You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

What is a Bid Bond in Kentucky?

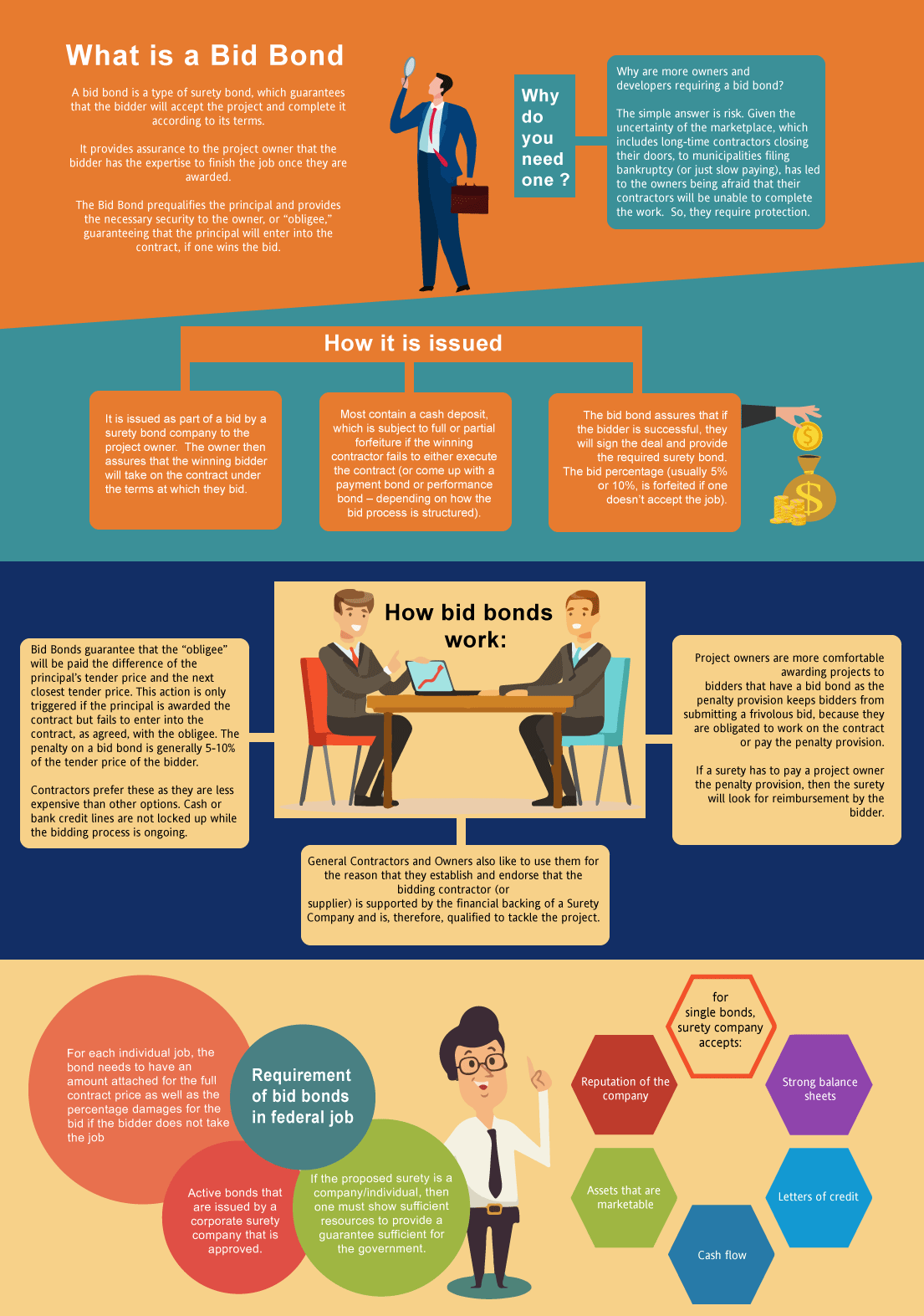

A bid bond is one of the types of surety bonds, that guarantees that the bidder will accept the contract and complete the contract according to its terms. It provides assurance to the project owner that the bidder has the expertise and capability to complete the job once the bidder is selected after winning the bidding process. The basic reason is that you need one in order to get the work. But the bigger question is why are more owners/developers requiring a surety bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes experienced contractors closing shop, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to complete the job. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Kentucky Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five or ten percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Kentucky?

Swiftbonds does not charge for a surety bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a P&P bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in KY?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Kentucky. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors. See our Performance Bond Cost page for more.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Kentucky?

We make it easy to get a contract bid bond. Just click here to get our Kentucky Bid Bond Application. Fill it out and then email it and the Kentucky bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each and every application for surety bid bonds and then submit it to the surety that we believe will provide the best bid and P&P bond for your company. We have a high success rate in getting our clients surety bid bonds at the best rates possible.

