You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

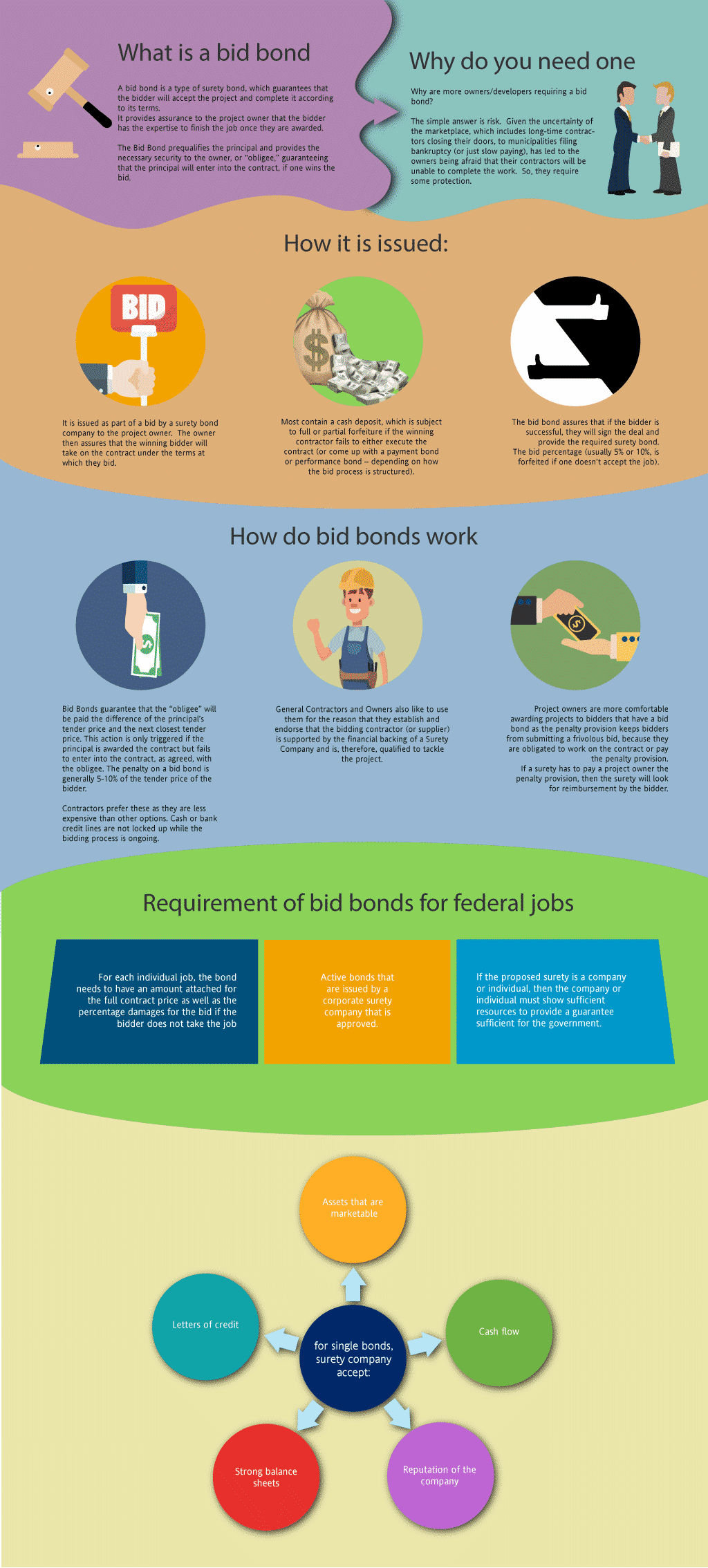

What is a Bid Bond in Louisiana?

A bid bond is one of the types of surety bonds, which guarantees that the bidder will enter into the agreement and complete it according to its terms. It provides assurance to the project owner that the bidder has the knowhow and wherewithal to finish the job once you are selected after the bidding process. The basic reason is that you need one to get the work. But the larger question is why are more owners/developers requiring a surety bid bond? The basic answer is risk. Given the uncertainty of the marketplace, which includes experienced contractors going out of business, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable complete the work. Thus, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Louisiana Bid Bond Application

a bid bond? - This is an infographic image explaining what is a bid bond with a two guys shaking hands, contractor, shapes and a dollar logos in a multi colored background." width="1024" height="2269" />

a bid bond? - This is an infographic image explaining what is a bid bond with a two guys shaking hands, contractor, shapes and a dollar logos in a multi colored background." width="1024" height="2269" />

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Louisiana?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the P&P bond if you win the contract. The cost of the bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond covering the contract.

