the owner that the contractor is financially secure and fully committed to the project.

We provide bid bonds in each of the following counties:

Androscoggin

Aroostook

Cumberland

Franklin

Hancock

Kennebec

Knox

Lincoln

Oxford

Penobscot

Piscataquis

Sagadahoc

Somerset

Waldo

Washington

York

And Cities:

Portland

Bangor

Augusta

Lewiston

Waterville

South Portland

Bar Harbor

Biddeford

Rockland

Saco

See our Maryland Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Cultivate Practical Advice When Considering Bid Bonds

We’ve gathered that making informed decisions about bid bonds can cultivate stronger relationships and better project outcomes. Based on our experience, here are four practical tips that every contractor in Maine should keep in mind:

Strengthen Your Financial Capacity

We’ve consistently found that it’s crucial to strengthen your financial standing before applying for a bid bond. Ensure that your company’s finances are in order and that the bid matches your operational capabilities.

Design Partnerships with Reputable Surety Providers

Our experience tells us that partnering with established surety companies is a strategic move. These partnerships ensure smoother processes and foster trust, which can make all the difference when dealing with project owners.

Frame Your Understanding of Bid Bond Terms

From what we’ve seen, understanding the full terms and conditions of the bond is paramount. Failing to read the fine print can lead to costly misunderstandings down the road.

Reinvent Your Financial Profile

We’ve realized that contractors who consistently maintain strong financial profiles often receive more favorable bond terms. Reinvent your approach to finances by focusing on credit, cash flow, and overall financial stability.

Elevate the Concept of a Surety Bid Bond

In our dealings with surety bonds, we’ve come to appreciate that a Surety Bid Bond elevates the professionalism of a contractor’s bid. This bond functions as a three-party agreement between the contractor, the project owner, and the surety company, where the surety guarantees the contractor’s obligations.

Empathize with the Project Owner’s Perspective

We’ve learned that empathizing with the project owner’s viewpoint helps contractors realize the value of bid bonds. It ensures that they are presenting themselves as reliable and financially stable partners, which is crucial for winning bids.

Frame How a Surety Bid Bond Functions

We’ve consistently observed that the function of a Surety Bid Bond is to act as a safety net for project owners. This bond guarantees that if the contractor retracts their bid or fails to execute the contract, the surety will compensate the owner for the difference between the original bid and the next best offer.

Mobilize Your Commitment Through the Bond

We’ve noticed that this bond serves as a tool to mobilize contractor commitment. Contractors who are backed by a surety bond are more likely to follow through on their bids, as the financial penalty for withdrawing is significant.

Initiate Your Application for a Surety Bid Bond in Maine

We’ve often found that the application process for a Surety Bid Bond in Maine is streamlined when contractors initiate early preparations. The process typically requires submitting financial records, previous project details, and credit reports to the surety company.

Build a Strong Application Foundation

We’ve come across that preparing a comprehensive and accurate application is key to securing a bid bond. Organizing your financial documents and credit history before applying will help expedite the process.

Lead with Financial Transparency

In our experience, transparency is critical when submitting financial documents. Surety companies want to see that you’re not only capable of completing the project but that you have a strong financial foundation that mitigates risk.

Clarify the Cost of a Surety Bid Bond

We’ve discovered through experience that the cost of a Surety Bid Bond in Maine is typically calculated as a percentage of the total bid. Generally, contractors can expect to pay between 1% and 3% of their bid amount.

Expand Cost Awareness

We’ve seen firsthand that contractors with strong financial backgrounds often receive more favorable rates. Expanding your understanding of the factors that influence bond pricing, such as credit score and project history, can help you secure a more competitive rate.

Broaden Your Awareness: Can You Be Denied a Bid Bond?

We’ve been in situations where contractors have been denied a bid bond due to poor financial health or insufficient credit. In our view, understanding the reasons for denials can help contractors adjust and improve their chances of securing a bond in the future.

Pioneer Financial Improvements

We’ve noticed that contractors who take the initiative to pioneer improvements in their financial records and business practices are more likely to avoid bid bond denials. Focus on maintaining strong credit, accurate financial reporting, and a history of reliable project completions.

Uplift Your Project Bidding with Bid Bonds in Maine

In our view, Bid Bonds in Maine uplift the entire project bidding process by fostering trust and reducing financial risks for project owners. From our experience, these bonds are essential for ensuring that contractors are serious about their bids and capable of delivering on their promises.

Maximize Your Competitive Edge

We’ve had firsthand experience with how bid bonds can maximize a contractor’s competitive edge. By securing a bid bond, contractors demonstrate their professionalism and financial stability, which often leads to more successful bid awards.

By implementing these strategies and working with reliable surety bond providers, contractors in Maine can confidently navigate the bid bond process, strengthen their credibility, and elevate their chances of winning high-value projects.