Unleashing the Value of Kentucky Bid Bonds: A Comprehensive Introduction

In Kentucky’s competitive construction and contracting landscape, bid bonds are indispensable tools that protect both contractors and project owners. From our perspective, these bonds act as a safeguard, ensuring that winning contractors fulfill their contractual commitments. In this guide, we’ll delve deep into the nuances of Kentucky bid bonds, exploring their purpose, benefits, and practical tips for securing them effectively.

Unleashing the Power of Kentucky Bid Bonds

Bid bonds play a critical role in the construction and contracting industries across Kentucky. They ensure that project owners are protected if the bidding contractor fails to fulfill their promises. From our perspective, understanding bid bonds is essential for contractors, project managers, and public officials alike.

Why Bid Bonds Matter in Kentucky

We’ve consistently found that bid bonds provide a layer of security, helping to ensure that projects proceed as planned. They guarantee that the winning contractor will not back out, giving project owners peace of mind and stability during the bidding process.

The Role of Surety Companies in Bid Bonds

In our experience, surety companies play an indispensable role by backing contractors. They ensure that contractors who win bids are capable of fulfilling the project terms, safeguarding both the project owner and the overall bidding system in Kentucky.

Illuminate Your Search for the Perfect Bid Bond

When contractors or businesses look to secure a bid bond in Kentucky, location can play a key role. Based on our experience, partnering with local surety companies ensures timely service and greater knowledge of state-specific regulations. We’ve often found that companies with a strong Kentucky presence can offer better insights and quicker turnarounds, helping contractors stay competitive.

Finding a Local Surety Company

In our view, working with local surety companies provides a significant advantage. We’ve observed that Kentucky-based firms often have deeper insights into state-specific regulations and a clearer understanding of the local market.

Comparing Bid Bond Providers

From what we’ve seen, not all bid bond providers are created equal. Contractors should compare rates, reputation, and customer service when selecting a provider. This can ensure they receive the best terms and support during the bidding process.

Who Gets the Bond? Conquer the Bid Bond Process in Kentucky

We’ve learned that bid bonds are crucial not only for project owners but also for contractors. The project owner gains peace of mind, knowing they are protected against unqualified bidders. Contractors, on the other hand, can use bid bonds to prove their credibility. In our view, this bond system strengthens the trust between all parties involved, fostering smoother project execution.

How Contractors Benefit from Bid Bonds

We’ve consistently found that contractors benefit from bid bonds by demonstrating their financial stability and competence. This boosts their credibility and can lead to more opportunities, particularly in competitive bidding environments.

Project Owners and the Bid Bond Security

From our perspective, project owners benefit by reducing the risk of dealing with unqualified or unreliable contractors. The bond provides a financial safety net, ensuring the project stays on track even if the winning contractor backs out.

We provide bid bonds in each of the following counties:

Adair

Allen

Anderson

Ballard

Barren

Bath

Bell

Boone

Bourbon

Boyd

Boyle

Bracken

Breathitt

Breckinridge

Bullitt

Butler

Caldwell

Calloway

Campbell

Carlisle

Carroll

Carter

Casey

Christian

Clark

Clay

Clinton

Crittenden

Cumberland

Daviess

Edmonson

Elliott

Estill

Fayette

Fleming

Floyd

Franklin

Fulton

Gallatin

Garrard

Grant

Graves

Grayson

Green

Greenup

Hancock

Hardin

Harlan

Harrison

Hart

Henderson

Henry

Hickman

Hopkins

Jackson

Jefferson

Jessamine

Johnson

Kenton

Knott

Knox

Larue

Laurel

Lawrence

Lee

Leslie

Letcher

Lewis

Lincoln

Livingston

Logan

Lyon

McCracken

McCreary

McLean

Madison

Magoffin

Marion

Marshall

Martin

Mason

Meade

Menifee

Mercer

Metcalfe

Monroe

Montgomery

Morgan

Muhlenberg

Nelson

Nicholas

Ohio

Oldham

Owen

Owsley

Pendleton

Perry

Pike

Powell

Pulaski

Robertson

Rockcastle

Rowan

Russell

Scott

Shelby

Simpson

Spencer

Taylor

Todd

Trigg

Trimble

Union

Warren

Washington

Wayne

Webster

Whitley

Wolfe

Woodford

And Cities:

Louisville

Lexington

Bowling Green

Paducah

Frankfort

Owensboro

Elizabethtown

Hopkinsville

Covington

Pikeville

Bardstown

See our Louisiana Bid Bond page here.

More on Bid Bonds https://swiftbonds.com/bid-bond/.

Revitalize Your Approach: Practical Advice for Bid Bonds

From what we’ve seen, securing a bid bond requires thoughtful preparation. Contractors must ensure their financial records are in order, and they should have a clear understanding of the project scope. We’ve consistently found that thorough documentation and transparent communication with the surety company can prevent delays or denials, ultimately securing the bond with ease.