How much do bonds cost in LA?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Louisiana. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors. See our Performance Bond Cost page for more.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Louisiana?

We make it easy to get a contract bid bond. Just click here to get our Louisiana Bid Bond Application. Fill it out and then email it and the Louisiana bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We thoroughly review each and every application for bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a great success rate in getting our clients surety bid bonds at the best rates possible.

Empower Your Bidding Process with Louisiana Bid Bonds

In our line of work, Bid Bonds empowers contractors by providing a reliable guarantee to project owners. These bonds ensure that a contractor’s bid is financially backed, enhancing the trustworthiness of the bidding process. For Louisiana contractors, understanding and securing bid bonds is essential for building credibility and ensuring project success.

Simplify the Search for a Louisiana Bid Bond Near You

We’ve often noticed that finding the right bid bond provider can feel daunting. However, by simplifying your search through online platforms and local agencies, you can quickly identify the best options available. Here are some streamlined solutions:

Louisiana-Based Surety Companies

These companies focus on regional projects, providing personalized service and understanding of local laws. Contractors often benefit from their extensive knowledge of Louisiana's unique bonding requirements.

Benefits of Local Surety Providers

- Tailored Solutions: Local providers offer customized solutions based on regional needs.

- Familiarity with Local Laws: Local sureties have a better grasp of state-specific bonding requirements.

Insurance Agencies as Bid Bond Providers

Many insurance brokers in Louisiana offer bid bonds as part of their larger suite of services. We've often found that these agencies are a convenient one-stop solution for both insurance and surety bond needs.

Why Choose an Insurance Agency for Your Bid Bond?

- Convenience: Combining insurance and bonding needs with one provider.

- Reputation: Many established insurance agencies have extensive networks and partnerships with top surety providers.

Drive Results by Understanding Who Benefits from Louisiana Bid Bonds

From our experience, bid bonds drive results for several key stakeholders in Louisiana:

Contractors

Bid bonds offer contractors the credibility to bid on more projects and gain the trust of project owners.

Enhancing Contractor Credibility

- Financial Backing: Having a bid bond assures the project owner that your bid is secure.

- Increased Opportunities: Contractors with bid bonds can access more lucrative projects.

Project Owners

With a bid bond in place, project owners are financially protected, knowing that they’ll be compensated if the selected contractor backs out.

Protecting the Project Owner

- Reduced Financial Risk: Bid bonds offer protection against a contractor pulling out.

- Encouraging Reliable Bids: Contractors with bid bonds are more likely to follow through on their bid terms.

Surety Companies

Surety companies provide the financial backing necessary for the bond, ensuring contractors can meet their obligations.

The Role of Surety Companies

- Financial Guarantee: Surety companies cover the financial risk for the contractor.

- Project Oversight: They ensure the contractor has the financial and operational capacity to complete the project.

We provide bid bonds in each of the following counties:

Acadia

Allen

Ascension

Assumption

Avoyelles

Beauregard

Bienville

Bossier

Caddo

Calcasieu

Caldwell

Cameron

Catahoula

Claiborne

Concordia

De Soto

East Baton Rouge

East Carroll

East Feliciana

Evangeline

Franklin

Grant

Iberia

Iberville

Jackson

Jefferson

Jefferson Davis

La Salle

Lafayette

Lafourche

Lincoln

Livingston

Madison

Morehouse

Natchitoches

Orleans

Ouachita

Plaquemines

Pointe Coupee

Rapides

Red River

Richland

Sabine

St. Bernard

St. Charles

St. Helena

St. James

St. John The Baptist

St. Landry

St. Martin

St. Mary

St. Tammany

Tangipahoa

Tensas

Terrebonne

Union

Vermilion

Vernon

Washington

Webster

West Baton Rouge

West Carroll

West Feliciana

Winn

And Cities:

New Orleans

Baton Rouge

Lafayette

Shreveport

Lake Charles

Alexandria

Slidell

Houma

Hammond

Bossier City

See our Maine Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Motivate Success: Practical Advice for Louisiana Contractors

We’ve consistently found that being proactive can motivate your success in securing Louisiana bid bonds. Here’s our expert advice for contractors:

Understand Project Needs

Align your bond requirements with the specific demands and scope of the project you're bidding for.

