You can now get a Bid Bond (almost) instantly. For Bids under $100,000, click here

For all bids greater than $100,000, get our Express Application form:

Express Application (click to download form)

- Complete the form and email to [email protected].

- Be sure to include the RFQ/ITB (bid specs from the obligee).

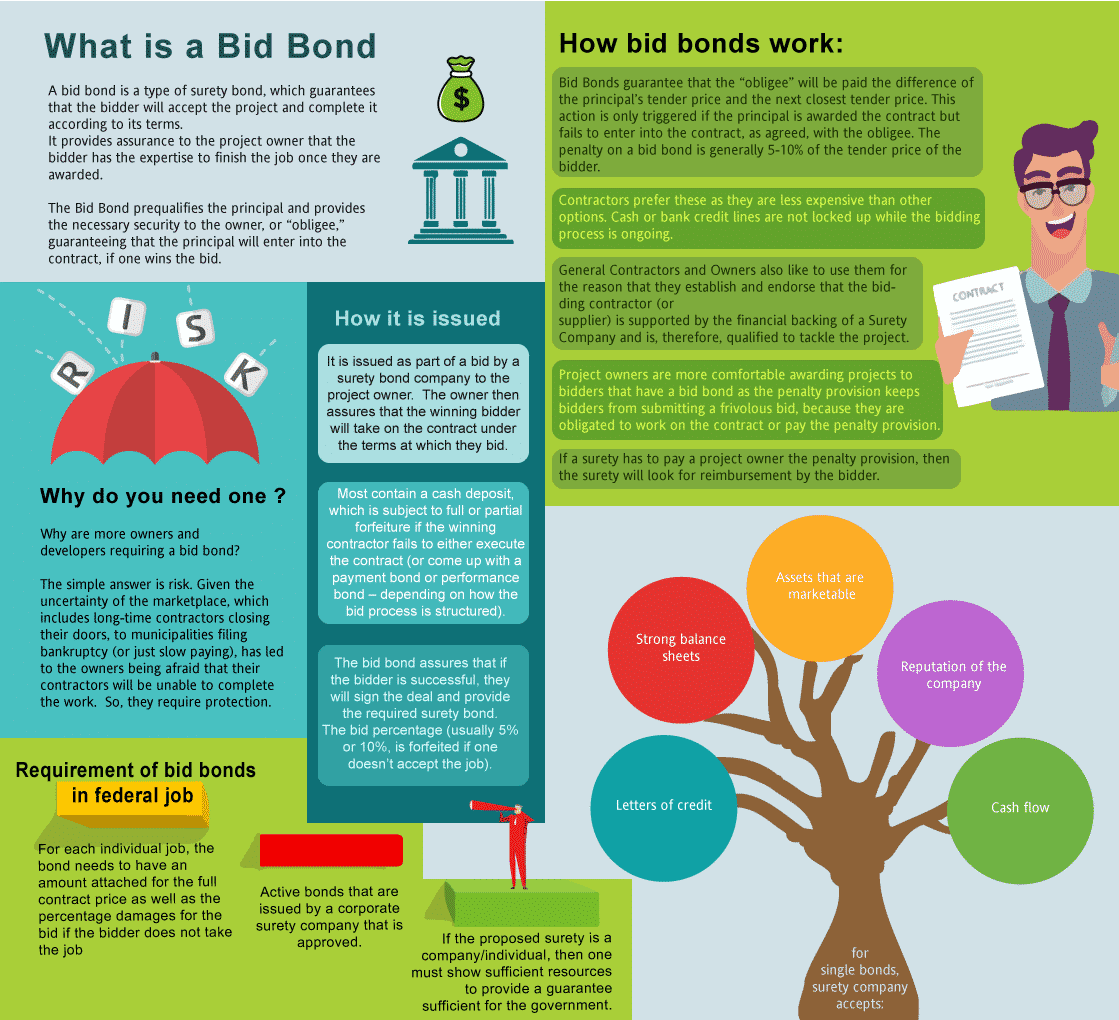

What is a Bid Bond in Kansas?