Preparation is Key

We’ve come to realize that well-organized financial records and transparent communication with surety companies are critical in securing a bid bond. Contractors should present a clear picture of their business’s financial health and experience.

Avoiding Common Pitfalls

In our experience, many bid bond denials stem from incomplete documentation or unclear project details. We’ve learned that clear, comprehensive submissions can speed up approval and prevent common issues that slow down the process.

Harness the Benefits: What is a Surety Bid Bond?

In our experience, surety bid bonds are a type of financial agreement between three parties: the contractor (principal), the project owner (obligee), and the surety company. This ensures that the project owner is compensated if the contractor fails to follow through on their winning bid. We’ve come to appreciate that this three-party relationship is a cornerstone of the bidding process in Kentucky.

Breaking Down the Three-Party Agreement

We’ve observed that each party in the bid bond plays a critical role. The contractor is responsible for the project, the project owner is protected, and the surety company acts as the guarantor. This dynamic creates a secure bidding process.

Surety’s Responsibility in the Agreement

We’ve often found that the surety company’s role goes beyond just issuing bonds. They also evaluate contractors’ financial health and capability, ensuring that only reliable bidders are approved.

Accelerate Your Understanding: How Bid Bonds Work in Kentucky

We’ve come to the conclusion that the way a bid bond works is fairly straightforward: the surety company guarantees the project owner that the contractor will either enter into the contract or pay the difference between their bid and the next acceptable bid. If the contractor defaults, the surety steps in to cover the financial gap. We’ve found this to be a critical function that keeps the bidding process secure and transparent.

Financial Assurance for Project Owners

We’ve consistently found that bid bonds act as a financial safeguard for project owners. Should a contractor default, the surety company is responsible for compensating the owner, ensuring the project isn’t delayed.

Contractor’s Obligation Under the Bid Bond

In our practice, we’ve seen that contractors are legally bound to either accept the contract or provide compensation if they withdraw after winning. This accountability strengthens trust in the bidding process.

Solidify Your Success: Applying for a Bid Bond in Kentucky

Applying for a bid bond in Kentucky can be a smooth process when approached correctly. We’ve noticed that working closely with surety companies that specialize in Kentucky laws ensures a more efficient application process. In our dealings with contractors, we’ve consistently observed that submitting clear financial statements and providing a detailed project plan are key factors that help secure the bond faster.

Documentation and Financial Transparency

We’ve found over time that financial transparency is key in securing a bid bond. Surety companies need clear financial statements and a well-outlined project plan to approve the bond application quickly.

Timelines for Securing Bid Bonds

In our view, early preparation is crucial. We’ve learned that submitting applications well before the bid deadline helps prevent unnecessary delays, allowing contractors to focus on winning the bid.

Refine Your Budget: The Price of a Surety Bid Bond

We’ve often noticed that the price of a surety bid bond is typically a percentage of the bid amount, generally ranging from 1% to 5%. This cost depends on the contractor’s financial standing and the project’s overall value. We’ve discovered through experience that improving your credit score and maintaining a solid business reputation can reduce the cost of obtaining a bid bond.

Factors That Influence Pricing

We’ve had the opportunity to notice that a contractor’s credit history and financial strength directly influence the cost of a bid bond. Surety companies evaluate these factors closely when setting the bond rate.

Ways to Lower Your Bid Bond Costs

From our own observations, contractors who maintain strong financials, improve their credit, and complete projects on time and within budget are more likely to secure favorable bond rates.

Aspire for Approval: Can Your Bid Bond Application Be Denied?

In our professional life, we’ve encountered situations where bid bond applications were denied. The most common reasons include poor credit history, insufficient financial backing, or a lack of experience in handling large-scale projects. Our experience tells us that contractors should be well-prepared and transparent with their surety company to avoid such pitfalls.

Common Reasons for Denial

We’ve observed over time that the top reasons for bid bond denials include insufficient financial documentation and poor credit scores. Contractors should focus on these areas when applying.

Tips for Ensuring Approval

From our experience, contractors who communicate openly with surety companies and provide clear, thorough financial documentation are more likely to secure bid bonds successfully.

Elevate Your Bidding Strategy: Concluding Thoughts on Bid Bonds in Kentucky

We’ve grown to understand that bid bonds are more than just a requirement in Kentucky—they are an essential element of building trust in the bidding process. From our perspective, having a solid understanding of bid bonds not only helps contractors win more bids but also enhances their credibility and reputation in the industry. In our view, navigating bid bonds successfully requires preparation, transparency, and a reliable partnership with a surety company.

The Future of Bid Bonds in Kentucky

We’ve come to appreciate that bid bonds will continue to play a significant role in the growth and development of Kentucky’s infrastructure and construction sectors. Contractors who master the process will remain competitive in an evolving marketplace.

Strengthening Your Bid Bond Strategy

In our practice, we’ve consistently found that staying informed about bid bond requirements and working with trusted surety companies is key to long-term success in Kentucky’s construction industry.