Tailoring Bid Bonds to Project Scope

- Different Project Sizes, Different Bonds: Understand how bond amounts vary based on project size.

- Review Requirements: Always carefully review the project’s bonding needs before applying.

Partner with Reputable Providers

We’ve found through experience that working with trusted surety companies improves your chances of approval and makes the entire process smoother.

Benefits of Working with Reputable Surety Providers

- Better Terms: Reputable providers can offer more favorable bonding terms.

- Faster Approvals: Established providers streamline the application and approval process.

Stay Financially Prepared

Maintain well-organized financial records to demonstrate stability and increase your approval odds with surety companies.

Financial Preparation for Bond Approval

- Organized Financials: Ensure that tax returns, financial statements, and credit history are up to date.

- Strong Cash Flow: Demonstrating solid cash flow increases your chances of getting approved for larger bond amounts.

Shape Your Strategy with a Clear Understanding of Surety Bid Bonds

In our observation, Surety Bid Bonds shape the entire bidding process by ensuring contractors will fulfill their bids. Should they default, the surety steps in to cover the project owner’s financial losses, reinforcing the integrity of the bid.

Why Surety Bid Bonds Matter

- Ensuring Project Continuity: A surety bid bond ensures that the project can continue if a contractor defaults.

- Protecting All Parties: Surety bid bonds protect both the contractor and the project owner from financial risk.

Uncover How a Bid Bond Works: Key Elements You Need to Know

We’ve come across numerous projects where bid bonds play a crucial role in safeguarding the bidding process. Here's how they work:

Submission

Contractors submit their bid along with a bid bond, ensuring their offer is backed by financial security.

Selection

If chosen, the contractor must follow through with the agreed-upon terms in their bid.

Compensation

If the contractor defaults, the surety compensates the project owner for any financial losses, maintaining project continuity.

Navigate the Application Process for a Surety Bid Bond in Louisiana

In our dealings with contractors, we’ve identified that a smooth application process can simplify securing a bid bond. Follow these essential steps:

Prequalification

Contractors must provide financial documents and a history of completed projects to prove they are capable of handling the work.

What’s Required in the Prequalification Stage

- Financial Statements: Up-to-date balance sheets and profit/loss statements.

- Project History: A record of completed projects showing the contractor's experience.

Submit Application

Once prequalified, contractors submit their formal application to a surety provider, ensuring that all required documentation is included.

Evaluation

The surety company will review the contractor’s financial health, credit score, and previous project experience to determine eligibility.

Evaluation Factors

- Credit Score: A high credit score increases your chances of approval.

- Financial Stability: Sureties assess whether your financial standing is strong enough to support the bond.

Approval

If approved, the surety company issues the bond, and the contractor can proceed with the bid.

Optimize Your Budget: The Price of Bid Bonds

From our perspective, we’ve noticed that the cost of a bid bond is typically a small fraction of the total project bid, usually ranging from 1% to 5%. However, costs may fluctuate based on the contractor’s financial status and the scope of the project.

Factors Influencing Bid Bond Costs

- Contractor Credit Score: A better credit score can reduce bond costs.

- Project Size: Larger projects often require higher bond amounts, which can increase costs.

Uncover Why Bid Bond Denials Happen: Stay Prepared

We’ve come across situations where bid bond applications are denied for various reasons, including:

Poor Credit

A contractor’s credit score plays a significant role in approval. Contractors with poor credit may find it harder to secure a bid bond.

Incomplete Financial Records

We’ve often found that financial transparency is key to securing approval. Incomplete or disorganized records can cause delays or outright denial.

Best Practices for Financial Documentation

- Up-to-Date Financials: Ensure all records are current and accurate.

- Professional Review: Having your financials reviewed by a professional accountant can improve the credibility of your documents.

Lack of Experience

New contractors or those with limited experience may struggle to get approved for large-scale projects, especially if they lack a strong financial foundation.

Propel Your Business Forward: Final Thoughts on Louisiana Bid Bonds

We’ve come to believe that bid bonds propel contractors toward greater opportunities in Louisiana. These bonds not only strengthen your bids but also safeguard the project owners' interests, ensuring a more seamless and reliable process. By focusing on maintaining financial health, partnering with a reputable surety company, and aligning with project requirements, contractors can navigate the bid bond process with confidence and success.

In our view, Louisiana bid bonds are an essential tool that transforms the way contractors approach projects, leading to better results and sustained success in the competitive construction industry.