A bid bond is one of the types of surety bonds, that guarantees that the bidder will enter into the agreement and complete the agreement according to its terms. The bid bond provides assurance to the project owner that the bidder has the knowhow and wherewithal to finish the job once you are selected after winning the bid. The simple reason is that you need one to get the contract. However, the larger question is why are more owners/developers requiring a surety bid bond? The simply explanation is risk. Given the uncertainty of the marketplace, which includes long-time contractors going bankrupt, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. Thus, they require a some protection.

Just fill out our bond application here and email it to [email protected] - click here to get our Kansas Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Kansas?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don't charge for a bid bond is that we will charge for the performance bond if you get the job. The cost of a bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges:

1) We do charge for Overnight fees

2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in KS?

Bond prices fluctuate based on the job size (that is, it's based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Kansas. Please call us today at (913) 286-6501. We'll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors. See our Performance Bond Cost page for more.

| Bond Amount Needed | Fee |

| <$800,000 | 2-3% |

| >$800,000<$1,500,00 | 1.5-3% |

| >$1.500,000 | 1-3% |

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Kansas?

We make it easy to get a contract bid bond. Just click here to get our Kansas Bid Bond Application. Fill it out and then email it and the Kansas bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We will review each and every application for bid bonds and then submit it to the surety that we believe will provide the best bond for your job. We have a great success rate in getting our clients surety bid bonds at the very best rates possible.

Mastering Bid Bonds in Kansas: Your Comprehensive Guide

Bid bonds play a pivotal role in the construction industry, particularly in states like Kansas. These bonds serve as guarantees that contractors will honor their bids and, if awarded the contract, will enter into the agreement. From our experience, bid bonds help ensure a level playing field for all parties involved. In this guide, we'll explore the essentials of Kansas bid bonds and provide insights to help you navigate the process.

Unlock the Best Kansas Bid Bonds Near You

We’ve often noticed that finding the right bond provider can make or break your bidding process. Many local and national surety companies offer bid bonds tailored for Kansas projects. In our dealings with contractors, we've seen that working with experienced bond agents who understand the specific requirements of Kansas law is critical.

How to Find a Reliable Provider

When searching for a Kansas bid bond, we’ve observed that reputable surety bond agencies with strong local and industry knowledge offer the best options. They not only understand Kansas-specific requirements but also help streamline the process by handling paperwork efficiently.

Compare Providers for the Best Terms

We’ve come to notice that comparing multiple bond providers can be advantageous. Look for differences in rates, processing fees, and terms of agreement. Make sure the provider is transparent about their costs and responsive to your needs.

Discover Who’s Involved in Kansas Bid Bonds

Three main parties are involved in the Kansas bid bond process:

- The Principal (Contractor): The contractor bidding on the project and promising to fulfill the obligations.

- The Obligee (Project Owner): The project owner who requires the bond as a protection.

- The Surety (Bond Provider): The financial institution or insurance company that guarantees the contractor's performance.

The Role of the Principal (Contractor)

In our experience, the principal or contractor is the key figure responsible for submitting the bid and fulfilling the project. The contractor’s ability to meet the project’s financial and operational requirements is a critical factor in securing the bond.

The Obligee's Protection (Project Owner)

We’ve found that the project owner, or obligee, benefits from the bid bond by gaining financial protection in case the contractor doesn’t honor the bid. This provides project owners with peace of mind when awarding large contracts.

The Surety’s Responsibility

The surety company guarantees the contractor’s performance. From our dealings with surety providers, their role is to evaluate the contractor’s credibility and ensure that they are financially capable of completing the project.

We provide bid bonds in each of the following counties:

Allen

Anderson

Atchison

Barber

Barton

Bourbon

Brown

Butler

Chase

Chautauqua

Cherokee

Cheyenne

Clark

Clay

Cloud

Coffey

Comanche

Cowley

Crawford

Decatur

Dickinson

Doniphan

Douglas

Edwards

Elk

Ellis

Ellsworth

Finney

Ford

Franklin

Geary

Gove

Graham

Grant

Gray

Greeley

Greenwood

Hamilton

Harper

Harvey

Haskell

Hodgeman

Jackson

Jefferson

Jewell

Johnson

Kearny

Kingman

KKansas

Labette

Lane

Leavenworth

Lincoln

Linn

Logan

Lyon

Marion

Marshall

McPherson

Meade

Miami

Mitchell

Montgomery

Morris

Morton

Nemaha

Neosho

Ness

Norton

Osage

Osborne

Ottawa

Pawnee

Phillips

Pottawatomie

Pratt

Rawlins

Reno

Republic

Rice

Riley

Rooks

Rush

Russell

Saline

Scott

Sedgwick

Seward

Shawnee

Sheridan

Sherman

Smith

Stafford

Stanton

Stevens

Sumner

Thomas

Trego

Wabaunsee

Wallace

Washington

Wichita

Wilson

Woodson

Wyandotte

And Cities:

Wichita

Topeka

Lawrence

Kansas City

Overland Park

Manhattan

Olathe

Salina

Hutchinson

Lenexa

Shawnee

Mission

Leawood

See our Kentucky Bid Bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Boost Your Success with These Practical Bid Bond Tips

In our observation, there are several key tips to keep in mind when dealing with bid bonds:

- Verify Your Eligibility: Make sure you qualify for a bid bond before submitting a bid.

- Work with an Experienced Surety: Always choose a reputable bond provider with experience in Kansas projects.

- Understand the Bond’s Conditions: Read through the bond’s terms carefully to avoid any potential misunderstandings.

- Prepare Financial Documents: We’ve noticed that providing strong financial statements increases your chance of approval.

Explore the Basics of a Surety Bid Bond

A surety bid bond is a specific type of bid bond that involves three parties: the contractor (principal), the project owner (obligee), and the surety company. We’ve come to understand that this type of bond acts as a guarantee that the contractor will accept the project terms if awarded.

What Happens If the Contractor Fails?

If the contractor withdraws or fails to execute the contract, the surety will compensate the project owner, often up to a specified amount. We’ve learned through experience that surety bid bonds offer significant protection for project owners, helping them avoid delays and additional costs.

Elevate Your Knowledge: Applying for a Surety Bid Bond

We’ve consistently found that the application process for a surety bid bond in Kansas involves several steps:

- Choose a Surety Provider: Look for a reputable provider specializing in Kansas bid bonds.

- Submit Financial Statements: Ensure your company’s financial health is well-documented.

- Complete the Application: Fill out the application thoroughly and accurately.

- Receive Approval: If your application is approved, you will receive your bid bond.

Documents You Need for the Application

In our experience, having the right documents in place speeds up the approval process. Make sure you have:

- Financial statements

- Company information and references

- Project details and bid documents

The Approval Process

We’ve often noticed that approval depends on the contractor’s financial health and experience. If these factors are strong, the approval process is usually smooth and quick. However, contractors with financial instability may face delays or higher costs.

Unlock the True Cost of a Surety Bid Bond

Based on our experience, the cost of a surety bid bond typically ranges from 1% to 5% of the total project bid amount. However, the cost can vary based on the contractor’s creditworthiness and the bond’s specific conditions.

Factors Affecting the Price

We’ve seen firsthand that the contractor’s financial standing, credit score, and project size all play significant roles in determining the bond’s price. Contractors with strong financials and a proven track record often secure better rates.

Challenge: Can You Be Denied a Bid Bond?

Yes, we’ve been in situations where contractors have been denied a bid bond. Common reasons include:

- Poor Credit History: If the contractor has a weak credit score or poor financial standing.

- Incomplete Application: Inadequate information or missing documents can lead to denial.

- Lack of Experience: In some cases, a contractor’s lack of prior experience can affect approval chances.

Steps to Improve Your Chances

We’ve found through experience that improving your financial health, having complete and accurate documentation, and working with an experienced surety provider significantly increases your chances of approval.

Concluding Thoughts: Mastering Kansas Bid Bonds

In our understanding, securing a Kansas bid bond is an essential step in the bidding process, providing protection for project owners and contractors alike. By working with a knowledgeable bond provider and preparing the necessary documents, contractors can confidently enter the competitive Kansas construction market. Whether you’re a seasoned contractor or new to the bidding process, we’ve always found that having a bid bond in place ensures a smoother and more transparent experience.